drserg

Oracle (NYSE:ORCL) is expected to report its Q2 FY23 results this month. The shares have fallen slightly so far in 2022. ORCL’s total return for the YTD is -2.96% vs. -27.7% for the Infrastructure Software industry (as defined and tracked by Morningstar) and -13.34% for the S&P 500 (SPY). ORCL’s trailing total returns for the past 3- and 5-year periods (16.1% and 12.3% per year, respectively) are higher than the total returns of the S&P 500 over the same periods (11.1% and 10.9% per year).

Long a dominant provider of database software, ORCL has shifted to focus on cloud-based data management and software solutions with a software-as-a-service (SaaS) model. The company was somewhat slow in shifting to a cloud-focused model, but has pivoted successfully and has been generating rapid revenue growth in cloud services. For Q1 of FY 2022 (reported on September 12th), cloud revenue was up 45% (in USD). On the earnings call for Q1, Oracle’s CEO, Safra Catz, stated that “our fundamental principle is to grow non-GAAP EPS, while substantially increasing cloud revenue.” Cloud revenue has risen rapidly but EPS growth has been somewhat slow.

Seeking Alpha

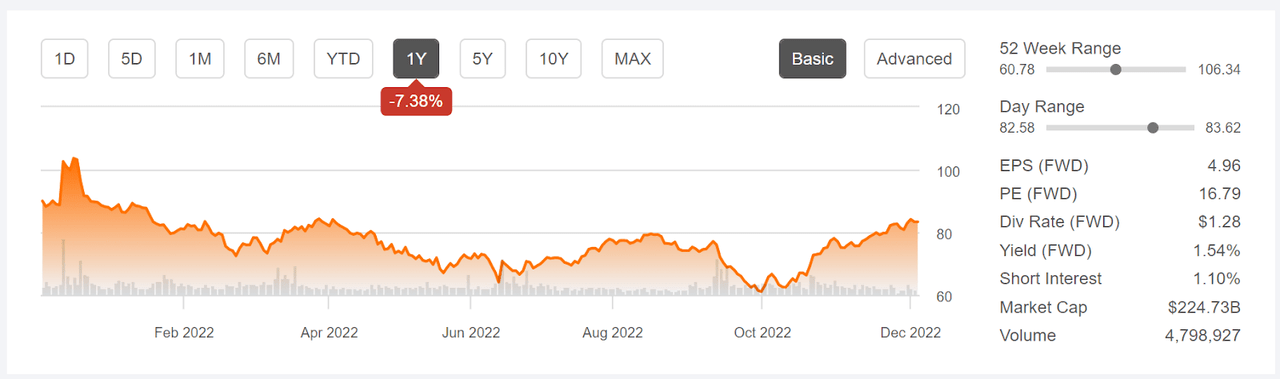

12-Month price history and basic statistics for ORCL (Source: Seeking Alpha)

