JuSun

Pacific Biosciences of California (NASDAQ:PACB) popped up on my radar a few years ago due to its potential to be a “pick & shovel” investment in genomics and gene therapies. Unfortunately, the stars never aligned to establish a position in PACB, and the ticker rocketed up once it was associated with Cathie Wood. Well, like many of Cathie Wood’s picks, PACB has been under immense selling pressure and has returned to its previous trading range despite the company making significant progress. This has provided me with another opportunity to get a shot at PACB at a reasonable valuation and ahead of projected growth.

I believe that Pacific’s Sequel IIe system has the potential to be the main growth driver in the near term. In addition, Pacific has multiple partnerships and programs that could generate potent catalysts that could have a positive impact on the share price. Moreover, Pacific has the financials to keep the company running to help unlock some of these catalysts and growth drivers. As a result, I consider PACB to be a prime candidate for the Compounding Healthcare “Bio Boom” Portfolio.

I intend to provide a brief background on Pacific Biosciences of California and will discuss why I am looking to swap PACB into the Bio Boom portfolio. In addition, I reveal my strategy for initiating a position in PACB and how I plan on managing that position over the remainder of 2022.

Background on Pacific Biosciences

Pacific Biosciences of California develops, manufactures, and commercializes genomic analysis systems to be used by pharmaceutical companies, institutions, hospitals, and academic facilities that work in genomics. PacBio’s systems offer a comprehensive list of genome sequencing capabilities from their single-molecule, real-time sequencing “SMRT” and HiFi sequencing technology. The company’s technology delivers long-read genomic sequencing as well as short-read sequencing.

The company’s Sequel IIe system has reduced the cost of using genomic sequencing equipment. According to PacBio, Sequel IIe can cut 90% of the data storage costs and reduce data analysis time by 70%-85%. Sequel IIe has the ability to analyze and sync the data to a cloud that can be accessed by scientists. The advanced capabilities of Sequel IIe allow the company to offer improved accuracy of long reads while also reducing costs.

PacBio’s technological prowess has attracted around a dozen partnerships and notable customers. PacBio has a partnership with Invitae (NVTA) to reduce the cost of genome sequencing. PacBio also has a research collaboration with Asuragen to combine Asuragen’s AmplideX PCR technology with PacBio SMRT sequencing for an accurate long-read sequence of the genome. Recently, the company announced they are working with Google (GOOG) to explore genomic analysis, machine learning, and algorithms to improve PacBio’s HiFi sequencing. Furthermore, PacBio is collaborating with Berry Genomics to bring PacBio’s long-read tech to China. Moreover, PacBio is working with Genomics England to identify genetic variants in rare diseases. Again, these are just a few of the company’s partners and customers.

Worthy Of A Spot In The Bio Boom Portfolio

The Compounding Healthcare “Bio Boom” Portfolio is comprised of speculative healthcare tickers that offer a unique investment opportunity with substantial upside. These investments are expected to generate substantial profit in the near term and have the potential to eventually hit multi-bagger status during its time in the portfolio. I believe PACB hits several of the Bio Boom criteria following a prolonged sell-off in the face of notable growth and progress.

Having a competent commercial organization that has established a track record for revenue growth is one of the key characteristics I look for in a commercial-stage Bio Boom Portfolio candidate. Typically, companies who are experiencing earnings growth and are expected to maintain growth in the coming years should see a rise in intrinsic value. Hopefully, the improvement in the company’s fundamentals should ultimately lead to a rise in the share price.

PacBio has demonstrated their ability to rapidly expand the use of Sequel II and IIe systems, and long-term growth prospects. The company’s Q1 earnings reported a record number of instrument shipments and puts the company on track to hit their full-year revenue guidance of around $160M-$170M, which will be a 23%-30% growth over 2021. By increasing the number of systems on the market, PacBio has amplified their commercial footprint, which should improve their sales over the long term as they launch product enhancements.

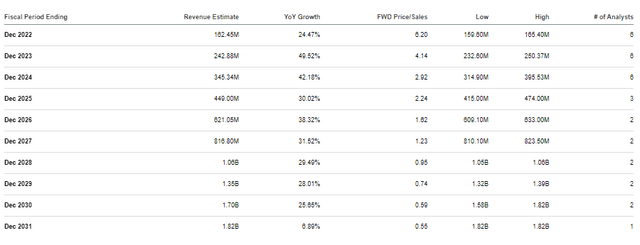

The Street expects PacBio to report strong double-digit revenue growth in the coming years with annual revenues rising above $1B before the end of the decade, which would be a <1x forward price-to-sales.

PacBio Annual Revenue Estimates (Seeking Alpha)

Considering the sector’s average price-to-sales is about 5x, PacBio can say PACB has considerable upside potential. Therefore, PacBio has at least one characteristic I like to see in Bio Boom tickers.

Another key characteristic found in Bio Boom tickers is the abundance of near-term and long-term catalysts that can inject some positive momentum into the share price. PacBio is making progress on their next generation of short and long-read sequencers. Their mid throughput short-read SBB instrument is on target for commercial launch in the first half of 2023. PacBio believes this SBB instrument will be the “world’s most accurate short-read platform.” For long-read, the company is working on their next-generation long-read sequencers that will be equipped with HiFi. These sequencers are expected to address the high cost and throughput that has plagued contemporary long-reads. If PacBio is successful with getting these next-gen products launched, they should improve their position as one of the market leaders, and dramatically improve their long-term outlook. As a result, any positive updates from these programs could be a potent catalyst that may well trigger a positive move in the share price and permit some profit taking.

