Shutter2U/iStock via Getty Images

We can easily forgive a child who is afraid of the dark; the real tragedy of life is when men are afraid of the light.”― Plato

Today, we take a deeper look at a commodity-focused concern feeding the EV industry. The stock appears cheap but has been weighed down by an EPA consent decree, whose tailwinds should dissipate over the year. Recent earnings were also slightly disappointing which triggered some new insider buying. A full analysis and recommendation follows below.

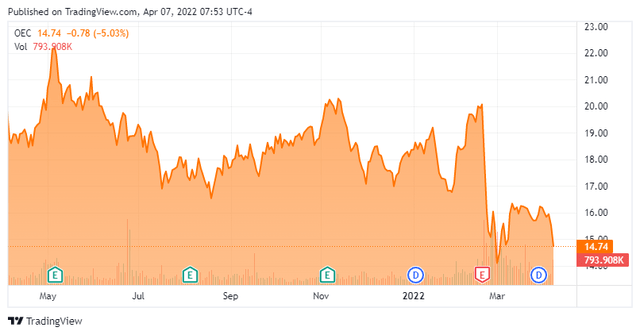

OEC – Stock Chart (Seeking Alpha)

Company Overview

Orion Engineered Carbons S.A. (NYSE:OEC) is a Luxembourg domiciled and Houston headquartered supplier of carbon black with 14 plants in ten countries on three continents. It is one of the world’s largest manufacturers providing its output to over 1,000 customers in 80 countries. With operations dating back to 1932, Orion was a business line of German concern Evonik until private equity investors purchased its carbon black operations in 2011. The company went public in 2014, with the selling shareholders raising gross proceeds of ~$350 million at $18 a share. Its stock trades right under $15.00 a share, translating to a market cap of approximately $940 million.

Carbon Black

Carbon black is produced by the reaction of a hydrocarbon fuel (usually residual heavy oil from petroleum refining, coal tar distillation, or ethylene production) with a small amount of combustion air at temperatures of 2,400 to 2,800oF. The unburned carbon is collected as an extremely fine black fluffy particle, 10 to 500 nanometers in diameter. The smaller the particle size, the blacker the particle. Orion sells its yield to the automotive, construction, and other industrial verticals, primarily under long-term contracts with formula-driven and (typically) monthly price adjustments for changes in raw material and/or energy costs, as well as forex to dampen volatility. These indexed contracts cover ~70% of its volume. Its non-indexed contracts are usually on terms of less than three months.

Operating Segments

Orion’s operating segments are a function of the two types of carbon black it produces: lower-margin Rubber Carbon Black and higher-margin Specialty Carbon Black.

Rubber carbon black’s largest application is in the production of tires, where it enhances durability and traction. The average car tire contains approximately 3kg of rubber carbon black. It is also employed in mechanical rubber goods, such as transmission belts, window seals, wires, and cables. Orion concentrates on the more technical (re: less commoditized) grades of this product, which have generated gross profit per ton between ~$220 and ~$290 over the past five years. This segment accounted for 73% of the company’s volume in FY21, while generating Adj. EBITDA of $120.0 million on net sales of $948.6 million, for an Adj. EBITDA margin of 13%.

Specialty carbon black has a wider range of uses, including pipe construction, power cables, automotive base coats, ink and toner for printing systems, and additives for enhanced electrical conductivity for batteries. Its production requires customization and more technical manufacturing processes. As such, it commands higher contracted prices, accounting for gross profit per ton between ~$600 and ~$775 during the past five years. Specialty Carbon Black was responsible for only 27% of Orion’s FY21 volume, yet generated a higher Adj. EBITDA of $148.4 million on net sales of $598.2 million, for an Adj. EBITDA margin of 25%.

To increase production, the company has embarked on two projects, the first of which is a plant expansion in Italy that will add 25 thousand metric tons [KMT] of specialty carbon black capacity that was completed in 2021 with production commencing on February 28, 2022. Orion is also constructing a carbon black facility in the world’s largest consumer market. The Huaibei, China project will add ~70 kmt of primarily specialty and technical rubber grades, with construction anticipated to finish in 2022 and a ramp in 2023-2024. To put these additions into perspective, Orion produced 964.3 kmt in FY21. Furthermore, these capacity adds allow the company to supply very conductive acetylene carbon black, which has applications in the fast-growing lithium ion battery market.

Marketplace

The company competes with Aditya Birla Group’s Birla Carbon, Cabot Corporation (CBT) in both rubber and specialty black carbon arenas and Tokai Carbon (OTCPK:TKCBY) and China Synthetic Rubber (amongst others) for rubber carbon black demand. In terms of sales, the overall carbon black market is ~$20 billion, and according to Orbis Research, specialty carbon black accounted for ~$3.3 billion of that opportunity in 2021.

