Khanchit Khirisutchalual

Investment Thesis

Pagaya Technologies (NASDAQ:PGY) recently completed its business combination with EJF Acquisition Corp. and became a public company with a valuation of around $8 billion. The company has yet to report any formal earnings but I will talk about why I like its prospect in this article.

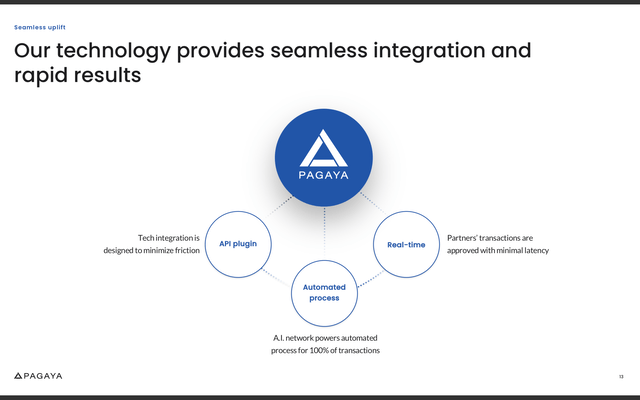

Pagaya is an Israeli company founded in 2016 by the current CEO Gal Krubiner. It is a fintech company that is revolutionizing how financial companies approve and recruit consumers by utilizing AI (artificial intelligence). It enables accurate, real-time consumer credit evaluation through the use of robust AI-driven credit and analytical technology. It allows lenders to find and accept new borrowers who fit their lending requirements without taking excessive risk.

Pagaya has a very compelling prospect as it is aiming to disrupt the current legacy credit rating system. It is operating with a simple white label business model and takes no credit risks. It has also been actively expanding its network and has landed multiple high-profile partners. The company has been growing rapidly and I believe it will continue to do so. Therefore, I rate Pagaya as a buy at the current price.

The AI lending paradox

AI lending technology had been a hot topic for a while due to the rise and fall of Upstart (UPST), an AI lending platform. In May, the company disclosed that it held part of its loan on its balance sheet which caused the market to panic as the company claimed to have no credit exposure. Recently, it lowered its guidance significantly from $300 million to $228 million, with net loss widening from $(4)-$(0) million to $(31)-$(27) million. This news caused investors to further question the legitimacy of its AI technology.

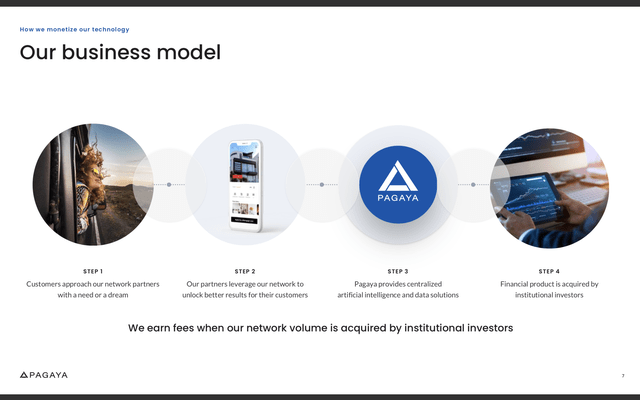

Pagaya operates in a much simpler yet efficient way compared to Upstart. Unlike Upstart which offers loans on its website (originated usually by banks), Pagaya simply offers white-label technology for its partners. There is no credit risk here. It earns a fee when a product is acquired through its AI network, or when assets are originated and serviced by its partners.

For example, when someone takes out a loan on SoFi (Pagaya’s partner), Pagaya earns a fee on that origination. This facilitator approach allows the company to scale much quicker, partner with much larger financial companies, and operate in different sub-sectors (e.g. credit card and POS).

I believe AI lending has a large potential as the legacy credit rating system like the Fico score has a lot of inefficiencies and neglects applicants that actually fit the lender’s criteria. AI lending allows better and wider credit access for consumers while financial institutions can have a broader target audience. AI lending also has a significant edge as it vastly reduces the time for decision-making and allows lenders to have access to data points from multiple sources.

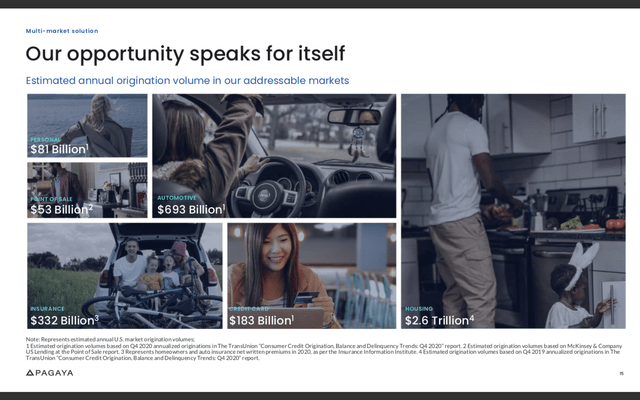

The TAM (total addressable market) for the company is huge, automotive loan alone is a $693 billion market. The company has been entering new verticals in the past few years, which include personal loans, auto loans, credit card/POS, and real estate loans. The entry into these new markets is broadening the company’s TAM. It is also actively expanding its partnership network and offering additional financial products to customers. I believe Pagaya is currently only touching the tip of the iceberg.

