John Howard/DigitalVision via Getty Images

Investment Thesis

When I last covered Organon (NYSE:OGN) for Seeking Alpha in November last year, I was optimistic that a company forecasting for $6.2 – $6.3bn of revenues in FY21, earning $1.2bn of net income across the first nine months of last year, was worth substantially more than $34 per share, and a market cap of ~$8.5bn.

More than eight months later, however, and Organon stock has fallen in value by 5%, trading at a value of $32 at the time of writing. In a few weeks’ time, on Aug. 11, the company will release its Q222 earnings. Ahead of this important date I think it’s worthwhile revisiting the investment case and trying to understand why the valuation of the company has not been growing as many investors thought it might.

I remain long Organon, and I’m still relatively bullish on the stock, based on the still strong revenue generation of its Established Brands division – $1.05bn in Q122 – and growth potential of both its other two divisions, Fertility and Biosimilars.

With that said, the level of risk involved in developing the latter two divisions – which generated revenues of just $378m and $99m in Q122 – so that they can eventually offset the inevitable decline in revenues of the Established Brands division – is relatively high, and Organon is furthermore heavily indebted – bank debt stood at $9.1bn as of Q122, while cash and equivalents was just $694m.

Since Organon was spun out of the pharma giant Merck (MRK) and began trading as a separate entity in June last year, shares have typically been priced within a range of $30 – $40, with a peak price of $39 achieved in March 2022 and June 2022.

As such, the current price of $31.7 may seem appealing to new investors, and there’s a healthy dividend to consider, which is calculated as 20% of free cash flow and is currently set at $0.28 per quarter, yielding 3.5%.

Business Overview – Established Brands

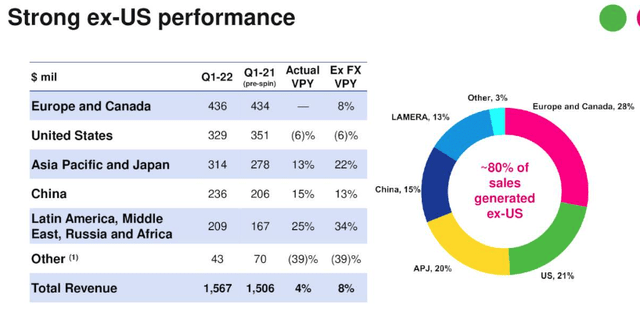

Organon generates the majority of its revenues overseas, as we can see below:

Organon revenue breakdown Q122. (earnings presentation)

Source: Q122 Earnings Presentation.

The company has six manufacturing facilities, which are based in Belgium, Brazil, Indonesia, Mexico, The Netherlands and the UK, where its drugs are manufactured – around 60 in total.

The majority of these are Established Brands whose sales had been stagnant or falling under Merck’s auspices, and which management felt would benefit from a fresh approach and impetus. Most of these products lost patent exclusivity many years ago, and only modest declines owing to loss of exclusivity (“LOE”) are expected going forward, so management’s main objective with this division is to try to flesh out sales of these older products for as long as possible.

Sales in Q122 of $1.05bn were up 10% year-on-year on a non-currency adjusted basis, although the comparison is not quite “apples and apples” since Organon’s spin-out date was officially June 2, 2021 – year-on-year comparisons will become much more relevant from Q3, management has advised.

Established brands mainly consists of cardiovascular medicines, which accounted for $1.6bn, or 26% of product sales in 2021, Respiratory – $1bn sales, 16%, dermatology, bone health and non-opioid pain management – $830m, 13%, and other established brands such as benign prostatic hyperplasia (“BPH”) therapy Proscar – $117m of sales in 2021. These products are sold by a global network of ~4k sales people.

Organon affirmed its FY22 guidance of $6.1 – $6.4bn when announcing Q122 earnings, while cautioning that FX translation headwinds mean the lower end of guidance is the more likely. EBITDA margin is forecast to be 34-36%, interest expense ~$400m, depreciation $100 – $115m, and tax rate ~18.5%, so from this we can deduce that net profits are likely to be ~$1.1bn – vs. $1.35 in FY21, earnings per share ~$4.7, and price to earnings ratio ~7x, which is outstanding ratio, suggestive of share price accretion.

