sefa ozel

Introduction

“Where to start?” This is pretty much what I ask myself every time I’m considering covering an oil and gas company. That’s based on the complexity of the situation we’re currently in. Supply has become an issue as drillers are not interested in how much they can grow production but in how much they can grow free cash flow. Unlike in prior cycles, oil production growth is subdued, allowing producers to boost dividends, initiate large buyback programs, and reduce debt. Ovintiv Inc. (NYSE:OVV) is one of the companies that are now finally able to generate high free cash flow after the former Canadian driller struggled to generate any shareholder value prior to the pandemic. The company is reducing net debt at a rapid pace, allowing management to switch its focus from debt repayment to shareholder returns. This will be achieved through its base dividend, special dividends, and aggressive buybacks.

In this article, I am going to walk you through my thoughts and explain why buyback-focused shareholders may enjoy owning OVV shares.

So, let’s get to it!

A New Era For Fossil Fuels

If there’s one thing I have discussed a lot since 2020, it’s subdued oil supply as a result of the global push for ESG (environmental, social, and governance). The pandemic marked the start of a new era for renewables – “build back better” is what most western politicians said.

However, it became a new era for fossil fuels as the supply of oil didn’t come back. In a recent article, I highlighted issues related to politics and related risk management on a company level.

For example, one of the things I like to highlight is that we’re in a “forced” energy transition as I wrote earlier this month.

New York Post

The New York Post – among many others – reported that National Economic Council director Brian Deese (Biden’s personal advisor) had a somewhat unexpected answer to the following question asked by CNN:

“What do you say to those families who say, ‘Listen, we can’t afford to pay $4.85 a gallon for months, if not years. This is just not sustainable?”

He answered:

“What you heard from the president today was a clear articulation of the stakes,” Deese answered. “This is about the future of the liberal world order and we have to stand firm.”

I also looked into comments from the IEA.

Headquartered in Paris, France, the International Energy Agency is what they call an autonomous intergovernmental organization that provides policy recommendations, analyses and data, and coverage of global energy markets.

For example, the IEA is working with the European Union on challenging energy problems in times of the Russia/Ukraine war.

Earlier this year, the organization asked a key question in one of its many reports.

A key question is what today’s energy crisis means for fossil fuel investments if we are still to achieve our collective climate goals. Are today’s sky-high fossil fuel prices a signal to invest in additional supply or a further reason to invest in alternatives?

The answer is exactly why I am bullish on fossil fuels as the answer – according to the IEA – is accelerating investments in renewables.

In the IEA’s landmark Roadmap to Net Zero Emission by 2050 published in May 2021, the analysis indicated that a massive surge in investment in renewables, energy efficiency and other clean energy technologies could drive declines in global demand for fossil fuels on a scale that would as a result require no investment in new oil and gas fields.

The need for this clean energy investment surge is greater than ever today. As the IEA has repeatedly stated, the key solution to today’s energy crisis – and to get on track for net zero emissions – is a dramatic scaling up of energy efficiency and clean energy.

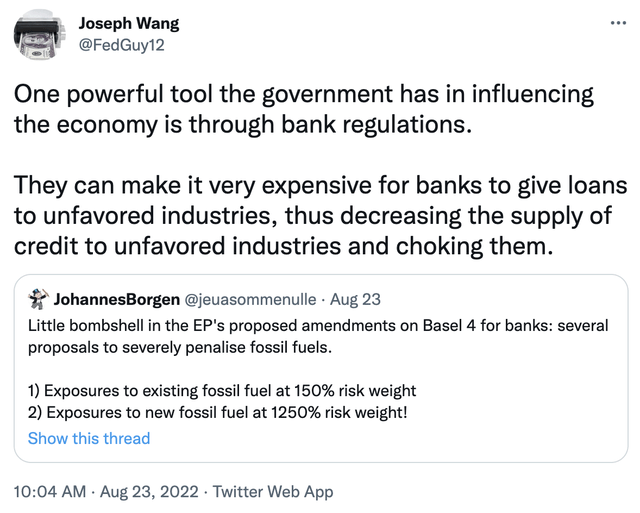

This is going so far, that it is made incredibly hard for banks (for example, in the Euro Area) to give funding to oil and gas companies. Below is a screenshot from a tweet that I believe perfectly highlights the situation:

In other words, we’re in a situation where (western) governments are pushing hard for the energy transition, making it hard for banks to provide funding. Also, a lot of corporations distance themselves from “dirty” industries to improve their own ESG profiles.

