John Moore

This article first appeared in Trend Investing on October 13, 2022 at C$0.395; however, the analysis has been updated for this article.

Arena Minerals [TSXV:AN] (OTCQX:AMRZF)

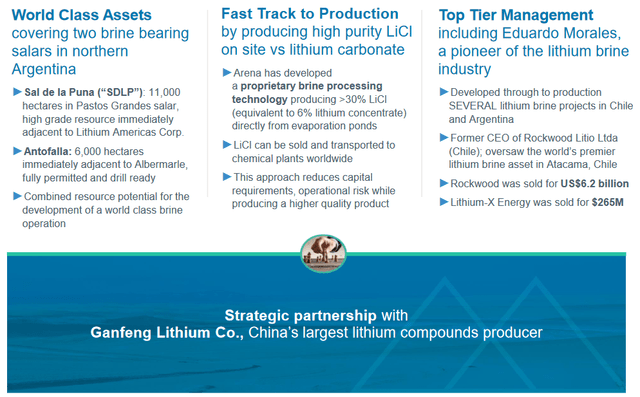

Arena Minerals [TSXV:AN] (OTCQX:AMRZF) (“Arena”) is a Canadian junior miner with two development stage lithium projects in Argentina and a copper project in Chile.

Arena’s strategy is to fast track production with low CapEx and Opex by producing and then selling an intermediary product (lithium chloride (“LiCl”)) from its Argentina salars. The lithium chloride can then be further processed by Ganfeng or others at another location to produce a final lithium chemical product (typically lithium carbonate but also LiOH or lithium metal). Arena plans to consolidate and develop their lithium brine assets to jointly produce >20,000 tpa LCE of lithium chloride.

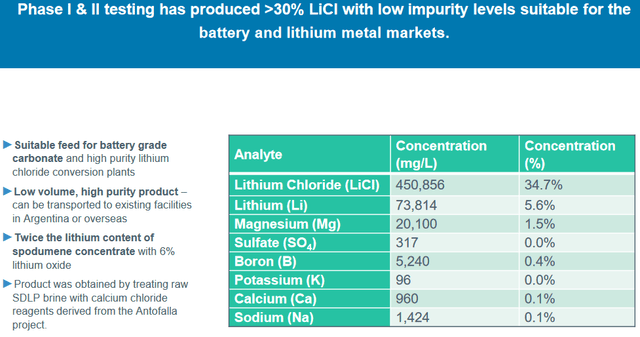

Note: Arena has developed a proprietary brine processing technology producing >30% LiCl (equivalent to 6% lithium concentrate) directly from evaporation ponds.

Arena Minerals 5 year price chart – Price = CAD 0.50

Yahoo Finance

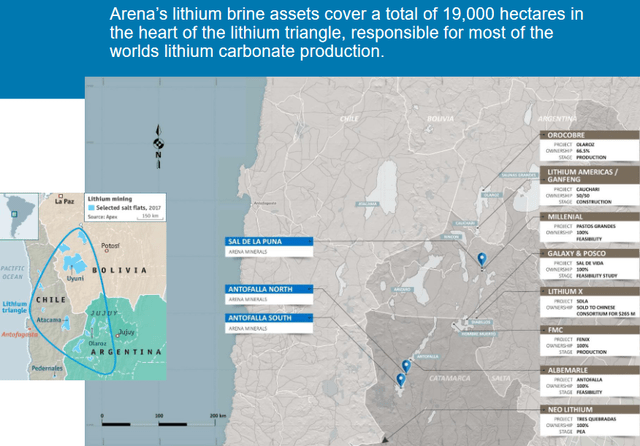

Arena’s projects

Arena’s projects and investments include:

- Sal de la Puna (“SDLP”) (65% owned) in and around the Pastos Grandes salar in Salta, Argentina – 11,000 hectares of tenements. (see below)

- Salar de Antofalla (100% owned) in Catamarca, Argentina – 6,000 hectares immediately adjacent and south of Albemarle’s (ALB) tenements. It is fully permitted and drill ready.

- Atacama Copper Project (80% owned) in Chile – Details here.

- 5.82 million shares of Astra Exploration – Astra owns the Pampa Paciencia epithermal gold property in the Atacama region of Chile.

Note: At the Sal de la Puna (“SDLP”) Project Ganfeng Lithium [SHE: 002460] (OTCPK:GNENF) has acquired a 35% project share. Ganfeng and Lithium Americas (“LAC”) each own a ~17% equity stake in Arena Minerals.

