2d illustrations and photos

Thesis

Virtus Stone Harbor Emerging Markets Income Fund (NYSE:EDF) is a small emerging markets fixed income CEF. We have covered this name before here and here, and are re-visiting it on the back of investor requests to refresh our view on the name.

The fund is up 20% in the past month, as compared to total returns close to 10% for both the S&P 500 and the long duration bond ETF (TLT). EDF’s recent performance has been driven by a move lower in risk free rates, a tightening in EM credit spreads, and a substantial narrowing in the fund’s discount to NAV. We discuss each factor in the below “Factors” section

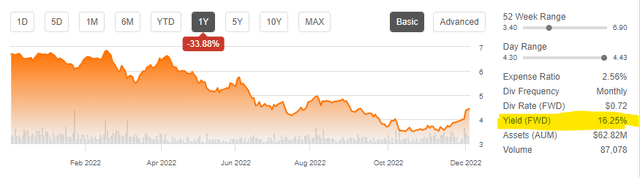

This fund is on the small side (under $100mm AUM) and runs a high leverage of 34%. We have seen time and time again small funds trying to drum up investor interest by disbursing more than they make via ‘return of capital’ distributions. The idea is to post an eye-watering dividend yield without having retail investors realize that it is unsupported, and in fact, it represents a return of their own capital investment. This is the case here, with EDF showing a 16% dividend yield:

This is not a real dividend yield. It is a gimmick, and it is unsupported. The portfolio is currently generating an approximate 7% yield, with the rest coming from ROC. This is the “modus operandi” for the fund, with the CEF’s NAV being down over -80% in the past decade (i.e. an annual 8% decrease which marries up with the ROC figure). High ROC funds are chronic underperformers and it is just a red flag gimmick that lures in uninformed retail investors. Say no to this 16% yielding CEF.

Factors Driving the Fund’s Performance in the Past Month

1) Narrowing of the fund’s discount to NAV

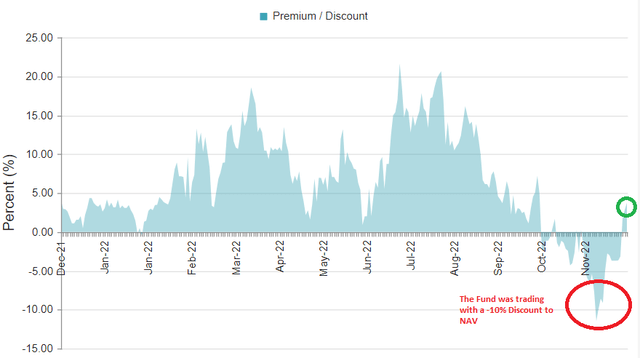

The CEF was trading at a discount to NAV of almost -10% during the October sell-off:

Premium / Discount to NAV (CEFConnect)

The CEF has now moved to a slight premium to NAV. We can see that investors usually fall for the fund’s gimmick of having a large artificial dividend yield, and usually bid the CEF at a premium to NAV.

2) A substantial fall in risk free rates

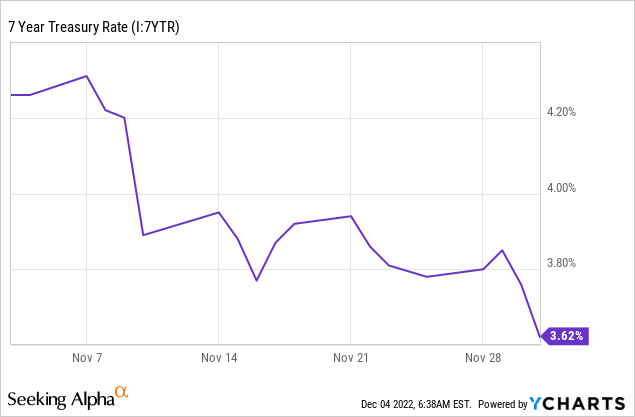

U.S. risk free rates have fallen substantially in the past month:

We can see how 7-year rates have fallen by more than 65 bps in the past month. We are using this tenor as a proxy for the fund’s duration. The market is now interpreting the Fed’s December 50 bps hike (expected hike) as somehow of a pivot. It is not a pivot, and the Fed won’t stop hiking, but the market is now retracing some of its move higher.

