Michael Vi

The big announcement from PagerDuty (NYSE:PD) in their Q3 results was that they achieved non-GAAP profitability, a quarter ahead of their previous guidance, with $3 million in non-GAAP operating income. The company even talked during the earnings call about the possibility of becoming a “Rule of 40” company. As a reminder, these are companies where the combined growth rate and profit margin exceed 40%. We find this a little ridiculous given how far PagerDuty really is from GAAP profitability, as the company continues to give out excessive amounts of stock-based compensation. Salaries and bonuses are real expenses, whether they are paid with cash or shares, and asking investors to just ignore these expenses because they are non-cash is absurd.

We have to give credit to the company on its revenue growth, with revenue growing 31% y/y to $94 million, and marking their 6th straight quarter of growth above 30%. Other encouraging statistics include churn being well below 5% of starting ARR, more than half of ARR coming from customers with two or more products, and total free and paid customers growing 22% y/y. The dollar-based net retention was 123% as customers continued to expand users and adopt more products and services.

In other words, the company is making solid progress operationally with very healthy revenue growth, proving that it has good customer retention with sticky products that are showing low churn even during a relatively tough economic environment. That said, we find the suggestion by the company that they are now profitable to be ridiculous give the massive gap between GAAP and non-GAAP profitability, most of which is the result of the company choosing to pay a significant portion of employees compensation in the form of stock. The way we see things the company is still a long way from reaching real profitability, and the valuation is a lot higher than it might seem at first glance.

Q3 2023 Results

Revenue was $94 million in the third quarter, up 31% y/y. The company delivered dollar-based net retention in Q3 of 123%, compared to 124% in the same period one year ago. Total paid customers increased by 5% annually to 15,265, compared to 6% in the year ago period. Free and paid companies on its platform grew to over 23,000, an increase of approximately 22%, compared to Q3 last year. The company continues to have a solid balance sheet, ending the quarter with $459 million in cash, cash equivalents and investments.

Financials

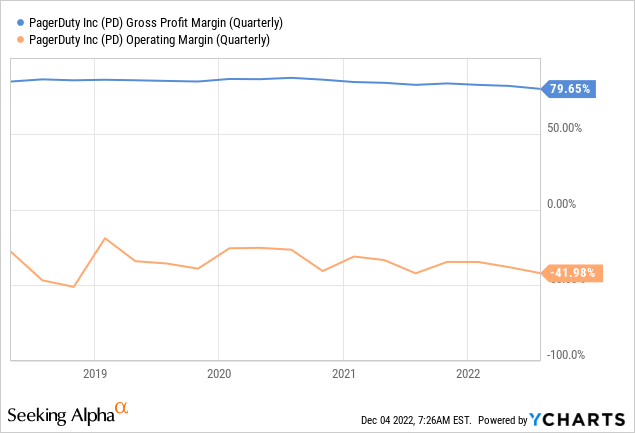

We are concerned that despite solid revenue growth, GAAP operating margin is showing very little in the form of operating leverage. The company remains massively unprofitable on a GAAP basis, mostly because of the large amounts of stock-based compensation it continues to give out as employee compensation.

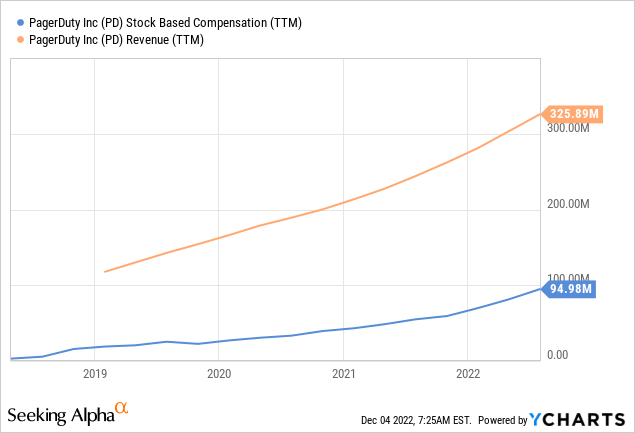

Stock-based compensation

While we agree that stock-based compensation can be a good mechanism to align employee and shareholder interests, we believe it is a real expense. Shareholder dilution is real, and the money companies later spend to buy back shares is also real. Just because it is a non-cash expense initially is not a good reason to ignore this expense. It is also clearly a very recurring expense, and even more concerning, it is an expense that has kept increasing. As can be seen in the graph below, stock-based compensation represents a very significant percentage of the revenues the company has generated.