Location map showing Arena’s Argentina lithium projects Sale de la Puna and Antofalla (source)

Arena Minerals company presentation

In this article we will focus on the Sal de la Puna Project in Argentina where Arena (65%) and Ganfeng Lithium (35%) are project partners working to develop a 40,000tpa lithium chloride (“LiCl”) operation.

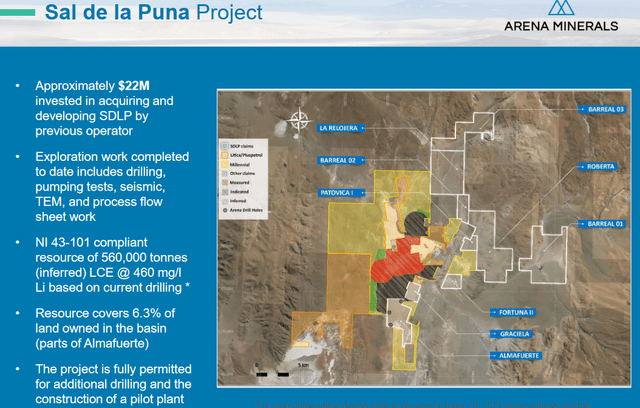

Sal de la Puna (“SDLP”) (Arena has 65% share)

Arena’s SDLP Project shares the Pastos Grandes salar where Lithium Americas [TSX:LAC](LAC) acquired in 2021 Millennial Lithium’s project for US$500m.

At SDLP Arena has a NI 43-101 compliant Maiden Inferred Resource of 560,000 tonnes of contained LCE @ 460 mg/l. This is a smaller size resource with a reasonable grade.

Samples from a 2019 pumping test averaged 532 mg/l lithium, with a Mg/Li ratio of 4.8, both of which are reasonable results.

The current Resource is based only from 6.3% of land owned in the basin (parts of Almafuerte claim), suggesting there is still significant potential exploration upside. Lithium bearing brine starts at 140m below surface and remains open below 640m.

The SDLP Project is fully permitted for additional drilling and the construction of a pilot plant.

Sal de la Puna Project showing their claims

In June 2022 Arena announced:

ARENA MINERALS PRODUCES 35% LITHIUM CHLORIDE IN PILOT TESTING AT SAL DE LA PUNA PROJECT… Eduardo Morales, Executive Chairman of Arena, stated, “We are very pleased with the concentration profiles of the SDLP brine and production of 35% LiCl directly from evaporation ponds. The impurity levels in the final product from our Phase I and II testing are very low, indicating that we can indeed produce a high purity product suitable for the battery and lithium metal markets.” He added, “We observed trends and reached product specifications similar to those achieved and commercialized at Atacama. We will continue pilot testing, focusing on process optimization, particularly on maximizing reagent efficiencies and recoveries.”

Note: Bold emphasis by the author.

As announced yesterday October 12, 2022, Arena has completed construction of its first evaporation pond at the SDLP Project. Arena stated:

The evaporation pilot pond covers a total of 10,000 m2 and has been filled with raw brine from the Almafuerte claim block. The evaporation pond has been designed to produce >35% lithium chloride (“LiCl”) (6% lithium) from SDLP raw brine… The pond has been filled to operating brine height with Pastos Grandes raw brine averaging 558 mg/l Li… We are in the process of selecting engineering firms for the design of a 40,000 tonne per annum lithium chloride facility.

Note: Bold emphasis by the author. A 40,000tpa facility is a significant size.

Aerial view of Arena’s pilot ponds (10,000sqm or 1 hectare) at the SDLP Project (source)

Arena Minerals news Oct. 12, 2022

Regarding Arena’s process to create >35% LiCl, the Company stated:

Arena’s business model and processing approach provides an environmentally friendly and sustainable alternative to the more conventional liming process that traditionally requires a chemical plant on site. In aiming to produce >35% LiCl directly from ponds, Arena does not require a more environmentally sensitive liming plant while minimizing the use (to almost zero consumption) of both power and fresh water thus reducing our carbon footprint. The Arena process is powered by solar energy (evaporation) and does not employ fresh water.

Note: Arena’s trick is to use a calcium chloride reagent produced at their Antofalla Project and add it to the SDLP brine pond.

Arena has produced >30% LiCl with low impurities, suitable as a precursor for the battery and lithium metal markets

Arena’s next step is much bolder

Arena has submitted a production Environmental Impact Study (“EIS”) for the permitting of a 40,000tpa LiCl facility. Arena stated:

The study evaluates the impact of constructing 490 hectares of lined evaporation ponds, thirteen production wells, and related ancillary infrastructure on the Almafuerte and Graciela claim blocks.

