JHVEPhoto/iStock Editorial via Getty Images

You may recall me beginning my previous article H&R REIT: Get Double-Digit Returns And Beat Inflation where I quoted trading economics

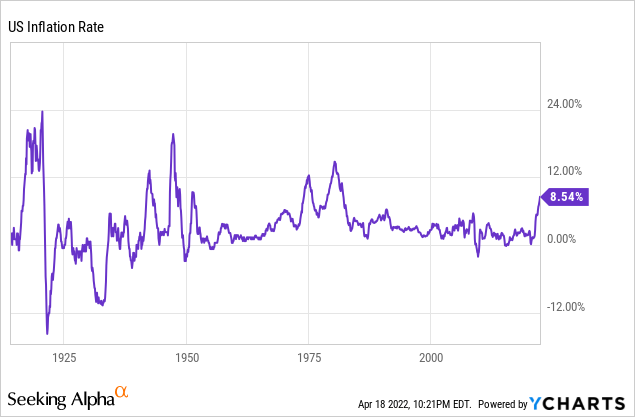

The annual inflation rate in the US accelerated to 8.5% in March 2022, the highest seen since December of 1981, up from 7.9% in February and compared with market forecasts of 8.4%. The cause of the increase in basic goods and services has been energy prices rising 32% from the prior months leading to a 48% increase in gasoline prices. Food prices jumped 8.8%, which is the most since May 1981.

Source: Trading Economics

All of this largely attributable to Russia’s invasion of Ukraine which we have all heard about and the necessary sanctions imposed by nations. Governments have done an impeccable job at keeping records on inflation, asset prices to compare to periods of high inflation on the other are in limited supply before 1970. That being said there are two periods since 1970 where inflation rose higher than 6% for consecutive years. These periods were in 1973-1975 and 1977-1981 which were attributable to the OPEC oil embargos and the Nixon administration attempting to fund the Vietnam War and social programs requiring substantial stimulus that lead to the abandonment of the gold standard.

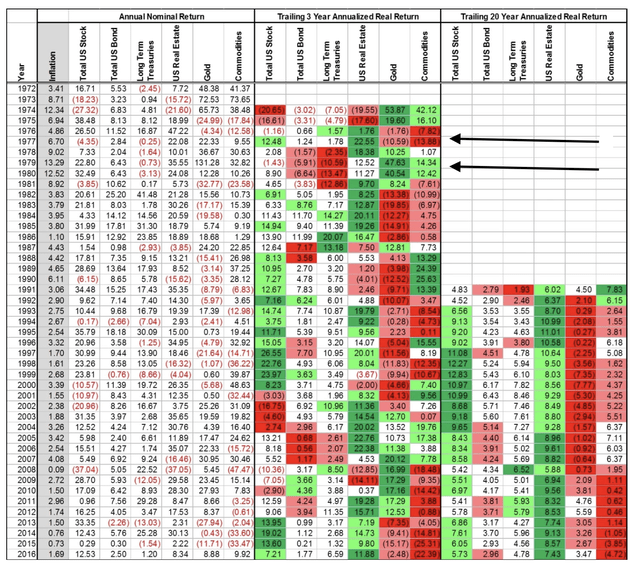

Real estate was the best performing asset through these periods when compared to gold, stocks, bonds and commodities. Investors in real estate would have maintained their wealth throughout the eighties as inflationary pressures died down and proved to be a much better “buy and hold” investment between the 1970 and 1990. Gold had some extremely strong years during this period which gets a lot of hype during periods of high inflation, on a 3-year trailing return basis investors lost a significant amount of their wealth in the eighties as inflation pressures died down.

Real Estate in Stagflation (engineeredportfolio.com)

The purpose of this article is to present a compelling opportunity in Orion Office REIT (NYSE:ONL) that is well positioned to provide returns well above inflation for the next few years.

