RichVintage/E+ via Getty Images

A few days ago, I wrote an article titled The Fearless REIT Investor in which I explained that “most REITs were forced to cut their dividend during the Great Recession, yet there were a handful of companies that made it through and continued to boost their dividends.”

In that article I decided to focus on the so-called Dividend Champions, “or what fellow Seeking Alpha analyst Justin Law describes as “the dividend-paying stocks that were able to grow their dividend for 25 years in a row or more.”

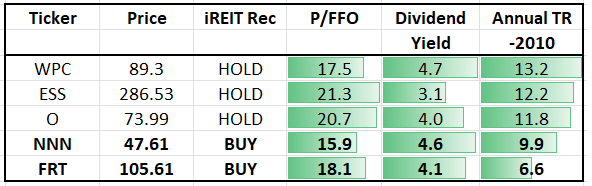

iREIT

As you can see (above), we only have two Dividend Champions on the Buy list right now: National Retail Properties (NNN) and Federal Realty (FRT).

Both of these retail REITs are trading at a wide margin of safety, and we’re fine with recommending them given their high-quality and cheaper valuation.

As I concluded (that same article) I explained that I would soon be writing The Fearless REIT Investor 2.0 examining REITs to buy that have paid and increased dividends from 10-24 years in a row…

The Dividend Contenders

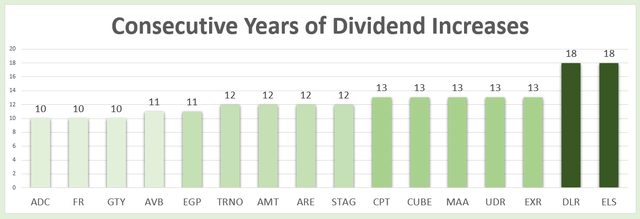

So, next up in the Fearless REIT series is the list of REITs that have paid an increased dividends for 10 to 24 years in a row, the Dividend Contenders.

Needless to say, several of these REITs cut their dividend in 2008 and had to reboot and a few of them were able to make it through the financial crisis unscathed, namely Digital Realty (DLR) and Equity LifeStyle (ELS).

The others listed shares during or after the recession, so they have never experienced a dividend cut yet…

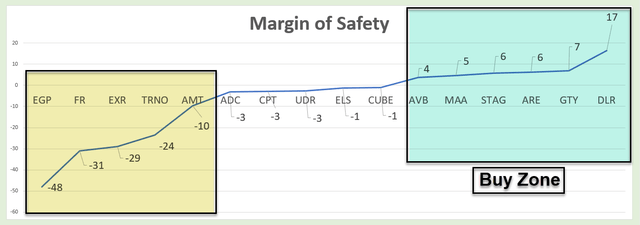

Now, many of these REITs are too expensive to buy right now, and while dividend growth is a great reason to buy REITs, we must always consider the all-important margin of safety.

Keep in mind that whenever the financial markets fail to fully incorporate fundamental values into securities prices, an investor’s margin of safety is high.

Columbia finance Professor Joel Greenblatt framed the margin of safety concept in a 2011 Barron’s interview:

“…it’s about figuring out what something is worth, and then paying a lot less for it.”

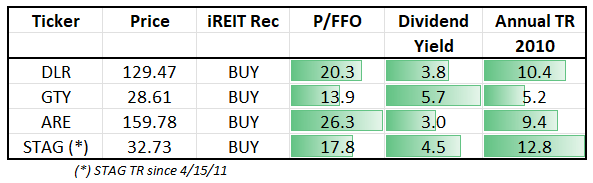

In order to expedite the screening process for these so-called Dividend Contenders I decided to utilize the iREIT on Alpha Tracker:

As you can see (above), there are five Dividend Contenders on our list that are trading with the highest margin of safety.