490 hectares of ponds is 490x the size of their 1 hectare pilot pond. That’s a sizeable operation.

Next Arena will prepare an economic study to determine the economics of the commercial project to produce 40,000tpa of LiCl; noting Arena is a 65% project share partner.

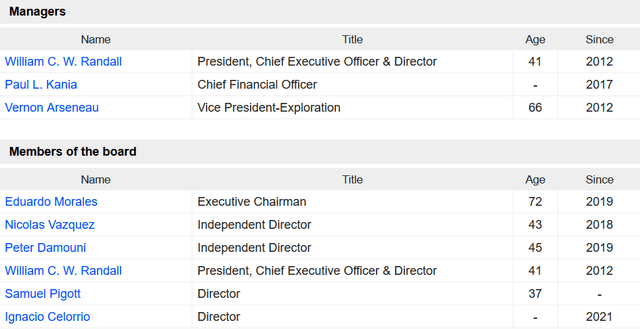

Management and shareholders

Arena has a highly experienced board and management team including:

- Chairman Eduardo Morales is a pioneer of the lithium brine industry with nearly 40 years of experience. At Atacama his team produced the world’s first commercial battery grade lithium carbonate and built and operated the Salar de Atacama mine, one of the world’s largest lithium brine operations. He was President of Rockwood Lithium Latin America which was sold to Albemarle for US$6.2b in 2014. Subsequently he was appointed CEO of Lithium-X Energy Corp. in 2016 which was acquired less than 2 years later for $265m.

- CEO Will Randal was one of the early movers in the lithium brine industry with the last 10 years focused in Argentina. He was CEO of Lithium X who discovered and developed the Sal de los Angeles lithium brine project in Argentina.

Management & Board (source)

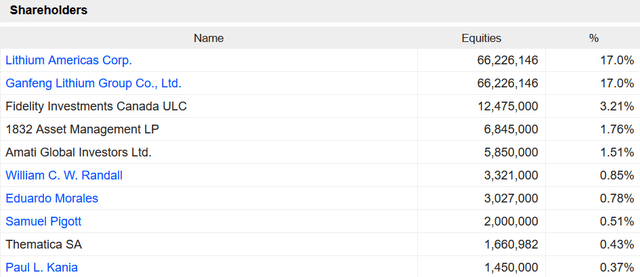

Top shareholders are dominated by LAC (17%) and Ganfeng Lithium (17%). Insider ownership is quite low

Valuation

Arena’s current market cap is C$194m with no debt. Cash levels look ok following recent warrant exercises expected to achieve C$7.367m in cash.

Analysts’ consensus is a “outperform” with a price target of C$0.85, representing 70% potential upside.

Note: In November 2021, Lithium Americas (“LAC”) paid C$0.54 per share for a parcel of US$10m of Arena shares. Today Arena trades at C$0.50.

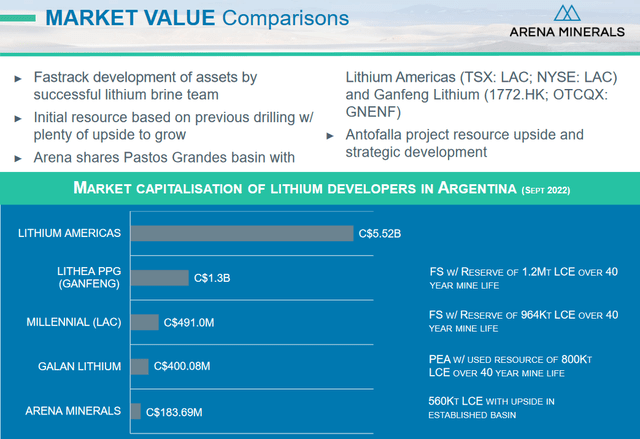

Comparison of market cap of peers with Argentina development stage projects (as of early Oct. 2022) – Arena’s market cap is now slightly higher

Risks

- Economic slowdown resulting in less EV sales, therefore less demand for batteries and hence lithium.

- Falling lithium prices.

- The usual mining risks – Exploration, permitting, funding, production, partner, environmental risks, project delays, cost blowouts.

- Business risks – Management, liquidity, debt, and currency risk.

- Sovereign risk – Moderate in Argentina.

- Stock market risks – Dilution, lack of liquidity (best to buy on local exchange – TSXV), market sentiment. Takeover risk is there by either Ganfeng or LAC, however it would likely be at a premium to the Arena valuation at the time; however investors could get caught out by a takeover if Arena was at a low price.

Key recent news

The recent news for Arena is shown below. The latest drill result of 641 mg/L is an excellent result.

