William_Potter/iStock via Getty Images

We are not rich by what we possess but by what we can do without.― Immanuel Kant

Today, we look at a small finance concern. The company went public last summer via a SPAC. Like so many brought to public via this avenue in 2021, the shares find themselves deep in “Busted IPO” territory. Is the stock now in the bargain bin, or should potential investors continue to maintain their distance? We hope to answer that question via the analysis below.

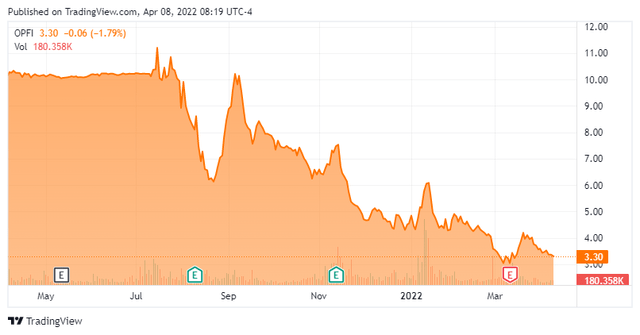

OPFI- Stock Chart (Seeking Alpha)

Company Overview

OppFi Inc. (NYSE:OPFI) is a Chicago-based financial technology platform that provides subprime loans to underbanked Americans through three bank partners plus its own facilities. Since inception, it has enabled more than $3.3 billion in gross loan issuance encompassing more than two million loans.

OppFi was formed in 2012 and went public in July 2021, when it merged into special purpose acquisition company (SPAC) FG New America Acquisition Corp. Its first trade transacted at $10.47 per share. The SPAC went public in 2020, raising gross proceeds of $237.5 million at $10 per unit, with each unit consisting of one share of Class A common stock and one-half a warrant to purchase another share at $11.50. OppFi stock currently trades around $3.25 a share, equating to a market cap of $370 million.

OPFI – Customer Profile (March Company Presentation)

The company is capitalized by two classes of common stock. The 13.6 million Class A shares confer economic interest and one vote per share. The 108 million Class V voting shares confer no economic interest, bestow one vote per share, and are convertible in Class A shares. Owing to this arrangement, management controls the shareholder vote.