Background

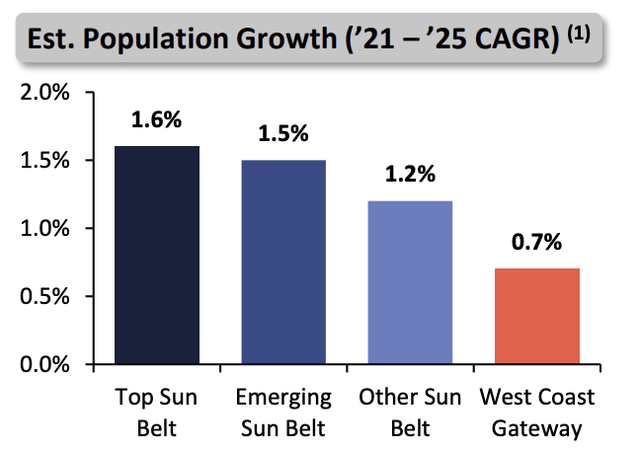

Orion Office REIT is focused on single-tenant net lease office space in Sunbelt and suburban markets that are experiencing economic and population growth. ONL was formed in October 2022 as a spin-off as part of the Realty Income Trust (O) and VEREIT merger.

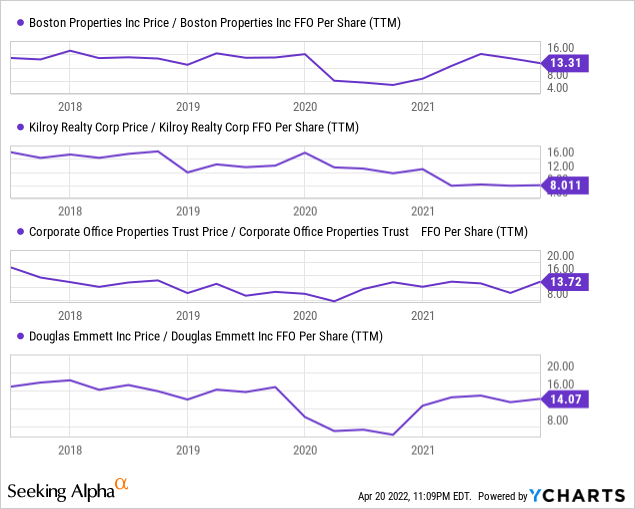

Office space has certainly met the ire of investors since the onset of COVID as most “white collar” workers that once occupied the existing workspace were required to stay home and utilize their company’s digital resources to fulfill their occupation requirements. These resources proved more than adequate and technologies such as Zoom Technologies became a staple in many people’s daily work lives. In fact many workers felt they were happier and more productive not being at the office largely because they didn’t have to deal with the nuances of commuting. It has been an unknown for sometime whether the shiny downtown office buildings in major cities would continue to be unoccupied. As we can see below the major office REITs are only just starting to reach their pre-COVID valuations.

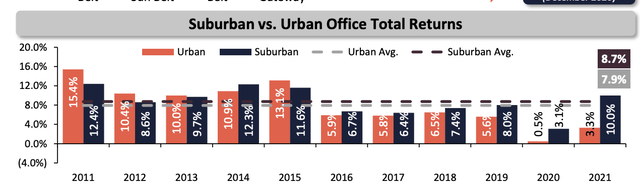

Although the outlook for expensive downtown office space in New York, LA or San Fransisco is unknown, ONL is actually exposed to the steady suburban markets where populations have been growing as people have relocated away from the “city core.” Net population flow out of urban neighbourhoods and into non-urban communities doubled between March and September 2020 as compared to the average for the same months in 2017 through 2019. As millennial preferences change, growth in suburbs may continue as the largest generation ages and begins to look for more affordable communities to settle down.

March 2022 Investors Presentation (Orion Office REIT)

March 2022 Investor Presentation (Orion Office REIT)

Large corporations continue to announce relocations and/or new corporate campuses away from major coastal urban hubs and toward inland suburban markets. For example, in Tempe, Arizona which is an eastern suburb of Phoenix, has seen an influx of well-known tech companies. DoorDash (DASH) moved into a new building on the edge of a Tempe reservoir and Robinhood (HOOD) rented out a floor in an office nearby in the later half of 2020. Amazon (AMZN) recently announced the intent to occupy five floors of this building to be occupied by 5,500 workers.

Big Tech Makes a Big Bet (NY Times)

In the last three quarters of 2021, the tech industry leased 76 percent more office space than it did a year earlier, according to the real estate company CBRE. Big Tech executives say that office expansions are to be expected and that modernized buildings will probably be spaces for people to collaborate rather than stare at screens.

Source: NY Times

Meta (FB) and Google (GOOG) (GOOGL) have announced plans to purchase/lease additional office space in Manhattan and Silicon Valley with Apple (AAPL) following suit in Silicon Valley in 2022. Microsoft (MSFT) and Google have also announced plans to purchase additional office space in places like Atlanta, Miami, and Colorado. Apple said it would build a campus near Raleigh, N.C., and has added space in San Diego.