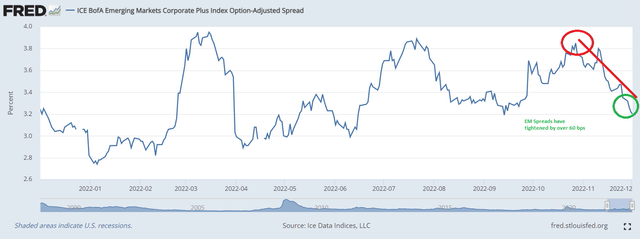

3) Tighter EM Credit Spreads

On the back of the risk-on overall environment, EM credit spreads have narrowed substantially in the past month:

We can see how EM spreads, as measured by the “ICE BofA Emerging Markets Corporate Plus Index Option-Adjusted Spread”, have tightened by over 60bps in the past month. EM credits have a high beta to risk-on markets, and coupled with talks about peak dollar and lower U.S. risk free rates have helped credit spread levels in the space.

Holdings

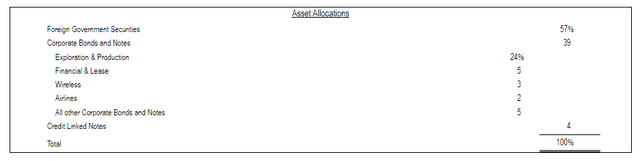

The fund holds a portfolio of EM bonds:

The Fund’s primary investment objective is to maximize total return, which consists of income and capital appreciation on its investments in emerging markets securities. The Fund seeks to achieve its investment objective by investing at least 80% of its net assets (plus borrowings for investment purposes) in emerging markets securities

We can see from the fund’s Semi-Annual Report the current parsing:

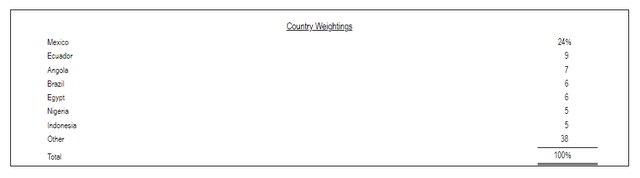

The fund is currently overweight Mexico domiciled risk:

Country Allocation (Semi-Annual Report)

More specifically EDF has large positions in Petroleos Mexicanos (PEMEX) and Poinsettia Finance:

Distributions

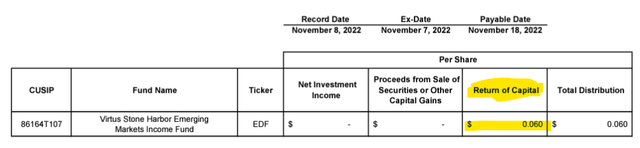

The fund is currently utilizing a very high amount of ROC, given its unsupported dividend:

November Distribution (Section 19a)

As of November 2022 the ROC figure is actually 100%.

Conclusion

EDF is a fixed income CEF focused on emerging markets. The fund is composed of fixed rate EM bonds, with a mix between hard currency and local bonds. The vehicle is overweight Mexico as a jurisdiction, with a large position in Pemex bonds. EDF is up more than 20% in the past month, on the back of a narrowing of its discount to NAV, tighter credit spreads and risk-free rates. The fund is on the small side (sub $100mm AUM) and runs a high leverage ratio of 34%. EDF has underperformed in 2022 on the back of higher rates and wider spreads, but it is set to have a sunnier 2023. Despite its improved outlook, the fund disburses an unsupported 16% dividend yield, mostly made up of ‘return of capital’. The fund’s portfolio only generates a 7% yield versus what the vehicle pays. The CEF has a history of overdistribution, with the fund’s NAV down over -80% in the past decade. With higher risk-free rates here, and some investment grade bonds yielding 6% to 7%, there is absolutely no reason for an investor to step into a CEF like EDF. Say “No” to this 16% yield, there are much better alternatives out there.

Be the first to comment