jetcityimage/iStock Editorial via Getty Images

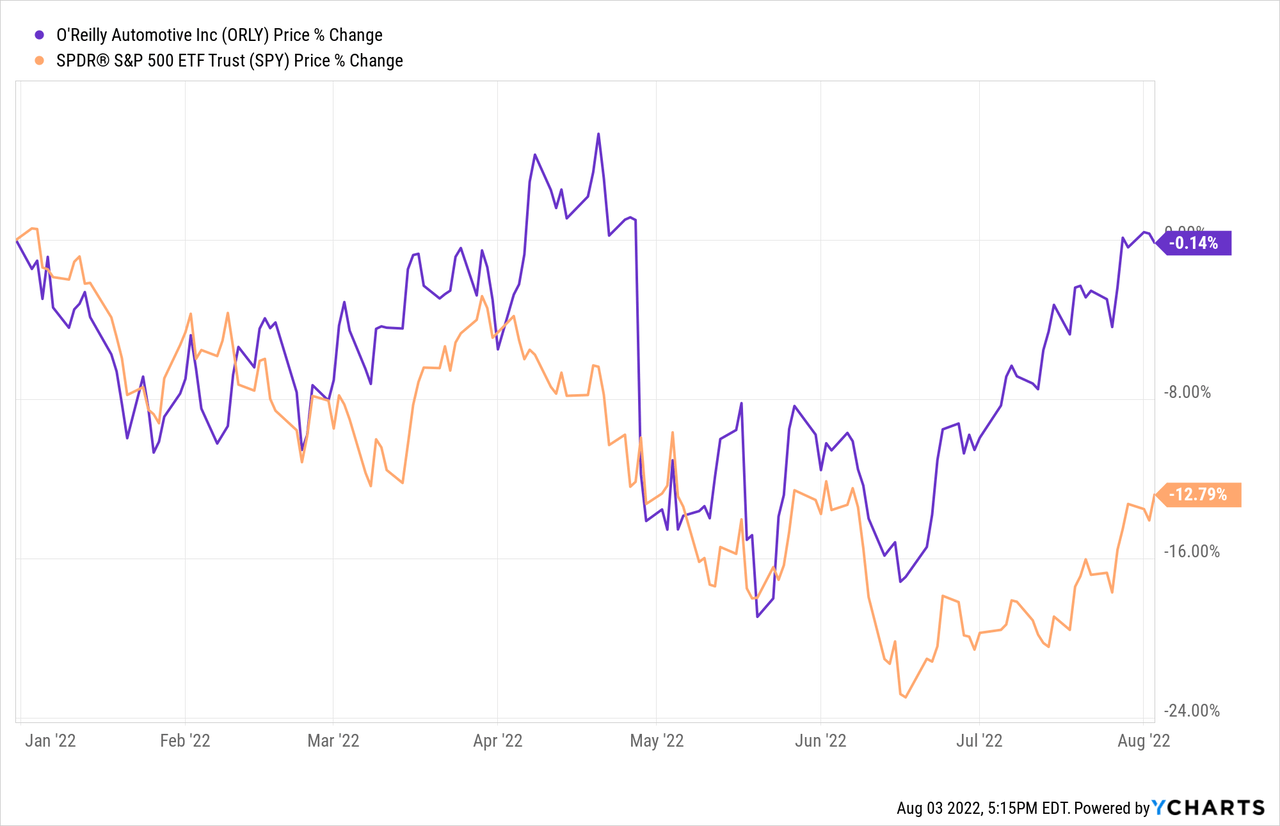

Despite the challenging macroeconomic environment, including rising inflation, increasing gasoline and raw material prices, O’Reilly Automotive’s (NASDAQ:ORLY) stock has substantially outperformed the broader market year to date, by staying essentially flat, while the broader market has declined by 13%.

In this article, we will take a look at the firm’s recent earnings report, and we will analyse what factors could be some of the primary drivers of the financial performance and the stock price in the near term.

Second Quarter Financial Results

The company’s sales for the 2nd quarter ended June 30, 2022, increased by $205 million, or 6%, to $3.67 billion from $3.47 billion year over year. At the same time, comparable store sales have also grown by 4.3%, additionally to the 9.9% for the same period one year ago. In fact, ORLY has been seeing comparable store sales growth not only for the last quarter, but also for the six months ended June 30, 2022 by as much as 4.5% year over year.

In our view, these figures demonstrate that despite the challenging macroeconomic environment and the declining consumer confidence in the United States, the demand for ORLY’s products remain high.

Consumer Sentiment

Let us actually take a closer look at why ORLY appears to be immune to the low consumer confidence.

A low or declining consumer confidence normally signals that the spending behaviour of the people is likely to change in the near future, resulting in reduced spending on durable and discretionary goods. Consumer confidence has been steadily declining in 2022 in the United States, falling even below levels recorded in 2008-2009, during the financial crisis. Reduced spending does not necessarily mean not purchasing certain types of goods or products at all, it may simply mean that a more affordable, lower cost alternative is chosen. Such a behaviour could actually even benefit ORLY’s business, as it also sells aftermarket automotive parts. (Aftermarket parts are usually somewhat cheaper, and made by different manufacturers — often several, giving customers more options to choose from.)