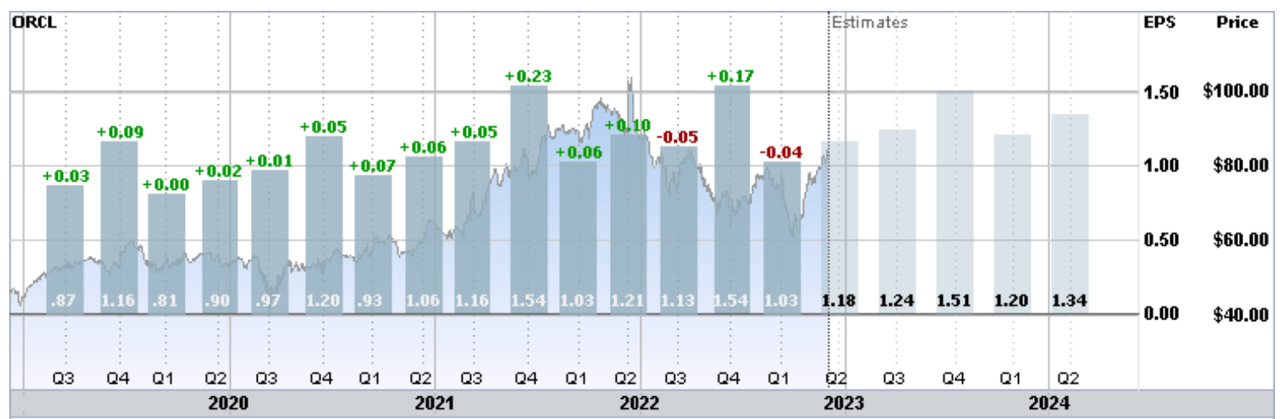

ORCL’s earnings have been quite stable over the past 4 years, with a modest growth trend. While EPS for Q1 of FY 2023 (reported on September 12, 2022) was slightly below expectations, the results were identical to those from Q1 of the previous year ($1.03 per share). The previously-reported quarter, Q4 of FY 2022, had EPS identical to the result from Q4 of FY 2021. The consensus outlook for EPS growth over the next 3 to 5 years is 9.9% per year.

ETrade

Trailing (4 years) and estimated future quarterly EPS for ORCL. Green (red) values are amounts by which EPS beat (missed) the consensus expected value (Source: ETrade)

ORCL’s forward P/E, 16.8, is quite low compared to historical levels. The P/E based on trailing twelve-month (TTM) earnings, 39.7, is considerably higher than the average over the past 5 years, however. The large disparity between the TTM and forward P/E values shows that the fair valuation for ORCL is particularly sensitive to the earnings outlook.

On June 8, 2022, ORCL completed its acquisition of Cerner Corporation, a provider of digital information systems for healthcare. The $28B deal is projected to substantially increase ORCL’s healthcare-related revenue stream. The expected contribution from Cerner is reflected in the consensus earnings outlook (see chart above).

I last wrote about ORCL on October 13, 2021, when I upgraded the stock from a hold to a buy. At that time, the Wall Street consensus rating for ORCL was a hold and the consensus 12-month price target was about 6% below the share price. The forward P/E, 20.39, was quite low, and the company had been consistently beating expectations on earnings for a string of quarters. Along with looking at fundamentals and the Wall Street consensus, I also rely on the market-implied outlook, a probabilistic price forecast that reflects the consensus view from the options market. The market-implied outlook was somewhat bullish.

Seeking Alpha

Previous post on ORCL and subsequent performance vs. the S&P 500 (Source: Seeking Alpha)

ORCL has underperformed the S&P 500 since this post. It is also of interest to compare ORCL to the 3 largest sellers of cloud data and analytics services: Amazon (Amazon Web Services), Microsoft (Azure), and Alphabet (Google Cloud). Using Yahoo! Finance dividend-adjusted historical prices from the closing price on October 13th to the most recent close, ORCL has returned a total of -12.0% vs. -42.6%, -13.0%, and -26.9% for Amazon (AMZN), Microsoft (MSFT), and Alphabet (GOOG), respectively.

For readers who are unfamiliar with the market-implied outlook, a brief explanation is needed. The price of an option on a stock is largely determined by the market’s consensus estimate of the probability that the stock price will rise above (call option) or fall below (put option) a specific level (the option strike price) between now and when the option expires. By analyzing the prices of call and put options at a range of strike prices, all with the same expiration date, it is possible to calculate a probabilistic price forecast that reconciles the options prices. This is the market-implied outlook. For a deeper explanation and background, I recommend this monograph published by the CFA Institute.

With more than a year since my last analysis, I have calculated updated market-implied outlooks for ORCL and compared these with the current Wall Street consensus outlook in revisiting my rating.