Hence, it makes sense for oil and gas companies to focus on profitability as boosting oil output creates a situation where oil prices can come down crashing when demand weakens again. It happened in 2014/2015 and 2020, to give you two recent examples.

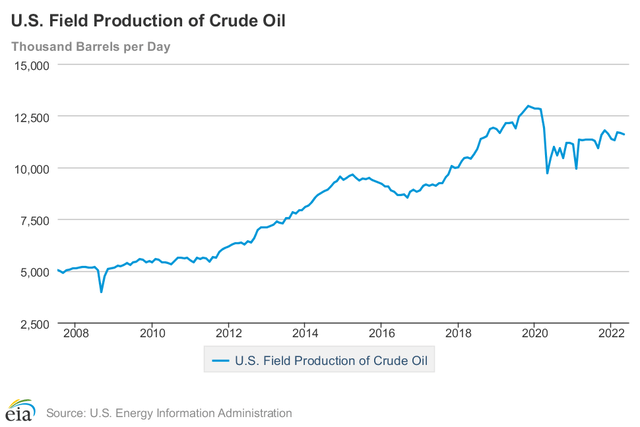

Now, unlike in prior post-recession periods, oil production is not soaring back. As a matter of fact, US field production of crude oil is roughly 1.2 million barrels per day below 2020 highs.

