David Becker

Introduction

Ouster (NYSE:OUST) is the only lidar company in the public universe with positive gross margins, but due to economic conditions, the company has not delivered revenues of scale. Without turning a profit to fuel the company’s existence, Ouster has borrowed and sold equity.

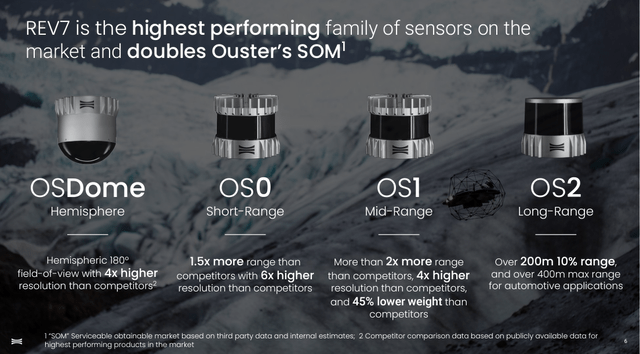

On the other hand, Ouster has not slowed down on progressing its technology. It released its new chip, L3, and a new line of sensors called REV 7, a 7th-generation product. Details of the upgrade are on the slide taken from the Q3 presentation.

REV 7 Suite of sensors (Ouster Lidar)

The reality is that Ouster’s technology, with every new chip release, can no longer be matched by MEMS or hybrid architecture. The digital multi-flash will likely separate Ouster tech for good in the next release. But to do that, the company needs to survive. And without money, it can’t.

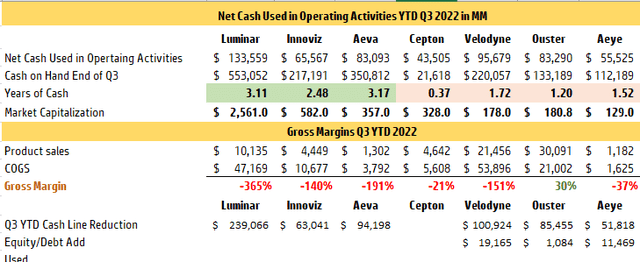

The table below illustrates that Ouster has only about one year of cash. Despite being seen on Amazon’s (AMZN) Proteus robot, the company’s mouth-shut policy on naming clients has left the share price to dwindle in value.

Net Cash Used in Operating Activities (Author sourced from companies’ data)

Selling more equity was also an option utilized at Velodyne (NASDAQ:VLDR). Unlike Ouster, Velodyne’s technology has peaked, and the company has been looking for new product solutions. Still, it has been unable to hit the cost targets and, due to it, canceled development of the H800 touted to be a $500 alternative to its expensive line of products.

In the state lawsuit against Velodyne, Ouster claimed that Velodyne tried to buy it in 2020, apparently aware of its technological superiority. Velodyne had money but lacked product competitiveness, as highlighted many times by the departed chairman and founder of the company, David Hall. Velodyne was losing the market, specifically to Ouster.

The first in the saga was the ITC investigation and federal lawsuit against Ouster. Velodyne declared how Ouster had taken the design of David Hall and copied it, accusing Ouster of replication. Even not a particularly technical person could say that the idea of a spinning lidar was fitted with far more than what Chinese companies, Hesai and RoboSense, did, confirming wrongdoing by agreeing to pay Velodyne licensing fee. Ouster did not copy aging mechanical technology, but architecture, a new one, digital, and that was what Velodyne wanted in 2020.

Merger – Technology

Now both, Ouster and Velodyne agreed to the merger, and the litigation by either party will soon be foregone. Called a merger of equals, the combination appears to reciprocate missing pieces and create a new, much more capable holistic entity. Both organizations will benefit, Velodyne using its contracts, IP library, and still, sizeable cash to promote and adapt Ouster’s technology and allow it to progress.

Ouster technology is superior and will continue to be because it can upgrade every single part of its sensor. How would one upgrade mirrors be a simple question to ask? You could call it semi-solid by a hybrid of flash beams and MEMS mirrors steering. Still, the product will remain analog or mechanical, reaching the end of the development journey. That happened to Velodyne, which has been around lidar block a few times.

In contrast to newcomers who yet must develop manufacturing, alone or with partners, Velodyne had seen full circle and foreseen likely an end of the technological pathway, which made the decision simple. That finite condition may have cost a company a deal with Hyundai, signed only in 2019.

Everyone knows that manufacturing is not easy, and Velodyne has not been able to get positive gross margins for as long as a public company or longer. Negative margins are a standard condition for all lidar participants, except for Ouster, quoting its digital architecture as the reason for cost-effective manufacturing, with the larger scale offering even better pricing. Something others like Luminar and Innoviz yet need to deliver.

Nevertheless, Innoviz (INVZ) and Luminar (LAZR) are preparing themselves for mass production. Watching the effort via revenue will be interesting to see how well they perform. Both companies enjoy smooth selling and interest in the market engaged by the publicity of design wins of brand-name automakers.