Keep in mind that while they appear cheap based on our valuation scoring model, they are not all the same quality, hence the reason I decided to put together a listicle for three on our Buy list (and a Bonus pick):

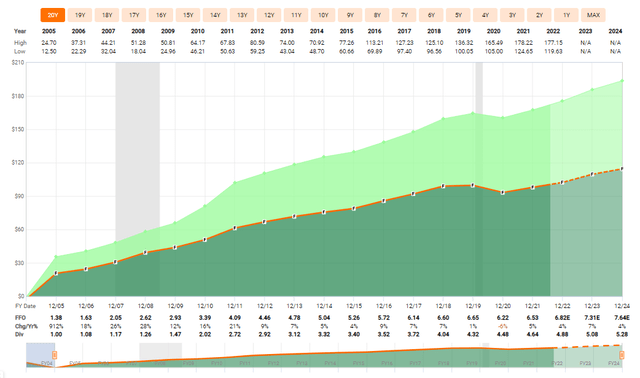

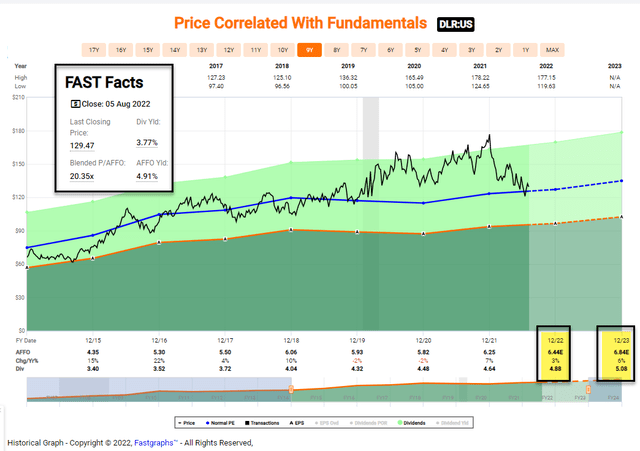

Digital Realty (DLR): 18 Years in a Row

DLR is one of the largest data center REITs on the market today with a market cap of $37.1 billion and more than 4,000 global customers and more than 290 data centers across the globe.

The company is the largest global provider of cloud and carrier-neutral data center and interconnection solutions.

If you keep up with the markets by any account or work with a computer or mobile device, well then you understand not only the importance of cloud, but you also understand the enormous amounts it has grown and continues to grow.

According to Precedence Research, they estimate that the cloud computing market size will grow to roughly $1.6 trillion by 2030, growing at a CAGR of 17.4% from 2022 to 2030. That’s an enormous market for cloud providers, but also the often-forgotten segment of data center providers.

DLR’s competitive advantages include its scale and cost of capital advantages. As I pointed out, the REIT has a tremendous scale advantage with 291 Data Centers across 50 metro areas. Around 58% of its business is in North America and the balance is spread across EMEA (27%), APAC (10%), and Latin America (5%).

DLR has maintained healthy and prudent financial management with best-in-class balance sheet metrics including Net Debt/Adjusted EBITDA of 5.9x and Fixed Charge Coverage of 5.7x. The company has 25% debt to equity and solid ratings from Moody’s (Baa2), Fitch (BBB), and S&P (BBB).

As seen above, DLR is trading at $129.47 with a P/AFFO multiple of 20.3x (in-line with the normal range of ~20x). While DLR is not a “screaming buy” I’m content with the buy below price of $155 given the strength of the underlying business model and strong customer demand.

Shares have pulled back by around 25% YTD and we added more to our position recently after debunking the short thesis.

Some of DLR’s top tenants include technology and telecom names such as Meta Platforms (META), Verizon (VZ), AT&T (T), IBM (IBM) and Oracle (ORCL), just to name a few.

As 5G continues to roll out, 6G in the future, more companies looking for data to be saved online, and even autonomous driving gains more traction, the need for data centers will only continue to benefit.

Shares are yielding 3.8% and we forecast a 25% annual return over the next 12 months. We’re most confident that the company will continue to grow its dividend as it gets closer to becoming a Dividend Champion.