Further, the firm also offers several different maintenance services, including e.g.: battery, wiper, and bulb replacement; battery diagnostic testing and electrical & module testing, which may be necessary regardless of the consumer sentiment.

For these reasons, in our opinion, ORLY is not likely to be severely impacted by the low consumer confidence in the near future.

Gross And Operating Margins

Gross profit in Q2 was up by 3% to $1.88 billion (51.3% of sales) from $1.83billion (52.7% of sales) for the same period one year ago. Despite the growing revenue, the gross margin has slightly contracted, primarily driven by rising inflation and elevated fuel prices.

We believe, however, that these headwinds are likely to be temporary. The price of crude oil is significantly off its peak, which has been reached in May. While the geopolitical situation remains uncertain in the Eastern European region, causing the oil price to remain potentially elevated for the rest of the year, compared to 2021 levels, in our opinion it is not likely to increase above $120 per barrel in the near future. Also, a promising sign that the FED is actively working on getting the inflation under control by increasing the interest rates. These could lead to improving gross margins and eventually to increasing net income in the second half of 2022, potentially leading to a positive impact on the share price.

Moreover, the 5% increase in selling, general and administrative expenses (“SG&A”) during the same period has resulted in a contraction of the operating margin. Operating income in Q2 has reached as much as $799 million (21.8% of sales) from $796 million (23.0% of sales) in the same period one year ago. Net income has decreased by about 1%, in comparison with the year-ago quarter.

Although the firm’s second quarter financial performance was negatively impacted by the current macroeconomic headwinds, we believe that continuing strong demand for ORLY’s products indicate that the automotive parts market remains strong.

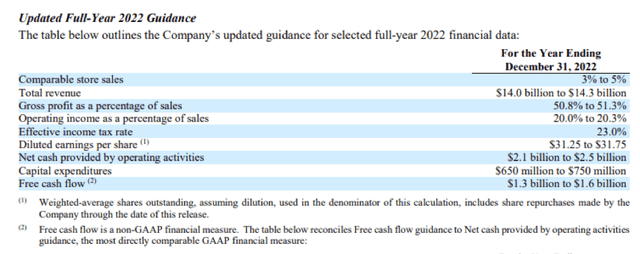

In their quarterly filings, however, the firm has remained more conservative and updated their guidance for the rest of 2022 to account for the potential headwinds:

Guidance (ORLY)

The firm has also reported on the status of their share repurchase program.

Share Buyback Program

Important to mention that the firm has repurchased 2.2 million shares of its common stock, at an average price per share of $620.27, for a total investment of $1.38 billion during the second quarter. All together in 2022, the company has already bought back 3.4 million shares of its common stock, at an average price per share of $635.40, for a total investment of $2.15 billion. Since the start of the share repurchase program in 2011, ORLY has bought back as much as 89.4 million shares, for a total investment of $19.16 billion. There is about $1.1 billion left under the current share repurchase authorisation.

We believe that the firm’s continuous commitment to share repurchases has created significant value to the shareholders and makes the firm an attractive investment choice.

Before concluding on the article, we will take a brief look at the valuation of the firm.

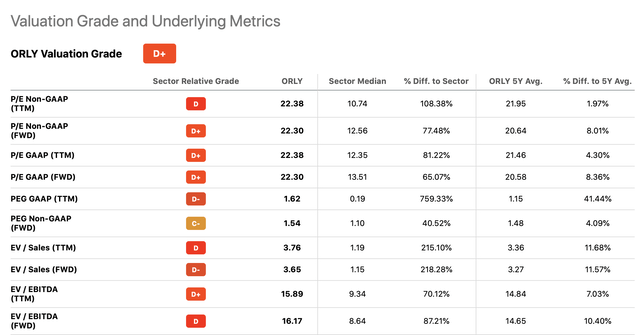

Valuation

According the traditional price multiples and valuation ratios, ORLY’s stock appears to be significantly overvalued compared to the sector median. According to some of the figures, the stock is trading at a more than 100% premium. On the other hand, ORLY’s stock has been also expensive historically, with its average P/E ratio for the last 5 years being around 22x. But even compared to its own historic average, the firm is trading at a premium currently.

In our opinion, this premium in the current market environment is not justified, despite the predicted growth in earnings for 2022 and 2023.

Key Takeaways

Comparable store sales growth in the second quarter indicates that the demand for ORLY’s products and services have remained high, despite the challenging macroeconomic environment.

On the other hand, elevated fuel prices, combined with inflation have resulted in contracting margins.

We believe, however, that these headwinds are likely to be temporary and may already have a less significant impact in the second half of the year.

The company’s commitment to share buybacks since 2011 has created significant value to the shareholders.

According to the traditional price multiples, the stock is selling at a premium compared to the sector median.

For these reasons, we currently rate ORLY as “hold”.

Be the first to comment