OntheRunPhoto/iStock Editorial via Getty Images

As COVID recovery for the airline industry has turned to a summer of difficult airline operations, much higher fares and costs, and a significant divergence in profitability between airlines in the industry, investors are increasingly confused about whether airlines are investable and, if they are, where and when to invest.

During most of the COVID pandemic, investors were told that low cost and ultra low cost carriers would have an advantage because of their focus on leisure travel which was less impacted by COVID and because legacy/global airlines had a much higher percentage of their revenue that came from longhaul international operations. After two years of COVID-impacted finances, it has become clear that many airline industry analysts painted with broad brushes that missed some of the significant earnings differences between airlines but also missed emerging themes including that low cost carriers were at a disadvantage, as I noted in this SA article Delta Air Lines Stock: The Company Moves Ahead Of The Pack (NYSE:DAL). Earnings guidance shows that there is a secular shift taking place in the U.S. airline industry in favor of the big 4 airlines and away from low cost carriers including JBLU and SAVE which were previous darlings of airline investors. In this article, we will explain the post-COVID trends that are shaping the U.S. airline industry as well as compare the strategies and financial performance of Southwest (NYSE:LUV) and United (NASDAQ:UAL) to help investors understand why LUV has a compelling story while expectations for UAL might need to be trimmed.

Capacity and Network Strategies

As soon as the summer of 2020, it became clear that U.S. airlines were taking very different strategies in returning capacity to the market after more than 90% of demand evaporated within weeks of the U.S. COVID lockdown. Delta and United fell in the camp of limiting capacity return on the belief that business travel, the backbone of those two airlines’ business models, would be suppressed for the long-term. United was slow to return capacity until late 2021 when it moved aggressively to re-add domestic capacity to near pre-COVID levels while it planned for a large international reopening for the summer of 2022. Southwest was more aggressive in reinstating capacity both in the summers of 2020 and 2021 and experienced operational challenges in part due to COVID-related staffing shortages. While the winter of 2021-22 was muted because of COVID, March 2022 ushered in a pace of domestic demand return that has not slowed while international travel demand, primarily to Europe, has been strong so far this summer.

Most of the U.S. airlines including Southwest and United are guiding to continued addition of domestic capacity with domestic revenue expected to exceed 2019’s levels even though domestic capacity is still likely to be at levels below 2019. With mere weeks remaining in the peak summer 2022 travel season, capacity guidance and airline strategies into the fall will provide significant insight into profit patterns that will likely define the industry and specific companies within it for the next few years. Key factors that will shape capacity and profit restoration include the networks of each airline as well as their fleet strategies, both of which become apparent months in advance.

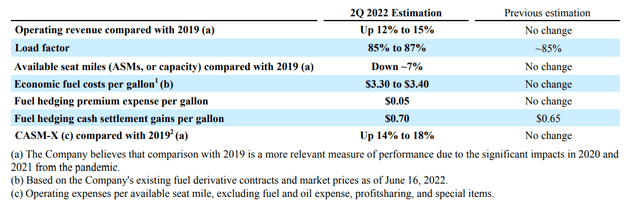

Southwest Airlines 2Q2022 guidance (Southwest.com)

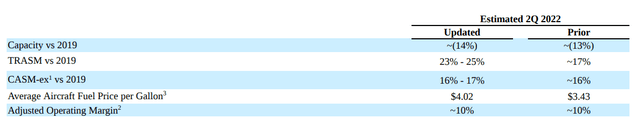

United Airlines 2Q2022 guidance (United.com)

Southwest has long been known for its ability to “flex” its network capacity up and down with economic conditions and that will be true in the fall of 2022 and beyond. Southwest has the highest dominance of its key markets or hubs of the big 4 airlines, largely because LUV has such a high proportion of gates and flights at its core hubs. It is by far the dominant airline at its Baltimore, Chicago/Midway, Dallas Love Field and Houston Hobby hubs reaching near monopolistic levels of service at those airports, even though those airports are part of large competitive multi-airport metro areas. Southwest reduced the number of flights/day in many of its markets to/from these and other “hubs” during the pandemic and has been re-establishing flight frequencies this summer and will do so in the fall of 2022 and beyond.