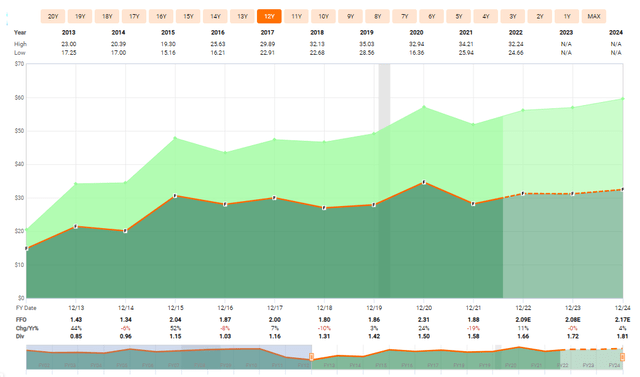

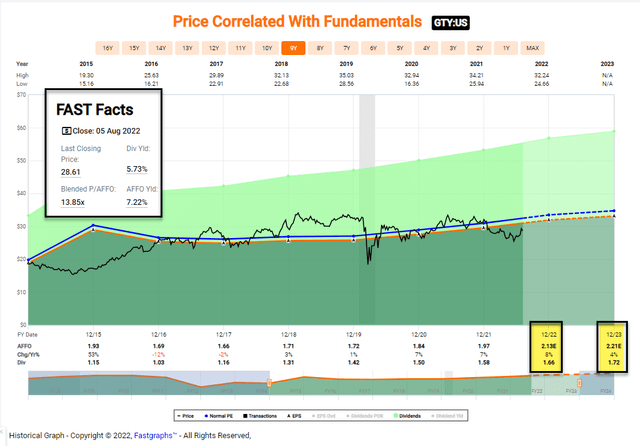

Getty Realty (GTY): 10 Years in a Row

GTY is a net lease REIT that owns 1,014 properties across 38 states and Washington, D.C., and a majority – 70% – of them are located on street corners where car traffic is both convenient and high. In addition, GTY’s portfolio is 99.4% occupied with a WALT (weighted average lease term) of 8.7 years.

GTY focuses on essential, e-commerce and recession resistant, retail businesses, and year-to-date the company has invested $52.8 million across 17 properties (through April 27, 2022) by acquiring 10 car washes (for $42.0 million), 3 convenience stores (for $8.1 million) and funded development of $2.7 million.

GTY’s portfolio is largely concentrated in the northeast, however the company has been expanding its operations in growth markets in the Mid-Atlantic, Southeast, Texas, and Colorado.

Convenience & automotive retailers are essential businesses, and e-commerce & recession resistant, and that’s why GTY and other net lease REITs like Realty Income (O) and Agree Realty (ADC) continue to invest in these properties.

GtY has also expanded into other automotive categories such as car washes (12.1%), repair (11.1%), auto service (.7%), drive thru (.4%) and auto parts (.4%), yet the core C-store business (73%) remains the primary investment vehicle.

GTY’s “moat” is the fact that the C-store sector is highly fragmented and provides a breadth of investment opportunities. Demand for auto care and maintenance are generally needs based and resistant to economic downturns. Also, the total number of vehicles in operation (~283 million) and average vehicle age (~12.2 years) are key factors supporting sector performance.

Also, GTY has a well-positioned balance sheet with ample liquidity – with ~$20 million in cash plus $300 million revolver capacity with $160 million ATM program capacity. GTY has a BBB- investment grade rating with stable outlook from Fitch (with 4.9x net debt / EBITDA as of Q2-22).

As viewed above, GTY trades at $28.61 per share with a P/AFFO of 13.9x (normal range is 15.7x). The dividend yield is 5.7% and well covered (78% payout ratio using AFFO per share).

GTY invests in markets that are experiencing population and traffic growth and increased consumer demand. I like the fact that the average ticket for a GTY acquisition in smaller and this makes the real estate somewhat fungible.

Around 99% of GTY’s portfolio is subject to rent escalation (1.6% annualized rent escalation rate) and analysts are forecasting growth of 8% in 2022.

iREIT maintains a BUY and we’re targeting shares to return approximately 20% over 12 months.

Alexandria Real Estate (ARE): 12 Years in a Row

ARE is a Life Science REIT that owns around 426 properties with GLA of 47.4M square feet, and the occupancy of this space at the latest quarter was 94.7%. The company has some extremely strong companies that aren’t going anywhere occupying the top of its ABR list.