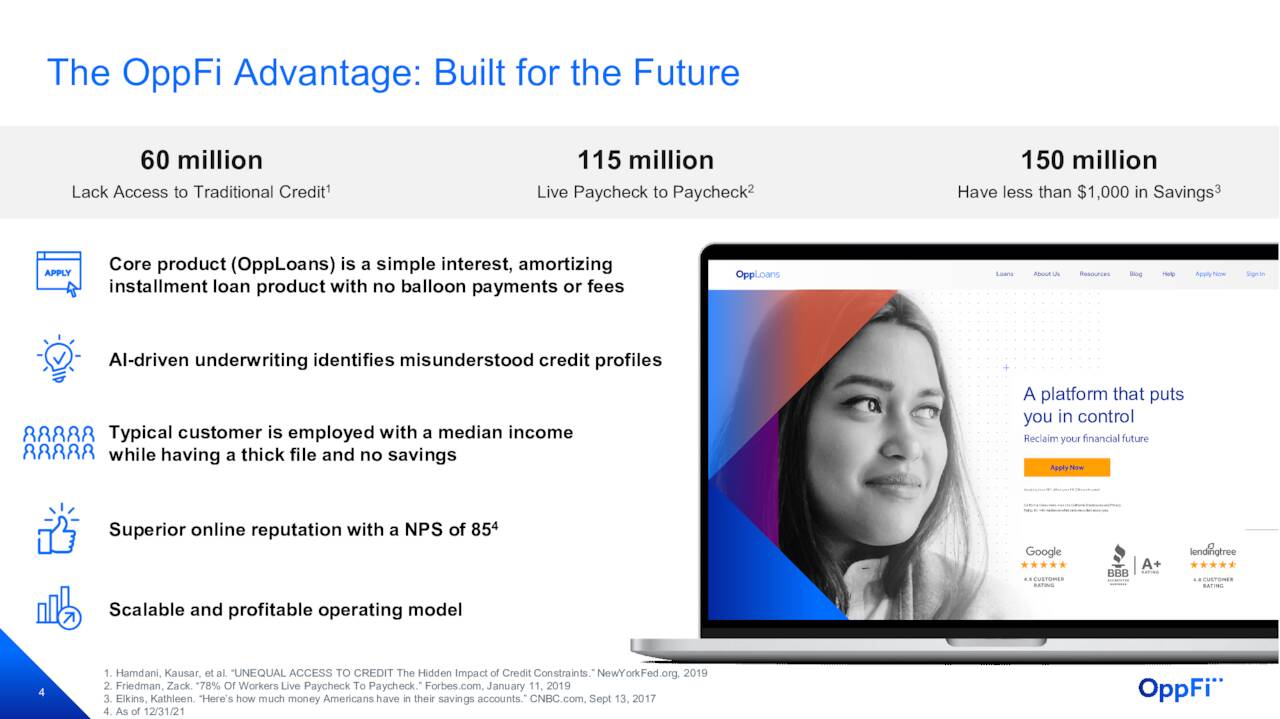

OPFI – Company Highlights (March Company Presentation)

Loan Application Process

With OppFi, a customer – most likely one of the 60 million Americans who do not have access to traditional credit, or of the broader population of 150 million who have less than $1,000 in savings – goes online or onto its mobile app and applies for a loan between $500 and $4,000. This typically is to cover an unexpected expense. The application process takes approximately five minutes. The company’s platform then first searches for traditional sub-36% financing alternatives, which typically results in a 90% rejection rate. If no mainstream credit options are available, the application enters OppFi’s underwriting platform, which generates a proprietary (non-traditional) credit score that determines the loan terms, as well as which of its three lending partners will provide the financing. The relationship with its bank partners, who fund ~91% of the loans, is akin to a managing general agent in the insurance industry. OppFi directly finances the other ~9%.

Approximately four-fifths of the decisions are automated, with applicants usually funded the following business day. The loans, which have no origination fee, are simple interest amortizing; thus, no balloon payment. The typical financing amount is ~$1,500 at an average term of 11 months with an annual percentage rate (APR) of ~150%. Although usurious, it is advertised as cheaper than other predatory lending products such as payday loans. The loan is reported to the three major rating agencies, permitting an opportunity for the borrower to improve his or her credit. Customers appear to love OppFi, giving the company a net promoter score of 85 and a 4.8 of 5.0 stars encompassing nearly 20,000 reviews.

Unit Economics

OppFi generates net income by receiving all or part of the interest paid on the loans minus those that are written off. The typical borrower refinances 1.5 times, creating zero-acquisition-cost loans for OppFi. From each of its nearly 800,000 unique customers, the company receives on average $1,657 of interest payments, of which 38% are written off. Approximately $200 is spent acquiring the customer and another $138 is needed to underwrite, originate, and service the loan. A further $92 is spent on interest to finance the loans it directly funds. That FY21 math leaves $604, for a contribution margin of 36%.

In addition to this offering, the company has entered more traditional financing products, introducing a high interest rate credit card – a graduation product for successful borrowers – as well as Salary Tap, a payroll deduction secured installment loan, in 2021.

