blackdovfx

Investment thesis

Oxford Square Capital Corp. (NASDAQ:OXSQ) has remained a higher-risk BDC company compared to its peers, and this position has not changed since my last article. The management made some changes in its investment portfolio, but the general trend and the asset classes remained unchanged. The management was able to grow the NAV for a short period, but the larger trend has returned and OXSQ has started to destroy shareholder value again. I believe that the recent price drop is justified, and this does not make OXSQ undervalued. I still stand by my previous opinion that the company is suitable for more risk-taking investors.

Portfolio restructure

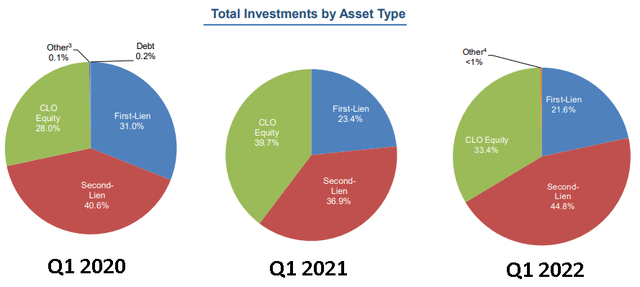

Since the start of the pandemic, the management made some changes in its investment portfolio. They try to focus on fewer industries to concentrate the capital for better returns. In Q1 2020 OXSQ had investments in 10 different industries and by the end of the first quarter of 2022, the management reduced it to 7. They no longer have exposure to Education or Aerospace and Defense sectors. This change does not mean fewer portfolio companies because the figure remained around the same (60) portfolio companies. In addition, the management structured its portfolio to riskier loans such as Second-Lien and CLOs. The First-lien loan part of the portfolio has been reduced by almost 10% since 2020. The weighted average effective yield of CLO equity investments at current cost is 8.9% lower than the 2021 average of 9.5% but higher than 2020’s average of 8.125%.

Investor Presentation Q1 2020,2021,2022

External trends affecting Oxford Square

There are major external factors in play at the moment which will and already have affected OXSQ. The Fed raised interest rates again in the last few days by 0.75 basis points and the U.S. is officially in recession, the latest quarterly GDP data is -0.9%. On the other hand, unemployment is low, and new job creation remains steady. But the available credit on the market started to shrink and the cost of borrowing started to rise. This will affect OXSQ as they use leverage in their investments. In addition, we are in the late expansion part of the credit cycle at the moment which means companies have to be prepared for an economic downturn with less consumer spending and declining asset valuations. The change of asset valuations can significantly hurt OXSQ’s already declining NAV but more on this later. The good news is that the prepayment risk on CLOs and other first and second lien loans will be virtually non-existent due to the rapidly rising interest rates. The rising interest rates also mean that there will be a pullback in new issue CLOs, according to S&P Global.