Southwest’s Chicago Midway, Dallas Love Field, Houston Hobby hubs as well as its emerging Nashville hub were all already operating close to capacity pre-COVID and will return to those levels in the near future. Southwest is reducing capacity in S. Florida where it became the highest cost of the three low cost carriers (along with JBLU and SAVE) at Ft. Lauderdale. As at both Houston and Chicago’s primary airports, Southwest added service to Miami International airport and industry data indicates that LUV is doing well at each of those airports where it competes directly against legacy carrier hubs. LUV is also restoring frequencies in the western U.S. which were some of the latest regions of the country to see recovery. Finally, Southwest is increasing its presence to/from Hawaii, a market it entered just before COVID not just with flights to/from the U.S. mainland but also with interisland flights, challenging Hawaiian Holdings (HA). Hawaii is expected to see a strong winter travel season esp. as Asian countries reopen tourism.

Domestically, Southwest and United have overlapping “hubs” in more metro areas than any other combination of U.S. airlines with LUV and UAL hubs at the same or nearby airports in the metro areas of Baltimore/Washington, Chicago, Denver, Houston, Los Angeles and the San Francisco/Oakland metro areas. Both airlines are focused on growth at Denver with that airport continuing to add gates that will be available for both carriers as part of long-term plans. The western mountain states have fared well during the demographic shifts that have taken place as a result of state policies and work from home practices during COVID as has also been true in Texas and in Tennessee where Southwest continues to look for more gate space at Nashville airport; an influx of new residents and businesses and an airport that underestimated the demand for airline services has left Middle Tennessee far short of the number of gates airlines want, including Southwest which is the dominant carrier.

United’s network is heavily centered on the northern tier of States which has meant that the recovery of its domestic network has been slower than for other airlines that have more southerly networks; United is the only one of the big 4 airlines that has its headquarters in a northern state while its San Francisco hub has been particularly hard hit by closures of East Asian economies. Not all markets have been slow to return, however; United’s Newark hub has faced massive operational challenges as a result of the FAA’s decision years ago to remove slot controls, leading to an influx of low cost carrier capacity that has resulted in the persistently worst on-time at large U.S. airports. United recently announced an agreement with the FAA to remove 50 flights/day or 12% from its Newark schedule, presumably with agreement from the FAA not to allow other airlines to add their own flights.

United has long touted its position as the U.S.’ largest international carrier and has aggressively restored its international network as quickly as it could. United execs touted during the pandemic that they expected post-COVID international revenues to be substantially improved because of the failure of a number of transatlantic low cost carriers; I discussed the demise of transatlantic low cost travel in this Seeking Alpha article just before the pandemic began Transatlantic Airline Turbulence Promises Higher Fares And Profits. Restoration of United’s transatlantic network has been aided by the FAA’s approval to allow United to return its Pratt & Whitney (RTX) powered 777-200/ER fleet to service after one of the Pratt engines failed shortly after takeoff 18 months ago resulting in the ground of UAL’s PW powered 777 fleet. United has added dozens of new routes across the Atlantic, restoring many of the routes it served pre-pandemic but also adding new service to heavily leisure oriented markets, some of which are more popular with European than American tourists. United’s aggressive transatlantic expansion raises the question if United has not missed an opportunity to park some of its older aircraft to adapt to a higher cost environment and is instead chasing too many highly seasonal markets that will require it to maintain staff which might not be well utilized for other parts of the year.

United has stated that part of its reason for adding so much transatlantic flying is because it is redeploying capacity from its transpacific network. United’s explanation requires examination given that it is likely that large portions of the transpacific demand that United had pre-COVID will not return. First, United was the largest U.S. airline to both China and Hong Kong – which in part resulted in United’s stature as the largest airline across the Pacific, regardless of nationality. While China is discussing reopening its aviation markets which have been heavily shuttered during the pandemic, it is doubtful that much of the demand will return. Businesses have been able to operate on a remote/virtual basis. In addition, the Chinese government has indicated it does not intend to incentivize the global travel of its citizens which it did pre-COVID. Finally, changing geopolitical realities make it likely that travel between the U.S. and China will continue at a much lower level than pre-COVID; right now, Delta and United are permitted to operate equal and very low numbers of flights to/from China and that level is a fraction of what either is authorized.