Recent History & Share Price Performance

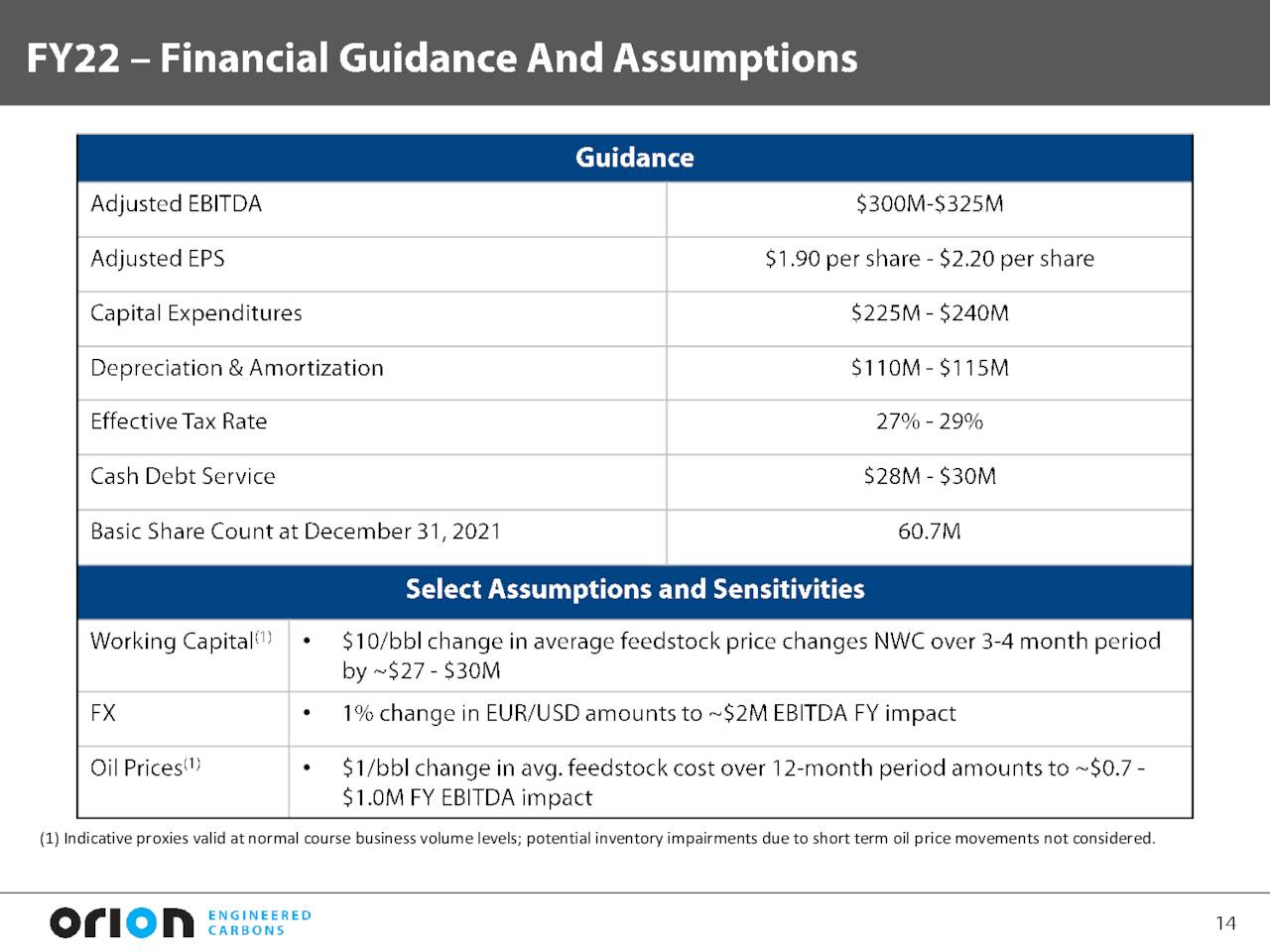

Given its customer base, Orion is a highly cyclical company and as such does not command high price-to-earnings or price-to-sales valuations. Despite the stipulations in its long-term contracts to dampen volatility, the company’s performance is still sensitive to oil prices and currency fluctuations. A $1/bbl change in feedstock cost impacts Orion’s EBITDA by $0.7 to $1.0 million and its working capital by ~$3 million per annum, while a $1 move in the EUR/USD affects EBITDA by ~$2 million.

