Travel Wild

Since my initial article on OneWater Marine (NASDAQ:ONEW), the company has reported two great quarters. In the latest Q3 earnings, same store sales increased 12%, revenue grew 40% from Q3 2021 to $595 MM, and EBITDA increased 45% from prior year to $95MM. Despite these two outstanding quarters, the share price has remained mostly flat. It currently sits at $32.23, a decline of 6.7% since my previous article was published. While there are macro risks that have led to ONEW’s -44% YTD share price decline, they have continued to grow revenue and EPS. Let’s dive into ONEW and see why I lean to a buy on this stock.

OneWater – Business Strategy

I like boats, I even own one, but I’m far from bullish on boats. Even though the boating market is currently strong, it is OneWater’s strong business model that has me interested. While I covered these ideas in more detail in my original article, I’ll hit some of my favorite parts of ONEW:

- They operate in a fragmented market. The boating retail industry is primarily small mom-and-pop locations, meaning they have few large competitors.

- They have a size advantage. Since most competitors are small, their size allows better manufacturer relations and ability to provide products like financing.

- They have a great M&A strategy. They want to help consolidate this fragmented market by being the buyer of choice for the mom-and-pop locations looking to sell, allowing ONEW to be picky about who they choose to acquire.

- They keep the acquired brand. They are not building a national brand. When they acquire a store, they keep the employees and maintain the local brand.

- They smartly leverage technology. Acquired locations are integrated into ONEW’s inventory system allowing them to share inventory with all locations allowing stores to better serve customers while carrying less local inventory.

- They are preparing for the cyclical nature of their industry. Management has many years of experience and know during economic declines boat sales decline while parts and service increase. They have made several acquisitions to grow this higher margin part of the business including T-H Marine, JIF Marine, and Ocean Bio-Chem.

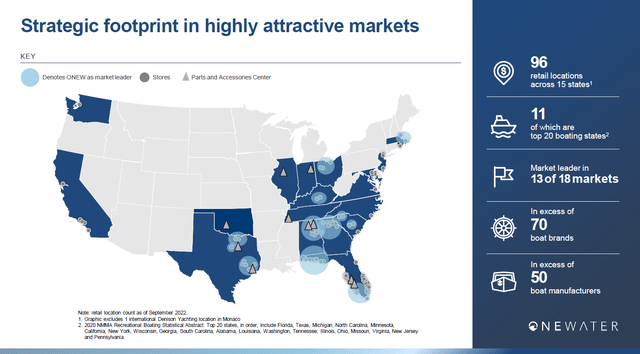

OneWater Retail Locations (ONEW Investor Presentation September 2022)

For investors, I believe their business strategy can lead to great long-term potential as they consolidate a fragmented market with a win-win strategy. For the mom-and-pop stores, owners looking to improve their business or retire can sell their business to a company who will keep their employees and the brand they have built. For OneWater, they can be picky about who the acquire, select the best locations that fit their portfolio, and can drive increased profitability out of the acquired locations through their technology and management.

. . . [inaudible] is a huge dealership that’s never had enough inventory. They haven’t had enough inventory for the last 3 to 5 years with certain brands. And now they can pull from the global inventory that we have. So, you can look at Grady or Pursuit. They can sell more bigger Grady-Whites, more bigger Pursuits than they have been able to in the past because we have more allocation because of the total network. And so let’s say we’re supposed to get a big Grady-White up in Ohio, well, if we can sell it in Florida beforehand, they’ll take that production spot” – Austin Singleton, Q2 Earnings Call

Boating Industry – Stronger than Ever

In the US we have a hot job market combined with high inflation, rising interest rates, high energy prices, supply chain challenges, war in Ukraine, and declining consumer sentiment. While shares of many companies, including ONEW, have been punished because of these risks, the boating industry seems to be ignoring the news.