In the Japanese market, access to Tokyo’s close-in Haneda airport increased in the early days of the pandemic after years of a phased opening to longhaul flights by the Japanese government – but nobody noticed the increased rights because COVID shutdowns cut traffic between the U.S. and Japan, the largest transpacific market. With the new rights at Haneda, Delta becomes the largest foreign carrier at Haneda airport which left more distant Narita airport while United and American both will maintain operations at both airports with operations at Narita airport largely in support of their Japanese airline joint venture partners. As I noted in previous SA articles, fares to close-in Haneda airport are much higher than to/from Narita so it is likely that United’s decision to support its Japanese partner, All Nippon Airways, will become more and more costly as higher value passengers gravitate to the close-in Haneda airport, lowering profit margins on the Narita flights. United’s transpacific network was not profitable even before COVID according to data which United filed with the DOT; it is certain that changing competitive realities will erode finances on its Asian franchise.

Southwest, of course, serves the Caribbean and some U.S. point of sale leisure destinations but does not fly longhaul international flights; it could well take advantage of the Boeing 737 MAX’s ability to fly from the Southern United States to well into S. America. Southwest began service to Mexico City years ago along with JBLU and other low cost carriers but was unable to penetrate the market, in part because of Southwest’s policy of requiring booking of its flights solely on its own website; LUV’s lower profile in foreign countries is being rectified by selectively distributing its flights through computerized airline reservation systems which also support online travel sites. It is likely that Southwest will carefully grow its presence into South and Central America using its presence along the Southern tier.

The big wildcard for United, Southwest and the rest of the airline industry lies heavily in what happens with the U.S. and global economy. With increasing analyst expectations of a recession and high inflation cutting discretionary spending, a high growth strategy such as United’s, particularly in international markets, is risky. In addition to macroeconomic concerns, there is undoubtedly a large component of “revenge travel” taking place this summer as people around the world who have not been able or willing to travel for more than two years venturing out on flights; that level of demand will not persist. While all of the U.S. airlines are quick to tout that domestic business travel has largely returned to pre-pandemic levels, a recession could easily tip businesses back into a cost reduction mode again, similar to what took place during COVID. Southwest’s long-time strategy of measured growth is reflected in its fleet plan just as United’s aggressive capacity growth is reflected in its own fleet plan.

Fleet and Fuel

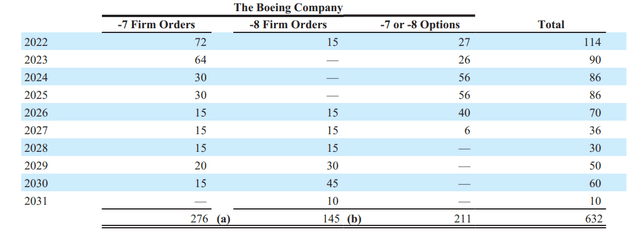

Southwest and United share one common theme – both have massive orders for the Boeing (BA) 737 MAX. As an all-737 operator, LUV’s entire order book is for the 737 MAX while United has more MAXs on order than any other type, although it also has orders for the Airbus A321 as well as a large order for the Airbus A350 which has been repeatedly pushed forward. Another common theme for both Southwest and United is that they have large orders for each of the two MAX models which have not yet been approved by the FAA. Southwest has ordered hundreds of the -7 model, the smallest in the series, which closely matches the 737-700s that are aging in LUV’s fleet. United has hundreds of the largest MAX model, the -10, on order although the likelihood of it being certified by the end of 2022 are even less likely than for the -7. Should Boeing fail to certify either model by the end of the year, costly retrofits or the need for Congressional intervention could come into play. Both Southwest and United will convert their MAX orders to the two medium-sized models, the -8 and -9, with LUV putting more seats onto its flights than it wants, potentially eroding its revenue control measures, while United will be deploying fewer seats, limiting its ability to reduce costs.