For context, the average PE ratio of the major US pharmas is ~24x, however Organon is unusual in that its “bread and butter” division – Established Brands, which will likely generate more than two thirds of Organon’s revenue in FY22 – is not its central focus. In effect, that’s similar to Merck itself prioritizing development of its immunology division, which accounts for <5% of revenues, rather than Keytruda, its >$17bn per annum selling solid tumor focused immune checkpoint inhibitor.

The trouble is, there will be no new product launches in the Established Brands division, so inevitably, even the most trusted of these drugs will eventually exhaust all of its new markets, innovative pricing strategies, and cheaper manufacturing overheads, and generate lower sales volumes. That’s likely why the market refuses to value Organon at more than ~1.3x forward sales however slow the declines may be, and presently there are hardly any declines of genuine note or concern.

That’s why I had expected to see Organon shares climb in value, and perhaps they will still do so once we have a full year’s worth of data to compare and contrast, but it also may be the case that the market is reserving judgment on Organon until it sees how the Reproductive and Biosimilar divisions pan out – and within these two divisions, I have one or two concerns.

Women’s Health Division

Organon refers to itself as a company focused on “improving the health of women throughout their lives” in the first paragraph of its 2021 annual report, which gives a clear indication of where its priorities lie.

The Women’s Health division’s lead product is Nexplanon, a long-acting reversible contraceptive, and other products inherited from Merck include NuvaRing, a vaginal contraceptive ring, Follistim, known as Puregon ex-US, which is used to help women attempting to get pregnant via IVF, and Cerazette, a progestin-only daily pill used to prevent pregnancy.

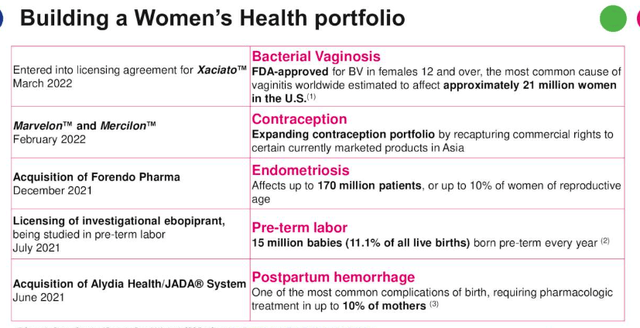

The division drove $1.6bn of revenue for Organon in 2021, but saw revenues fall year-on-year in Q122, from $399m, to $378m, although as mentioned, comparisons may be unreliable, and Organon management preferred to focus on “double digit fertility growth” and its M&A activity, shown below.

M&A and new product launches within Women’s Health. (earnings presentation)

Source: Q122 Earnings Presentation.

Organon has paid $240m to acquire Alydia Health and its 510k cleared JADA system, which is indicated for postpartum hemorrhage – and $75m, plus up to $870m of development and commercial milestone payments, for Forendo, whose lead asset is FOR-6219 – an experimental oral inhibitor of 17β-hydroxysteroid dehydrogenase type 1 (HSD17B1) being developed to treat endometriosis.

Marvelon and Mercilon are combinations of progestin and estrogen used as daily pills to prevent pregnancy, and most recently, Organon has agreed a licensing deal for Xaciato, targeting bacterial vaginosis.

As impressive as the M&A activity – and in-house – development has been, however, management has provided no forward guidance as to how lucrative these new opportunities may be. The slide above provides some guidance as to how large the markets are – 10% of mothers experiencing postpartum hemorrhage, 170m endometrioisis sufferers, but Organon is essentially in uncharted territory here which increases the level of risk. Where the Established Brands division almost guarantees a certain revenue threshold, the Women’s Health division is far more speculative.

Biosimilars Division

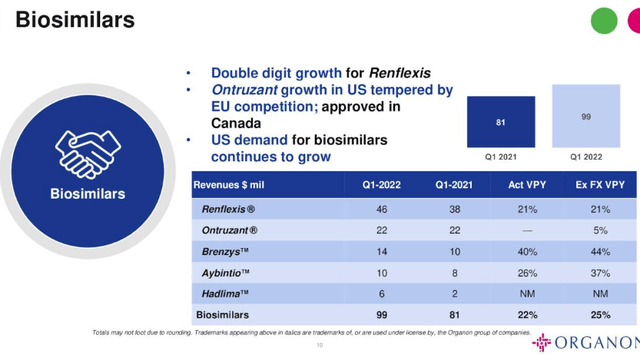

The Biosimilars Division begins from a much lower revenue base than Women’s Health – revenues in Q122 were $99m, up 22% year-on-year, with the usual caveat about comparing pre and post spinout, and there are five marketed products, as shown below.

