DNY59/E+ via Getty Images

The COVID-19 pandemic, and the range of policies aimed at mitigating its impact, has triggered a return to levels of inflation unseen for 40 years. While inflation is likely to moderate from these very high levels during 2022, we believe it will settle and persist at a rate higher than we have become used to over recent cycles.

We believe that makes a strong case for thinking about inflation in the asset allocation process, but also about the broader objective of portfolio diversification. Many investors could be lacking sufficient inflation exposure after experiencing such a long period of stable prices. Moreover, such a major economic inflection, combined with such fragile markets, is likely to be characterized by the kind of heightened market volatility we have already seen this year.

We think that means a portfolio that is prepared for higher inflation should contain not only assets that can mitigate against and take advantage of inflation, but also assets that can diversify against the uncertainty and volatility of the journey.

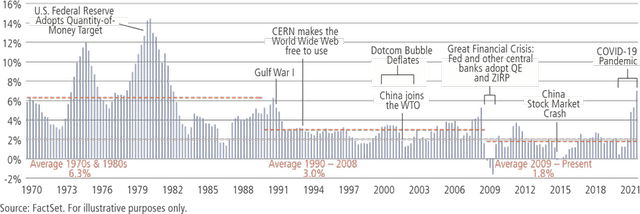

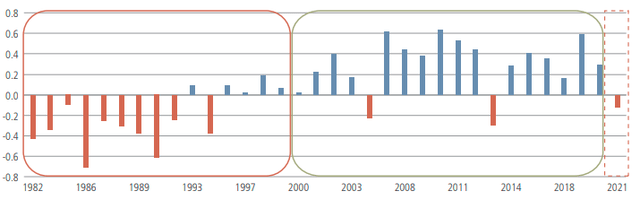

THE COVID-19 PANDEMIC HAS TRIGGERED A RETURN TO LEVELS OF INFLATION UNSEEN FOR 40 YEARS…

U.S. Consumer Price Index, Year-On-Year Change, As Of December 2021 (FactSet)

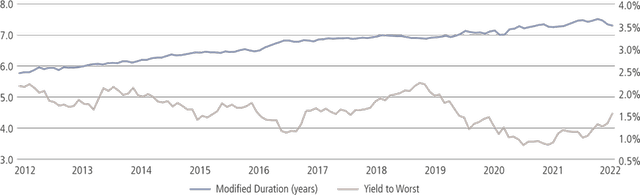

… LEAVING BOND MARKETS VULNERABLE TO RISING RATES, AFTER A DECADE OF YIELDS DRIFTING LOWER AND DURATION DRIFTING LONGER…

Bloomberg Barclays Global Aggregate Bond Index Yield And Duration, As Of January 31, 2022 (FactSet)

For illustrative purposes only. Indexes are unmanaged and are not available for direct investment. Investing entails risks, including possible loss of principal. Past performance is no guarantee of future results.

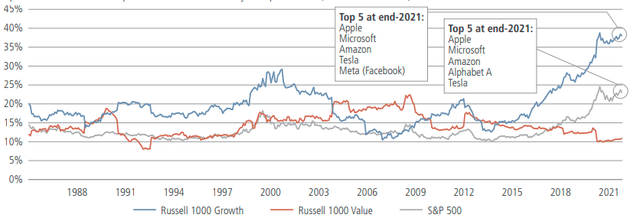

… AND EQUITY MARKETS VULNERABLE TO RISING RATES, AFTER A DECADE OF CONCENTRATION IN LONG-DURATION GROWTH STOCKS…

Proportion Of Index Market Capitalization Accounted For By Its Top Five Stocks, As Of December 31, 2021 (Bloomberg)

For illustrative purposes only. Indexes are unmanaged and are not available for direct investment. Investing entails risks, including possible loss of principal. Past performance is no guarantee of future results.