After peaking above $36 in mid-2018, shares of OEC began a protracted decline that was more a function of regulatory and exogenous events than typical swings in the economy. Most important of these actions was the resolution of a decade-long initiative/inspection of Orion’s domestic carbon black plants by the U.S. Environmental Protection Agency. Owing to the fact that carbon black production creates nitrogen oxide [NOX], sulfur dioxide (SO2), and particulate matter emissions, the EPA issued a consent decree requiring the company to install pollution control equipment, including gas scrubbers (to reduce NOx) at two of its facilities and catalytic reduction technology (to lower SO2) at four. These free-cash-flow-injuring modifications have cost Orion $210 million to date, of which it was able to claw back ~$83 million from its former parent Evonik. The company estimates the remaining work, covering two plants, will require an additional $90 million outlay, of which $70 million will be deployed in 2022.

Additionally, the pandemic’s impact on the global economy hurt Orion’s top line, with its FY20 net sales falling 23% to $1.14 billion. Consequently earnings took a hit, falling from $1.87 a share (non-GAAP) in FY19 to $1.04 in FY20. With the market anticipating the impact of these events, shares of OEC cratered below $6 a share during the pandemic-induced selloff in March 2020. Furthermore, Orion’s stock is on the wrong end of the current ESG ‘wokeness’, which effectively eliminates demand from certain institutional investors.

