jetcityimage/iStock Editorial via Getty Images

Although there has been a tremendous amount of uncertainty as of late, particularly when it comes to the production and sale of vehicles, one company that has done extraordinarily well is PACCAR (NASDAQ:PCAR). As a producer of trucks, specifically of light, medium, and heavy-duty commercial trucks operating under key brand names like Kenworth, Peterbilt, and DAF, the company has done extraordinarily well for itself from both a fundamental perspective and a share price perspective. It is true that management is expecting some weakening in the company’s fundamental condition in the near term. That we can and could last for some time. Given this uncertainty, combined with the fact that the company has already done incredibly well in recent months, and factoring in that shares look a bit lofty relative to similar firms, and I do think that now might be the time to consider more appealing prospects. But for those focused on the very long run, who don’t mind experiencing some volatility over the next few quarters, now might be as good a time as any to buy up some of the stock.

A nice journey

The past few months have been a great journey for shareholders of PACCAR. You see, back in May of this year, I wrote an article that took a bullish stance on the company. In that article, I acknowledged that the prior couple of years had been rather difficult for the company. But I found myself encouraged by the fact that it looked to be recovering. Even though the broader market was starting to show some worrisome signs, I felt that shares were priced low enough and fundamental performance was strong enough to warrant a ‘buy’ rating on the company. Since then, the company has handily delivered. While the S&P 500 is down by 8.4%, shares of PACCAR have generated upside for investors of 10.4%.

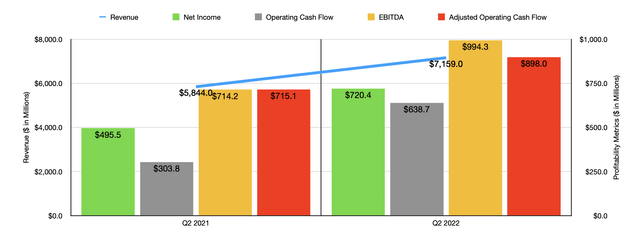

Author – SEC EDGAR Data

To see why this upside has occurred during what has otherwise been a difficult market, we need only look at the company’s recent financial performance. In particular, we need to look at data covering the second quarter of the firm’s 2022 fiscal year. This is the only quarter for which data is now available that was not available when I last wrote about it. During that quarter, revenue came in at $7.16 billion. This represents an increase of 22.5% over the $5.84 billion generated the same time one year earlier. Truck revenue for the company grew by 28.7%, climbing from $4.15 billion to $5.34 billion in response to higher truck deliveries and improved pricing in the company for all of its markets. Total truck deliveries in the quarter came out to 46,900. That’s about 17% higher than the 40,100 experienced in the second quarter of 2021.

Parts sales, meanwhile, increase by 18.2% from $1.21 billion to $1.43 billion, also driven by higher demand and higher pricing. The only weak spot that the company experienced was in the financial services category. Revenue they’re actually dropped, plunging by 18.4% from $456.3 million to $372.5 million. Management chalked this up to lower used truck sales. Although this may seem odd, it actually makes a lot of sense when you consider the supply chain issues that the world has seen. Fewer people would want to sell their used vehicles, instead putting them to use to generate attractive cash flows.