EIA

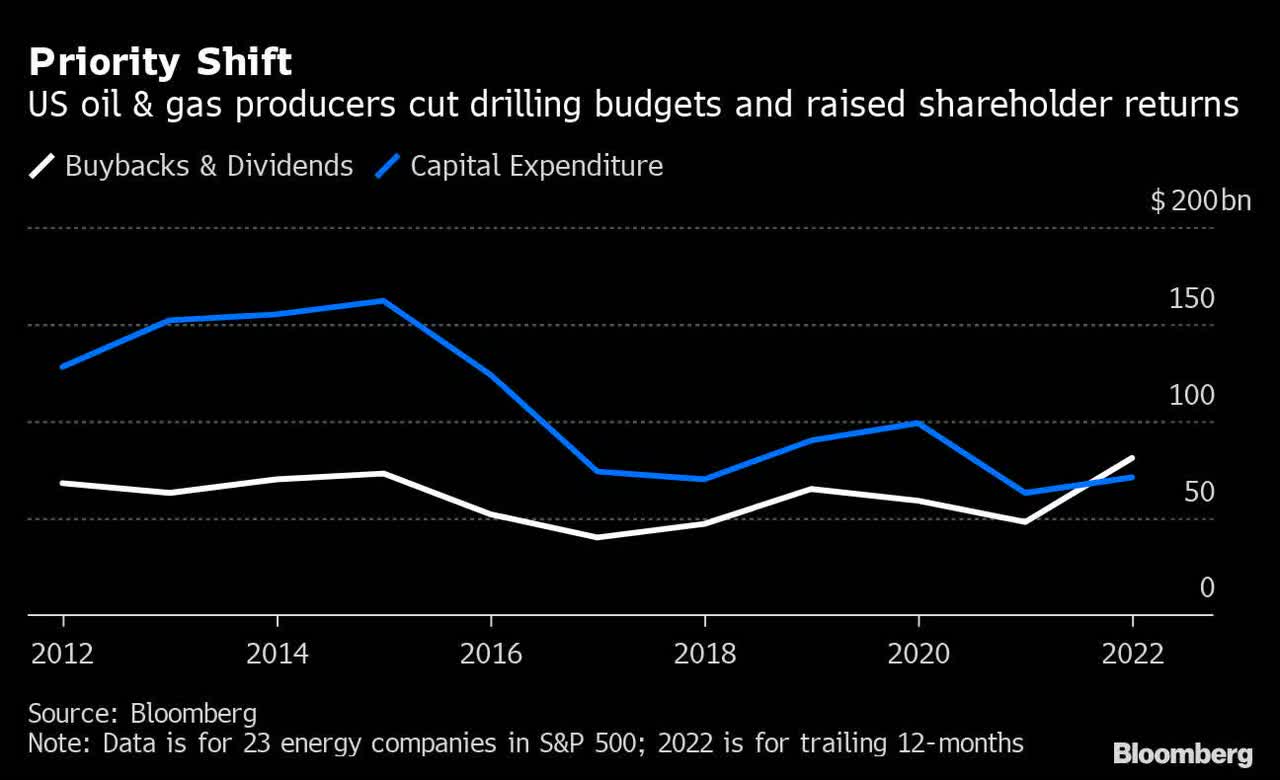

That’s no surprise as companies aren’t focused on production anymore. The chart below visualizes this. Total shareholder distributions exceeded industry capital expenditures earlier this year.

Bloomberg

Ovintiv is a great example of the shift from production growth to shareholder distributions.

Shareholder Value With Ovintiv

Ovintiv is listed in both Canada and the United States. The company was founded in April of 2002 in Calgary, Canada, where it became the largest energy company and largest natural gas producer in the nation. Back then, it was under the name Encana.

In 2019, the decision was made to move the company to Denver, Colorado, where the company is now headquartered under the new name Ovintiv.

Ovintiv Inc. (SEC 2021 10-K)

The company’s main operations are located in the Anadarko, Permian, and Montney Basins with smaller operations in Bakken and Uinta. On a full-year basis, the company aims to produce between 177 and 180 thousand barrels of oil per day. natural gas liquids production is expected to be between 82 and 84 thousand barrels per day with natural gas production of at least 1,450 MMcf per day.

That’s roughly 500MBOE/d (thousand barrels of oil equivalent per day) given that 1,000 cf worth of natural gas is roughly 1/6 barrel of oil – in terms of energy density.

In other words, Ovintiv is overweight natural gas, which isn’t bad news given that natural gas is in a structural bull market as supply constraints and very high future demand for liquid natural gas is poised to keep prices high. I discussed this in great detail in this article.

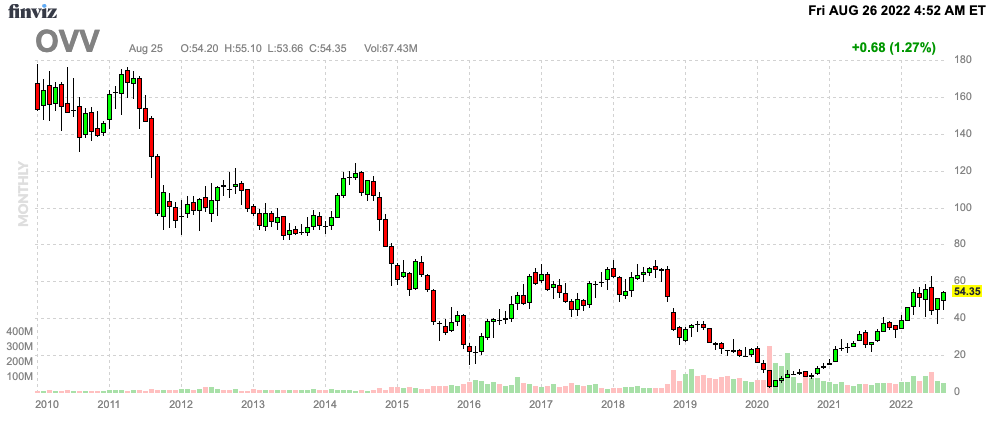

Before I continue, let me show you the long-term chart of OVV. One of the reasons why I have never covered OVV in the past is because it was a terrible place to be. While the company did benefit (a bit) from higher oil prices in early 2014 and the post-2016 recovery, it wasn’t able to escape the long-term downtrend that annihilated long-term investors.

FINVIZ

Now, this has changed.

For example, the company is extremely profitable. Its breakeven oil price is $35, which includes its base dividend. Moreover, the company is adjusting its hedges. As of 2Q22, the company has only 40 thousand barrels of oil hedged starting 1Q23. Moreover, only 400 MMcf/d of natural gas has been hedged (so far) for 1Q23 and beyond.

