Pekic

Thesis

Oscar Health, Inc. (NYSE:NYSE:OSCR) continues to spearhead through its growth trajectory. The company’s top line growth and the business potential are some things to note; however, given the current market conditions, it is possible that Oscar Health will continue to see its share price decline as investors flee to safety and avoid long duration stocks like Oscar Health. As a result, we are recommending a “HOLD” for Oscar Health right now, but will look to change our thesis as market conditions improve.

Company Overview

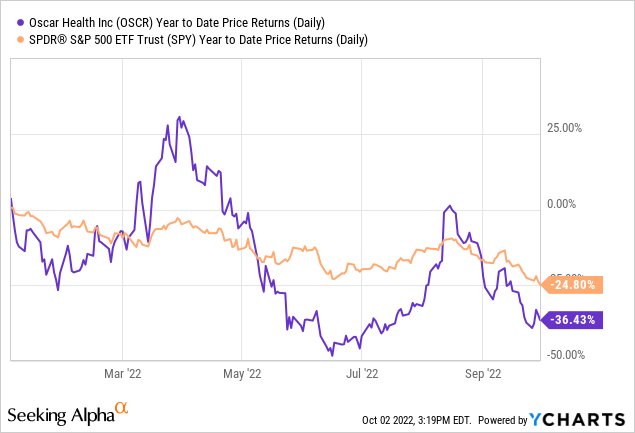

Oscar Health, Inc. is a technology-based health insurance company that sells insurance directly consumers. The company completed its Initial Public Offering in March 2021, and raised $1.4 billion at an IPO price of $39 per share. Since then, the company has seen a precipitous decline in shareholder value, as the company now trades at around $5 per share at a market capitalization of $1.06 billion. Year-to-date, Oscar Health’s stock price has shown higher volatility than the overall index, and the stock price has declined more than the index as well. The company’s stock returned -36.43% this year, compared to the S&P 500’s decline of -24.80%.

Recent Financial Performance

Good Growth in Key Areas

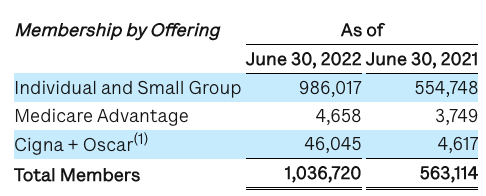

Oscar Health showed substantial growth in Q2 2022 compared to the previous year in key areas of performance. First and foremost, the company’s revenue increased from $539.2 million to $1.02 billion YoY, which represents a 92.2% growth. In that same time frame, the company’s membership also increased by around that margin, as the number of users jumped from 563,114 to 1,036,720 within a year, marking an 84% YoY increase. On a simple back of the envelope calculation, it is good to see the growth in revenue outpace the growth in users, which may show generally the increase in revenue synergies of Oscar Health’s recently developed new product lines and services.

Q2 Earnings Release

Widening Losses

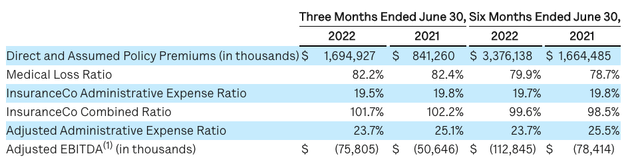

On the other hand, even as the top line grew substantially, the company’s net loss widened on a YoY basis from -$73 million to -$112 million. Though it’s not favorable to see the net loss widen on a year-over-year basis, we believe the increase in losses in the context of a near $500 million increase in revenue alleviates some concerns. Nevertheless, the efficiency ratios have been looking solid with a decline in key ratios such as Medical Loss Ratio and Adjusted Administrative Expense Ratio, which declined 20 bps and 140 bps YoY. As such, though the losses have widened, we believe that we are seeing the benefits of increasing operational leverage as the company’s top line and user base grows. Furthermore, the company has $2.36 billion in cash on hand, and we believe that the company from a liquidity perspective has enough runway to continue to operate at a loss. So at the moment, we believe that top line and membership growth is the most important.

Strong Fundamentals

Oscar Health operates in the healthcare market, specifically the segment of the healthcare market that focuses on digitized healthcare offerings and virtual medicine. The market growth trajectory is high for the next decade, and we believe Oscar Health’s brand and position in the market sets the company up for the great chance to take advantage of the market growth. The “Smart” Healthcare Market is expected to grow at a solid CAGR of 13.4% until 2030 and so is “Big Data” in Healthcare, which is expected to grow at a CAGR of 13.85% in the same time frame.

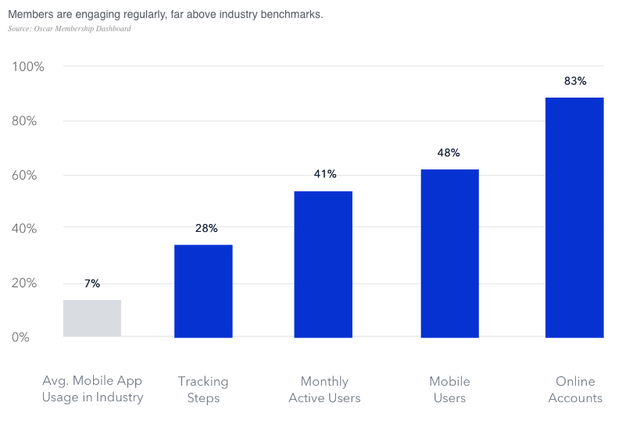

As more and more young people start to look for healthcare options, we believe that Oscar Health’s technology first business model will provide the company with a significant competitive edge over the larger, older incumbents in the industry. As one can see below, Oscar Health members are more tech-savvy than the average in the industry. Therefore, in the long term, we do believe that company will be able to have strong margins and profitability based on its reliance on technology and data. Currently, at a 0.3x P/S multiple, we believe there could be potential valuation upside in the future.

Risk

Given the strong fundamentals and the tailwinds supporting this company, we believe that the main short-term risks of the company is based on market sentiment. As the Federal Reserve raises interest rates and bond yields go higher, companies like Oscar Health with no profits and a long-term investment horizon will be most impacted by the rising yields. Simply, as yields rise, other investment propositions start to look more attractive, such as bonds that are now paying 4% risk-free yield in the next couple of years, and there will be a focus on investments with returns in short-term horizon rather than the long-term. As such, we believe that interest rate risk will have high impact consequences for Oscar Health, and regardless of the fundamentals, we can see its valuation contract substantially over the short-term. Therefore, we think that one should take a position in the stock only when prices have stabilized and the market conditions look more stable.

Conclusion

Oscar Health is a company with strong growth and business fundamentals, and the company is favorably positioned in an industry with increasing digitization and new consumers that are more tech-focused. Though the long-term outlook is strong, at the moment, we believe that the company’s stock price may have further downsides to go due to the rising yield environment and a shift to a “risk-off” sentiment among investors. Once yields stabilize and monetary conditions can be properly accounted for, we will reassess Oscar Health stock for our readers.

Be the first to comment