Wall Street Consensus Outlook for ORCL

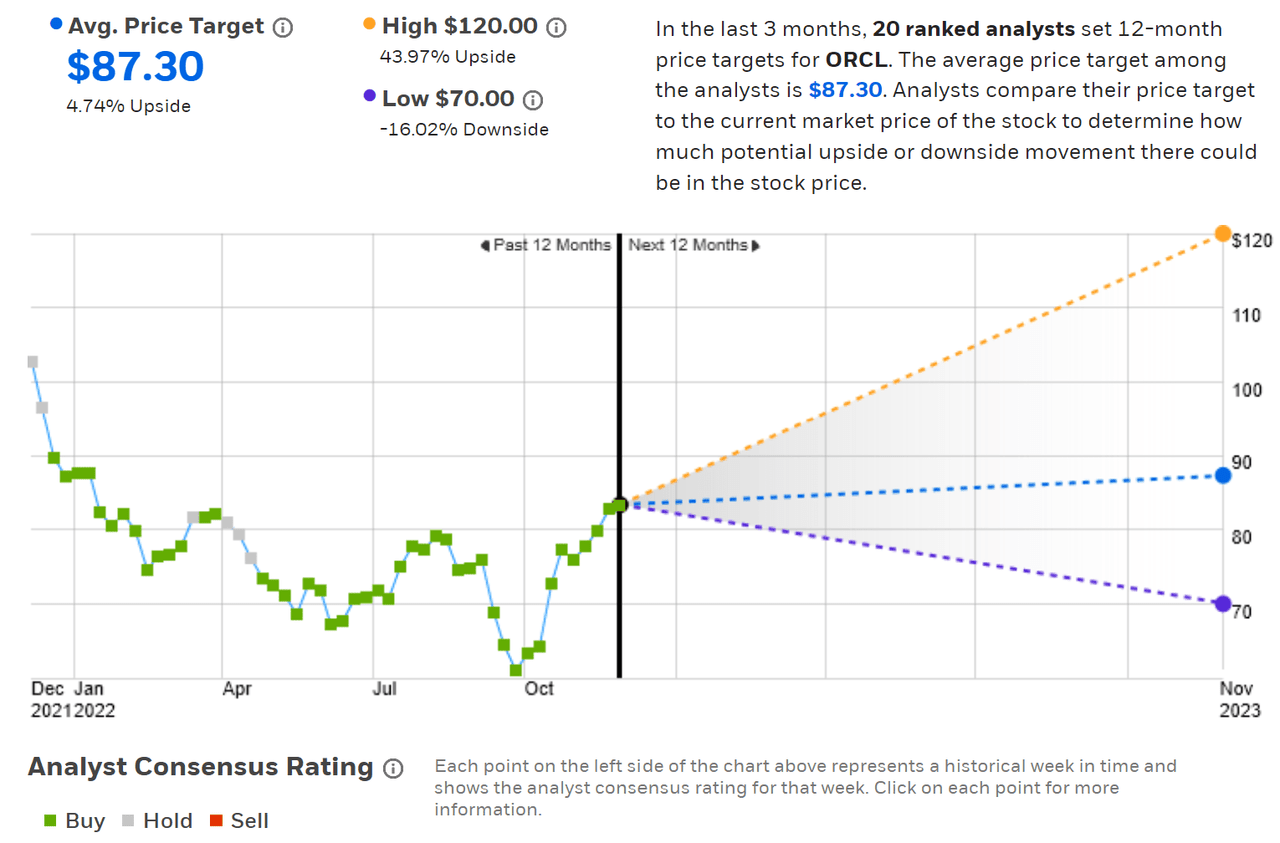

ETrade calculates the Wall Street consensus outlook for ORCL by aggregating the views of 20 ranked analysts who have published ratings and price targets in the last 3 months. The consensus rating is a buy and the consensus 12-month price target is 4.7% above the current share price, for an expected total return (including the dividend) of 6.2%. The dispersion among the individual analyst price targets is quite high, which diminishes my confidence in the predictive value of the consensus.

ETrade

Wall Street analyst consensus rating and 12-month price target for ORCL (Source: ETrade)

