JHVEPhoto/iStock Editorial via Getty Images

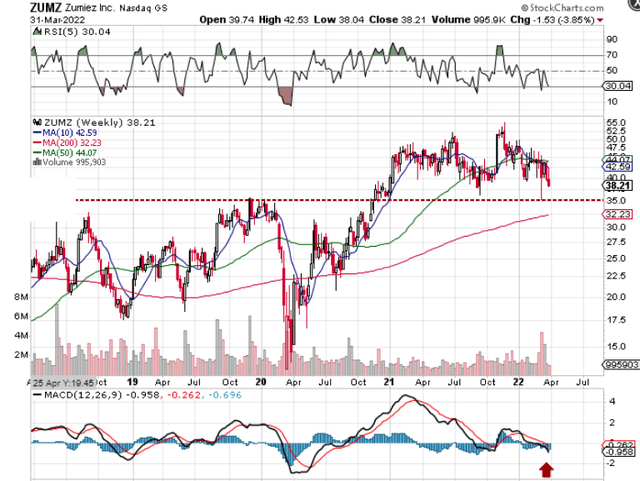

As we can see from the technical chart of Zumiez Inc. (NASDAQ:ZUMZ) below, shares are now down well over $10 a share (20%+) since the start of calendar 2021. As we have depicted on the chart, if shares were to continue to fall, the next support level is located at Zumiez’s 2019 highs of just under $35 a share. If this level was to fail, one would think that the stock’s 200-week moving average of $32.23 would most certainly put a halt to the selling.

A drop to the latter support level mentioned above would most certainly present a strong long-term buying opportunity in Zumiez for reasons we will get into. For the moment though, Zumiez remains a hold as shares have not printed any type of convincing bottom yet and short-interest (Now approaching 20%) continues to rise. Probably the prime reason for the jump in short interest in recent weeks was the comments made by the CFO in relation to forward-looking guidance for Q1 and beyond on the recent fourth-quarter earnings call. Knowing full well the fiscal first quarter of 2022 had not started that well, the CFO used the opportunity to advise the market of what was coming down the pike.

Technical Chart Of Zumiez (Stockcharts.com)

Management now believes sales in the first quarter will come in around the $218 million mark which is a tough comparable ($279 million was the top-line number in Q1-2021). Earnings are also expected to see a significant drop due to higher costs surrounding more store hours as well as the return of travel to company events. Management alluded to Russia’s invasion (which appears to have altered spending habits at least in the short term) along with the multiple economic stimuli early last year as reasons for the lower comparable. In saying this, management seems to be banking on a robust recovery in the seasonally popular third and fourth quarters and this is where investors need to be careful at least in the short term.

Why? Because based on historic trends, the company’s trailing return on equity for example (23.37%) is well ahead of its 10-year average (13.26%). Furthermore, the technical chart above is essentially a result of Zumiez’s known fundamentals at this point in time. This means the expected $1.54 & $2.50 in earnings per share for the third and fourth quarters, respectively, of fiscal 2022 have already been well priced in by the market at this stage. Despite the fact that 34 stores are expected to be opened in fiscal 2022, sales are expected to drop by roughly 3.9% and earnings by 2.5%. Suffice it to say, a further drop in share price may be on the cards here.

A slowdown in growth however does not make a bad company overnight, and here is where growth investors differ in a big way to value investors. For example, in fiscal 2021, Zumiez generated $135 million of operating cash flow which equates to a trailing cash-flow multiple of 5.65. Although cash flow generation is expected to be softer this fiscal year for reasons cited above, Zumiez will continue to be able to invest through the cycle due to the absence of debt on the balance sheet and almost $300 million in cash & marketable securities. Furthermore, the existing buyback program is expected to come to an end this year, so this will free up more cash-flow going forward if indeed more share buybacks are not initiated.

Suffice it to say, as long as Zumiez can generate sufficient cash flow to keep on investing behind the business aggressively, then the company will grow as long as the firm doubles down on what has been working. This brings us to the stock’s valuation, and although Zumiez’s earnings are cheaper (GAAP multiple of just under 8), its assets (P/B of 1.6) and sales (P/S of 0.8) are very close to its average multiples over the past 5 years or so. Suffice it to say, we would like a better discount here which is why we would like to see a test of those above-mentioned support levels.

To sum up, although Zumiez’s fiscal 2022 is expected to put an end to the strong growth path the company has been on, investors need to remember where the stock has come from. Over the past decade, sales have increased by almost 8% per year on average, and earnings per share have increased by close to 15% annually on average. Yes, there were catalysts that lined up well for the company in 2021 but investors need to look beyond the tough comparables that are coming and instead focus on the long-term trend. Zumiez is a quality outfit, and its integrated model has clearly been functioning with respect to generating demand despite inflationary pressures and supply chain headwinds. A solid weekly swing will most likely confirm the bottom here. We look forward to continued coverage.

Be the first to comment