While big-ticket consumer discretionary has been left behind by investors, somebody forgot to tell the boat industry,” Citi analyst James Hardiman wrote in a new note to clients. “Our channel checks of more than 30 North American boat dealers suggest an acceleration in sales and other leading indicators as weather improved during the month of May. – Source

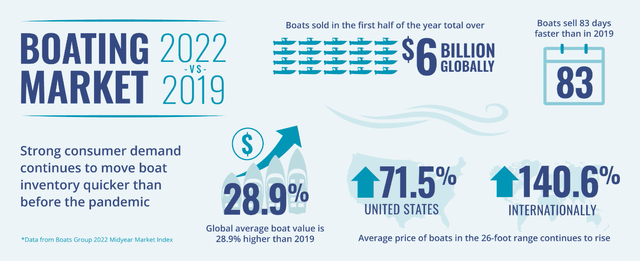

Boating Market 2019 vs 2022 (Boats Group Market Report)

Source: Boats Group – Boating Market Report

Austin Singleton, CEO of OneWater, mentions several drivers of these trends including people moving to or near water, buying a second home near the water, and manufacturers coming out with new, innovative products. Additionally, the industry is experiencing supply chain issues that are creating shortages contributing to higher prices of new and used boats. Since 2019, the global average boat cost has increased 28.9% to $182,900. For further comparison, MarineMax’s (HZO) average selling price for a new boat was $227,000 in FY21 and ONEW’s was $160,000 for FY21.

There is 1 million used boats a year that change hands and the majority of it is person to person. And what we are working feverishly trying to get in the middle of that. – Anthony Aisquith, Q2 Earnings Call

Manufacturers are also helping to drive the market with new products. Since used boats have retained more of their value, boat owners are able to sell their boats and purchase an upgraded product. In a Boat Trader survey of those selling their boats, 4% were doing so for economic uncertainty, 3% because of higher gas prices, while 39% were selling to upgrade their boat.

For investors, this hot market should be a great place to invest, but the market has not been rewarding discretionary stocks. For many cyclical stocks, there are real reasons to be concerned that future demand will be impacted from inflation and rising rates. These are risks that investors should consider, so let’s discuss them for OneWater

Risk for OneWater

Beside the potential for the US to enter a recession, there are three risks for ONEW that I would like to discuss in more detail. They are high inflation, rising interest rates, and supply chain challenges.

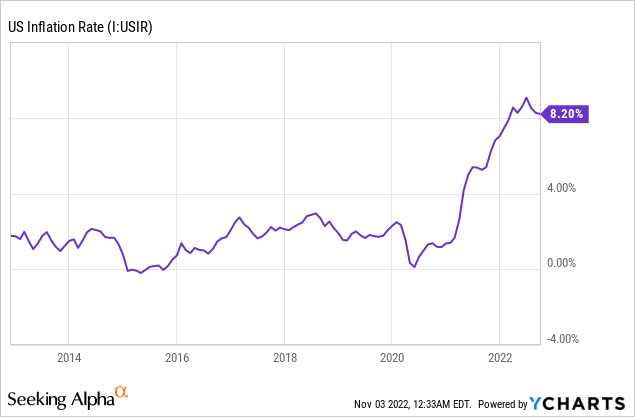

High Inflation

Inflation is impacting everyone, but there is evidence it impacts lower income families more. You can think of this in terms of marginal utility. If you give a family making $40k an extra dollar, they will likely spend it, but giving that extra dollar to someone making $1 MM and they will likely save most of it. We’ve also seen where higher income families saved more money during the pandemic.

This idea is important when we talk about boats, not only because they are expensive, but because OneWater sells expensive boats. We’ve seen that both MarineMax and OneWater’s average boat selling price is over $160,000. These expensive vessels are also often attached to other expensive purchases such as a marina slip or a tow vehicle.

So far, this has been a long way of saying people who buy boats from ONEW have high incomes or net worths, meaning inflation would have to be high enough to drive them away from purchasing a boat. As we’ll see in the next, I don’t think inflation itself will be the main risk as we have already seen a dramatic rise in boat prices and demand still remains elevated.