These include Bristol Myers Squibb (BMY), Moderna (MRNA), Eli Lilly (LLY), Sanofi (SNY), and Takeda Pharmaceutical (TAK).

ARE began by focusing only on life science and tech, and then further by leasing significant amounts to only the best in the business, and then even more by diversifying to where its top tenant, BMY, is less than 3.6% of the REITs total ABR.

ARE owns and develops some of the most attractive properties in this entire sector – in the entire nation – and around the globe. Just take Alexandria Point as an example, the second-largest life lease in the company’s history, with which ARE deepens its relationship with BMY in San Diego.

ARE’s “moat” is its quality buildings and tenants:

ARE Investor Presentation

In addition, ARE has an impressive balance sheet with $5.5 billion in liquidity (as of Q2-22) and solid credit metrics including 5.1x Net Debt and Preferred to Adjusted EBITDA and no debt maturities until 2025. ARE also has strong credits ratings from Moody’s (Baa1) and S&P (BBB+).

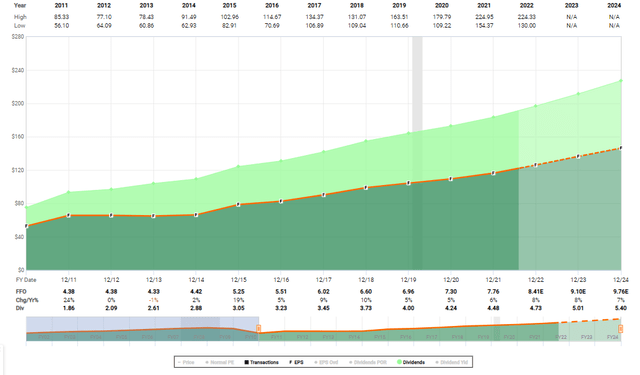

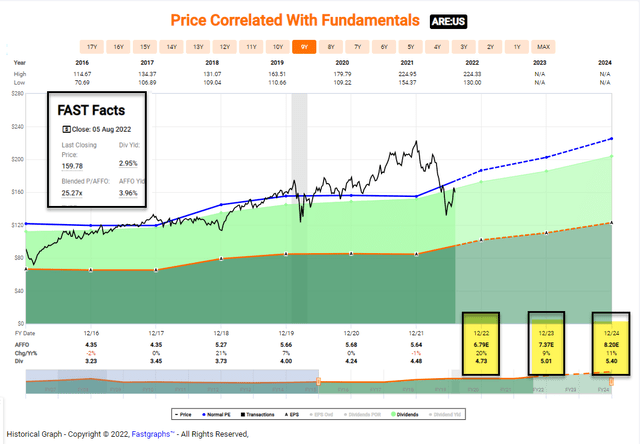

As seen above, ARE trades at $159.78 with a P/AFFO of 26.3x (normal range is 27.5x). The dividend yield if just under 3.0% and well covered (with a AFFO payout ratio of 70%).

One of the things that I admire about ARE is its disciplined capital allocation practices with a visible, multi-year, highly leased value creation platform. As seen above, analysts are forecasting ARE to grow (AFFO by share) by 20% in 2022, 8% in 2023, and 11% in 2024.

We recently interviewed the company’s CEO, Joel Marcus, for iREIT on Alpha members. We’re targeting ARE to return ~25% over the next 12 months.

Bonus Pick: STAG Industrial (STAG): 12 Years in a Row

STAG is an industrial REIT that own 551 properties within 40 states all here in the US. Those 551 properties are made up of 110.1 million square feet of industrial space.

The growth we have seen from the company has been staggering. Since going public back in 2011, the company has gone from 93 properties to 551 properties. Since the IPO the portfolio had 21% of its annual base rent attributable to Flex/Office type properties, whereas today that’s down to 0.1%, making STAG a pure-play industrial REIT.

STAG’s top 10 tenants make up 10.8% of total ABR with the top 20 tenants making up 17.5% of total ABR. You can see that the company is very well diversified amongst its tenant base, as the largest tenant, Amazon (AMZN), only makes up 3.2% of total ABR.