One of the most important characteristics of a Bio Boom stock is a relatively healthy financial position to help fund a promising technology or fuel a commercial effort in order to unlock additional value. PacBio finished Q1 with $963M in unrestricted cash and investments. PacBio estimates this cash position is sufficient to fund the company’s current development and commercialization efforts long enough to reach breakeven. Considering the economic environment and the volatility in the equity markets, PACB is undeniably in a better position to maintain their operations at full throttle compared to other cash-burning tickers.

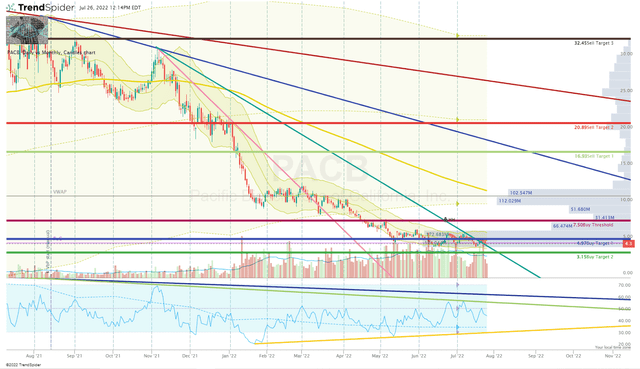

Chart technical analysis is also a critical item when assessing Bio Boom tickers. Regardless of the company’s fundamentals, the charts show us how we can take advantage of the opportunities the market provides. Like most of the small and mid-cap healthcare tickers, PACB has had a rough go since February of 2021, when it was trading above $53 per share. Now, PACB is trading less than 1/10th of its all-time highs after getting punished along with most of Cathie Wood’s ARK Genomic Revolution (ARKG) holdings.

PACB Daily Chart (Trendspider)

We can see that PACB’s rate of descent is slowing and the daily trading volume has started to increase. This could be a sign that PACB is starting to base and buyers are starting to accumulate. What is more, the Daily Keltner Channel is below the Monthly Keltner Channel has me anticipating a strong pivot back into the monthly channel in the near term.

Although this is still a bearish Daily Chart, I believe the market is providing us with an opportunity to establish a position that can be traded or turned into a long-term investment.

Some Common Concerns

Although the future looks bright for PacBio, the ticker is far from being risk-free. The company is still dealing with COVID-19 headwinds disrupting flowing lab throughput. This is still an ongoing concern as we see the undulating cases in China, which have used lockdowns to help slow the spread. It is possible COVID-19 lockdowns and public health policies will continue to have a negative impact on labs and their productivity for a prolonged period of time. Obviously, this could reduce utilization and hurt revenues.

Another concern is the company’s OpEx, which was $92.7M (non-GAAP) in Q1. This was a 99% increase from $46.7M in Q1 of last year. This upsurge is due to the increase in headcount, expenses associated with the Omniome acquisition, and R&D expenses. The company might be scheduled to report significant revenue growth, however, that won’t mean much if the company’s cash burn far outpaces the company’s cash earn. Clearly, a year-over-year cut in EPS could have a negative impact on the share price and could hinder a potential reversal until the company can return to reporting EPS growth.

One more concern to keep an eye on is competition. The company has several competitors that could outperform PacBio in the lab and on the market. Illumina (ILMN), Oxford Nanopore (OTCPK:ONTTF), 10x Genomics (TXG), Thermo Fisher Scientific (TMO), and Bionano Genomics (BNGO) are probably the first that comes to mind. Indeed, there are a number of larger companies that could become direct competitors in the future such as Agilent Technologies (A), and Danaher Corp (DHR) to name a few.

Indeed, these risks are common in small-cap stocks and are prevalent throughout my Bio Boom Portfolio. It is probable that the company will be able to address these concerns in due time. However, there is a possibility that these issues persist fueling relentless selling pressure and crushing investor sentiment. As a result, my conviction grade for PACB is a 2 out of 5.

Earnings Focus

I believe PacBio needs to report encouraging earnings reports for the remainder of 2022 in order to reestablish some positive energy around the ticker. PacBio expects revenue to grow sequentially compared to the $33.2M in Q1 of 2022, and fall in the range of $160M-$170M for full-year 2022. This would be about 23%-30% growth over last year.

Obviously, COVID-19 or global supply chain constraints could impede the company’s ability to hit these numbers, so it is imperative that investors remain vigilant around upcoming earnings reports. Even a small miss could trigger a substantial sell-off.

On the other hand, if the company outperforms in China and is able to beat expectations, we could see a rapid resurgence of momentum in the share price.

My Plan

I am looking to establish a PACB position in the near term using our system of Buy Threshold and Buy Targets. For PACB, the Buy Threshold is currently $7.50, which is the highest value I am willing to pay given the technical and fundamental analysis. PACB’s Buy Target 1 is set at $4.97 and Buy Target 2 is at $3.15. These Buy Targets are key technical levels located around discounted valuations. I use these Buy Targets to set limit orders and/or alerts to change strategies. In the case of PACB, I will set a few buy orders at these levels to establish a position, and accumulate with periodic cost-averaging.

Once I have established a position, I will immediately set sell orders at my Sell Targets in order to book some profits and move the position into a “House Money” state.

The strategy is to remove the original investment from the market after hitting Sell 2 and leave the “House Money” position to be sold for profit at Sell Target 3 or retained for a long-term investment.

For PACB, I anticipate holding a core position for at least five years in anticipation that the company will eventually become profitable and will graduate into the Compounding Healthcare “Bioreactor” growth portfolio.

Be the first to comment