FrankRamspott/E+ via Getty Images

We’ve been intently watching how the pandemic and the reopening trade has influenced the rise and fall in fortunes of container shipping companies over the last few years. We think Orient Overseas (OTCPK:OROVY) gives a good perspective on how the cross-currents and ripple-effects of supply chain disruptions largely stemming from the Western world has influenced an Asia-centric liner business. We also look to anticipate where the company and its stock will find homeostasis as the dislocation unwinds, hopeful a bargain opportunity may present itself in the next 6 months or so.

The Company

Hong-Kong based Oriental Overseas International Limited is the parent company of Oriental Overseas Container Line Limited (OOCL), and as a group container shipping business overwhelmingly contributes the majority of revenues. The company itself is majority owned by COSCO SHIPPING (OTCPK:CICOY), and under the COSCO umbrella collectively they form the fourth largest shipping company in the world.

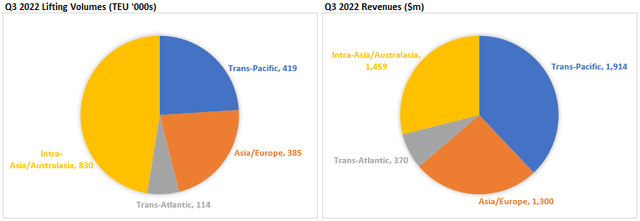

OOCL is predominately focused on the Asian market, with its most recent operational reports showing that 47% of container liftings from shipping lanes within the Asia Pacific region. However, the region doesn’t contribute the most revenue, with that mantle instead belonging to Trans-Pacific routes.

Although Asia shipping lanes made up the largest proportion of volumes, Trans-Pacific business was the largest driver of revenues, driven almost entirely by the inflated shipping rates observed recently. (Quarterly Operational Updates)

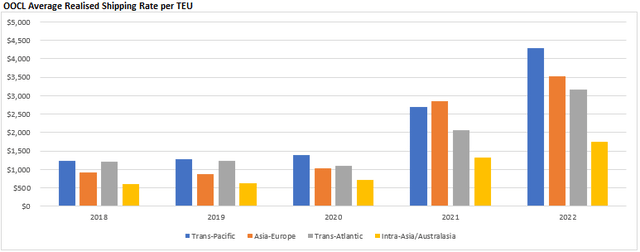

The reason for this is the oft-discussed supply chain disruption starting 2021, as the demand for shipped goods coming out of the pandemic outstripped the labour and services available for processing, resulting in the unprecedented spike in shipping rates across the world. This phenomenon was highly publicised at US ports, and the data we parsed showed that OOCL benefited significantly from trading between Asia and the Americas.

Shipping rates have increased over the last two years, most drastically on Trans-Pacific routes (Quarterly Operational Updates)

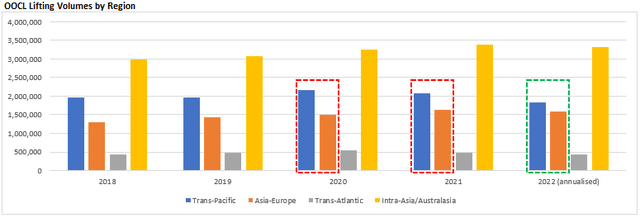

What surprised us a little more was that Trans-Pacific volumes, and to a lesser extent Asia-Europe, were up in 2020 and 2021 compared to prior years. This contradicted the narrative we understood which was longer waiting times at sea was negatively impacting volumes. We hypothesise that OOCL was agile and opportunistic in adding capacity to these high-yielding routes as freight rates rose rapidly in the last few years. We are keen to confirm if this was a tactical or strategic decision when future data becomes available, and if there will be enduring implications to its focus on the Asia Pacific region.

The increase in volumes to the Americas and Europe (in red) was somewhat unexpected, as we have seen competitors reporting decreases over the same timeframe. With volumes down across the board this year, we are watching where they will normalise to in 2023 and beyond. (Quarterly Operational Updates)

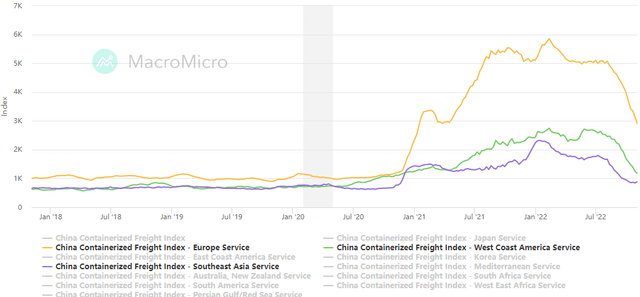

2022 volumes are on track to decrease year-on-year, amidst a backdrop of continued processing capacity shortage coupled with decreased demand from end-consumers concerned about an economic downturn, as well as perhaps some elements of over-commitment of container ships to these routes. As we speak, we see spot rates on all routes rapidly falling, though we cannot predict where and when prices will normalise. We are closely monitoring, curious as to how this aligns with the eventual size of OOCL’s footprint and its geographic distribution once the dust settles.