Southwest Airlines aircraft orders (southwest.com)

United Airlines aircraft orders (United.com)

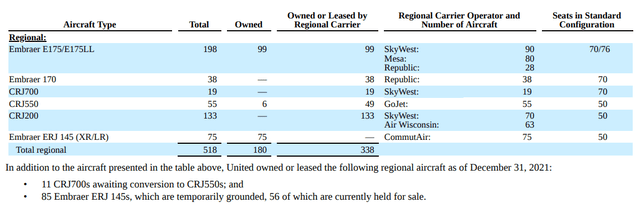

United’s fleet replacement is heavily driven by its need to restructure the composition of its fleet as a result of its long-standing dependence on regional jets. UAL contracts for the world’s largest fleet of 50 passenger regional jets even though regional jets are becoming increasingly more costly to operate on a per-seat basis due to both labor and fuel issues. United unveiled its United NEXT strategy to replace hundreds of its regional jets with mainline jets that seat 100 or more passengers per flight, dramatically reducing operating costs per seat but also adding capacity at levels that will be far in excess of the GDP, esp. if the U.S. tips into a recession. Given that United has the lowest local market share of the big 4 airlines in its core markets – and overlaps more with Southwest than either American or Delta – United’s strategy of replacing hundreds of regional aircraft might be operationally necessary but the rate at which United is doing it will undoubtedly lead to lower fares in United hub cities.

UAL regional jet fleet (UAL 2021 10-K)

Southwest’s fleet strategy has long involved measured growth as well as replacement of older aircraft; Southwest has long demonstrated that efficiency – heavily driven by labor efficiency but supplemented by modern aircraft – is more important than excessive purchases of new generation aircraft; many of LUV’s 737-700s are well over 20 years old, requiring more costly maintenance given the short-haul nature of LUV’s network. LUV has scores of aircraft leases that will expire in the coming years so it can accelerate the retirement of older aircraft or it can retain aircraft, including owned models, in order to enhance its growth. Southwest’s measured fleet replacement and flexible growth strategy appears to be much less risky than United’s.

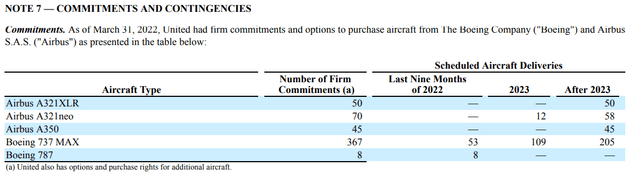

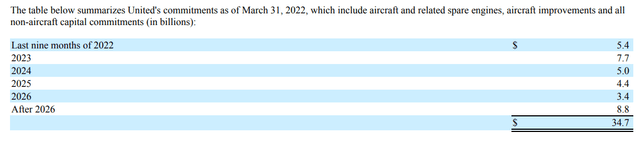

UAL capex commitments (UAL 1Q2022 10-Q)

United’s fleet strategy contains one very important consideration. While United is committed to taking delivery of hundreds of new domestic mainline aircraft over the next few years, including over 100 in 2023 alone, UAL is virtually stopping its longhaul international fleet replacement even though United operates the most fuel inefficient international fleet in the world. United is the largest remaining operator of the 777-200/ER including scores of 777-200ERs powered both by the previously mentioned Pratt & Whitney engines as well as by GE engines. The 777 as both the -200ER and -300ER model is the least fuel efficient aircraft in its size class among current modern aircraft meaning that United will be spending 20-30% more per seat on fuel for 777 flights compared to newer, more modern aircraft including the 787s United already has. United’s decision to add hundreds of new generation domestic aircraft while adding very few additional new generation international/widebody aircraft will cost the company hundreds of millions of dollars per year in higher fuel costs just on the basis of fuel efficiency.