4Q21 Results & Outlook

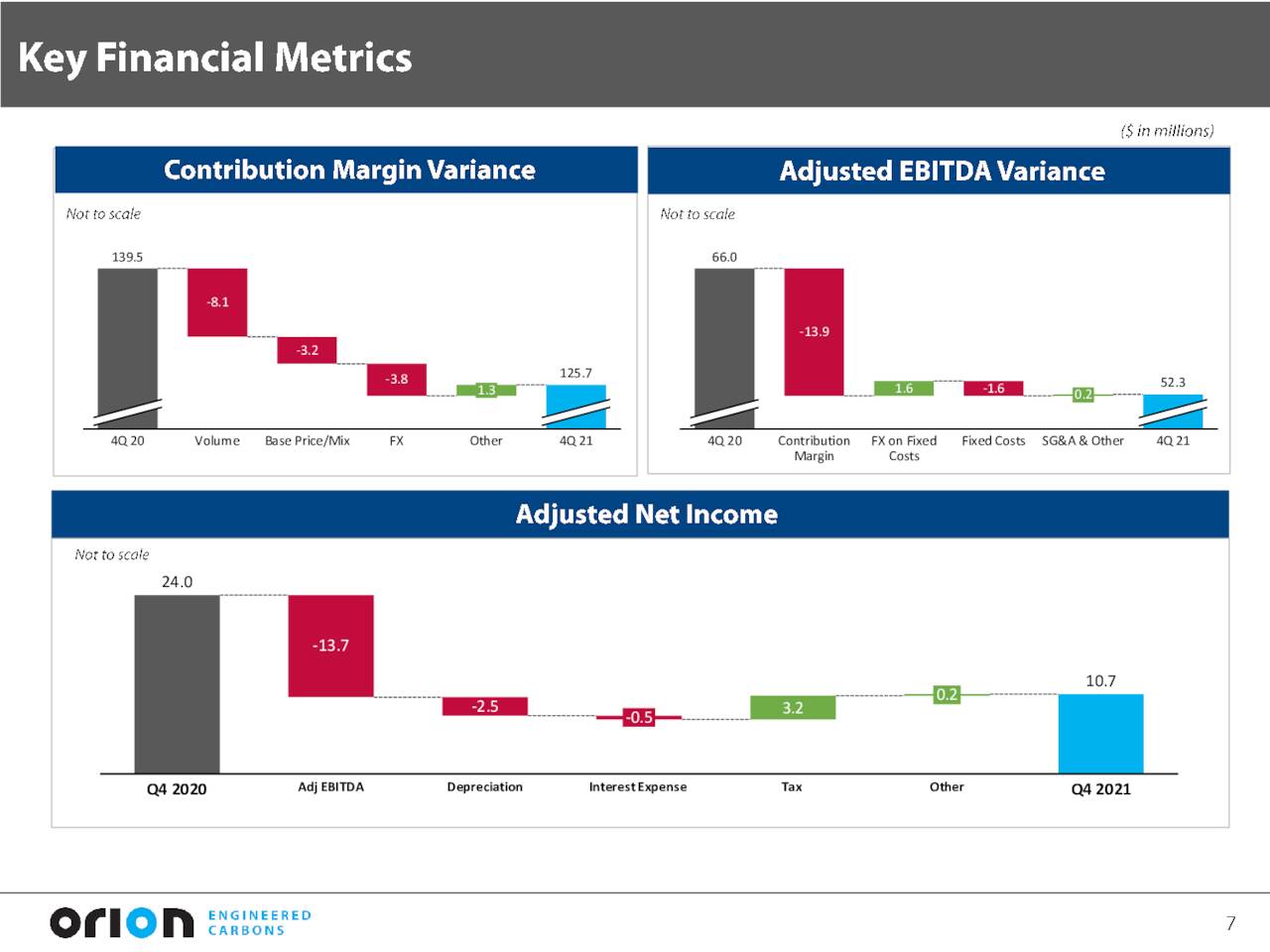

With that said, the company enjoyed a significant recovery for most of FY21 and its stock crested $20 a share several times during that year and again just prior to its 4Q21 earnings release, which was a notably weaker than expectations. On February 17, 2022, Orion announced 4Q21 EPS (non-GAAP) of $0.17 and Adj. EBITDA of $52.3 million on net sales of $392.7 million versus 4Q20 EPS (non-GAAP) of $0.40 and Adj. EBITDA of $66.0 million on net sales of $315.7 million. Most of the disappointment was at the bottom line, which fell $0.18 a share short of expectations, whereas net sales were $10 million shy of Street consensus.

The miss at the top line was blamed on lower demand for some products – partly due to a strike at a key Korean tire customer – supply chain issues, delays in emission reduction execution at the company’s Ivanhoe facility in Louisiana, and planned plant turnarounds. Unfavorable product mix and higher incentive compensation were the culprits at the bottom line. Orion indicated that contracted pass throughs of higher feedstock costs were a net positive in the quarter.

These results brought FY21 non-GAAP EPS to $1.73 (versus $1.04 in FY20 and $1.89 in FY19) and Adj. EBITDA to $268.4 million (versus $200.0 million in FY20 and $267.3 million in FY19) on net sales of $1.55 billion (versus $1.14 billion in FY20 and $1.48 billion in FY19) – in many aspects, a return to 2019.

However, despite providing FY22 guidance comprising Adj. EBITDA of $312.5 million and non-GAAP EPS of $2.05 – based on range midpoints – representing 16% and 18% gains (respectively), the forecast, like its 4Q21 earnings, was below Street expectations. As such, Orion’s stock sold off 25% over the subsequent four trading sessions to $15.08 a share.

OEC – FY2022 Guidance (February Company Presentation)

