Chainarong Prasertthai/iStock via Getty Images

Summary

Otonomy, Inc. (NASDAQ:OTIC) has a full pipeline of assets targeting disorders of the ear. There are few competitors working in the space, and the indications they are targeting are large indications, including tinnitus and hearing loss. Neurotology is an unconquered frontier and Otonomy is taking on some of the most challenging indications.

One in eight Americans has hearing loss, and there are no FDA-approved medicines. Promising early data has been generated by Otonomy in these indications. However, expectations should be tempered by a realistic assessment of the obstacles and the history in these indications, which includes many outright failures.

Background on Drug Development in the Ear

Drug developments in disease states with difficult-to-explore and poorly understood biology, such as the inner ear and brain, are among the most challenging. There are no approved treatments for tinnitus (ringing in the ears or the perception of sound) or hearing loss. While there are theories about the processes underlying these symptoms, the basic biology is poorly understood.

Both tinnitus and hearing loss are clinical presentations that emanate from a diverse set of circumstances and thus may have a variety of causal mechanisms. Finding treatments in indications with a heterogeneous patient population is particularly challenging. Running clinical trials is difficult due to trying to assemble a homogenous cohort. Interpreting efficacy signals in small trials is particularly difficult given this heterogeneity. Even determining which standardized tests give consistent results in untreated patients is a challenge. Given there are no approved therapies, the tests and regulatory endpoints which will be accepted by the FDA are also unknowns.

Perhaps even more importantly, tinnitus and hearing loss are conditions where there are no biomarkers that predict efficacy. Drug targets are essentially “guesses” based on theories about the causes of these disorders. Development efforts are likely to be an iterative process where learnings about patient selection, dosing and endpoints inform future trials.

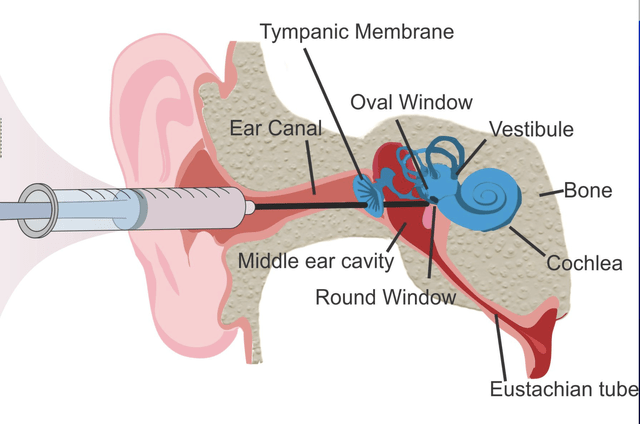

ENTs perform a variety of surgical procedures, but one additional difficulty is that drug delivery to the inner ear is invasive due to anatomical constraints. Reaching the cochlea and inner ear is done via intratympanic injection, where a needle is passed through the ear canal and then through the eardrum to administer medications into the middle ear space. Most drugs require sustained exposure to target tissue, and achieving this in a difficult-to-reach location where sustained drug exposure may be necessary presents an additional challenge.

Frontiers in Cellular Neuroscience

Precedent suggests developing therapeutics for these indications is an extremely difficult task. Auris Medical, Otonomy and Frequency Therapeutics have all previously posted disappointing results. Sensorian, a French biotech, recently announced their candidate failed to meet the endpoint in a hearing loss study.

OTO-413

OTO-413 is an intratympanically administered injection that consists of brain derived neurotrophic factor (BDNF), a naturally occurring protein believed to be capable of repairing damaged cochlear synapses. A study published in The Journal of Otolaryngology- Head and Neck Surgery describes the ability of BDNF to improve hearing in an animal model. The authors concluded, “Brain-derived nerve growth factor (BDNF) plays an important role in cochlear development so it is plausible that it could restore hearing loss if delivered directly into the cochlea.” The formulation OTO-413 is designed to give sustained exposure to BDNF over a few weeks into the cochlea. Preclinical and animal studies have shown that intratympanic delivery of OTO-413 can migrate through the round window membrane to reach the deep parts of the cochlea. This was shown to restore synapses.

A Phase I/II trial of OTO-413 in 39 patients with speech-in-noise hearing difficulty (most also had moderate hearing loss in quiet settings) was completed in December of 2020. Patients enrolled in the trial self-reported hearing problems in a noisy environment. In the placebo controlled dose escalation trial, OTO-413 was well-tolerated and no serious adverse events were reported.