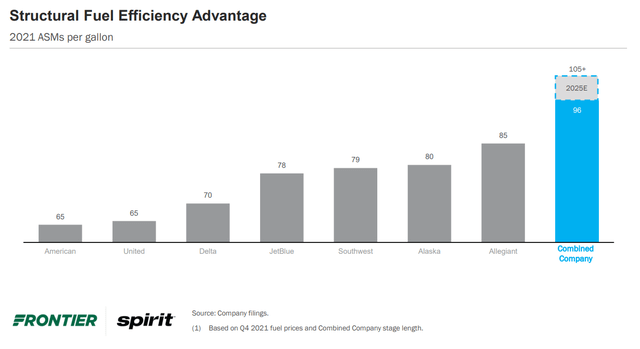

US Airline Industry Fleet Efficiency (FlyFrontier.com)

The cost of fuel has increasingly become a huge problem for airlines and could become the largest single expense item this year, displacing labor costs. Airlines face challenges not just with fuel efficiency but also with the actual cost of fuel. Southwest has long hedged jet fuel, primarily as a budget planning tool, but it has regularly lost $100 million per year on those fuel hedges. However, those hedges are paying off handsomely right now, just as they did in the mid-2000s when Southwest was one of the few airlines that had fuel hedges after the legacy airlines were forced to liquidate their hedge positions due to weak balance sheets. Southwest paid half the cost for jet fuel compared to its large competitors and used the savings to grow, including into Denver where it quickly established itself as a credible competitor to United. More than 15 years later, for the current quarter, Southwest is guiding to pay $3.30-3.40 per gallon for jet fuel including a 65 cent/gallon net hedging benefit compared to $4.02 for United on a system average basis for the 2nd quarter. American and United are tied for the least fuel efficient fleets among U.S. airlines, in part because of their use of 777s and because of their large regional jet fleets (there are no new generation engine regional jets in the U.S).

Balance Sheet and Stock Performance

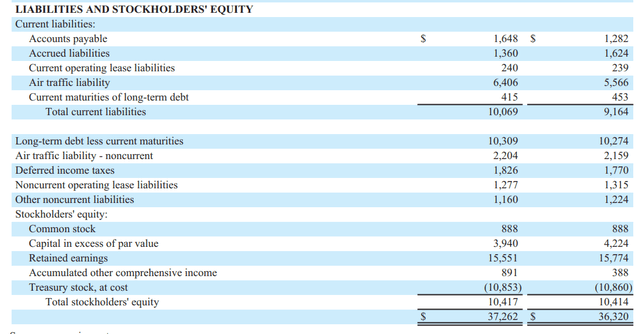

Southwest has long maintained its capex spend at levels that ensure its debt levels remain at enviable levels while United’s massive order for 500+ new aircraft is certain to push it into the position of the most indebted U.S. carrier, overtaking American for that title. Investors frequently have cited AAL’s high levels of debt as a reason to avoid that carrier’s stock – but AAL is reducing its capex and has a much higher chance of paying down its debt than UAL which will add enormous amount of debt or aircraft leases – which show up on the balance sheet – faster than UAL can possibly generate cash to cover them. Further, airlines around the world took on debt to survive – which counters the myth that airlines received enough money to cover the cost of their sustained low revenues during COVID – and UAL will have virtually no chance to pay down that debt before it starts adding more aircraft debt. Southwest, in contrast is already making significant efforts to pay down its COVID-related debt.

Southwest Airlines Liabilities and Stockholders’ Equity

LUV Liabilities & Stockholder Equity (Southwest 1Q2022 10-Q)

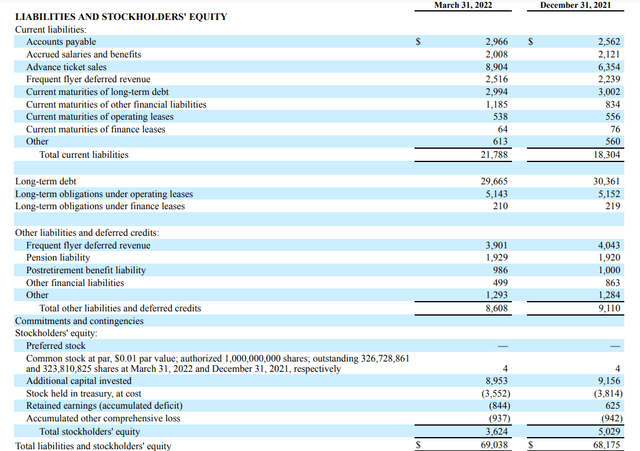

UAL Liabilities & Stockholder Equity (UAL 1Q2022 10-Q)