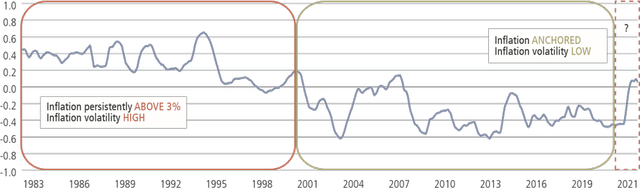

… WHICH MAKES LONG-TERM INVESTMENT PORTFOLIOS VULNERABLE TO A POTENTIAL RISE IN STOCK-BOND CORRELATION…

One-Year Rolling Correlation Of Daily Returns, S&P 500 Index Versus U.S. 10-year Treasury, As Of January 7, 2022 (Bloomberg) Average U.S. 10-Year Treasury Return (%) On Days When The S&P 500 Index Ended Down By 2% Or More, As Of December 31, 2021 (Bloomberg)

For illustrative purposes only. Nothing herein constitutes a prediction or projection of future events or future market behavior. Due to a variety of factors, actual events or market behavior may differ significantly from any views expressed. Indexes are unmanaged and are not available for direct investment. Investing entails risks, including possible loss of principal. Past performance is no guarantee of future results.

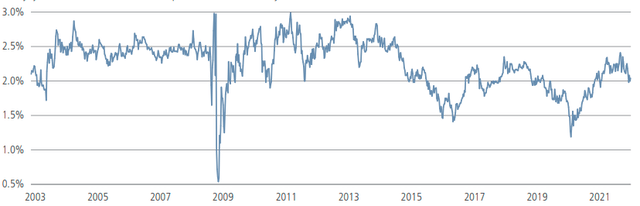

… AND WITH LITTLE SIGN YET OF HIGHER STRUCTURAL INFLATION IN LONG-DATED TREASURIES, MARKETS MAY HAVE A VOLATILE ADJUSTMENT AHEAD…

U.S. 5y5y Forward Breakeven Inflation Expectation, As Of February 3, 2022 (Federal Reserve Bank of St. Louis (NASDAQ:FRED))

For illustrative purposes only. Nothing herein constitutes a prediction or projection of future events or future market behavior. Due to a variety of factors, actual events or market behavior may differ significantly from any views expressed. Investing entails risks, including possible loss of principal. Past performance is no guarantee of future results.

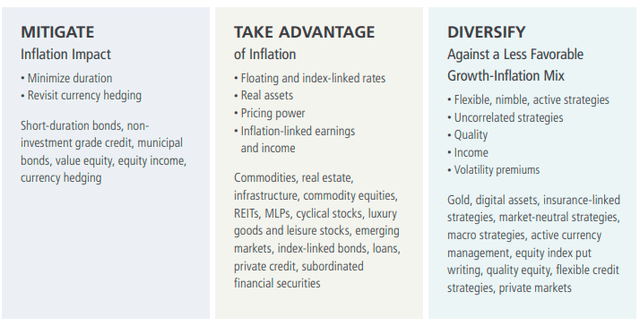

… REINFORCING THE CASE FOR THINKING ABOUT INFLATION EXPOSURE AS PART OF THE BROADER OBJECTIVE OF DIVERSIFYING A LONG-TERM INVESTMENT PORTFOLIO

Taking Inflation Exposure As Part Of The Broader Objective Of Diversifying A Long-Term Investment Portfolio (Neuberger Berman)

For illustrative purposes only. This material is general in nature and is not directed to any category of investors and should not be regarded as individualized, a recommendation, investment advice or a suggestion to engage in or refrain from any investment-related course of action. Investing entails risks, including possible loss of principal.

In modern industrial economies, moderate inflation is considered a good thing. It incentivizes consumption and investment in productive capacity, which stimulates broader economic activity. During economic slowdowns, it enables central banks to cut interest rates below the rate of inflation without having to go all the way to zero.

By contrast, low inflation and deflation can be symptoms of an economy in poor health, reflecting subdued consumer demand and underutilized capacity. At the other extreme, persistent high inflation raises costs for businesses and consumers, and can ultimately lead to widespread corporate failure and economic hardship – threatening a vicious cycle as investment in productive capacity is increasingly withdrawn.

That ideal of moderate inflation is helpful for understanding policy responses to inflation over the past 40 years.

30 Years Fighting Inflation, 10 Years Fighting Disinflation

Monetary authorities brought the high inflation of the 1970s under control by aggressively raising policy rates. This set off 40 years of disinflation, pushed lower by the technological advances of the internet age and the absorption of the labor forces of China and other emerging nations into the global trading community.

When inflation tipped into negative territory during the Great Financial Crisis of 2008-09, fiscal and monetary authorities intervened in the opposite direction with large economic rescue packages, zero and even negative policy rates, and quantitative easing. They were preparing to withdraw these measures when the coronavirus pandemic compelled them to return to them more aggressively than ever.