When asked to reveal its hedging strategy, the company basically said that it changed its strategy a bit to account for a healthier balance sheet. The goal is to protect the company against the downside, but also to benefit from more upside as I’m sure that every energy executive is aware of the potential long-term uptrend in oil. This is a part of the answer the company gave analyst Greg Pardy during the 2Q22 earnings call:

And so today the way we are hedging is, we’re hedging to manage the risk of a very low period of commodity prices, and what we’re doing is – you know what drops out of that is we want to be able to protect the business against those low prices and still be free cash flow neutral or better after the base dividend, and so what you’re seeing us do is hedge about 20% to 25% of production. We’re doing it a quarter at a time, four quarters out.

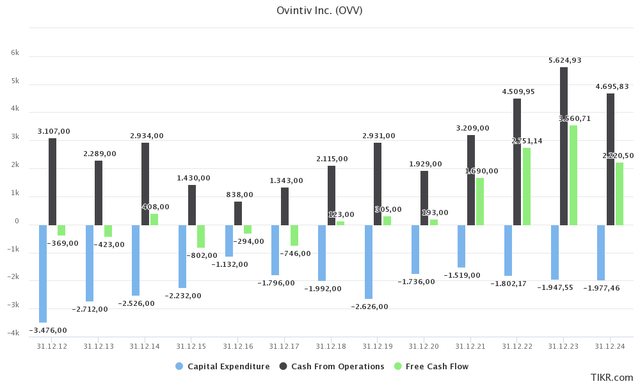

With that said, the chart below basically shows why OVV shares are suddenly attractive. Prior to the pandemic, the company struggled to grow free cash flow (operating cash flow minus CapEx). Capital costs were high and highly volatile operating cash flow prevented the company from generating value for its shareholders. Hence, the stock price prior to 2020 looks absolutely terrible.

Now, the company is maintaining an annual CapEx budget of close to $2.0 billion, leading to high free cash flow as strong oil prices (and lower hedging activity) are causing operating cash flow to consistently exceed $4.5 billion – based on current conditions.

TIKR.com

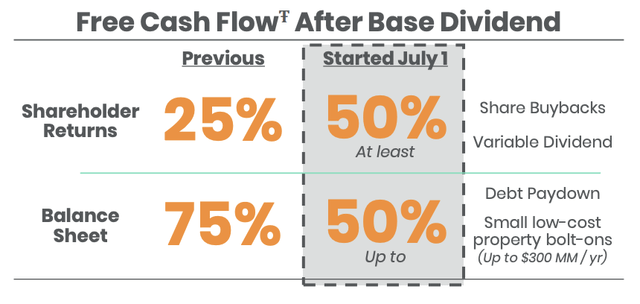

Hence, during this summer, the company shifted its cash priorities. Prior to July 1, the company directed 75% of its free cash flow (after the base dividend) towards balance sheet debt reduction. Now, it’s 50/50.

Ovintiv Inc.

Using 2Q22 numbers, the company did $713 million in free cash flow. $64 million of it went to the company’s base dividend. The base dividend is currently $0.25 per share per quarter, or $1.00 per year, which translates to a 1.8% yield.

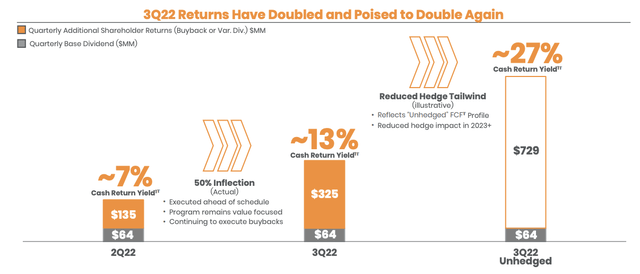

This leaves $649 for other plans, meaning $325 for debt reduction, and the same amount for buybacks. Hence, the total 3Q22 (the following quarter) distributions are expected to be $389 million. That’s 2.8% of the total market cap in a single quarter. 11.3% annualized.

These numbers make sense as the company has an implied free cash flow yield of 15.9% if I use 2024 FCF expectations of $2.2 billion. I think OVV will report much higher FCF by then as analysts are incorporating a “normalization” of oil prices, which I do not expect. Yet, even if that were to happen, sky-high shareholder distributions are secured.