Luminar’s first client, Volvo (OTCPK:VOLAF), sold about 90K of the XC 90 model globally in 2021; the EX90 may sell half. Assumed at $1000 per Iris sensor, that would provide $45M revenue for Luminar, but at what COGS? The company is battling to improve its gross margins, which is very difficult when starting manufacturing processes. Today it is selling prototypes at negative 350%, so there is plenty of room to improve. A scale of 250K sensors per year can certainly help, but it has not guaranteed success.

The situation is also risky for Innoviz, as it has yet to figure out how to mass produce its InnovizTwo sensor to meet the spec embraced by Volkswagen. The deal for BMW (OTCPK:BMWYY), which could offer revenues in 2023, involves manufacturing through Magna (MGA). The number of cars is expected to be under 10K in 2023, and some think it may not be that. Innoviz’s revenue in 2023 is predicted to be $34M, which may be too high of an expectation. Volkswagen (OTCPK:VLKAF) is still years away, and looking at the money availability, Innoviz is running out, and sooner rather than later, it will be selling equity.

Ouster has an answer for consumer vehicles in the DF line, which Sense Photonics, another acquisition, built using shutter flash, a complementary to the multi-beam flash created by Ouster. Ouster has already reduced the form factor and, with the help of TSMC (TSM), is moving to the next level of design with the Chronos chip and the availability of B samples in the new year.

The future Ouster is looking at is more than just driver assistance, now declared as an objective by Austin Russell, clearly limited by a single augmenting vehicle’s body sensor, which esthetics may have fewer, dedicated to Volvo brand buyers. That future Ouster is looking into has autonomous vehicles, commercial, and then in the second round of consumer design wins post-2025, something which current scanning MEMS or hybrid sensors appear not to provide.

Merger – Cash

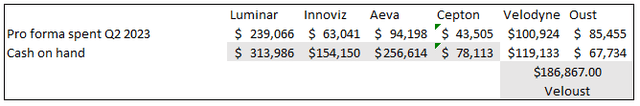

Below is a pro forma expectation of the same spending and what the combined company’s cash looked like on entry to Q3 2023. It excludes any effort of saving money, as the spent is precisely as it has been for nine months of 2022. In comparison, the spending for other lidar companies is shown. I included Cepton’s $100M cash injection by Koito.

Pro forma Cash Q3 2023 (Author)

The combined Velodyne/Ouster revenue is expected to be around $172M in 2023, the highest among all. Luminar is supposed to have $124M in revenue coming second. Suppose the combined business operates the way Ouster has and accommodates some proprietary sales of Velodyne’s products until they get replaced or modified by Ouster tech. In that case, we can see a gross margin reduction, which will likely recover with a complete transition to digital technology.

That conservative, without savings efforts, $186M can carry a new entity into 2025, saving some $75M through synergies. If the revenue growth is robust and, let’s say, hits over $400M in 2025, the new entity could be net positive and draw no cash by 2025. By 2026, yet to be named company may hit profitability.

Velodyne has licensed its 360 technology to both, Hesai and RoboSense. Growth of those companies in this sector is also seen encroaching on solid lidar and the use of VCSEL and SPAD, an Ouster domain. It would be more than expected that the combined entity will call on patents to combat digital lidar infringement globally. There is a good chance both companies may be interested in licensing Ouster patents.

Merger – Industry

Moreover, the industry is consolidating, which helps create more capable companies when they survive. Quanergy (OTCPK:QNGY), which is still trying to float, is an example of how hard it is to live another day without cash. Ibeo Systems, seen as a flash competitor to Ouster, has gone bankrupt, despite ZF ownership and investment from China. Leddar Tech, another presence in lidar, has stopped producing hardware, focusing on software. The trend is likely to accelerate, and that should not come without a surprise. The combined spending on research and development of the seven companies summed up to $425M just in 9 months. It is an astronomical sum not afforded in a fraction by many privately held companies, leaving them behind in the technological gap.

The merger between Ouster and Velodyne offers continuance for both. Velodyne seems to have a robust software portfolio and an extensive list of clients. With its digital technology progress, Ouster can easily incorporate it into Velodyne’s network. Both companies will stop competing for the same customer base. Even on the geopolitical front, in my opinion, a new company should attract North American and European businesses opposing the infiltration by secretly or openly Chinese state-supported enterprises like Huawei, which is also toiling in lidar. The biggest threat here is not Luminar but Chinese Hesai, which is in too many US-based enterprises. The chip embargo and IP protective policies should embrace the new company rather than copycat selling for less subsidized by the state.

Merger – Investment

As an investor in Ouster, I am excited to see what will happens next. The market, however, may not be able to see this potential. The lengthy process of completion of the merger until the first part of 2023 is also a reminder that time is erosive to the value of shares, especially when companies will remain silent during the pre-merger period. My resolution for those who own shares of either company is to hold, and if appetite to increase holdings is there, to wait for post-merger shares.

The merger agreement has a reverse split clause written in it. While I am not a fan of executing this agreement, a large pool of shares, and frankly, the negativity of the market, which on more than one occasion kept shares of Ouster and Velodyne under $1, could force upon it. At that point, I would be interested in buying again.

Be the first to comment