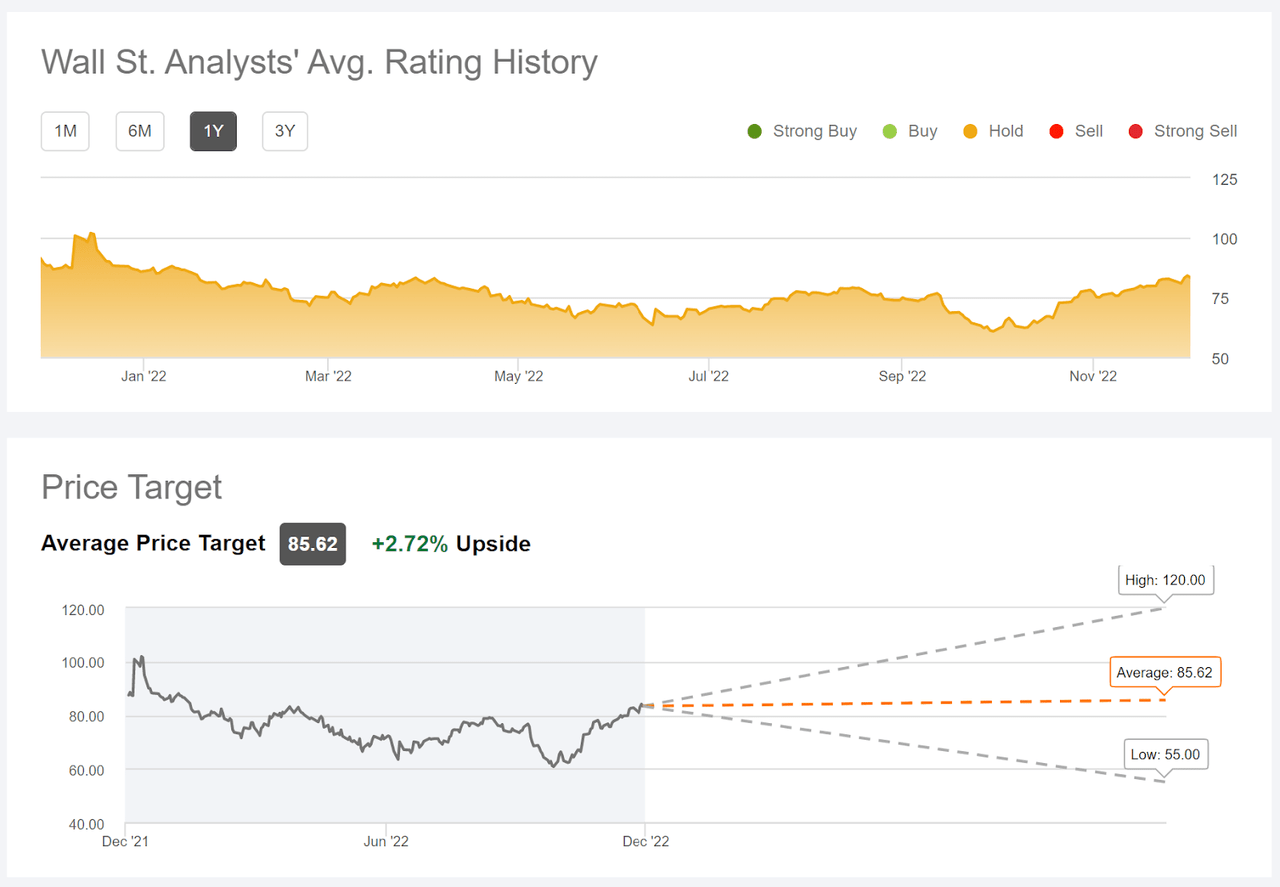

Seeking Alpha’s version of the Wall Street consensus outlook is based on the views of 31 analysts who have published ratings and price targets over the past 90 days. The consensus rating is a hold and the consensus 12-month price target is 2.7% above the current share price, for an expected total return of 4.2%. The spread in the individual analyst price targets is even higher than in the ETrade results.

Seeking Alpha

Wall Street analyst consensus rating and 12-month price target for ORCL (Source: Seeking Alpha)

As a rule of thumb, I strongly discount the consensus price target when the ratio of the highest and lowest analyst price targets is greater than 2. In the ETrade results, this ratio is 1.71 ($120 / $70). In the Seeking Alpha results, the ratio is 2.18. The level of disagreement among the analysts is definitely in the range that I consider the consensus to be of limited value.

Market-Implied Outlook for ORCL

I have calculated the market-implied outlook for ORCL for the 6.4-month period from now until June 16, 2023 and for the 13.5-month period from now until January 19, 2024, using the prices of call and put options that expire on these dates. I selected these specific expiration dates to provide a view to the middle of 2023 and through the end of 2023.

