JoeLena/E+ via Getty Images

Last time, we initiated coverage on Packaging Corporation of America (NYSE:PKG), providing a deep dive into the company’s key takeaways. Thanks to six competitive advantages, we rated PKG with a clear buy and a target price of $160 per share. Here at the Lab, we have a good grip on paper companies, and today we are back to analyze its just-released quarterly results. Within our paper coverage, PKG is the first one to report, later on, we will also provide specific publications for WestRock (WRK) and International Paper (IP).

Q3 Results

Packaging Corporation of America’s disclosure wasn’t ideal; however, the company delivered top-line sales of $2.1 billion compared to the $2.0 billion reported in last year’s third quarter. Starting with the CEO’s words, PKG was able to exceed its guidance for Q3 despite a continuous negative effect from raw material inflationary pressure. The packaging segment was below management expectations. However, price increase implementation is still ongoing and is generating important bottom-line results. The company is also focused on maintaining low operating costs thanks to “process efficiency optimization efforts and material usage initiatives”.

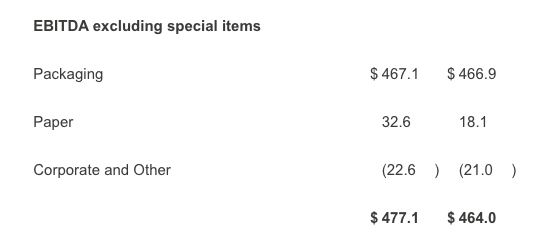

Looking at the divisional level, compared to the Q2 results, the Packaging division and the Paper segment volumes were down by 6% and 6,000 tons respectively. However, both divisions recorded an increase in revenue lines thanks to higher prices. Going down to the P&L analysis, PKG lowered its interest expense and tax payment. These positive outcomes were partially offset by higher logistics costs, higher depreciation, and also higher maintenance expenses. To sum up, compared to Q3 results in 2021, the company achieved a better EBITDA in absolute value and also better profitability.

PKG EBITDA by Division (PKG Q3 Press Release)

Conclusion and Valuation

Concerning the valuation, our internal team values paper mills by averaging and combining the following two metrics:

- An 8x multiple on EV/EBITDA on our NTM estimates,

- A DCF analysis with a CoE of 10% and a long-term growth rate of 2%.

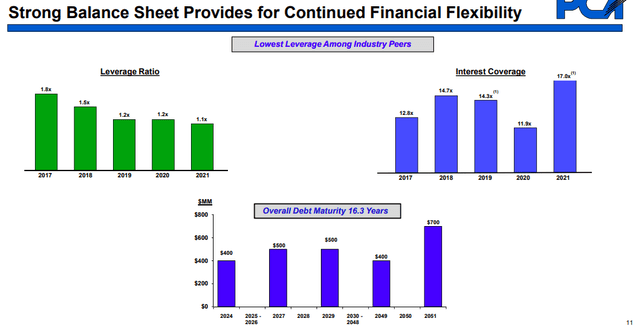

Out of the three companies, Packaging Corporation of America is already the most profitable one with the lowest SG&A expense ratio. We should also remember that the company has lower debt compared to its peers as well as a lower payout ratio, having increased its dividend per share year-on-year (even during COVID-19). More importantly, PKG has no exposure to Russia. Given the latest results and based on our forecast assumption, we confirm our $2 billion EBITDA for 2023, maintaining our buy target at $160 per share.

PKG Debt Metrics (Bank of America Global Agriculture & Materials Conference)

Be the first to comment