The 2020 lockdowns were initially disinflationary. Consumers saved at unprecedented rates. The impetus quickly turned inflationary, however, as governments supported exposed businesses and workers. Reassured consumers began to spend before many factory workers, farm workers, ship crews, lorry drivers and shop assistants had returned to their jobs.

Even in the aftermath of war, it is rare for such fragmented and under-resourced supply chains to be met with such a wave of pent-up demand. Across Europe and the U.S., inflation hit levels unseen since the 1980s. The Bank of England (BoE) has already started raising interest rates, the U.S. Federal Reserve (Fed) has adopted a much more hawkish tone, and as eurozone unemployment and inflation hit their lowest and highest levels, respectively, in the era of the single currency, the European Central Bank (ECB) has followed suit.

Transition to Structurally Higher Inflation Could Heighten Volatility

Much of the supply chain disruption associated with the pandemic is likely to subside. The current extreme inflation is unlikely to last. But we see four major reasons why this could prove to be a lasting inflection point, leaving us with inflation that is structurally higher than we have become used to over the past 20 years.

DE-GLOBALIZATION

- Supply chain disruptions may not last forever, but they have been painful enough for companies to begin localizing and diversifying – leavening the “just-in-time” arrangements of the past 40 years with more “just-in-case” redundancy.

- Governments are also encouraging re-shoring for security of supply, particularly in strategic goods such as semiconductors.

CHINA

- China’s population is aging, barely growing and as urbanized as it is ever likely to be; as a result, its government now prioritizes equality, good health, the environment, and the automation of the economy over jobs – generating growth.

- Decades of China exporting disinflation as the workshop of the world are over.

FISCAL AND MONETARY POLICY

- We perceive an implicit and explicit expansion of central bank mandates, which deprioritizes price stability relative to social goals such as the financing of sustainable infrastructure, full employment, greater equality and fiscal liberality.

- Responding to the ongoing impacts of both the Great Financial Crisis and the pandemic, fiscal authorities around the world also appear to be adopting more populist economic policies that could tip the balance in favor of labor over capital, which we consider to be inflationary.

DE-CARBONIZATION

- The transition to renewable energy and an electrified economy is necessary but costly: cutting investment in carbon-intensive energy, while demand continues to grow and the supply of renewables is still being built, is likely to generate “Greenflation” – in energy commodities and the metals that are likely to play an important role in the net-zero economy.

Longer-dated bond markets may have started to adjust in 2022, but they are still not priced for structurally higher inflation. While they were as low as -1% at the beginning of the year, U.S. real yields remain negative and have only recently pushed above -0.5% at 10 years, for example. We think the Fed aims to get real yields back to zero, which would require a further decline in inflation expectations, a further rise in nominal long-dated yields, or both. The Fed’s messaging on tighter policy has so far flattened the yield curve, however, as long-dated yields have risen slower than short-dated yields. We suspect investors are still not ready to recognize that we have hit an inflection point, or acknowledge the structural inflationary forces we see at work.

“Markets have not priced for persistent long-term inflation: they are more focused on the potential downward trajectory through 2022 and 2023. But we think inflation will be structurally higher than we’ve become used to over the past 20 years.”

– Brad Tank, CIO – Fixed Income“

For 10 years, central banks loosened whenever growth faltered; now, facing inflation, they are poised to tighten when growth expectations rise. That’s a big shift. Alongside what we see as potentially structural inflationary forces, it could leave us with a much less favorable growth-inflation mix, leading to higher market volatility and uncertainty.”

– Robert Surgent, Senior Portfolio Manager, Multi-Asset Class

That leaves financial markets vulnerable, in our view. A decade of slow global growth, zero interest rate policies, quantitative easing and the subsequent search for growth and yield left us with unique, and uniquely fragile, market dynamics:

- Historically low bond yields

- Historically tight credit spreads

- Historically high equity market valuations

- Historically high demand for “growth” stocks

Leaving equities and bonds

- Expensive

- Increasingly correlated

- Sensitive to changes in interest rates, and at risk should rates need to rise substantially to control inflation

The volatility that has opened 2022 has begun to reflect this market fragility, as well as the potential for a less favorable growth-inflation mix than we have faced over much of the past 20 years. We believe that volatility is likely to persist for the foreseeable future.