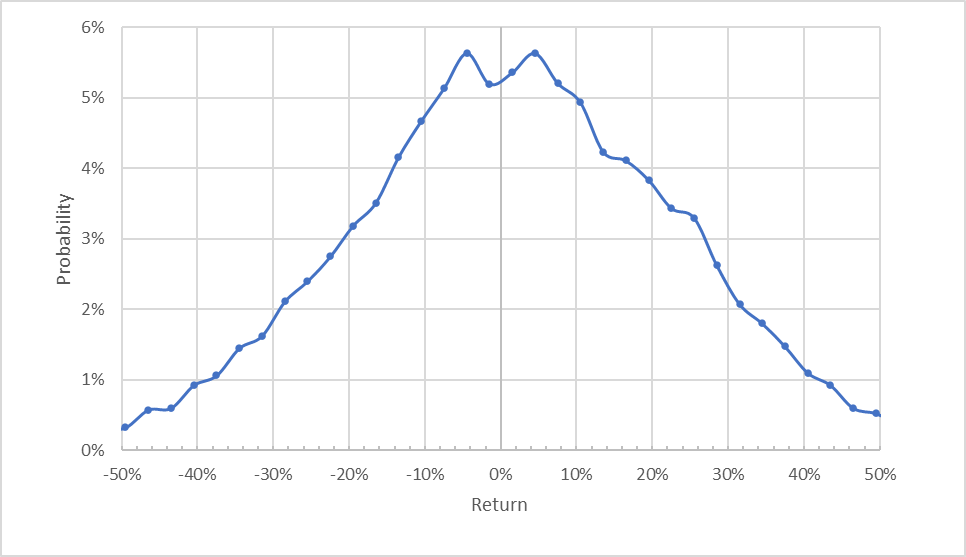

The standard presentation of the market-implied outlook is a probability distribution of price return, with probability on the vertical axis and return on the horizontal.

Geoff Considine

Market-implied price return probabilities for ORCL for the 6.4-month period from now until June 16, 2023 (Source: Author’s calculations using options quotes from ETrade)

The outlook to the middle of 2023 has peak-probability outcomes that are generally symmetric, with equal probabilities for positive and negative returns. For larger-magnitude price returns, the probabilities of positive returns tend to be higher than for negative returns. Compare, for example, the probability of having a return of +20% to the probability of a -20% return. The expected volatility calculated from this outlook is 33% (annualized). This is a moderate volatility level for large-cap stock.

To make it easier to compare the relative probabilities of positive and negative returns, I rotate the negative return side of the distribution about the vertical axis (see chart below).

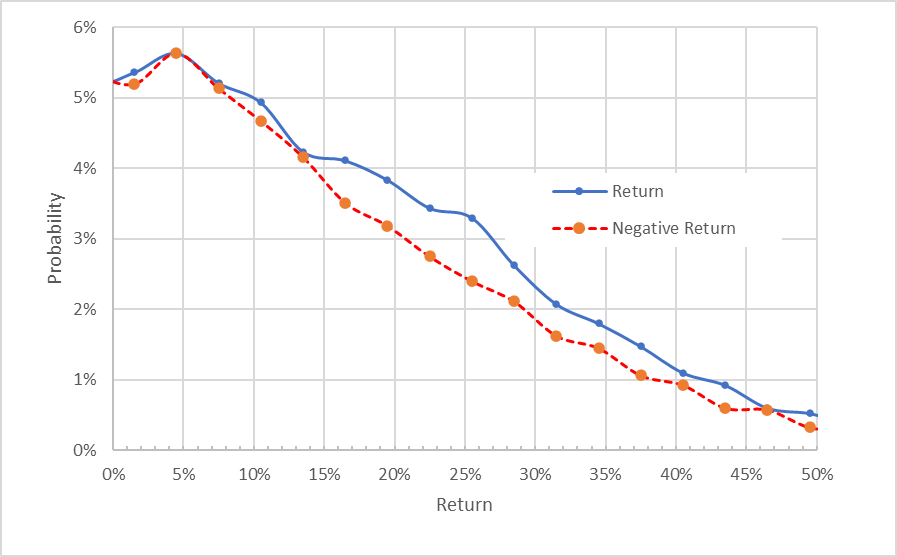

Geoff Considine

Market-implied price return probabilities for ORCL for the 6.4-month period from now until June 16, 2023. The negative return side of the distribution has been rotated about the vertical axis (Source: Author’s calculations using options quotes from ETrade)

This view makes it easier to see the tilt in probabilities to favor larger-magnitude positive returns (the solid blue line is above the dashed red line for returns greater than +/-15%). This is a bullish outlook for ORCL for the next 6.4 months.

