cerro_photography/iStock via Getty Images

From the Portfolio Managers Desk

Here at HB Insights, we cover the entire health care spectrum tremendously well. We continue to uncover selective opportunities with the space that deliver outsized risk-adjusted alpha to equity portfolios. We’ve covered OraSure Technologies, Inc. (NASDAQ:OSUR) at length several times in the past here on Seeking Alpha [most recently here and here] too, and shifted our rating from a buy to hold in the process.

We had positioned OSUR as a tactical long in January FY21 amid growing organic revenues and a pivot into new assay markets, and are very familiar with the name having closed the position in FY22. Move to Q3 FY22, and OSUR’s organic top line growth has remained flat whilst Covid-19 tailwinds continue to diminish. This presents as a key risk looking ahead.

Investment Thesis Summary

Here we reiterate the hold rating on OSUR. Our internal team has noted continuing risk to the company’s top line when factoring Covid-19 revenues out of the equation. Alas, Covid-19 continues to be the bulk of upside in turnover – and therefore earnings for the company – and we remain trigger shy on the name consequently. Rate hold on a $3.03 valuation.

Earnings still reliant on Covid-19 testing

OSUR came in with a strong set of numbers last quarter with upsides relative to consensus at the top and bottom lines. Revenue of c.$80 million (“mm”) was up 39% YoY, underscored by greater revenue volume for the company’s InteliSwab Covid-19 test kit. In fact InteliSwab turnover increased 95% YoY and led to a 20% sequential increase in gross margin for the segment. OSUR now has capacity to produce ~1.6mm tests per week and expects its capacity to double by FY23.

Moving down the P&L, and GAAP gross margin was 34.4% and a sequential decline from ~35% in Q1. Part of the decrease in gross margins has been a shift in revenue mix towards the lower margin diagnostics business, that saw tremendous growth of over 200% YoY last quarter.

Meanwhile, operating expenses gained ~69% YoY to $48.87mm however the increase stemmed from a $10.5mm non-cash expense related to the change in fair value adjustments of acquisition considerations. As a result, OSUR saw a GAAP operating loss of $19.97mm. Removing this non-cash expense from OPEX and the operating loss is ~$10mm and net loss $8.8mm.

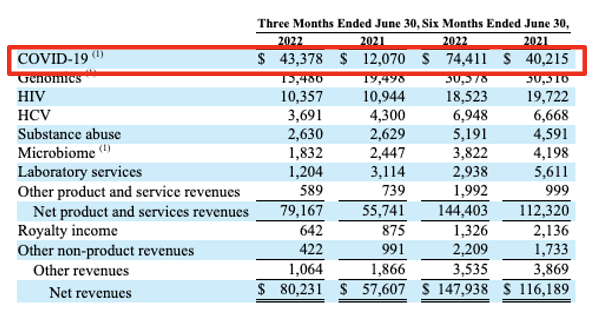

Moreover, as seen in Exhibit 1, the company recognized $43mm in “Covid-19 related revenue” in its revenue clip. This is a QoQ increase of $31mm and a similar $31mm quarterly increase from the same time last year. This accounts for ~54% or net revenue, up from ~21% in Q2 FY21. This fact has us trigger shy on the name as our investment case around OSUR is built on its ability to expand away from Covid-19 revenue into adjacent markets. However, to date, it hasn’t managed to do so, and most segments actually saw a YoY decline in the three month period for Q2 FY22, as seen in Exhibit 1 also.

Exhibit 1. OSUR continues to book large percentages of net revenue from Covid-19 sources with numbers jumping substantially YoY at the top-line.

Data: HB Insights, OSUR 10-Q Q2 FY22

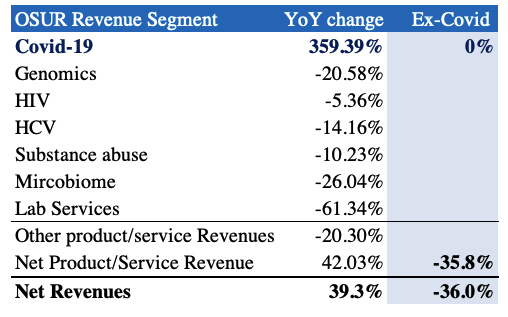

Moreover, as seen in Exhibit 2, when removing the contribution of Covid-19 revenue to the company, we note net quarterly turnover decreased by a total 36% YoY. This has implications moving forward. Firstly, management noted on the Q2 earnings call that gross margin remains under pressure due to the shift in revenue mix to the lower margin diagnostics business.

Next, revenues are primarily Covid-related and declined YoY ex-Covid-19, as shown below. Not to mention, the US Government’s recent policy to stop funding free at-home Covid-19 testing from September 2. Therefore, we remain trigger shy on this name until further clarification can be obtained on how it intends to hedge 54% of the top-line looking ahead and distribute revenue more evenly to its core business.

Exhibit 2. Covid-19 revenues continue to underpin the bulk of turnover for OSUR, whereas organic growth saw a net decline YoY when backing Covid out.

Data: HB Insights, OSUR SEC Filings

OraSure valuation and summary

Shares are trading at a discount of 1.08x T12M sales and are priced attractively at 0.8x book value. At this multiple, we’d theoretically be paying $3.78, which suggests that shares may in fact be fair and reasonably priced at these multiples, versus representing an attractive discount.

Moreover, the market has priced OSUR at 0.88x forward sales, roughly 81% below the sector media, suggesting investors are pricing a below-sector result from the company at the top line looking ahead. This falls in-line with current sales trends. Assigning 0.88x to our FY23 sales estimates of $250mm set a price target of just $3.03, indicating a value gap to the downside. Previously, we’d valued OSUR at $2.54.

With these points in mind, our research team is estimating $323mm at the top for OSUR in FY22 and sees this diminishing to $216mm by FY24 as the accretive impact from Covid-19 continues to narrow. Whilst FCF has remained negative this hasn’t been supported with adequate quarterly ROIC, and OSUR continues to print losses below the bottom line as a result. We reiterate the hold rating for OSUR awaiting more clarity on non-Covid revenues.

Be the first to comment