What Might This Mean for Portfolios?

In these conditions, we believe investors preparing for structurally higher inflation should seek to achieve three things:

Inflation Exposure As Part Of The Broader Objective Of Diversifying A Long-Term Investment Portfolio (Neuberger Berman)

For illustrative purposes only. This material is general in nature and is not directed to any category of investors and should not be regarded as individualized, a recommendation, investment advice or a suggestion to engage in or refrain from any investment-related course of action. Investing entails risks, including possible loss of principal.

We would argue that seeking out inflation-sensitive assets today is not only about the desirability of the inflation exposure itself, but about the broader objective of portfolio diversification: we believe many investors could be lacking sufficient inflation exposure after experiencing such a long period of stable prices. Moreover, such a major economic inflection, combined with such fragile markets, is likely to be characterized by heightened market volatility – as we have seen already this year.

Fixed Income: Short Duration, Floating Rates, Flexible Strategies

Fixed income portfolios are arguably most at risk from an inflationary environment. Inflation and higher rates tend to lower the present real value of a fixed income stream. The longer-dated those income streams are, the more sensitive their present value is to changes in rates – they exhibit longer duration. Should a long-term real yield of 1% or even zero be required to make inflation settle between, for example, 2.5% and 3.0%, nominal yields will be substantially higher than they are today.

“Right now, TIPS are not the cheapest way to express an inflation view, but with more attractive valuations they would remain the most direct way to gain exposure.”

– Ashok Bhatia, Deputy CIO, Fixed Income

“When inflation is higher, we certainly become more cautious around sectors that require significant labor, or face other costs that might prove difficult to pass on to customers.”

– Joe Lynch, Global Head of Non-Investment Grade

In fixed income, we think the priority is to mitigate the impact of inflation.

- Short duration: Minimizes the negative impact of rising rates: with the Fed, the ECB and the BoE turning more hawkish on inflation, we favor this positioning in both U.S. and European markets.

- Non-investment grade credit: To maintain yield with shorter duration, we favor adding credit risk with U.S. and European high yield bonds, dedicated short-duration high yield strategies, tradable bank loans and securitized debt.

- U.S. municipal bonds: Short-duration, with somewhat lower credit risk, in many cases underpinned by a strong housing market.

- Currency hedging: As cyclical uncertainty and higher inflation raises the potential of higher currency market volatility, hedging can help isolate and manage risks.

Although inflation is generally challenging for bond portfolios, there are ways to take advantage.

- Treasury Inflation Protected Securities (TIPS) and other index-linked bonds: Short-dated U.S. TIPS were one of the few bond markets where total returns matched the 7% U.S. inflation rate in 2021, but they are now expensive – we think it is prudent to watch real yields for a more attractive entry point.

- Floating rate securities: Tradable bank loans, private credit, securitized credit tranches and municipal variable rate demand obligations have already been outperforming due to their short duration – rising floating-rate coupons may add to their total return once central banks embark on their projected rate hikes.

- Subordinated financial securities: Strong credit quality and attractive yields combine with the potential for financial sector issuers to benefit from rising interest rates.

Bond markets offer ample ways to diversify risk: via duration, credit risk, currency risk, regional risk, fixed or floating rates, senior or subordinated positions in capital structures.

- Flexible strategies: The high level of cyclical uncertainty makes the case for “go anywhere” strategies that are able to shift with economic data and investor sentiment.

Equities: Pricing Power, Renewed Focus on Yield

Equities have tended to outperform bonds during periods of higher inflation, but that appears to have more to do with the strong growth that often accompanies rising inflation, rather than inflation itself. The potential for a less favorable growth-inflation mix is good reason to re-examine style and sector tilts in equity portfolios, but also to re-think the balance of passive versus active approaches.

“Think of the equity market in terms of upstream and downstream. Upstream companies such as commodity producers and semiconductor manufacturers find it easiest to pass on their costs. Downstream, facing the consumer directly, it’s much harder to pass costs on. The midstream companies manufacturing capital goods are between those two extremes.”

– Raheel Siddiqui, Senior Research Analyst, Equities

“Growth has outperformed value so much over the past decade that it has come to dominate benchmark indices. So-called ‘core’ indices are now growth indices. Growth indices are now ‘super growth’ indices. And growth stocks are much more at risk from rising rates than value stocks.”