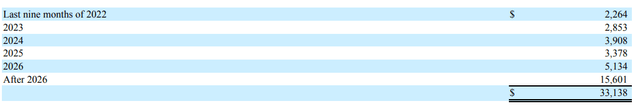

UAL debt obligations (UAL 1Q2022 10-Q)

Airline stocks have been on a roller coaster ride throughout the pandemic. After losing more than 50% of their value in the early weeks of the pandemic, airline stocks have clawed back gains with every bit of good news. Since the beginning of the year, airline stocks have had many weeks during which they performed better than the market as a whole including some high profile industries. As fuel has remained elevated and as the general economic outlook has weakened, airlines have returned to being largely in line with the rest of the market.

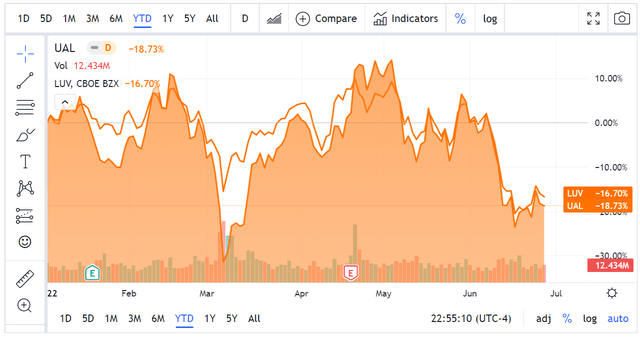

LUV vs UAL YTD stock chart (Seeking Alpha)

Southwest and United stock have performed remarkably similarly on a year to date basis and above the industry average which has been pulled down by discount carriers, driven in part by the contest to win SAVE. UAL outperformed LUV before fears of global economic malaise put the brakes on hopes of continued strong international travel.

LUV set the standard for sustainable financial performance by an airline and they have maintained that reputation. LUV vs. UAL is a very good comparison in the airline industry. I believe that LUV will have the upper hand based on its more stable and conservative capacity strategies, its successful fuel cost reduction strategies, and its much stronger balance sheet.

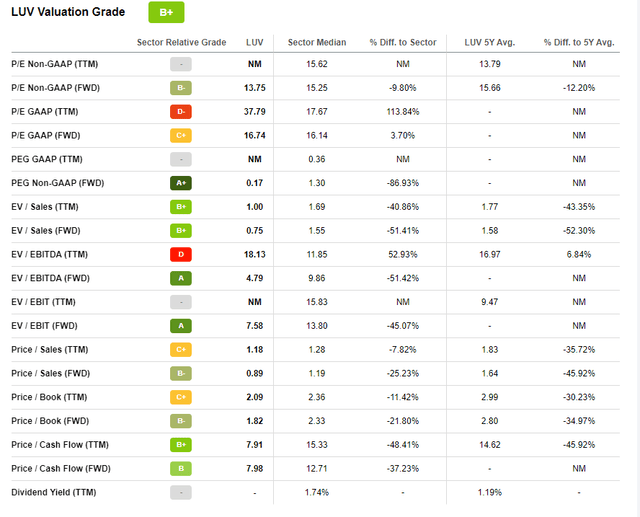

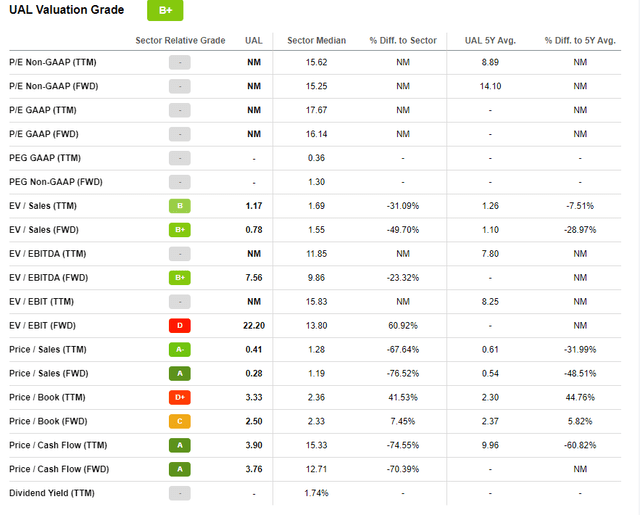

Valuation

In order to assess valuation of LUV and UAL, we need to consider the following:

- All U.S. airlines are holding excessive amounts of cash based on historic levels; the early days of COVID produced a liquidity crisis for U.S. airlines that prevented access to credit lines, even for carriers like Southwest. Net debt is a more meaningful statistic since some cash is being held that could reduce debt levels.

- Federal aid to airlines includes restrictions on stock buybacks and payment of dividends. Southwest historically paid dividends while United did not. It is likely that LUV will restore a dividend when it can. Both LUV and UAL actively bought back stock pre-COVID and both have issued stock during COVID; it is far more likely that UAL will issue stock in part because of its much higher capital needs.

- United, like American and Delta, mortgaged its loyalty program (FFP) during COVID highlighting how profitable these programs are; LUV’s loyalty program is valued at a much lower level in part because LUV is predominantly a domestic airline while UAL’s program is global with many partners. UAL’s FFP is not fully encumbered although the percentage of UAL’s fleet that is encumbered is much higher than LUV’s.

- While currently at historically low to advantage levels compared to themselves, UAL’s short interest at 7% is more than 3 times higher than LUV’s level of short interest.

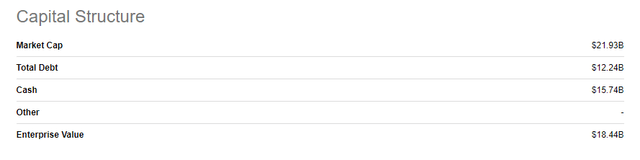

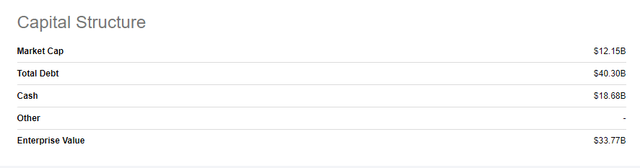

In terms of capital structure, the most notable difference between LUV and UAL is that LUV’s cash exceeds its debt while even UAL’s net debt far exceeds its market cap.

Southwest Capital Structure (Seeking Alpha)

United Capital Structure (Seeking Alpha)

As would be expected, valuation metrics for the airline industry that involve historic earnings have little value given the losses the industry experienced and the expected increase in sales going forward. P/S comparisons favor UAL only if you believe their narrative of sustained, strong international sales. The commentary above indicates that their optimism about international revenue is probably excessive. Cash flow valuations will be significantly altered as UAL spends aggressively on new aircraft. If AAL has been shunned by investors because of the high debt loads and debt service costs, the corollary should even be stronger for UAL which is acquiring new aircraft at a far more aggressive pace than AAL did.

Southwest Valuation Metrics (Seeking Alpha)

United Airlines valuation metrics (Seeking Alpha)

Finally, airline stocks throughout the pandemic have largely moved as a block with movement of global airlines more affected by closing and reopening of international markets.

Executing Your Trades

Because airline stocks are volatile, have underperformed the market during the pandemic, and face structural issues including macroeconomic effects and outsized fuel and labor cost movements in the near term, I recommend minimizing cash outlays in a LUV vs. UAL play, relying on options to do the work.

UAL’s historically weakest quarters are the 4th and 1st calendar quarters, in part because UAL has one of the smallest footprints in Florida among U.S. airlines while international travel is at seasonal lows during those quarters. Further, jet fuel prices are likely to remain elevated at least through the winter of 2022-23 as the EU executes its plans to cut off imports of Russian energy. I suggest balanced options strategies timed around 4th quarter 2022 and 1st quarter 2023 earnings via calls for LUV and puts for UAL.

Be the first to comment