- November 9, 2022 – ARENA MINERALS DRILLS HIGH GRADE DISCOVERY HOLE AT SAL DE LA PUNA PROJECT: 641 MG/L LITHIUM OVER 255 METRES.

- October 12, 2022 – ARENA MINERALS COMPLETES POND CONSTRUCTION.

- October 6, 2022 – ARENA MINERALS TO ACQUIRE 2,000 HECTARES ADJACENT TO R-01 DISCOVERY IN PASTOS GRANDES.

- October 3, 2022 – ARENA MINERALS DISCOVERS 275 METRE AQUIFER AVERAGING 441 MG/L LITHIUM AT FORTUNA II CLAIM BLOCK AND PROVIDES SAL DE LA PUNA PROJECT DRILL UPDATE.

- June 27, 2022 – ARENA MINERALS PRODUCES 35% LITHIUM CHLORIDE IN PILOT TESTING AT SAL DE LA PUNA PROJECT.

- May 24, 2022 – ARENA MINERALS ENTERS COLLABORATION AGREEMENT WITH LITHIUM AMERICAS… “The intention of the Collaboration Agreement is to share technical information and explore opportunities for collaborating on potential development alternatives.”

- April 11, 2022 – ARENA MINERALS DRILLS 300 METRE GRAVEL AQUIFER AVERAGING 503 MG/L LITHIUM AT SAL DE LA PUNA PROJECT; MOBILIZES ADDITIONAL DRILL RIGS.

- December 6, 2021 – ARENA MINERALS ANNOUNCES INCREASED INVESTMENT BY LITHIUM AMERICAS AND APPOINTMENT OF BOARD NOMINEE

- October 19, 2021 – ARENA MINERALS ANNOUNCES MAIDEN 560,000 TONNE LITHIUM CARBONATE EQUIVALENT BRINE RESOURCE ESTIMATE AT SAL DE LA PUNA PROJECT.

- July 26, 2022 – ARENA MINERALS ANNOUNCES CLOSING OF SAL DE LA PUNA ACQUISITION AND INITIAL TRANCHE OF OFFERING

- June 10, 2021 – ARENA MINERALS RECEIVES CONFIRMATION OF GANFENG LITHIUM’S CO-FUNDING OF SAL DE LA PUNA ACQUISITION AND APPOINTMENT OF BOARD NOMINEE.

Source: Company news

Further reading

Arena company highlights

Conclusion

Arena has already come along way and looks extremely well partnered (Ganfeng) and potentially financially backed (LAC, Ganfeng) to become a LiCl producer, perhaps as soon as 2025-26 (subject to permitting and funding, etc.) from their Sal de la Puna Project in Argentina.

In 2022, at their 65% owned flagship Sal de la Puna Project, Arena has achieved production of 35% LiCl (with low impurities suitable for battery grade carbonate) directly from their pilot evaporation ponds. They also began work on the next stage of development with permitting for 490 hectares of ponds to produce 40,000tpa of LiCl.

The main advantage of producing the intermediary product LiCl is that Arena does not need to pay for and build a lithium carbonate plant. Less approvals, less money, and ‘faster to market’. In this case Ganfeng looks to be a willing buyer as they are able to process the LiCl into lithium carbonate ready for the EV market. SQM produces LiCl at Salar de Atacama ready for export so it has been done already at scale. The main negative is the loss of some value-add product and less vertically integrated from brine to carbonate.

Near term catalysts are Project permitting and further progress of a commercial LiCl production operation at Sal de la Puna, as well as drill results and potentially resource upgrades. Also any further development at Arena’s Antofalla salar or in their Atacama Copper Project in Chile. Given the LiCl production process takes about 1-2 years of evaporation, it may be possible for Arena to be producing LiCl in 2025-26. Perhaps even earlier if Arena’s proprietary brine processing technology works quicker.

Management is top tier with an excellent track record in lithium brine projects in both Chile and Argentina. LAC and Ganfeng both own 17% each of the shareholder register which is a strong positive; however a takeover of Arena is a possibility.

Valuation looks reasonable on a current market cap of C$194m. However, it depends on how well the company can progress. Analysts’ consensus is an “outperform” with a price target of C$0.85.

Risks revolve mostly around further growing the resource, developing the project, and funding (stock dilution). Also, there is moderate country risk in Argentina. Please read the risks section.

We view Arena Minerals as a good speculative buy (high risk/high reward), suitable for a 5 year plus time frame, especially if you are positive on the outlook for lithium.

As usual all comments are welcome.

Be the first to comment