– Eli Salzmann, Senior Portfolio Manager, Large Cap Value Equities

Just as with bonds, to mitigate the impact of inflation on equities one can minimize the negative impact of rising rates.

- Value stocks: Exhibit lower duration than growth stocks, whose earnings are likely to be more weighted to the future.

- Equity income: Companies that tend to pay a high share of their profits as dividends provide cash flows that can also help to shorten duration.

To take advantage of inflation, begin by thinking of markets in terms of “upstream” and “downstream” businesses.

- “Upstream” businesses: Commodity producers, real-asset owners, semiconductor manufacturers, banks and capital goods manufacturers generally find it easier to pass on their costs than “downstream” business, such as retail.

- Luxury goods and leisure: Exceptions to the upstream-downstream rule, because their price hikes can be more easily absorbed by their consumers.

- Cyclical stocks: Many upstream and midstream businesses are cyclical – they could be at risk from lower economic growth, but current low valuations may provide a buffer.

- Emerging markets: Central banks in many emerging countries moved fast to control inflation and now stand ready to loosen, rather than tighten, monetary policy – ultimately, however, our outlook depends more on growth relative to the U.S. than inflation or policy dynamics.

To diversify an equity portfolio suggests defensive positioning.

• Defensive quality: Sectors such as consumer staples and healthcare are downstream businesses with limited pricing power, but current low valuations may provide a buffer against the potential impact of inflation, and many are longstanding payers of steadily growing dividends, which may shorten their duration and raise their resilience against inflation.

Alternative Investments: Real Assets, Uncorrelated Strategies

Historically low bond yields, tight credit spreads and high equity market valuations raise the likelihood that stocks and bonds will become more correlated and more volatile. In our view, the potential for structurally higher inflation and a less favorable growth-inflation mix increases that likelihood still further. The traditional 60/40 portfolio appears vulnerable. We think alternative diversifiers will need to play a more prominent role, with a focus on those with particular sensitivity to inflation.

“The journey towards structurally higher inflation is beset with uncertainty. A shift away from ‘passive,’ ‘set-and-forget’ asset allocation models such as 60/40 or naïve risk parity seems likely, in favor of more tactical, responsive approaches.”

– Erik Knutzen, Chief Investment Officer – Multi-Asset Class

“De-globalization, de-carbonization and redistribution are likely to create more demand for commodities, potentially moving them from their traditional role as a hedge against cyclical inflationary spikes to a new role as a hedge against structurally higher inflation.”

– Hakan Kaya, Senior Portfolio Manager, Commodities, Quantitative and Multi-Asset Strategies

“A toll road may collect revenues tied to CPI, a utility’s revenues may be tied to its commodity feedstock, and even assets that tend not to have long-term inflation-adjusted contracts, such as ports, tend to be critical enough to have considerable pricing power.”

– Josh Miller, Research and Portfolio Analyst, Infrastructure Private Equity

Real assets are often the heart of portfolios designed to take advantage of inflation.

- Commodities: De-globalization is likely to increase global competition for commodities; the policy focus on equality implies greater spending power for those on lower incomes, who tend to spend more on commodities; and de-carbonization is likely to increase demand for many commodities, especially metals.

- Real estate: As construction costs rise, the value of existing real assets also tends to rise; to justify construction costs, rents across the sector are likely to have to rise too; many sectors have longer-term leases with contractual inflation-linked escalators, others have annually renewable leases, with rents rising and falling with consumer prices and wages.

– Multifamily residential real estate: Wage inflation is the key demand driver, and its short leases mean that it also exhibits minimal duration.

– Real Estate Investment Trusts (REITs): Listed companies that specialize in managing real estate assets. - Infrastructure: Contractual long-term usage charges often adjust in line with a producer or consumer price index or, in the case of a utility, the price of its commodity feedstock; other assets are often critical enough to have considerable pricing power.

– Renewable energy infrastructure: The feedstock is free, but particularly during the de-carbonization transition, renewables producers can benefit from the same high consumer energy prices set by fossil fuel utilities.

– Master Limited Partnerships (MLPs): Listed companies that specialize in managing midstream energy infrastructure assets (increasingly set up or converting to C-Corporations, but often still referred to as MLPs).