Stock Performance Since IPO

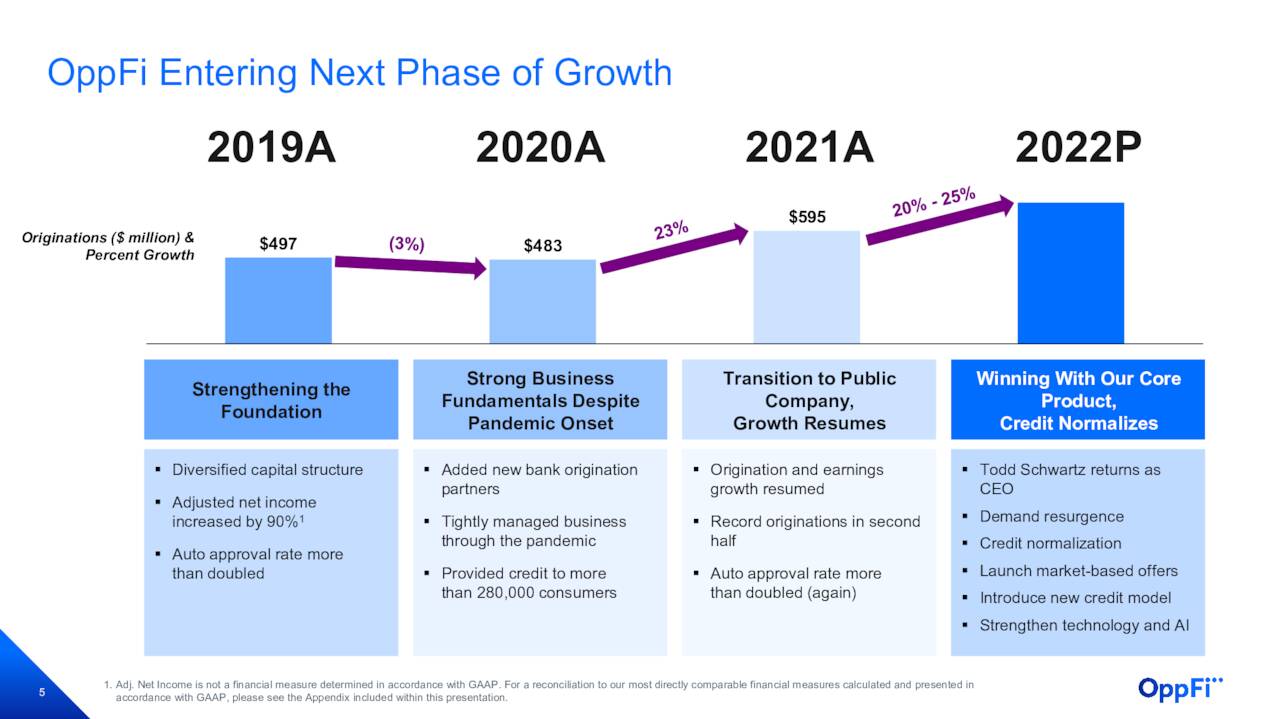

On its roadshow, OppFi attempted to sell itself not only a sub-prime fintech disruptor, but also as the only profitable SPAC-birthed company that was growing its top line at a CAGR of 50+% FY18-FY20 – metrics worthy of high PE and price-to-sales multiples. However, as with most SPACs, it’s been a case of overpromise and underdeliver. On its road show, it projected FY21 revenue growth of 29% to $418 million, but ended up delivering $350.6 million. Further down the income statement, old management apparently did not foresee a normalizing of credit – the extent of which will be discussed shortly – blaming underperformance on exogenous factors such as the Delta variant. Not surprisingly, its stock has tanked 67% from its opening trade, creating a shakeup in the C-suite with a new CFO and the return of the company’s founder (Todd Schwartz) as CEO.

