Joshua Sammer/Getty Images Entertainment

Luxury goods producer Hermes (OTCPK:HESAY), best known for its leather bags, looks like a richly valued company on the face of it. With a price-to-earnings (P/E) ratio of 41.7x, logically it would seem about right that its share price has tumbled by almost 30% year-to-date. And by extension, it makes sense to believe that there’s a fair bit of downside to it in the near future, especially considering the current state of the stock markets. In this article, I explore why Hermes has such high market multiples in terms of its performance and peer comparisons. It concludes that there may indeed be a downside in the short term, but there are still plenty of reasons to buy it for the medium and long term.

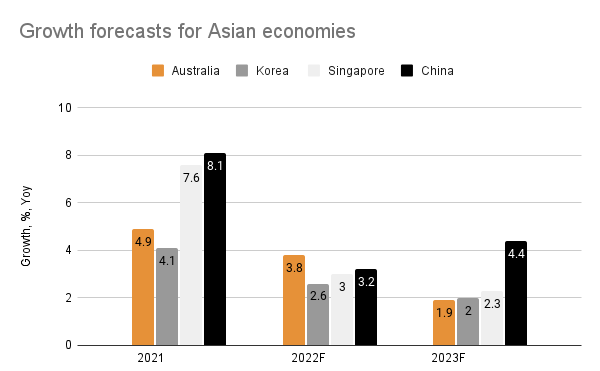

Sustained Asian demand

China is a huge market for luxury products, and its slowdown has affected these companies’ performance to some extent recently. But there’s a difference when it comes to Hermes. While other companies in the segment like Burberry (OTCPK:BURBY) and LVMH (OTCPK:LVMUY) have warned of the impact of the uncertain Chinese situation, Hermes appears less concerned about it. One look at its solid financial results for the first half of 2022 (H1 2022) explains why. Asia ex-Japan, like its peers, is a big market for the company too, accounting for almost half of its revenue. But unlike the other cases, for instance, LVMH, growth from this region has been a healthy 15% year-on-year for it. It’s lower than the overall revenue growth of 23%, as other regions showed much faster growth, to be sure, but it’s not poor either.

It explains this as due to…

… high level of activity across the region and by sustained sales in Singapore, Australia and Korea. Greater China strongly bounced back in June after being penalised by sanitary restrictions and store closures in April and May….

Also, it’s worth noting that this growth has been achieved over a very strong base. In H1 2021, the region grew by 70% over 2019, the last pre-COVID-19 year. In 2023, growth in these economies is expected to slow down as per the IMF’s latest estimates (see chart below), however, there could be some support from recovery in China that it has already started witnessing. As I pointed out in the case of LVMH recently, this could continue to buoy revenue growth.

Source: IMF

Expanding margins despite high inflation

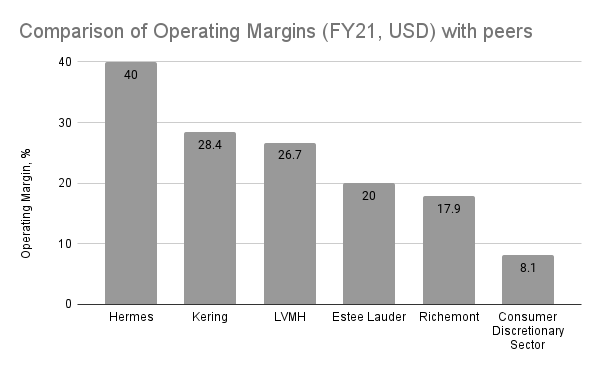

Its rising margins at a time of high inflation are also notable. At 42.1% at the end of June 2022, HESAY’s operating margin is the highest it’s been in at least 10 years, even though its operating costs have risen in double digits over the past year. Ditto for its net margins at 30.5%, which have bounced back impressively after dropping to 13.5% during the pandemic.

Further, its margins are also higher than those of other luxury companies, which sets it apart from the segment. In any case, the luxury segment tends to have higher margins in any case compared to say, the consumer discretionary sector as a whole, which has a much lower operating margin of 8.1%. So, we are then looking at a company in a high-margin segment, whose margins are higher than even its peers and they are growing as well.

Source: Seeking Alpha

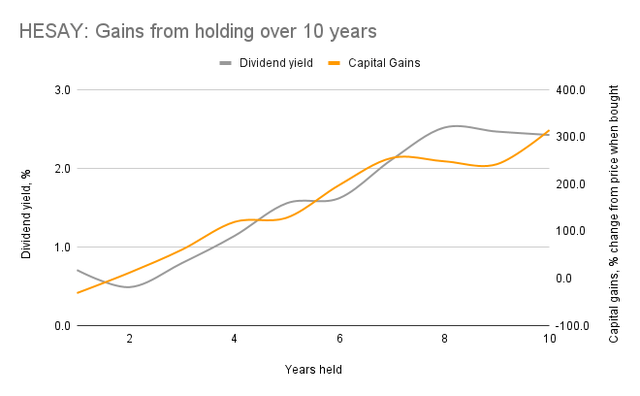

Long-term gains

It’s little wonder then that the company has made some neat gains for investors over the years. An investor who bought the stock 10 years ago would have made capital gains of almost 315%. Even if it was bought 5 years ago, the gains would be some 120%. Even its dividend yield, which is quite muted at 0.7%, starts looking slightly better in the context of an investment made in Hermes ADRs 5 and 10 years ago respectively at 1.6% and 2.4%.

Sources: Seeking Alpha, Author’s Estimates

A consistently high earnings ratio

The one ostensible drawback to HESAY is its high price-to-earnings ratio of 41.7x as I write. It’s the highest among its peers, with Estee Lauder (EL) a distant second at 33x and it’s way higher than the ratio for Gucci owner Kering (OTCPK:PPRUY), at 14x. This can be seen to imply that Hermes is overvalued. But this needs to be seen in terms of both its earnings and a historical context.

For the last financial year, its net earnings grew by 64.5% in USD terms, which is faster than all its peers save LVMH, which saw a huge growth of 138.5%. Its operating ratio at 40% is second to none, with Kering a distant second at 28.4%. Further, its P/E right now is actually a tad below the median value of 41.9x over the last 13 years. It has risen to as high as 126.8x. Seen in this light, its P/E is more an indication of the premium that investors are routinely ready to pay for holding a largely dependable stock.

Valuation risk

At the same time, it’s essential to note that HESAY’s P/E has touched a low of around 30x historically. Since we are in particularly unpredictable times right now, with huge risks to the downside, it’s probably a good idea to be prepared for the worst. China’s recovery may well be thwarted if new coronavirus variants show up and send it back into lockdowns. Softening in Europe and USA is expected to continue in 2023 as well, which could slow the company down. If its P/E were to reduce to its past lows, that would translate into a potential fall of 28% in price from current levels, indicating that there could be a better price to buy HESAY at.

Consider the investing timeframe

Considering only the short term, HESAY would be a wait-and-watch. However, it’s hard to overlook the gains it has made for investors over the past five or 10 years. These indicate that for the medium-term or long-term investor, it still continues to be a buy keeping in mind its sustained current performance, expanding margins and China’s recovery.

Be the first to comment