In addition, there will always be demand for office space in many industries such as health care services and telecommunications to name a couple. Could you imagine if your doctor, physiotherapist, or dermatologist decided to only offer their services online or if your phone broke having to get it replaced by calling your service provider for assistance rather than taking it in person to the technician. These are just a few of ONL’s clients.

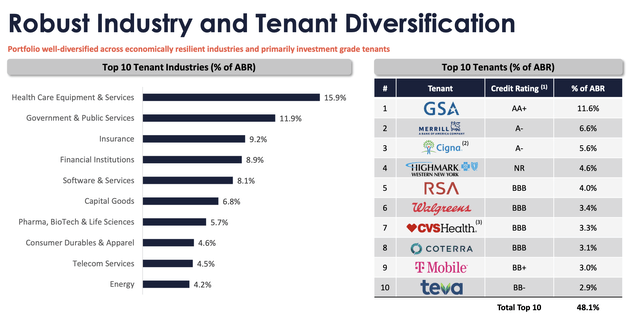

ONL has a very high-quality portfolio, with over 70% of its portfolio leased to investment-grade tenants with their largest tenant being the Government Services Agency. The next largest tenant is Merrill Lynch who ONL signed an 11 year lease extension with in November 2021 where they will occupy approximately 482,000 rentable square feet in 3 properties in Princeton, NJ and is ONL’s largest investment by annualized base rent.

The largest sectors of ONL are healthcare, telecommunications, and insurance, which are well-capitalized companies that have steady operations regardless of the economic environment. The top ten tenants represent only 48% of ABR. In addition the properties were 91% occupied as of March 2022 and targets returns of 8-12 years.

March 2022 Investor Presentation (Orion Office Space)

Investment Thesis

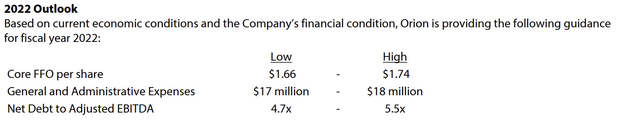

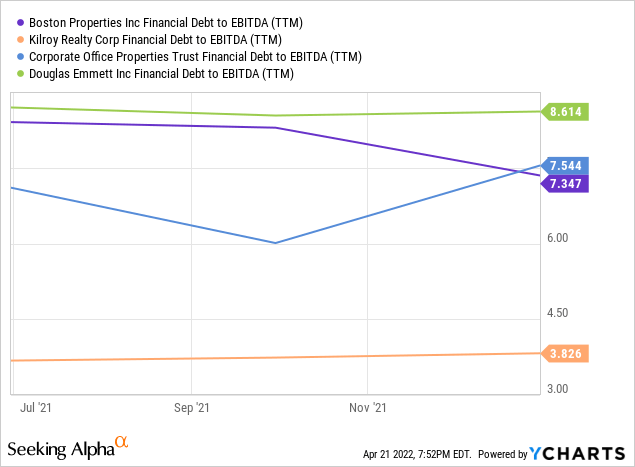

Management has guided for $1.66-$1.74 in FFO per share for fiscal 2022 and Net Debt to EBITDA of 4.7-5.5x. At the current price of ~$14/share this would imply a valuation of ~8x FFO which is not only cheap in the REIT space but as shown above is very cheap for even office REITs which trade at 13-14x FFO. ONL’s leverage is also very low for the REIT sector which is typically at 7-8x EBITDA. It seems the market has greatly undervalued this investment for a number of reasons which I have counter arguments for.

March 2022 Earnings Report (Orion Office REIT)

The first and most obvious reason to dislike the REIT is that it is a recent spinoff with a short existence under the current management. It is also a misconception that a larger company spun off the assets because they were considered “lower quality” or “toxic.” The reason for the spinoff is that O’s expertise is in managing in retail properties and at this time command a higher premium (conversely a lower cap rate) than that of office properties. Moving away from being a diversified REIT makes it cheaper for them to access capital for new developments in the absence of office properties which is a drag on their valuation. Most of ONL’s properties are actually considered “Class A” properties so should not be considered lower quality. Furthermore, its not like ONL’s assets just came of the chopping block as they had been accretive while being managed by O and now have the former executive management team of VEREIT at the helm who obviously unlocked enough value in VEREIT to make it an attractive acquisition for O.