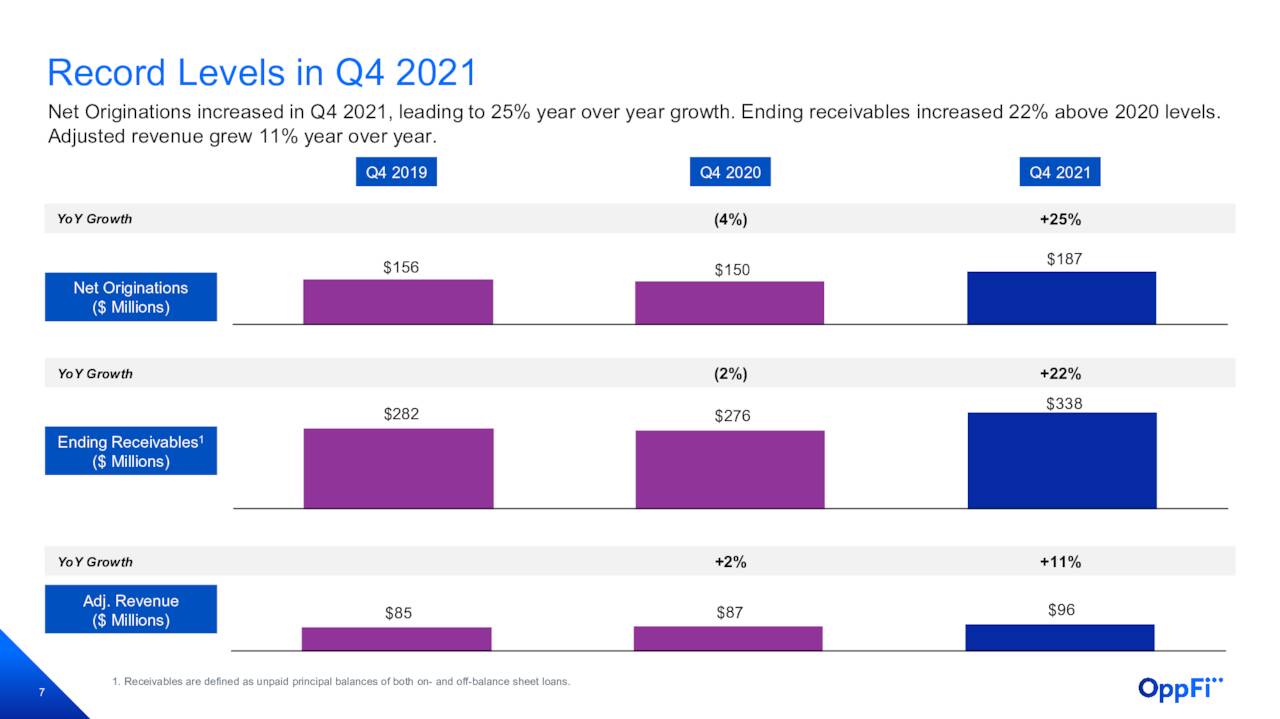

4Q21 Earnings & Outlook

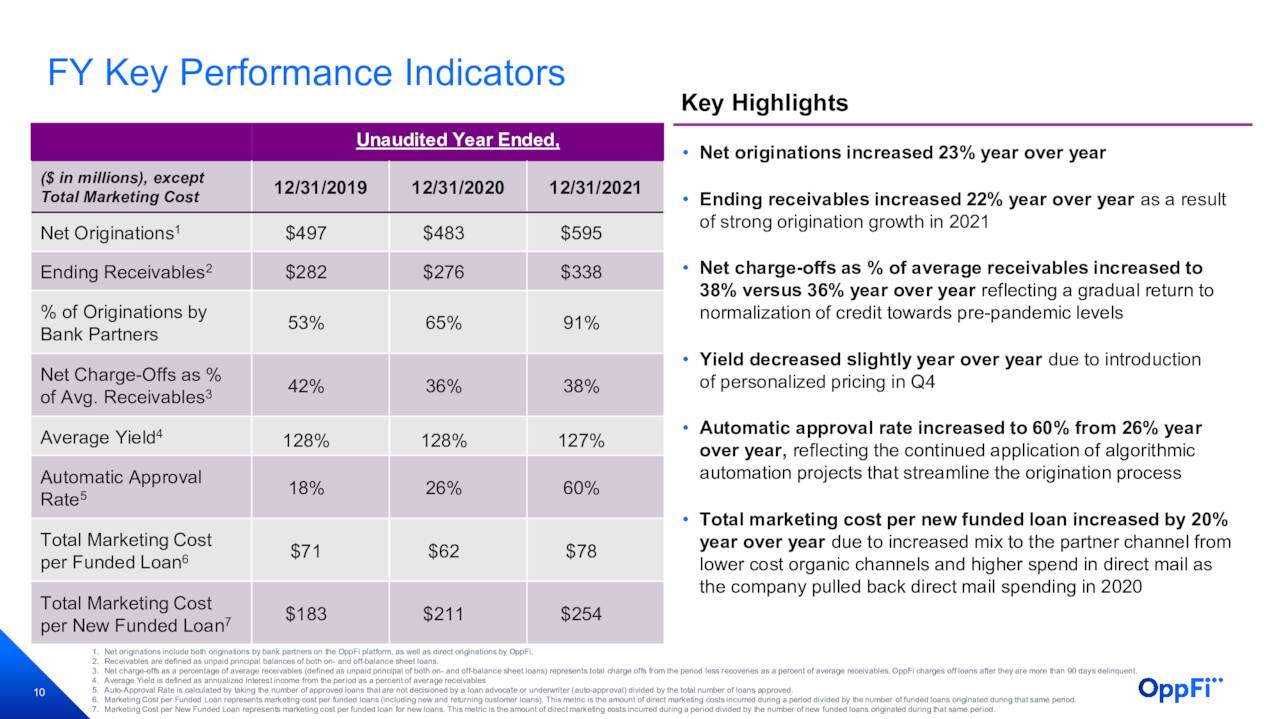

The disappointing revisions continued as part of OppFi’s 4Q21 earnings report and conference call, conducted on March 10, 2022. The company earned net income of $11.4 million (non-GAAP), or $0.13 a share, and Adj. EBITDA of $20.4 million on revenue of $96.0 million versus non-GAAP net income of $21.1 million and Adj. EBITDA of $34.7 million on revenue (adjusted to reflect only interest and loan related income) of $86.5 million in 4Q20, representing declines of 46% and 41% and a gain of 11%, respectively. Year-over-year per share comparisons are not applicable due to OppFi not being publicly traded in 2020. However, the $0.13 a share post missed Street expectations by $0.02 and revenue was $4 million shy.

OPFI – 4th QTR Performance Indicators (March Company Presentation)

For FY21, the company earned net income of $65.8 million ($1.93 a share, non-GAAP) and Adj. EBITDA of $116.9 million on the aforementioned revenue of $350.6 million as compared to non-GAAP net income of $55.2 million and Adj. EBITDA of $101.2 million on revenue of $291.0 million, representing gains of 19%, 16%, and 20%, respectively.

OPFI – 4th Quarter Highlights (March Company Presentation)

With the new management team came a revised set of projections. Based on the midpoints of ranges, OppFi now expects to generate non-GAAP earnings of $0.39 a share and Adj. EBITDA of $96.6 million on revenue of $429.4 million in FY22. These forecasts are versus $0.80 a share (non-GAAP) and Adj. EBITDA of $182 million on revenue of $656 million made approximately nine short months ago. OppFi is Exhibit A as to why sentiment is so negative towards SPAC-birthed IPOs. With that said, the shot of sobriety and the return of the company’s largest shareholder as CEO provided the stock with a boost, rebounding 38% to $4.19 over the subsequent six trading sessions before resuming its slide back to the low-$3 area.

OPFI – Growth History/Projections (March Company Presentation)