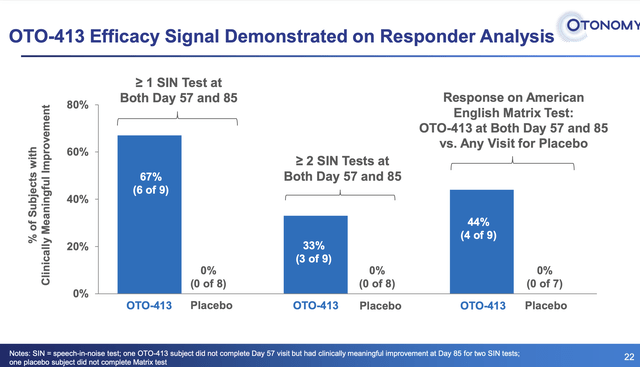

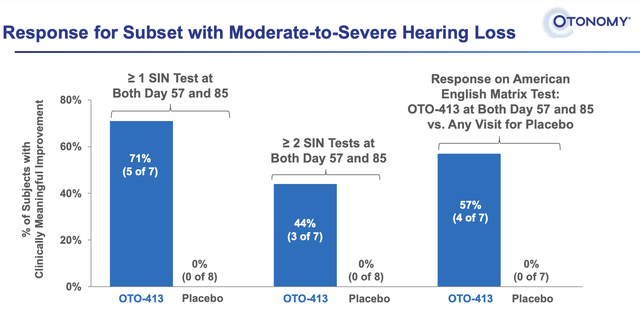

Although there were 4 dose cohorts, only the ten patients in the high dose cohort had a significant response. Nine of those patients were evaluable, while the tenth patient did have a response but did not complete the trial. A higher proportion of patients treated with OTO-413 achieving clinically meaningful improvement from baseline for SIN (speech in noise) tests at both Days 57 and 85. The response appeared to be slightly better in the subset of patients with moderate-to-severe hearing loss.

Otonomy’s results appear promising enough to pursue a larger trial to confirm an efficacy signal. The company is currently enrolling a Phase 2a cohort in a randomized, double-blind, placebo-controlled study which will include 30 hearing loss patients. Twenty patients will receive a single intratympanic injection of 0.3 milligrams of OTO-413 and the remaining 10 will receive a placebo injection. Patients will be followed for three months and evaluated for response on three speech in noise tests as endpoints. A read out is expected in the early part of 2Q 2022. Otonomy will also evaluate the 0.75 mg and 1.5 mg dose. The company plans on initiating additional dose escalation trials in 2022.

Finances

Otonomy closed an offering at $2.25 per share in 2021 to bring in an additional $34 million and has $77 million of cash on hand. Operating expenses were approximately $48 million for 2021 and the company anticipates cash will be adequate through the second half of 2023. The cash on hand of $77 million will likely be insufficient to run larger Phase 3 trials in both indications. However, the company may have institutional support and sufficient capital if the data is promising.

Frequency Therapeutics received $80 million upfront for ex- US rights to their hearing loss treatment after it showed promising Phase 1 data. This demonstrates that there is a potential for an external partner to help finance later trials if Otonomy produces positive Ph 2 data.

Institutional Ownership

Suvretta Capital, RA Capital and Baker Brothers hold positions.

Management

Jay Lichter, Ph.D., a venture capitalist founded Otonomy with his treating ENT after being diagnosed with Meniere’s disease, a disorder of the inner ear which causes hearing loss, tinnitus and vertigo. The company was founded in 2008 and David Weber, Ph.D., has been the CEO of Otonomy since 2010.

Otonomy has a less than impressive five year track record with shares falling from a high near $40 to $2.20 per share. Much of this descent was due to OTO-104 (Otividex) which failed to meet endpoints in a Ph 3 trial for Meniere’s Disease in 2021. OTO-104 had also failed to meet the endpoint in an earlier trial and the company burned a lot of cash following a questionable strategy to move forward with Phase 3 trials. The share price has not recovered despite the advancing tinnitus and hearing loss programs.

Analyst Commentary

Commenting on OTO-413, analyst Tyler Van Buren stated that it “appears active based on the initial data” and suggested OTO-413 “could generate a very large, currently unquantifiable, level of peak sales,” which is not reflected in the current share price.

Conclusions

Tinnitus and hearing loss are two of the most challenging indications but they are also each billion dollar markets. A therapy with even modest efficacy would likely be well received by both patients and physicians. Otonomy is in the earliest stages of determining an efficacy signal in both tinnitus and hearing loss and cohort sizes are small. Thus, it is difficult to have a high level of confidence that the efficacy signal will be reproducible. Development is likely to be an iterative process to determine appropriate patient selection, dosing strategies and study design.

Without success in these indications, the company is likely to have a difficult path forward. One common mistake small biotech companies make is to move forward assets with questionable efficacy despite poor results. Certainly, if mixed results or a weak signal emerge, investors may want to closely follow whether management is making an appropriate decision given the data.

If Otonomy succeeds in Phase 2 in either tinnitus or hearing loss, the value of the company would likely soar as investors recognize the large and lucrative market opportunity which lacks meaningful competition. The hearing aid market is approximately $10 B and a hearing restoration therapy would likely capture a large market share.

There are 13 million potential patients with tinnitus, many of whom may want to have a simple injection to reduce the annoyance of ear ringing. A data readout for OTO-313 in tinnitus is expected later in 2022 and offers a second shot on goal. Otonomy offers the classic biotech binary opportunity where investors need to decide for themselves if the considerable risk is worth the considerable potential reward. Otonomy has many “shots on goal” (2 clinical and 3 pre-clinical) but given the odds of success are low, this is quite necessary.

Be the first to comment