All three major billboard companies will be reporting earnings over the first 8 days of November. ZargonDesign/E+ via Getty Images

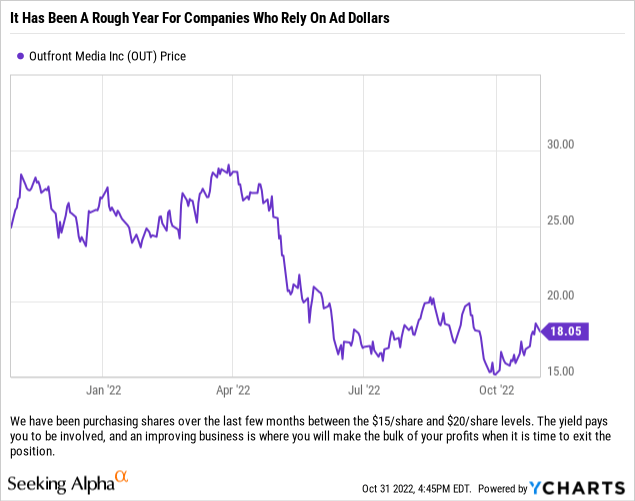

We have been buyers of Outfront Media (NYSE:OUT) the last few months, taking advantage of the opportunity to purchase shares under the $20/share level and locking in a yield between 6% and 7%. This is not a trade, but rather a long-term hold in some of our portfolios so the next few quarters are not really material to us – instead we are focused on the next 5-10 years and what that means for this business moving forward. With that said, the next few quarterly results will be telling and should give investors an idea of how the billboard business will be impacted by this high inflation, increasing interest rate environment.

Readers might remember the last time that we covered Outfront Media was a time of major transition for some of the billboard companies; especially those with exposure to certain foreign markets and transit ad inventory in the largest MSAs in the United States. We argued that eventually ridership would come back and that advertisers would have to find available inventory (with billboards in high demand, some ad dollars would trickle back to transit, even if less traveled after COVID, due to the NEED to advertise).

We have been correct on many of our predictions and it looks like we should see nearly all of them materialize with Outfront’s current quarterly results that will be released on Thursday.

So What Should Investors Watch For?

The most important metrics, in our opinion, are billboard revenues and profit margin, which will tell investors whether the demand is still there for Outfront’s inventory. For this quarter, it should be, but management should have a pretty good idea of the next quarter as well with a month already on the books. The guidance on the U.S. billboard segment, which will be based in part off of the data they already have, will be key as some small businesses are experiencing difficulties with staffing shortages and inflation eating into profits. If the demand is still there, especially if for both national and local accounts, then that would obviously be bullish for investors moving into the fourth quarter, historically the company’s strongest of the year.

The problem child for Outfront, and a few other players as well, has been the transit business. Traffic has not rebounded for a myriad of reasons, including but not limited to work from home, companies moving work forces to other locations, people refusing to use mass transit and crime and homeless issues on mass transit systems.

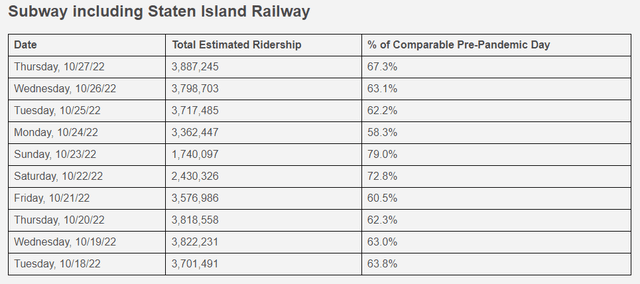

Recent subway ridership shows continued improvement, even though we are still below 75% of pre-pandemic levels. (MTA Info)

The good news is that ridership is slowly increasing, even New York’s MTA shows that over the last 8 months, that subway ridership as a percentage of pre-COVID traffic has increased from the low 50% range to the low 60% range on most workdays and that on the weekends, with entertainment venues open again and sports allowing spectators again, ridership gets close to 80% of the pre-COVID levels. Some forms of transportation have fully recovered, as can be seen by the data from the bridges and tunnels, which is below.