Valuation

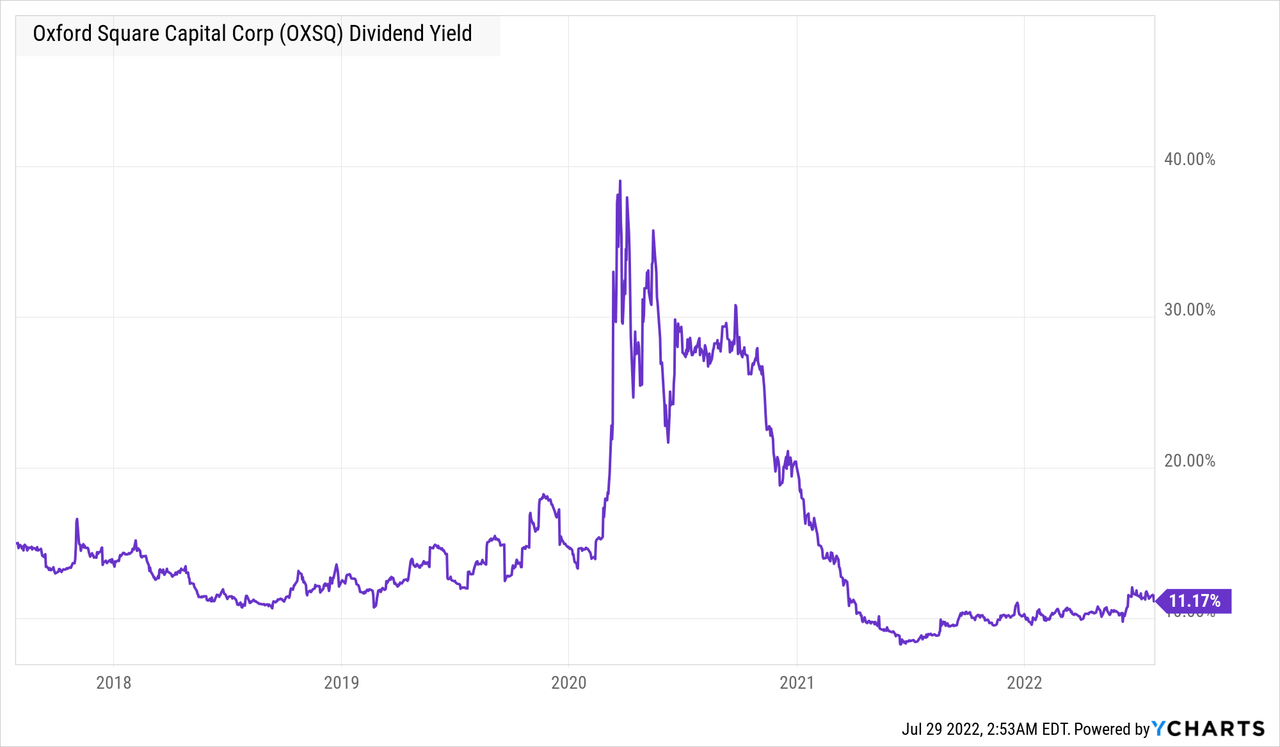

The company had a few good months when management could grow the NAV. Pre-pandemic, investors saw a gradual decline in shareholder value. Despite the short boom in the second half of 2020 and 2021, OXSQ seems to now be sliding back to destroying shareholder value again. Since the third quarter of 2021, the NAV has been on the decline and I see no signs that this trend will break in the future. This is why I think the recent price drop is justified and does not make the company undervalued. Due to this price drop, its dividend yield is above 11% which can be attractive to income investors. However, the shareholder value behind its 11% yield is not strong enough in my opinion. OXSQ’s P/E ratio is currently above its 5-year average by 11% and its P/E ratio is also above the sector median which further supports my fairly valued stock theory. Based on the last 12 months, the company would be undervalued due to its high dividend yield, but looking at a broader perspective, the above 11% dividend yield is not extraordinary.

Company-specific Risks

Due to their high-risk portfolio, the valuation of their investments is a key factor. Any unexpected and significant changes or volatility in the capital markets could cause the value of OXSQ’s investments to decline heavily, just as we saw during the pandemic. This may cause a snowball effect and the credit rating agencies might downgrade the company’s credit rating, which will hurt borrowing costs and the perception of credit risk associated with the company’s debt portfolio. In addition, it will affect the ability of OXSQ to access the debt markets on favorable terms. At the moment this risk is not a primary one, but it is worth noting that during a stronger than anticipated recession this might happen. As the median probability of a recession grows by 17.5% over the next 12 months (47.5% among economists believe there will be a true recession not only GDP contraction) the likelihood of a lower valuation of OXSQ’s investments also grows. The aggressive interest rate increase makes it more difficult for OXSQ to access credit on favorable terms, as the market expects the interest rate over 3% by the end of the year. This could decrease the value and increase the number of defaults on CLOs especially if the underlying loan’s default ratio increases.

The SEC has raised questions regarding certain non-traditional investments, including investments in CLOs. The company mentions this risk factor specifically in its 10-K which means investors have to monitor this risk closely because a significant part of OXSQ’s income comes from its CLO investments.

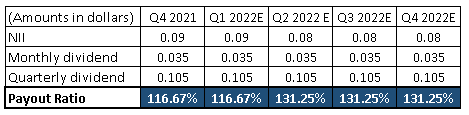

My updated take on OSXQ’s dividend

In my previous article, I stated that the company is not among the safest choices for income investors. I still stand by this opinion. The management could maintain the monthly $0.035 dividend yet, however, the payout ratio is beginning to be too high to maintain in the long term. Especially because OXSQ has a long history of dividend cuts. I do not expect any dividend increases in the near future, but I would be happy if the management could maintain the current dividend coverage at least. The external factors such as the aggressive rate hikes may help their NII in the second half of 2022 which may ease the pressure from the payout ratio in the short term.

The table is created by the author. All figures are from the company’s financial statements and SA Earnings Estimates.

Final thoughts

Oxford Square Capital is still one of the riskiest BDC companies on the market in my opinion. This does not mean that investors cannot see it as a good investment, but it is more suitable for risk-takers. The recent price drop is justified, and at the moment, I cannot see any external or internal factor that would suggest short or medium-term price appreciation. My ratings remain the same and have not changed since my last article, therefore OXSQ is a hold for me.

Be the first to comment