Strong Partnerships

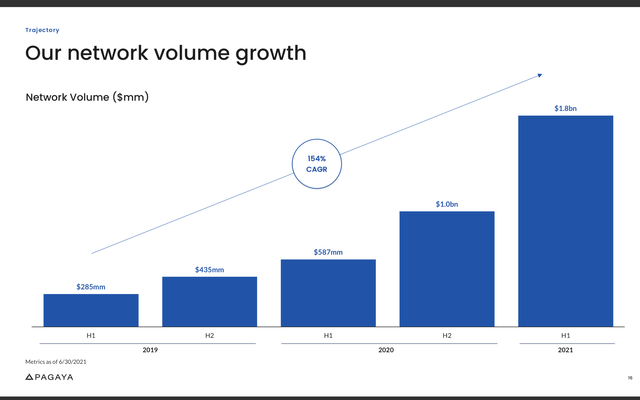

While Upstart partners mostly with credit unions and regional banks, Pagaya partners with much more established blue-chip companies like Visa (V), SoFi Technologies (SOFI), Ally Financial (ALLY), and more. These partnerships are likely to significantly boosts its network volume growth, which has been growing at a triple-digit CAGR (compounded annual growth rate) in the past few years, as shown in the chart below.

Last year, the company announced a partnership with US neobank SoFi, allowing its members to have broader access to different financial products.

Anthony Noto, CEO of SoFi, on partnership

“We are excited to leverage SoFi’s sophisticated tech platform, strong brand, and consumer appeal to originate loans through Pagaya’s AI network, extending its business to a broader audience, so more people can access credit and achieve their financial goals.”

Earlier this year, the company announced a strategic partnership with Visa, enabling Visa’s expansive network of merchant partners and issuing co-brand financial institutions to leverage Pagaya’s technology to expand customers’ access to financial products. It also partnered with Ally Financial. By utilizing Pagaya’s analytics for application analysis, Ally’s credit card business will be able to target more “pre-qualified” individuals who don’t meet its current traditional credit standards.

Jack Funda, SVP of Visa, on partnership

“Expanding access to financial tools and services is core to Visa’s purpose – uplifting everyone everywhere – and we’re excited to work with companies who bring new technologies to this challenge. Through our partnership with Pagaya, we’re providing our issuing bank clients and co-brand partners with next-generation technology to expand their customer base, boost conversion rates, increase purchasing power, and thus grow their revenue,”

Explosive Growth

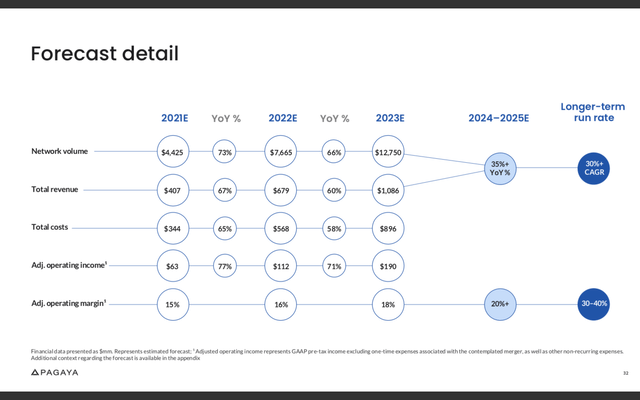

While Pagaya hasn’t reported any official financial earnings, its past result and revenue forecast indicate explosive growth going forward. The company revenue increased from $94 million in 2020 to $407 million last year, representing a 333% increase, and is forecasted to further increase by 66% this year. While network volume is also up 178% from $1.6 billion in 2020 to $4.4 billion in 2021, and is forecasted to increase to $7.7 billion this year. Unlike most hypergrowth stocks, the company is also already profitable. It posted an adjusted operating income of $63 million in 2021, representing an adjusted operating margin of 15%. The company is targeting a long-term revenue CAGR (compounded annual growth rate) of 30%+ with an adjusted operating margin of 30%-40%. I believe this is achievable given the opportunities that lie ahead.

Conclusion

In conclusion, I believe Pagaya has massive potential. The company is disrupting the legacy credit system with its AI lending technology, which enables much quicker approval time and wider credit access. The TAM for the company is huge as the credit market is a very large industry, and it is also actively expanding into new verticals too. It has a simple and easy-to-adapt business model that allows it to scale quickly. It has already successfully landed multiple blue-chip partners like Visa and SoFi. The company has been growing revenue rapidly and is forecasted to continue to do so. I think Pagaya is only just getting started and I really like the prospect of the company, therefore I rate it as a buy.

Be the first to comment