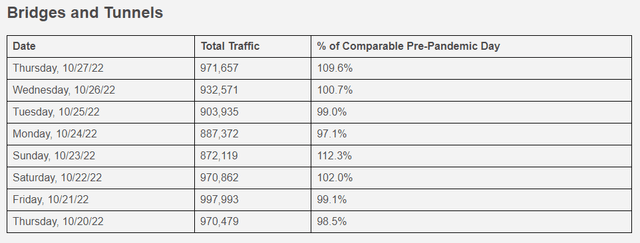

While riders may be staying away from the subway and some work from home, those who are coming into the city are utilizing the bridges and tunnels – which should not be all that surprising with car ownership soaring in the NYC area over the last year or two. (MTA Info)

So, while less people may be coming into New York City to work, they have chosen alternative means of getting to their destination.

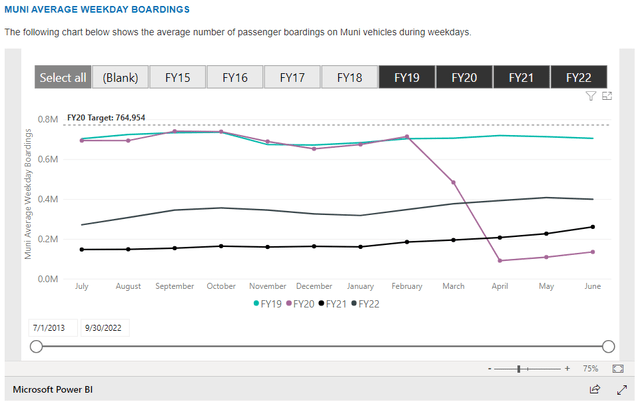

The ridership issue is much the same in San Francisco, another area of interest for Outfront shareholders, with data showing that in June of 2022 that traffic was still just back to 56.66% of pre-pandemic levels. While that seems abysmal, the number of riders is up just over 53% in June of 2022 compared to the same period in 2021…so that is something.

Ridership is still down significantly compared to 2019, however it did rebound sharply in 2022 compared to 2021. (San Francisco Municipal Transportation Agency)

As bad as all of this looks, we think the good news is that Outfront’s management team has been able to capitalize on their assets and should be able to come in possibly above the $100-125 million increase in U.S. transit revenue we mentioned back in March. The company is basically just under that revenue level through two quarters, and those should be the two smallest quarters on a revenue basis for the year (it is worth mentioning that they were the easiest comps), so after this quarter we most likely will be revising up our estimates on the transit business.

How About The Distribution?

We think that the dividend/distribution is pretty secure right now, even with some hiccups in the economy right now. Is Outfront’s geographic footprint ideal for the current environment? No, but as the economy continues to open up in major MSAs and people return to their pre-pandemic habits, we would expect Outfront to continue to benefit. With a strong tailwind for the U.S. billboard business, and the Canadian and transit segments ramping up, we think that the distribution is not only pretty safe at its current rate, but that the company might very well look at increasing it in the next few quarters.

Debt Load

While the debt load is sizeable here, with what was a rich average coupon rate prior to the Federal Reserve aggressively raising interest rates, we think that investors can rest at night knowing that the company does not have a maturity to address until 2025, and barring any major acquisitions we think that they can handle that roll in a way that might not see any sizeable increase to the company’s annual interest expense or cash flows.

Acquisitions

Outfront has been aggressive, although not as aggressive as competitor Lamar Advertising (LAMR), on the M&A front. The billboard business is going to continue to be a roll-up game, and we hope that Outfront has some small acquisitions to report because those bolt-on/roll-up plays are the most profitable for a player such as Outfront. There is certainly enough firepower to do a larger deal, but we would point out that some sellers may have some remorse with not pulling the trigger sooner as they look at interest rates soaring and buyers get a little more picky on the assets they want to bid on.

Our Final Thoughts

We own this name and like it because it gives you a solid annual payout coupled with the opportunity to participate in significant upside should the economy not totally crash. In the current environment, we see no reason why this could not jump back up to the $25/share level on a quarter or two of good results with an uptick in ridership data for the transit side of the business. If billboards can maintain their current level of demand, then transit might provide the next leg up for the stock – and if that happens then shares could very well test their highs.

Be the first to comment