Rising Interest Rates

Interest rates have been increasing as the fed tries to combat the previously discussed high inflation. Let’s see what Anthony Aisquith, President and COO, has to say about rising interest rates:

We continue to fight to get people to finance. And so it has zero effect on us at this point. – Q2 Earnings Call

Since ONEW has had to operate with higher interest rates on financing, even when many other rates were low, they are not seeing much change from rising rates. Their customers also do not seem to need financing. We can hear this message right from Austin Singleton during their Q2 Earnings Call:

It’s not something the majority of our customers come in planning on writing a check and its conversion that we really had to work on. . . The rates haven’t moved significantly. One of the things I’ll point out that as rates continue to go down, boat financing rates did not. They kind of hung out in that low-5s, mid-4s to low-5s. And so they haven’t seen the increase as fast as or as quick as like mortgage rates, but anything is better than that on the day-to-day, especially over the last couple of weeks.

Supply Chain Challenges

Supply chains are challenging many industries including boating. MasterCraft (MCFT) said “our growth in net sales and earnings were constrained due to supply chain disruptions and labor challenges associated with COVID” during their Q4 2022 Earnings Call. Brunswick (BC) expects their inventory to remain thousands of units below historical averages and Marine Products (MPX) said inventories are historically low and demand continues to be high. Malibu Boats (MBUU) is predicting supply issues could extend into 2024 during their latest call:

We and other marine experts continue to believe that channel inventories will not reach normal levels until the end of calendar 2023 or the beginning of calendar 2024. This provides us with a great ramp-up opportunity despite any macroeconomic conditions that may exist.” – Malibu Boats Q4 2022 Earnings Call

For OneWater, they have been able to leverage their size and manufacturer relations to get allocated more supply. With their inventory technology, they are also matching customers to products across all their retail locations. The high demand and supply chain issues are leading ONEW to having elevated presold inventories, customer deposits at levels higher than prior years, and new products from manufacturers selling out into 2024.

We do not see inventory returning to a new normal for 24 months with the current demand. Growth during a time when OneWater and the industry are at record low levels of inventory is a testament to the dedication of our team and the resilience of our business model. – Austin Singleton, Q3 Earnings Call

For investors, these risks are concerning, but ONEW has a lot of advantages to navigate these challenges including their size, technology, and management’s expertise. I believe in the current environment they will continue to grow and the major risk being an overall decline or recession in the US economy. Since this risk is uncertain, we could also see ONEW’s share price continue to be held down due to fears of the cyclical nature of this business.

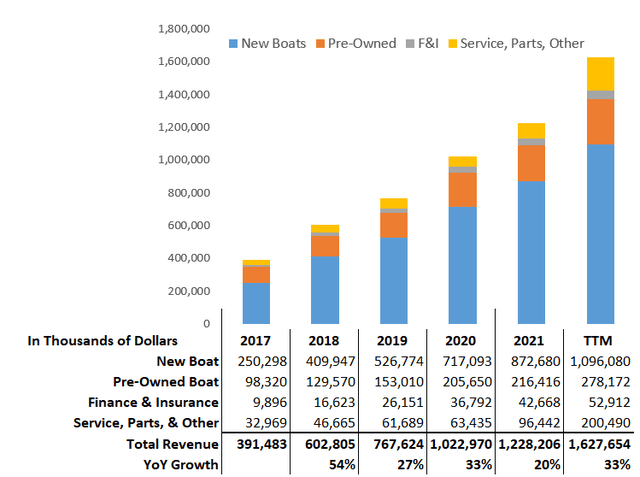

Financials and Growth

Through organic growth, acquisitions, and adding new products, OneWater has been continually growing revenue more than 20% YoY since before the pandemic. Management has also worked to grow parts and service revenue due to its higher margin and better resiliency during economic slowdowns. In the chart below we see Parts and Service grew from ~8% of revenue in 2017 to 12% of revenue in the latest TTM numbers. While only 12% of the revenue, these products and services deliver 18% of the grow profit due to their higher margin.