Balance Sheet & Analyst Commentary

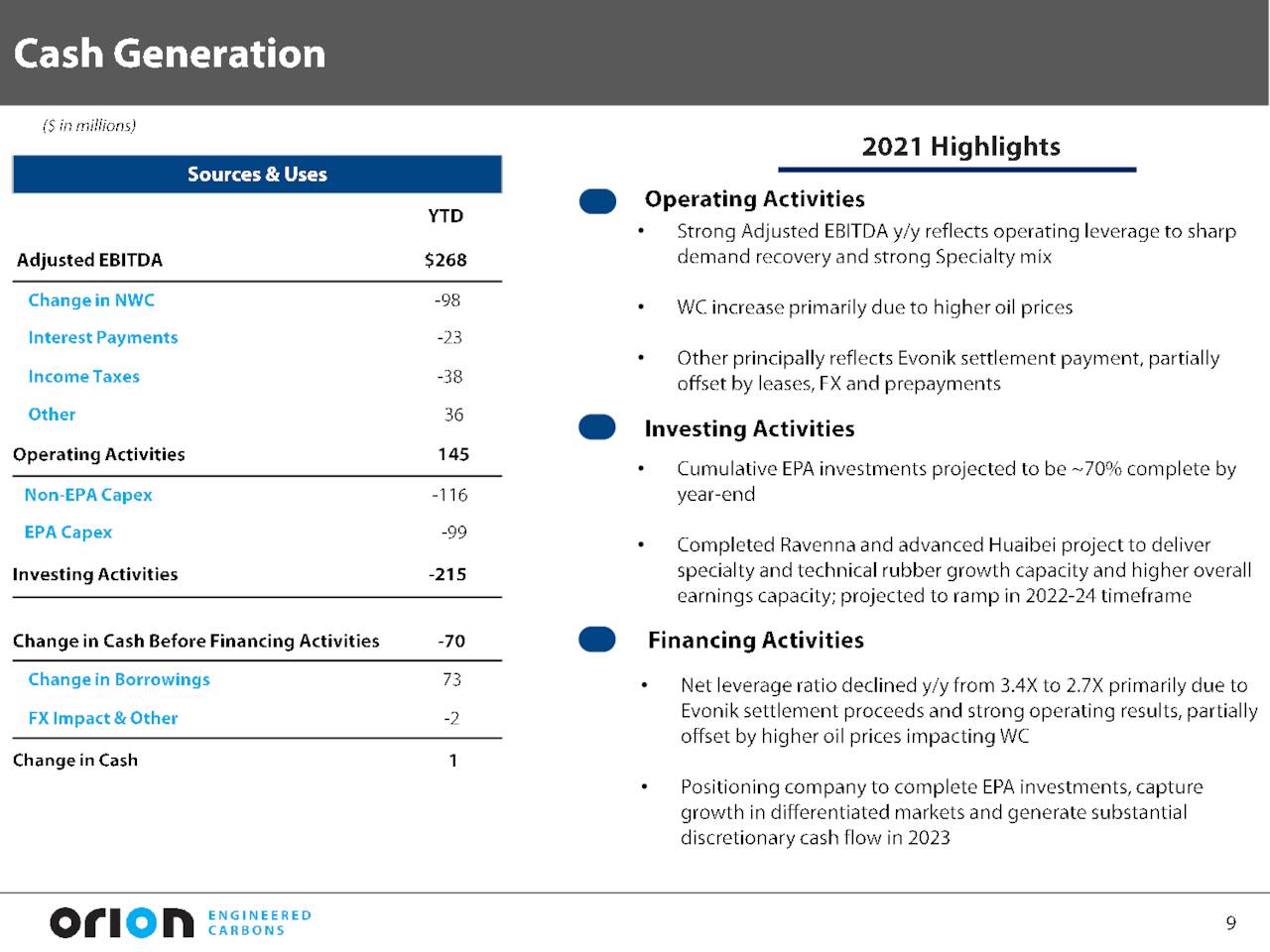

Although the company generated $145.2 million from operating activities in FY21, it is not producing much free cash flow as it its projects in Italy and China, as well as its upgrades to reduce emissions at its U.S. facilities, continue to drain operating cash. Even though Orion’s cash level of $65.7 million was nearly flat versus YE20 and long-term debt was reduced from $655.8 million to $631.2 million, short-term debt increased by $69.1 million as certain lender commitments were converted into bilateral credit agreements to circumvent covenants related to its revolving credit facility. These maneuvers and a large increase in Adj. EBITDA during FY21 lowered leverage from 3.4 at YE20 to 2.7 at YE21. With that said, the EPA capex will largely fall of the books in 2023, improving the company’s free cash balance.

OEC – Key Financial Metrics (February Company Presentation)

After suspending its quarterly dividend – then $0.20 – during the pandemic, Orion reinstated it, albeit at only $0.02, in January 2022.

OEC – Cash Generation (February Company Presentation)

Before, Orion’s earnings announcement, Street analysts had been expecting FY22 EPS of $2.25 and $2.52 for FY23. They lowered those estimates to $2.09 and $2.34 (respectively) after the report. With that said, analysts are mostly bullish on Orion’s prospects, featuring one outperform and two buy ratings against one underperform. The three firms offering commentary over the past three months have price targets of $16 (underperform), $24, and $28.

In late February 2022, insiders turned bullish on their own company, with the CEO and two board members purchasing a total of 56,550 shares in the low-to-mid-$15 area.

Verdict

OEC – FY2021 Key Milestones (February Company Presentation)

At approximately the same time insiders were purchasing, Orion announced a price hike on all specialty carbon black products effective April 1st, with the grade, manufacturing process, and location determining the amount of specific increases. Although its stock is trading at a FY22E PE multiple of 7.5 while forecasted to grow earnings double-digits over this year and next, it is hard to get excited about a company that is exhibit A of the ESG movement, its announced efforts to recycle carbon black notwithstanding.

Highly cyclical stocks such as this one are usually only good for trades. This is especially true given the volatility in the energy and other commodity markets the invasion of Ukraine has triggered. In this instance, with a low forward PE paired with disproportionately higher growth on the horizon, Orion might be a decent covered call candidate under normal circumstances. Liquidity is good, but option premiums don’t seem large enough to compensate for the volatility we are seeing in the commodity markets at this time. Therefore, we have no investment recommendation on OEC at time, but might revisit it in the future if things calm down in the overall market and the shares see additional insider buying.

Look at how a single candle can both defy and define the darkness.”― Anne Frank

Bret Jensen is the Founder of and authors articles for the Biotech Forum, Busted IPO Forum, and Insiders Forum

Be the first to comment