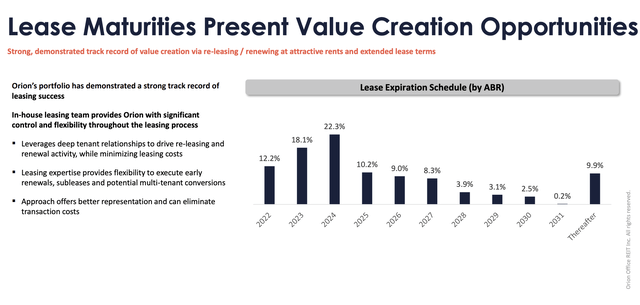

Second, ONL’s weighted average lease term is ~4 years which is on the low side for an office REIT as they like most office REITs target lease terms of 8-12 years. This is because 53% of current leases by ABR expire before the end of 2024.

March 2022 Investor Presentation (Orion Office REIT)

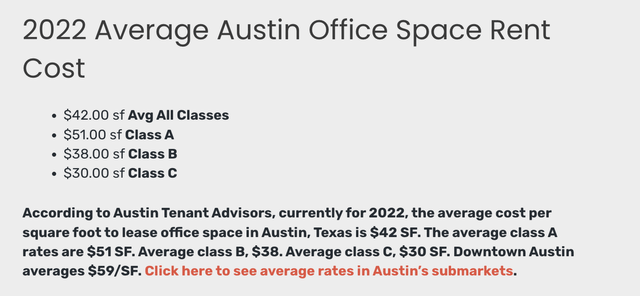

Many would see this as a negative as it decreases cash flow predictability. I share the view of ONL as it is actually an opportunity to lock in higher lease rates in a period of rapidly rising inflation. ONL’s average base rent (ABR) per sf is $16.89 but this should rise significantly in the next couple years. Texas is their highest geographical concentration as a percentage of total portfolio ABR/sf and currently they realize an ABR/sf in the state at $17.46. According to Austin Tenant the average cost per sf in Austin, TX is $42/sf ($51/sf for Class A properties). Class A properties in Austin are highly sought after by the aforementioned tech companies as they are image conscious.

| Location | Number of Properties | Rentable SF | Annualized Base Rent | Current ABR/sf ($) |

| Texas |

15 |

1353 | $23,621 | $17.46 |

| NJ | 4 | 829 | $20,262 | $24.44 |

| Illinois | 12 | 1322 | $16,193 | $12.25 |

| NY | 5 | 787 | $13,383 | $17.01 |

| Average | $16.89 | |||

Source: Company Filings, Author’s Tables

How Much Does Office Space Cost in Austin Texas? (www.austintenantadvisors.com)

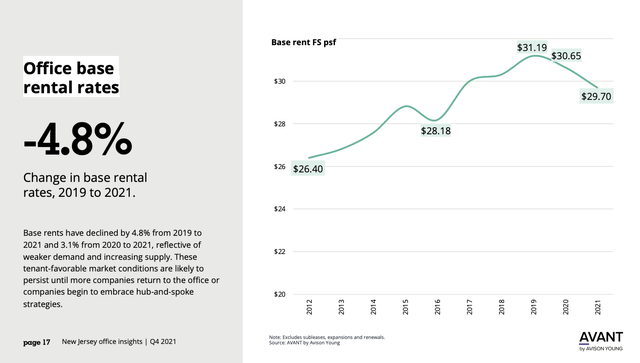

The cost of office space in New Jersey had been on a steady rise between 2012 and 2019 (~3% annualized), but has declined by 5% since as a result of COVID. The decline is expected to flatline and average market base rent in NJ is still above that being charged by ONL.