Theory indicates that the market-implied outlook is expected to have a negative bias because investors, in aggregate, are risk averse and thus tend to pay more than fair value for downside protection. There is no way to measure the magnitude of this bias, or whether it is even present, however. The potential for a negative bias reinforces the bullish interpretation of this outlook.

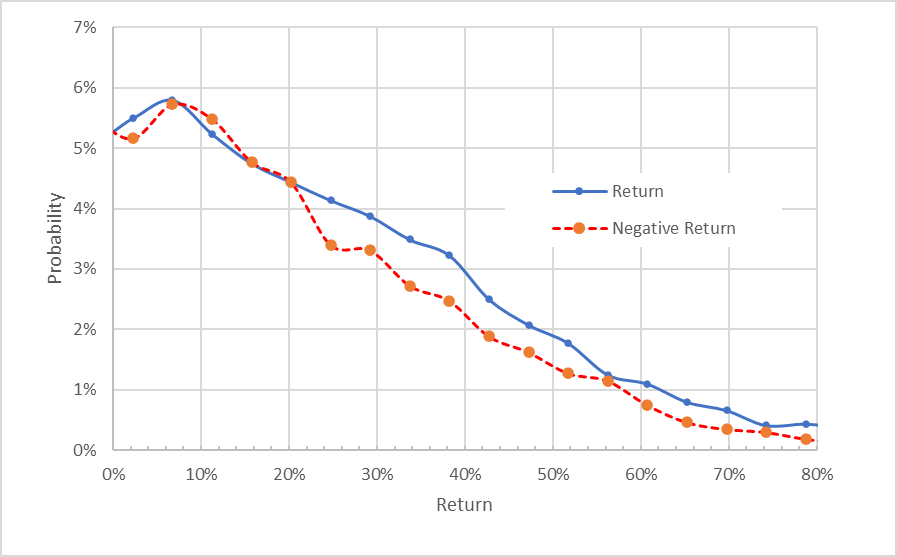

The outlook to mid-January of 2024 is remarkably similar to the shorter-term outlook. While the probabilities of positive and negative return are well-matched for smaller-magnitude price changes, the probabilities of positive returns are elevated for larger-magnitude swings over the next year. This is a bullish outlook. The expected volatility calculated from this distribution is 33% (annualized).

Geoff Considine

Market-implied price return probabilities for ORCL for the 13.5-month period from now until January 19, 2024. The negative return side of the distribution has been rotated about the vertical axis (Source: Author’s calculations using options quotes from ETrade)

The market-implied outlooks to the middle of 2023 and to the start of 2024 are very consistent. The probabilities of smaller price swings are comparable for positive and negative returns, but the probabilities of larger-magnitude changes in the share price favor positive returns. The options market is suggesting that the probabilities of positive surprises are higher than for negative surprises. This is a bullish outlook for ORCL, particularly given that theory suggests that the market-implied outlook will be negatively biased. The expected volatility is about 33% for both outlooks.

Summary

Oracle has turned in remarkably stable earnings over the past several years. This is especially notable given that this period spans the COVID pandemic. Oracle is a legacy player in data management and was somewhat slow to migrate to a cloud-focused business model. The company now appears to be having considerable success in growing revenue. Management is clearly aware of the need to grow earnings. The prevailing view from Wall Street is that growth in the next year or two will be very limited and the consensus price target corresponds to a total return of only 5.2% over the next year. There is, however, a wide spread in the individual price targets so I discount the Wall Street consensus. The market-implied outlook for ORCL is bullish to the middle of 2023 and into the start of 2024, with moderate volatility. I am maintaining my buy rating on ORCL.

Be the first to comment