According to the company, in an unhedged scenario, the cash return yield could reach 27%, which means the company is now in the same group as high-performers like Devon Energy (DVN).

Ovintiv Inc.

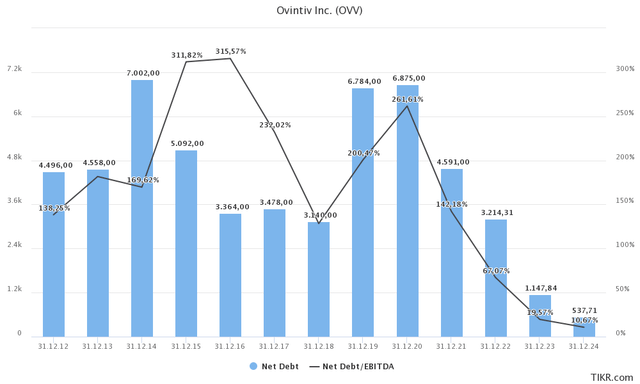

With regard to my earlier balance sheet remarks, the company is indeed on track to lower net debt (gross debt minus cash) to $3.2 billion this year. That’s less than 0.7x EBITDA and likely followed by further declines towards $540 million in 2024.

TIKR.com

Depending on the price of oil in the second half of this year, the company is on track to reach its $3.0 billion net debt target this year. Also, note that the company has no long-term debt maturities before 2026 when $688 million in debt is due. After that, the next maturity is in 2030. In other words, even if FCF were not high, it would have some protection against rising rates.

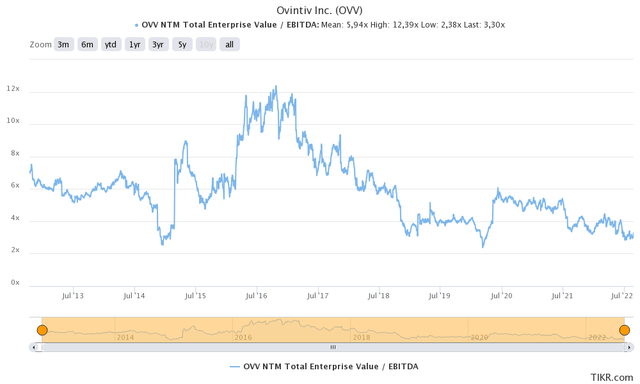

Moreover, shares are still extremely attractively valued, even after rallying 60% year to date. The company is trading at 3x EBITDA assuming that it can do at least $5.0 billion in annual EBITDA under these conditions. Next year, EBITDA is expected to be $5.9 billion, followed by a decline to $5.0 billion in 2024.

The enterprise value is $15.1 billion based on the $13.8 billion market cap, $1.15 billion in 2023E net debt (to incorporate high free cash flow and debt reduction), as well as a mere $100 million in pension-related liabilities.

That valuation is too low given the company’s capabilities. Even 4x NTM (next twelve months) would be below “fair” value, in my opinion.

TIKR.com

What this implies is that OVV has at least a 35-40% upside without coming anywhere close to overvalued territory.

Takeaway

Ovintiv is a different company. Not only did the company change its name and move to Denver, but it also is in a completely different environment. Unlike in prior cycles, oil supply is expected to remain subdued as companies are managing risks, by lowering debt, maintaining stable production rates, and using high free cash flow to boost shareholder distributions.

While OVV shares used to be wealth destroyers prior to the pandemic, the company is now doing much better. It has efficient operations with low breakeven prices, high natural gas exposure, which I like, and a very healthy balance sheet, which is now opening the door for new buybacks and special dividends.

Moreover, the valuation is attractive, providing investors with more upside.

However, given that I have written a lot of articles on oil (companies), I still want people to be careful. Energy is volatile and steep regular drawdowns are not uncommon. Regardless of how good the bull case may sound, please be aware of what you’re buying. Do not go overweight energy and take high volatility into account.

That said, I think we’re in a fantastic environment with a lasting bull case for energy stocks – especially the ones accelerating shareholder returns like (in this case) OVV.

(Dis)agree? Let me know in the comments!

Be the first to comment