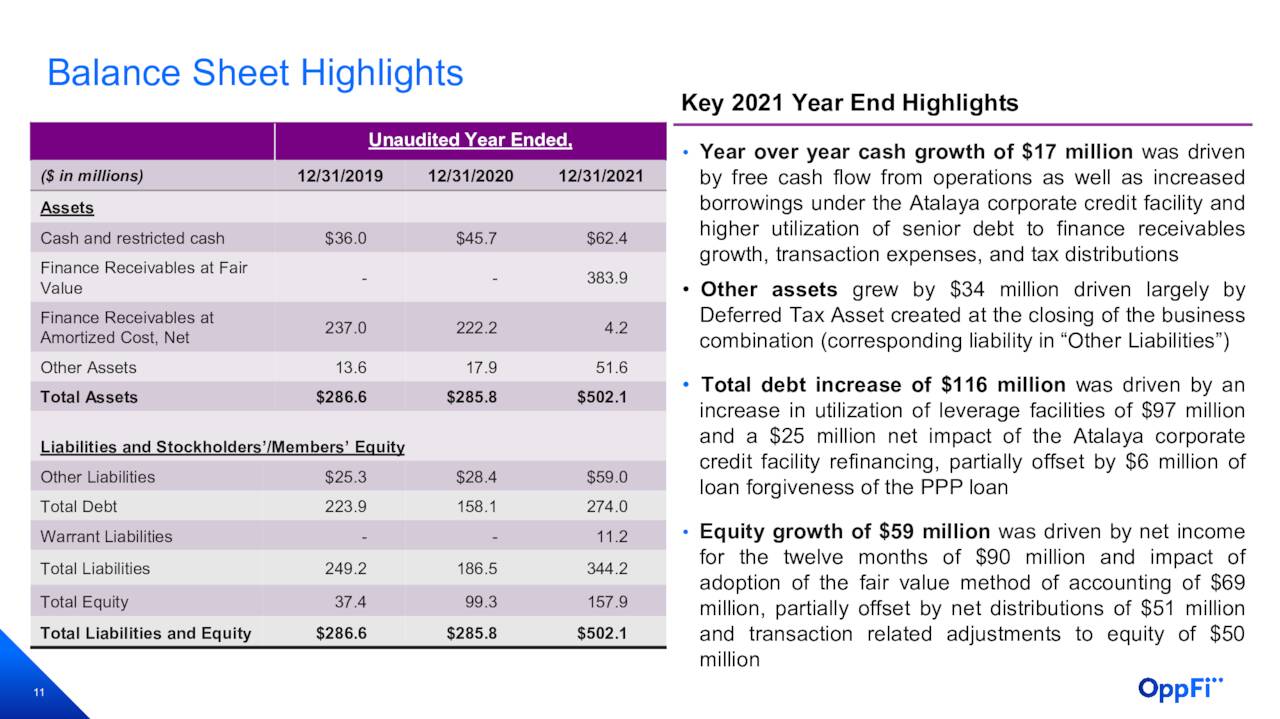

Balance Sheet & Analyst Commentary

Also contributing to the optimism was the board’s announcement of a $20 million share repurchase program concurrent to its earnings announcement. As of December 31, 2021, OppFi held cash of $62 million and total funding capacity of $473 million versus debt of $274 million.

OPFI – Balance Sheet Highlights (March Company Presentation)

Street analysts, with the exception of Piper Sandler, bought what OppFi was selling during its road show and have clung to those recommendations, albeit with revised price objectives. Collectively, the prognosticators have three buy and one outperform rating versus Piper’s hold and a median price target of $7. They expect the company to earn $0.43 a share on revenue of $384.4 million – curiously, far lower than management’s estimate – followed by $0.77 a share on revenue of $463.7 million in FY23.

Verdict

The return of the company’s largest shareholder as CEO will provide a patina of credibility to OppFi. But, at the end of the day and fintech trappings notwithstanding, it is still a sub-prime lender, competing with traditional, non-bank, and buy-now-pay-later platforms. That vertical rarely receives (or is worthy due to the inherent risks) of nosebleed PE and/or price-to-sale valuations.

That said, trading at south of .9 times management-projected price-to-FY22E sales and a forward PE of under 9 (again, management projections), shares of OPFI are nearing an attractive entry level, especially if one believes the Street’s FY23 consensus estimate of $0.77 a share, which represents a doubling of earnings over management’s FY22 projection ($0.39 a share). A retest of the $3 level – the all-time low in OPFI shares is $2.98 – is a decent entry point for a small “watch item: holding in this name until new management shows signs of delivering on its projections.

Poverty is the parent of revolution and crime.― Aristotle

Bret Jensen is the Founder of and authors articles for the Biotech Forum, Busted IPO Forum, and Insiders Forum

Be the first to comment