The China Containerized Freight Index, as a gauge of spot shipping rates, shows a falling trend towards pre-pandemic levels. We watch with interest where rates across all regions will normalise to. (MacroMicro)

Financials & Valuations

Orient Overseas has benefited from these exceptional times to report record earnings over the last few reporting periods, with H1 2022 net profit of $5.664bn representing an annualised EPS of over $17 (HK$134) and an annualised P/E under 1x (current stock price at $16.30/HK$127). In absolute terms this will seem enticing, but we have observed P/E ratios around these levels among shipping peers.

There are also a few nuances with the stock’s recent price movement to note. For one, on the back of record 6 month earnings the company announced dividends of $6 (HK$47) representing a 70% of H1 profits. As the stock went ex-dividend in late August, the stock dropped by a commensurate amount, and has continued falling since losing almost 50% in value.

The drop in price late August was a result of the stock going ex-dividend, and would represent a simultaneous decrease in assets and shareholder equity in the company. (IBKR)

The other implication of such a large dividend payout is that in Q3 the company would have seen an erosion in cash (Jun 22: $10.9bn) and shareholder equity (Jun 22: $13.1bn) of $4bn, which have not yet shown up in reported financials. The other side of the balance sheet has also seen structural changes due to record earnings, with long-term borrowing obligations almost entirely eliminated (2018: $3.7bn). Point being, the apparent value of the stock can be easily obfuscated by the wildly volatile balance sheet and financial metrics depending on the date of the data snapshot.

Final Thoughts

Obviously, the dividends are handsome reward for an existing shareholder, but the magnitude of movements of the balance sheet, the stock price, in addition to shipping rates and earnings forecasts, must be overwhelming for a prospective investor to digest. With the profit trend for the company trending downwards, we would suggest waiting for some of these fluid factors, particularly shipping rates, to settle down.

It is also worth reminding that tax implications for a stock which is returning such significant profits as dividends could be material, depending on the jurisdiction of the stock listing and the location of the investor. This forum focuses on US-listed stocks but Orient Overseas also trades in Hong Kong through the ticker <316>, and after accounting for frictional costs it may perhaps be a more attractive option.

However, there is good reason why we are keeping an eye on this stock. The Hang Seng Index (HSI), of which Orient Overseas is a constituent, is trading at 13-year lows, in turn broadly impacted by concerns about China’s growth. We would instead watch the strength of the economies which OOCL ships to, as a more appropriate barometer of the company’s prospects.

Within that, with Intra-Asia shipping lanes its most important by volume, we think that a healthy business environment in Asia Pacific ex. China will lead to strong performance by Orient Overseas. With much of global markets worried about growth in the US and Europe in addition to China, we see a chance that investors will mischaracterise the stock as a victim of poor economic conditions when in fact it may be able to find a narrow path to continued prosperity by serving stronger-than-expected demand from emerging nations in the region.

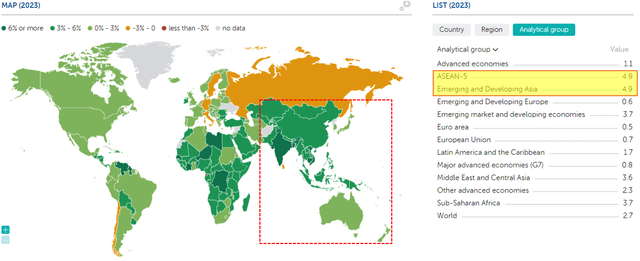

In spite of predictions of a global economic downturn, it should be noted that Asia Pacific is expected to grow almost 5% in 2023. As OOCL’s largest market, we will be looking for robust shipping volumes from the region to support revenue and earnings. (IMF)

Specifically, we will be tracking how spot rates for the Asian shipping lanes will trend over the next few months, and the company’s allocation of shipping resources to the region, to validate this investment thesis.

We also hope that concurrently the stock price overshoots on its way down, and offers a more enticing entry point. In the meantime, with all signs pointing to a continued downward trend we would be wary of acting cavalier in looking to time the bottom of the stock price.

Ultimately, we are looking for an alignment of the stars in terms of normalised shipping rates, strong shipping volumes, and a stock price floor sometime in the next 6 months. We expect to have much more clarity on a potential investment opportunity once full-year results are announced early 2023.

(Reported $ amounts reference USD as the reporting currency of Orient Overseas)

(USDHKD=7.80 assumed in analysis)

Be the first to comment