High valuations, low yields and the potential for a less favorable growth-inflation mix make the need to diversify equity and bond risks greater than ever.

- Uncorrelated markets: Some market risks are entirely different from the economic risks of equities and bonds, such as those associated with catastrophe bonds and other insurance-linked securities.

- Uncorrelated strategies: Low correlation can potentially be achieved when long and short positions create market-neutral exposures, as with relative-value and market-neutral hedge funds; or when returns are sought from short- and medium-term trading, as with macro or trend-following strategies.

- Active currency management: While spikes in currency market volatility have coincided with periods of economic and market stress (sometimes inflationary, sometimes disinflationary), more gradual rises in currency volatility, and therefore active return opportunity, have tended to correlate with periods of declining inflation expectations – this could make active currency management a useful diversifier as inflation declines from its current extremes, and should we move into a less favorable growth-inflation mix.

- Gold and digital assets: While it can be vulnerable to rising rates, gold has a history of strong performance when the growth-inflation mix is unfavorable; Bitcoin’s built-in scarcity could give it the potential to hedge against inflation and fiat currency debasement – as adoption grows and regulation increases trust, we think some cryptocurrencies could de-correlate from risk assets and behave more like “digital gold”.

- Equity index put writing: Earns premiums that have tended to rise during times of market uncertainty and volatility by effectively selling insurance against substantial drops in equity indices.

- Private equity: Valuations of existing underlying assets may be at risk because they tend to be growth-oriented and long-duration, but fund commitments made today are likely to be invested over the coming two to three years, potentially benefitting from more attractive valuations – historically, private equity vintages raised when public market valuations peaked have gone on to generate some of the best returns.

To Stay Diversified, Prepare for Inflation

We believe it is now prudent to think about which investment classes have the potential to mitigate against and deliver positive exposure to higher inflation.

But we also believe inflation exposure should be seen, not purely on its own terms, but as one important means of delivering a genuine approach to portfolio diversification at a time of low bond yields, high equity valuations, extreme growth-equity market concentration, tight stock-bond correlations and the potential for a less favorable growth-inflation mix. We believe inflation dynamics should be in focus now because the economic conditions are changing – but also because investors could be lacking sufficient inflation exposure after experiencing such a long period of stable prices.

That implies two considerations.

First, we believe care should be taken not to tilt too far toward inflation sensitivity, and to keep in mind ways to add broader volatility dampening and uncorrelated assets and strategies, as a complement and a balance to inflation exposures.

Second, the best results are unlikely to come from simply adding a long list of inflation-sensitive asset classes to your portfolio. Each asset class comes with different characteristics that imply different roles in a portfolio at different sizes.

Some, such as commodities, exhibit high inflation sensitivity and high volatility, but relatively low correlation with equities and bonds. Others, such as value and cyclical stocks or listed real estate and midstream infrastructure, come with relatively high inflation sensitivity and volatility, but also relatively high correlation with the equity market. Floating-rate loans can pair inflation sensitivity with moderate volatility and modest correlation with equities and bonds – but the risk of more severe downside in credit tail events. Inflation-linked bonds have tended to deliver high inflation sensitivity with low volatility in the past, but current valuations may compromise them on both counts today.

Creating the right mix of inflation-related and traditional assets for your risk-return profile and your diversification demands careful thought. We think the road we are on leads to structurally higher inflation. But that road is unlikely to be straight or smooth, and we believe a balanced set of portfolio risks can help investors navigate it more securely.

