Liliya Filakhtova/iStock Editorial via Getty Images

NVIDIA (NASDAQ:NVDA) pre-announced simply horrendous Q2 earnings today.

- Revenue of $6.7 billion vs $8.1 billion guide

- Non-GAAP midpoint margins of 46.1% vs 67.1% guide

- Gaming revenue of $2.03 billion, down 44% QoQ

- Data Center revenue of $3.81 billion, up 1% QoQ

- Professional Visualization revenue of $0.5 billion, down 20% QoQ

These numbers are ugly. The press release suggests to me the company is likely to have a GAAP net loss in Q2, and significantly lower Q3 and Q4 earnings than the market has expected.

The company blames the shortfall on “macroeconomic headwinds”. Investors should ignore this management obfuscation and instead read that as “CRYPTO CRYPTO CRYPTO”. Nvidia sales in “Gaming” and “Professional Visualization” have been heavily driven by cryptocurrency mining in recent years, despite management hoping investors would believe otherwise. Investors should be wary of management that has not come clean with shareholders.

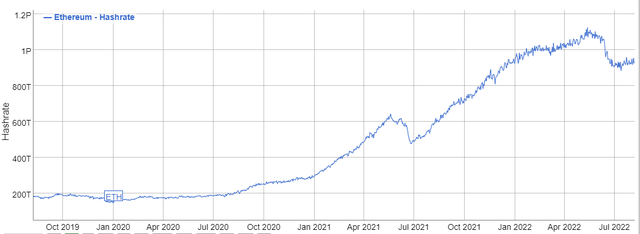

Now that Ethereum (ETH-USD), far and away the most valuable coin for GPU-powered mining, is moving away from proof-of-work (compute-intensive mining) to proof-of-stake (ownership of coins and minimal computational load), miners have slowed down their Nvidia GPU buying for mining purposes. Ethereum is in the final phase of testing the proof-of-stake code and appears likely to make the conversion by early Q4 (perhaps by end of September).

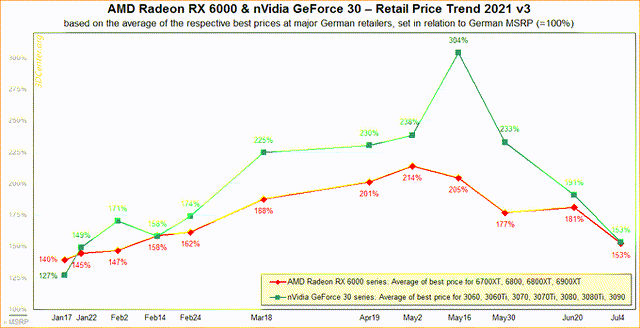

During the Ethereum mining boom times, miners had pushed up GPU prices to over twice the MSRP. In addition to strong unit sales, Nvidia was able to increase margins by capturing some of the elevated pricing. But now the mining demand has slowed and prices have finally fallen well below MSRP for some Nvidia GPUs. In my view, Nvidia GPU pricing drops have only just begun—much more pain is ahead.

The channels are choked full of inventory that Nvidia partners will need to move despite demand falling off a cliff. And miners are likely to dump their used GPUs into the market as well. The Ethereum hashrate history shows that an enormous number of GPUs have been purchased for crypto mining in the past two years. All of that excess demand is likely to disappear. And miners will look to monetize their cards in the used market. Nvidia GPU demand is likely to drop by millions of units. Q3 and Q4 are likely to be painful as well. Investors will finally learn how much of Nvidia “Gaming” and “Professional Visualization” sales were actually crypto-driven.

In early trading following the release, NVDA was trading down as little as 4.5% at times despite this news. I don’t know who was buying NVDA at such a rich valuation, but they may be disappointed as events unfold. I believe the pain for investors has barely started.

Nvidia’s valuation remains absurdly high. Investors may be assuming that Q2 is a short-term blip due to China and Russia demand factors. A review of the Ethereum mining situation shows this kind of thinking to be misguided.

Investors who bought into the “hypergrowth” narrative may soon see what happens to growth companies with high earnings multiples when growth turns negative. NVDA is currently trading at 47x TTM earnings. With declining earnings, that figure could easily move towards the triple digits in the coming quarters if the stock price does not decline significantly. Such a lofty valuation may be unsustainable, especially with the Federal Reserve tightening aggressively. Investors should avoid the stock and wait for it to come down to a reasonable valuation before buying. Nvidia is a great company, but the deteriorating fundamentals do not justify the valuation.

Be the first to comment