New Jersey office market insights (www.avisonyoung.com)

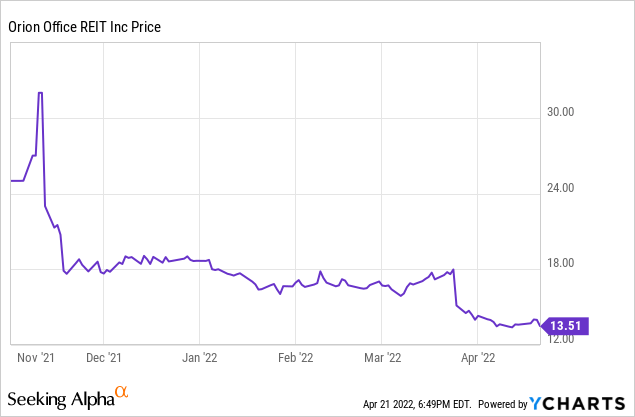

Third, as historical FFO was $2.40/share on ONL’s properties as per the December 2021 Earning Report, investors expected a 40-60% payout ratio equal to a dividend of at least $1.00/share. This would have meant a respectable yield of at least 5% in early March and would have made for a great income investment. On March 22, 2022, management revised their guidance on FFO/share for 2022 to $1.66-$1.74/share and declared a quarterly cash dividend of $0.10 per share which meant a payout ratio of 25% on revised guidance and a paltry dividend yield of ~2% at the $17.50/share price at the time of the announcement. The stock fell by 60% within 24 hours following the announcement.

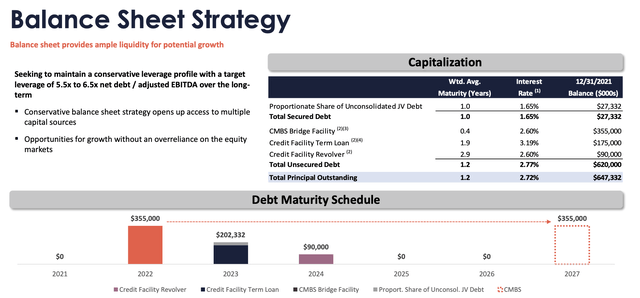

It is unclear the reason for the revised guidance. Some have posited that ONL’s financial capacity was lacking but I don’t see how that could be the case as they refinanced the short-term bridge loan with a $355MM five-year, 4.971% fixed-rate CMBS loan collateralized by 19 properties and funded $35.5MM of required lender reserves for future rent concessions and tenant improvement allowances at the respective properties. In addition as of March 2022 there was $346.4MM of liquidity, comprised of $12.4MM in cash on hand and $334MM of available capacity on the revolving credit facility and 98% of assets are currently unencumbered.

March 2022 Investor Presentation (Orion Office REIT)

In January 1, 2022, the leases with tenants at Orion’s Northbrook, IL and Berkeley, MO properties expired, and those properties are currently vacant but these assets only make up less than 10% of their ABR.

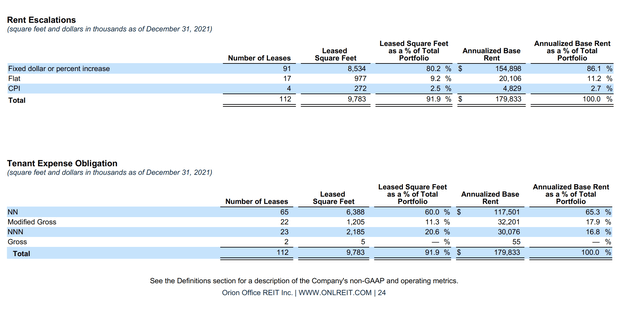

As a result of being an 80% “triple net” REIT, operating costs should not be expected to rise significantly as these are largely passed on to the tenant. ONL also has the ability to employ rent escalations on ~89% of its square footage. Both of these features are major tailwinds for them in periods of rising inflation.

March 2022 Earnings Presentation (Orion Office REIT)

My conclusion is that management expects some redevelopment expenses in the near term and therefore decided not to over extend on the dividend. I still believe a $2.40/share minimum “run rate” is not unrealistic in the near future and would imply a P/FFO of ~6x. “Run Rate” NOI is $124MM and using a fair 6.5% cap rate would imply a NAV of $22/share which would imply at least 63% upside from the current share price.

Conclusion

ONL is one of the cheapest REITs in the sector, but is also poised to benefit greatly from inflation with being “triple net,” rent escalations, and as it renews or reallocates its glut of expiring leases over the next three years at higher rates. There is little doubt in my mind that this REIT can more than double in value as a result of these tailwinds. All dividend hungry investors should not be too concerned as this REIT should reach its “run rate” FFO within the next few quarters and even surpass it. A minimum $1/share dividend would not be unreasonable to expect in the next couple years and would imply a respectable ~7% forward yield at the current price.

Be the first to comment