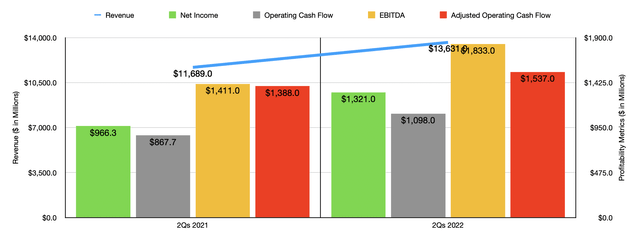

Author – SEC EDGAR Data

This strong top line performance was instrumental in pushing the company’s profitability higher as well. Net income in the second quarter of the 2022 fiscal year was $720.4 million. That dwarfs the $495.5 million generated in the second quarter of 2021. This rise in profitability was driven largely by an improvement in the average truck sales price that the company recorded. The company benefited to the tune of $630.9 million from average truck sales prices. It also benefited to the tune of $95.5 million from increased sales volume. A lot of this increase, however, was offset by $512.8 million in additional average per truck material, labor, and other direct costs, as well as to the tune of $36.7 million associated with factory overhead and other indirect costs. The improved profitability also helped to boost cash flows. Operating cash flow grew from $303.8 million in the second quarter of 2021 to $638.7 million the same time this year. If we adjust for changes in working capital, it still would have risen, climbing from $715.1 million to $898 million. And over that same window of time, we also saw EBITDA improve, climbing from $714.2 million to $994.3 million. As can be expected, these results were also instrumental in continuing the strong performance for the 2022 fiscal year as a whole, with results for the first half in its entirety relative to the same time last year shown in the chart above.

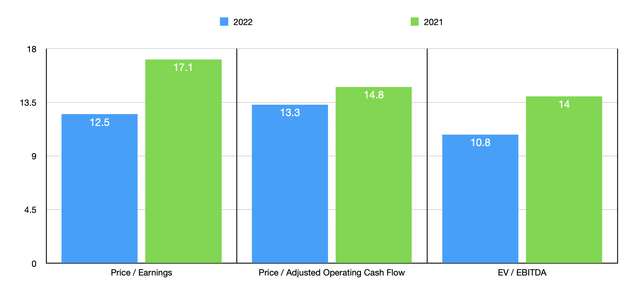

Author – SEC EDGAR Data

Management has not really provided any detailed guidance moving forward. The only thing they did say is that deliveries are likely to be between 44,000 and 48,000 compared to the 32,800 seen one year earlier due to semiconductor shortages. This makes relying on assumptions of the future rather risky. But we really have no other choice. If we assume that the rest of the 2022 fiscal year will look like the first half of the year, then we should anticipate net income of $2.53 billion, adjusted operating cash flow of $2.37 billion, and EBITDA of $3.47 billion. These numbers would give us a forward price to earnings multiple of 12.5, a forward price to adjusted operating cash flow multiple of 13.3, and a forward EV to EBITDA multiple of 10.8. These numbers stack up favorably compared to the multiples that the company is trading at if we rely on data from the 2021 fiscal year instead. This can be seen in the chart above. As part of my analysis, I also compared the company to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 14.1 to a high of 62. Two of the five firms were cheaper than our prospect. Using the price to operating cash flow approach, the range was between 8.6 and 16.2. And using the EV to EBITDA, we get a range of between 9.4 and 15.3. In both of these cases, four of the five companies are cheaper than PACCAR.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| PACCAR | 17.1 | 14.8 | 14.0 |

| Cummins (CMI) | 14.9 | 14.1 | 9.4 |

| Terex (TEX) | 14.1 | 10.6 | 9.4 |

| Oshkosh (OSK) | 19.1 | 11.3 | 12.9 |

| Westinghouse Air Brake Technologies (WAB) | 31.1 | 16.2 | 15.3 |

| Manitowoc (MTW) | 62.0 | 8.6 | 10.6 |

Takeaway

All the data shown right now tells me that PACCAR continues to do great from a fundamental perspective. Shares still look quite affordable, particularly on a forward basis, but they are a bit lofty relative to similar firms. Given how much shares have increased recently and how pricey they are compared to their peers, and considering economic uncertainty, I do think investors who were worried about performance over the next year or so should be a bit more cautious. So while I would have no problem buying the stock if I were looking at a 5- or 10-year investment horizon, I do think anybody looking at a shorter timeframe than that should consider this a ‘hold’ right now. To be clear, if it weren’t for broader economic uncertainty, all other factors combined would still lead me to rate the firm a ‘buy’.

Be the first to comment