Biosimilars revenues Q122. (earnings presentation)

Source: Q122 Earnings Presentation.

Renflexis, Ontruzant and Brenzys are biosimilars for autoimmune conditions, breast cancer therapy trastuzumab, and plaque psoriasis, while Aybintio is a biosimilar for Bevacizumab – marketed and sold by Roche (OTCQX:RHHBY) as Avastin, and generating multi-billion dollars per annum in revenues.

The latest product is Hadlima, which is Organon’s biosimilar for Humira. Biosimilars are like generic drugs, permitted to be marketed and sold when the original drugs patents expire, and unlike generics they “have no clinically meaningful differences in safety, purity or potency (safety and effectiveness) compared to the reference product” (definition from the FDA Website).

Humira has been one of the world’s best selling drugs for a decade, typically selling >$15bn per annum, and it will go off patent in 2023. Hadlima is expected to be one of the very first biosimilars of generics to make it to market, sometime in 2023, although several months after Amgen’s (AMGN) Amjevita. There also will be a host of generics flooding the market from 2024, driving down price points and taking market share away from Hadlima.

Although Organon management told analysts on the Q122 earnings call that there are >$100bn worth of “blockbuster biologics going off patent in the next decade” and Organon has a strong partner in biologics in the form of Samsung Bioepis, the problem is that generics / biosimilars can’t hope to generate anything close to the same kind of revenues as the actual drugs during their periods of exclusivity.

The competition is intense since there’s no exclusivity granted to generic or biosimilar manufacturers, the price points much lower, and often, by them time a drug such as Humira goes off patent, there are new and better drugs on the market – such as AbbVie’s long term Humira replacements Skyrizi and Rinvoq, Bristol Myers Squibb’s (BMY) Zeposia, Pfizer’s (PFE) Xeljanz, to name just four.

As such, a division of just five biosimilars generating <$100m per quarter is unlikely to support a climbing share price, being too early stage. Biosimilars is an exceptionally promising field of drug development – perhaps more valuable outside the US, where budgets are more restrictive – and Organon may one day play a leading role in it, although it should be noted that Viatris (VTRS) – a company formed via the merger of Pfizer’s legacy brands division, and generic drug manufacturer Mylan – offloaded its nascent biosimilars division almost immediately to Biocon in a $3.3bn deal.

Conclusion – Organon Needs To Deliver Earnings or Progress of Note In Q222 To Drive Upside – But The Company May Need More Time

The conundrum for Organon management to solve is how to develop the types of products within its Women’s Health and Biosimilars division that can have the kind of revenue generating impact that the products in its Established Brands did when they were first released, many years ago.

Every dip in revenues within the Established Brands division – which is practically inevitable – must be offset by a rise in the revenues of Women’s Health or Biosimilars. In my opinion Organon management has done a good job developing Women’s Health, although this has proven a difficult market – this division did not thrive under Merck’s stewardship, and companies such as Evofem Biosciences (EVFM) have suffered devastating losses trying to market and sell its prescription contraceptive vaginal gel, for example.

On the other hand, the biosimilars division is simply too small and is perhaps proving too complex an area in which to develop cheap and effective medicines, even with a deep-pocketed partner like Samsung on board.

I had originally believed that the sheer weight of revenue provided by Established Brands would drive the share price up as the market followed the trend of most companies whose P/S ratios are scarcely >$1, and realised these companies were undervalued.

That hasn’t proved to be the case, however, and the interplay between the three divisions looks a little incongruous, and the direction of the company uncertain.

Nevertheless, I will continue to hold my Organon stock. There will be sufficient free cash flow in Fy22 to support a growing dividend, in my view, even with onerous debt repayments to be made, and in a few quarters time, when there are valid year-on-year comparisons to be made, I’m hopeful that the market will begin to understand that the longevity of the Established Brands division is better than expected, and the growth within the other two divisions can increase exponentially with each passing quarter.

That needs to be proven much more comprehensively in Q222 than it was in Q122, however, as Organon needs to appear more than the sum of its parts, or Merck shareholders who inherited the stock, as well as new shareholders, will start to become disillusioned.

Be the first to comment