Guidance

For the fourth quarter, PagerDuty expects revenue in the range of $98 million to $100 million, representing a growth rate of 25% to 27%, and net income per diluted share in the range of $0.02 to $0.03. This implies an operating margin in the range of 1% to 2%. Importantly, these are non-GAAP earnings that the company is guiding.

For the full fiscal year 2023, the company expects revenue in the range of $368 million to $370 million, representing a growth rate of 31% with a net loss per share of $0.01 to breakeven. This implies an operating margin of negative 1% to breakeven for the year. Again, this is non-GAAP guidance, and on a GAAP basis the company is likely to post significant losses.

Valuation

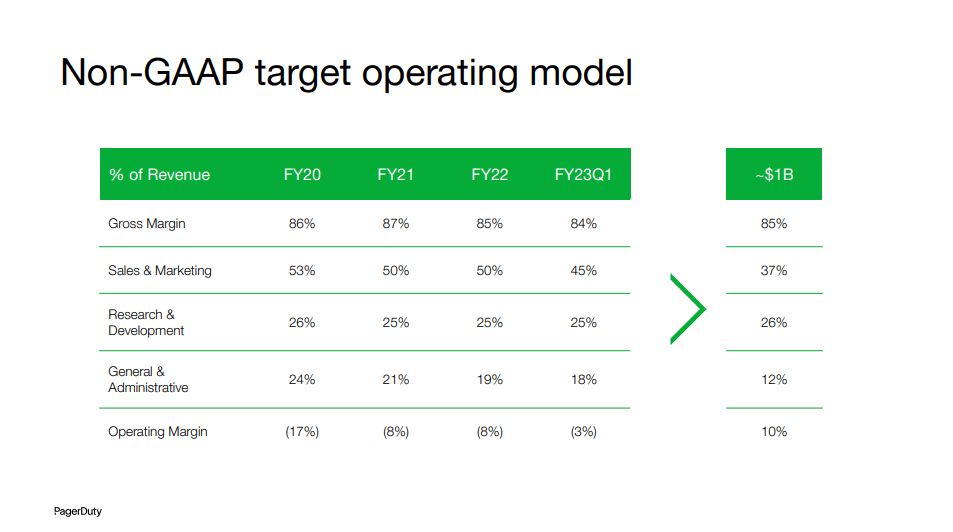

PagerDuty has shared their Non-GAAP target operating model, where they show that their objective is to reach a ~10% operating margin at a scale of ~$1 billion. This would mean that even if the company manages to reach a billion dollars in annual revenue, they would still be making GAAP losses, should they continue giving out >20% of their revenue in stock-based compensation.

PagerDuty Investor Presentation

If we completely ignore stock-based compensation, then shares would appear to be reasonably valued. Based on analyst estimates compiled by Seeking Alpha for FY24 to FY26, a 30% earnings growth rate from FY27 to FY33, a 3% terminal growth rate, and discounting everything with a 10% rate, we get a net present value of the earnings stream of ~$25 per share. It seems that investors are therefore listening to the company and ignoring this significant expense. If we take stock-based compensation into account, we believe shares are more than a 100% overvalued.

| EPS | Discounted @ 10% | |

| FY 24E | 0.14 | 0.13 |

| FY 25E | 0.33 | 0.27 |

| FY 26E | 0.58 | 0.44 |

| FY 27E | 0.75 | 0.51 |

| FY 28E | 0.98 | 0.61 |

| FY 29E | 1.27 | 0.72 |

| FY 30E | 1.66 | 0.85 |

| FY 31E | 2.15 | 1.00 |

| FY 32E | 2.80 | 1.19 |

| FY 33E | 3.64 | 1.40 |

| Terminal Value @ 3% terminal growth | 51.99 | 18.22 |

| NPV | $25.35 |

Risks

We believe the biggest risk for PagerDuty investors is valuing the company using non-GAAP numbers that ignore massive amounts of stock-based compensation. Based on our analysis, shares appear to be currently fairly valued if this expense is ignored, but massively over-valued when taking it into consideration.

Conclusion

PagerDuty delivered a solid quarter operationally, with significant revenue growth, and showing that its products are “sticky” and have good retention even during tough economic conditions. That said, we find it ridiculous that the company is presenting itself as profitable, when in fact it is still generating massive GAAP losses. Shares appear reasonably valued if one is willing to ignore stock-based compensation, but massively overvalued if one takes this expense into account.

Be the first to comment