______________

This material is provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice. This material is general in nature and is not directed to any category of investors and should not be regarded as individualized, a recommendation, investment advice or a suggestion to engage in or refrain from any investment-related course of action. Investment decisions and the appropriateness of this material should be made based on an investor’s individual objectives and circumstances and in consultation with his or her advisors. Information is obtained from sources deemed reliable, but there is no representation or warranty as to its accuracy, completeness or reliability. All information is current as of the date of this material and is subject to change without notice. Discussions of any specific sectors and companies are for informational purposes only. This material is not intended as a formal research report and should not be relied upon as a basis for making an investment decision. The firm, its employees and advisory accounts may hold positions of any companies discussed. Nothing herein constitutes a recommendation to buy, sell or hold a security. Specific securities identified and described do not represent all of the securities purchased, sold or recommended for advisory clients. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. Any views or opinions expressed may not reflect those of the firm as a whole. Neuberger Berman products and services may not be available in all jurisdictions or to all client types. References to third-party sites are for informational purposes only and do not imply any endorsement, approval, investigation, verification or monitoring by Neuberger Berman of any content or information contained within or accessible from such sites. Investing entails risks, including possible loss of principal. Investments in hedge funds and private equity are speculative and involve a higher degree of risk than more traditional investments. Investments in hedge funds and private equity are intended for sophisticated investors only. Indexes are unmanaged and are not available for direct investment. Past performance is no guarantee of future results. The views expressed herein may include those of the Neuberger Berman Multi-Asset Class (MAC) team or Neuberger Berman’s Asset Allocation Committee. The Asset Allocation Committee is comprised of professionals across multiple disciplines, including equity and fixed income strategists and portfolio managers. The Asset Allocation Committee reviews and sets long-term asset allocation models, establishes preferred near-term tactical asset class allocations and, upon request, reviews asset allocations for large, diversified mandates. Tactical asset allocation views are based on a hypothetical reference portfolio. Asset Allocation Committee members are polled on asset classes and the positional views are representative of an Asset Allocation Committee consensus. The views of the MAC team or the Asset Allocation Committee may not reflect the views of the firm as a whole and Neuberger Berman advisers and portfolio managers may take contrary positions to the views of the MAC team or the Asset Allocation Committee. The MAC team and the Asset Allocation Committee views do not constitute a prediction or projection of future events or future market behavior. This material may include estimates, outlooks, projections and other “forward-looking statements.” Due to a variety of factors, actual events or market behavior may differ significantly from any views expressed. Nothing herein constitutes a prediction or projection of future events or future market or economic behavior. The information in this material may contain projections, market outlooks or other forward-looking statements regarding future events, including economic, asset class and market outlooks or expectations, and is only current as of the date indicated. There is no assurance that such events, outlook and expectations will be achieved, and actual results may be significantly different than that shown here. The duration and characteristics of past market/economic cycles and market behavior, including any bull/bear markets, is no indication of the duration and characteristics of any current or future be market/economic cycles or behavior. Information on historical observations about asset or sub-asset classes is not intended to represent or predict future events. Historical trends do not imply, forecast or guarantee future results. Information is based on current views and market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. A bond’s value may fluctuate based on interest rates, market conditions, credit quality and other factors. You may have a gain or a loss if you sell your bonds prior to maturity. Of course, bonds are subject to the credit risk of the issuer. If sold prior to maturity, municipal securities are subject to gain/losses based on the level of interest rates, market conditions and the credit quality of the issuer. Income may be subject to the alternative minimum tax (AMT) and/or state and local taxes, based on the investor’s state of residence. High-yield bonds, also known as “junk bonds,” are considered speculative and carry a greater risk of default than investment-grade bonds. Their market value tends to be more volatile than investment-grade bonds and may fluctuate based on interest rates, market conditions, credit quality, political events, currency devaluation and other factors. High yield bonds are not suitable for all investors and the risks of these bonds should be weighed against the potential rewards. Neither Neuberger Berman nor its employees provide tax or legal advice. You should contact a tax advisor regarding the suitability of tax-exempt investments in your portfolio. Government bonds and Treasury bills are backed by the full faith and credit of the United States Government as to the timely payment of principal and interest. Investing in the stocks of even the largest companies involves all the risks of stock market investing, including the risk that they may lose value due to overall market or economic conditions. Small- and mid-capitalization stocks are more vulnerable to financial risks and other risks than stocks of larger companies. They also trade less frequently and in lower volume than larger company stocks, so their market prices tend to be more volatile. Investing in foreign securities involves greater risks than investing in securities of U.S. issuers, including currency fluctuations, interest rates, potential political instability, restrictions on foreign investors, less regulation and less market liquidity. The sale or purchase of commodities is usually carried out through futures contracts or options on futures, which involve significant risks, such as volatility in price, high leverage and illiquidity. This material is being issued on a limited basis through various global subsidiaries and affiliates of Neuberger Berman Group LLC. Please visit www.nb.com/disclosure-global-communications for the specific entities and jurisdictional limitations and restrictions. The “Neuberger Berman” name and logo are registered service marks of Neuberger Berman Group LLC.

©2022 Neuberger Berman Group LLC. All rights reserved

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment