Max Zolotukhin

P10 (NYSE:PX) initiated a public offering (and up-listing – the company was previously listed OTC) last fall at a time when the market was quite enthused about the stocks of large private equity firms like Apollo (APO), Blackstone (BX), Carlyle (CG), and KKR (KKR) which were nearing all-time highs. Since that time shares in the aforementioned PE giants are down 40+%, while P10 has held up much better, falling only 14% from its IPO price. To be fair P10’s IPO was not very well received (the company’s initial offering priced below the ‘low end of the range’). Had it priced in the middle of its range it would have returned -20% or so, which is still considerably better than the large publicly traded PE firm.

I believe the main reason for P10’s relative outperformance is that the firm is only exposed to recurring management fees rather than the much more volatile incentive fees (also known as ‘carry’) which tend to disappear quickly in difficult market environments where there is a lack of exit opportunities (IPOs, M&A, etc.). Recurring management fees are calculated as a fixed percentage of committed capital – unlike the fees earned by managers of publicly traded equities which can vary widely based on share prices, P10’s fees are earned based on the amount invested. Equally important is that private investment funds typically have a 10-year duration ensuring a long-time horizon of juicy fee collection.

Though its shares are more expensive than most of the private equity giants, P10 offers investors an opportunity to participate in the most attractive part of the private equity pie – recurring (and growing!) management fees.

What is P10?

P10 is a holding company for a group of fund of funds for private equity/debt and venture capital – it operates under the RCP Advisors, True Bridge, and Enhanced Capital Brands, among others. In the fund of funds business, the company serves the needs of smaller institutional investors (smaller endowments or pension funds) which don’t have the resources to employ a full team of analysts to diligence private equity funds and investment opportunities. These smaller institutions are effectively outsourcing their private equity/debt and venture investing to P10.

On behalf of its clients, P10 has a team of analysts which conduct due diligence on private equity/debt/VC funds. Importantly, P10’s research extends well beyond the private equity giants and encompasses hundreds of middle market firms which would likely be unavailable to smaller institutions.

In addition, by pooling together the funds of smaller institutions, P10 can make available certain funds which would otherwise be inaccessible. Suppose that a small endowment wishes to invest $5 million in private equity but wants to split this amongst four different funds. In many cases, $1.25 million would be too small to invest in an Apollo or Blackstone flagship fund. However, P10 makes this investment possible by pooling together many smaller institutions.

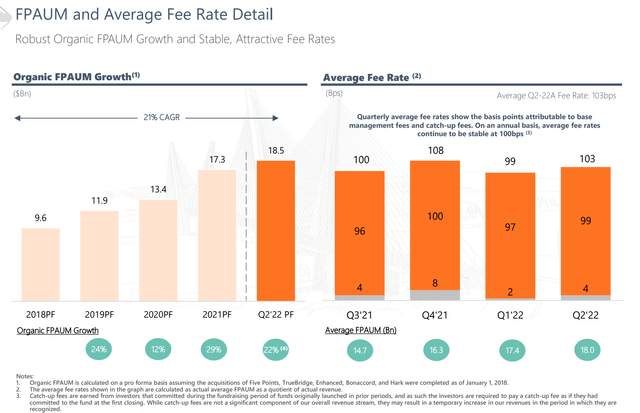

As you can see below, P10 is very well paid for providing its services, receiving about 1% per year:

AUM & Fees (P10 Investor Presentation)

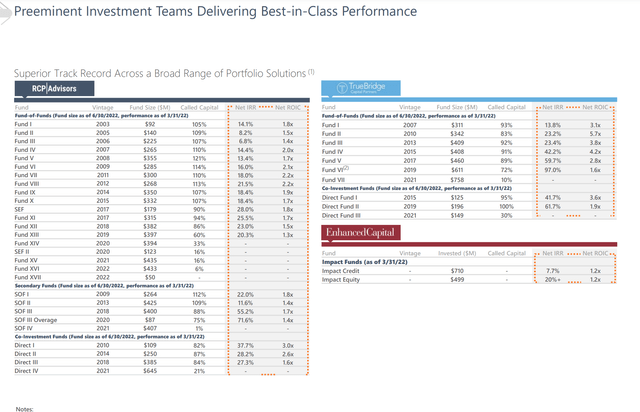

P10 was built via acquisition whereby it has purchased fund of funds focused on new areas (such as debt funds and venture capital), as you can see above, the company has generated strong organic growth. P10’s organic growth is a function of increased allocations to private investments by institutions as well as a strong track record. Despite the additional layer of fees (P10’s fees are charged on top of the private equity manager’s fees), P10’s clients have been well served as shown in the results achieved below:

Historical Fund Track Record (P10 Investor Presentation)

I believe that the long-term (multi-decade) trend of increased allocation to private investments is likely to continue and that P10 is likely to be a prime beneficiary.

Valuation & Conclusion

Here is a simple napkin model showing P10’s current earnings power:

|

2022e |

|

|

Revenue |

185 |

|

EBITDA |

103.6 |

|

Margin |

56% |

|

Interest |

10 |

|

Capex |

2 |

|

Taxes |

0 |

|

FCF |

91.6 |

|

FCF/share |

0.75 |

|

P/ FCF |

14.0 |

I simply apply the average fee earned by P10 to its current asset base. In the interests of conservatism, I’ve used an EBITDA margin at the lower end of the company’s historical range (55-60%). There’s a pretty good possibility that EBITDA margins expand over time, especially if the company continues to be successful in growing assets under management. It is important to note that P10 is unlikely to pay taxes for the foreseeable future. The holding company was formed using a shell which contains hundreds of millions worth of tax Net Operating Losses (NOLs). In addition, having been built via acquisition of fund of fund firms, P10 is able to create a non-goodwill intangible asset upon acquisition which is tax deductible. This brings me to $0.75 per share in free cash flow.

As we sit today P10 trades at 14x free cash flow per share. Relative to Blackstone (deducting excess cash & investments & taking into account management fees only), which trades at 24x recurring profits, P10 looks like a bargain. Using the same methodology, KKR trades at a much lower multiple, about 15x (KKR has considerable excess cash & investments relative to other PE firms). And then there is Apollo which I wrote about last week and is a different animal together following its merger earlier this year with Athene. Apollo trades at less than 11x earnings though this includes lower quality fixed annuity income.

As we sit today, I have a meaningful position in Apollo and a much smaller position in KKR. Having followed these companies for nearly a decade I’m very comfortable investing in them, particularly at what I consider attractive valuations. While I don’t own P10 today, it is a business I’m actively monitoring and I’d be interested in owning it should its relative valuation (to APO & KKR) improve or if the company continues to generate high levels of organic growth.

Risks

1. While P10 has a very stable income profile based on sticky assets and fees, it is categorized as an alternative asset manager. Alternative asset manager shares are volatile, owing to the cyclical performance fee component.

2. P10 has a limited trading history and there is less information about the company than more established firms like Apollo, KKR, and Blackstone.

Be the first to comment