Another tailwind for the company is the fact they have 11.4% of their leases coming due in 2023. This will again provide the company an opportunity to bump those leases up to be more in-line with market rates, which will be beneficial to the business.

STAG has plenty of room for growth between the growing demand and lack of supply for industrial real estate combined with the opportunity to remarket some of these leases that are coming to an end.

Like the REITs referenced above, STAG also has a strong balance sheet with investment grade ratings from Moody’s (Baa3) and Fitch (BBB). The company has around $412 million of liquidity and a Net Debt to Run Rate Adjusted EBITDAre of 5.1x.

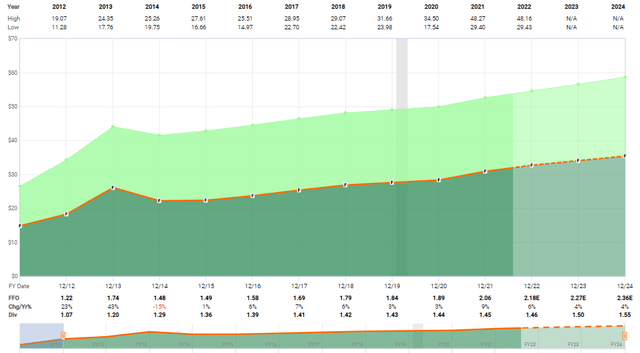

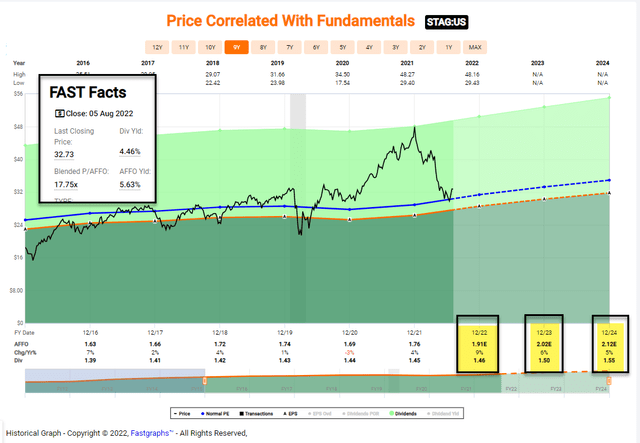

As you can see, STAG is not screaming buy these days, but we still consider the Boston-based REIT a sound Buy. Shares are trading at $32.73 with a P/AFFO of 17.8x (normal range is 16.5x).

While this appears a tad rich, based on historical metrics, STAG is actually a much higher quality REIT today, thanks to its safer dividend.

Some have been lulled asleep by STAG’s very modest dividend growth, yet the company has been using its excessive firepower to reduce its payout ratio, which makes the dividend even safer. The payout ratio was 106% (based on AFFO per share) in 2017 and it’s now around 82%.

Many also like STAG because it pays monthly dividends.

As viewed above, analysts are forecasting around 9% growth in 2022 and 6% in 2023 and 5% in 2024. The dividend yield is 4.5% and iREIT targets shares to return around 20% over the next 12 months.

Nothing to Fear Folks…

According to President Franklin D. Roosevelt (in his first inauguration speech) there’s nothing to fear in this world. The only thing one has to fear is the dark thoughts lying inside the mind…

“So, first of all, let me assert my firm belief that the only thing we have to fear is … fear itself – nameless, unreasoning, unjustified terror which paralyzes needed efforts to convert retreat into advance.

In every dark hour of our national life a leadership of frankness and of vigor has met with that understanding and support of the people themselves which is essential to victory. And I am convinced that you will again give that support to leadership in these critical days.”

Now keep in mind that the context in which Roosevelt made this speech was the Great Depression and the point is that a “positive mental attitude,” as it were, will help to prevent the worst possible outcomes.

To put that into REIT investor perspective, and now a post pandemic mindset, my best advice to you is to “follow the money” or more succinctly always remember…

“The safest dividend is the one that’s just been raised.”

Happy REIT Investing!

iREIT

PS: Stay tuned for The Fearless REIT Investor 3.0 that will highlight REITs that have paid and increased dividends from 5 to 9 years in a row…the Dividend Challengers!

Be the first to comment