Yearly Revenue (Author’s Chart using 10-K / 10-Q Data)

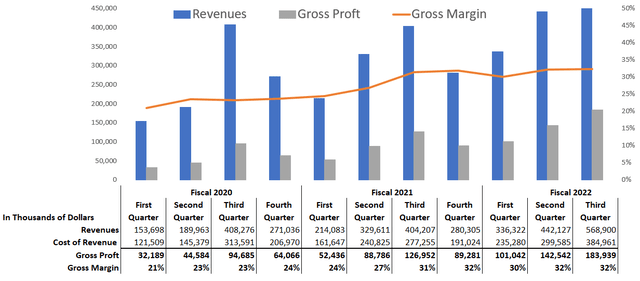

If we look at quarterly data, we can see the yearly cycle in revenue due to seasonal changes in boating activities. With the supply chain shortages and large amount of pre-sold inventory, there is potential we will see less cycles over the next few quarters. Additionally, gross margin has expanded since the start of COVID due to demand and supply chain issues. Note that Q1 2020 ending December 31, 2019 and Q2 2020 ending March 21, 2020 are mostly pre-covid numbers.

Quarterly Revenue (Author’s Chart using 10-K / 10-Q Data)

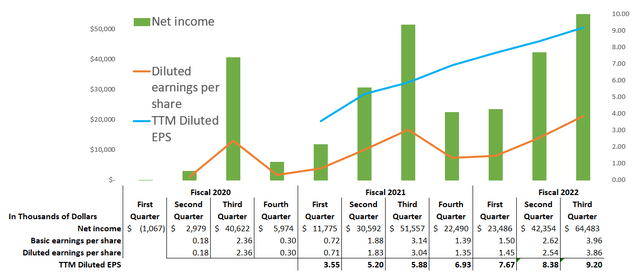

Lastly, we can look at Net Income and EPS. With the increase revenue and margin, ONEW has been able to grow diluted EPS despite the diluted share count also increasing, which will be discussed in the following section. OneWater is guiding to an EPS of $9.20 to $9.60 for FY 2022 with the mid-point being only 2% above the current TTM Diluted EPS number.

Net Income and EPS (Author’s Chart using 10-K / 10-Q Data)

For investors, this growth look great but this is a cyclical industry that can drastically shift if the economy enters a recession. For myself, I really like OneWater’s strategy of growing by consolidating a fragmented market. OneWater’s management team has many years of experience, including the 2008 financial crisis, so I believe a downturn could be a time for OneWater to continue to consolidate the industry.

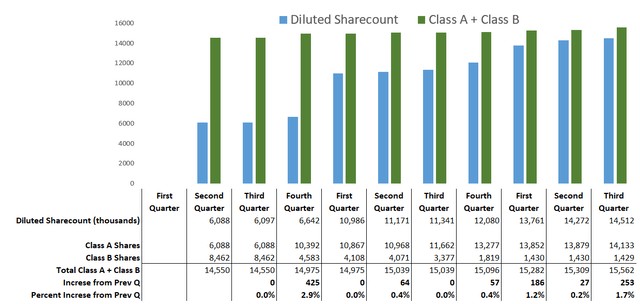

Dilution and Buybacks

As seen in the chart and table below, most of the increase in the diluted share count over the past few years continues to be conversion of Class B to Class A shares. While there has been some dilution related to acquisitions, ONEW has previously announced a $50 MM share repurchase program, which represents around 1.4 MM shares at a share price of $35 per share, or ~9% of the Total Class A and Class B shares outstanding.

Management has not taken advantage of this buyback program, though. As explained during the Q3 earnings call, after the announcement they entered into a blackout period until the next earnings release. During this blackout they started to pursue the acquisition of Ocean Bio-Chem, which prevented the blackout from lifting. They remain committed to the buyback, but will compare buyback to further acquisitions:

But I think that we are not going to lower our cadence on the acquisitions. They are just too accretive. But we are also going to be mindful of what the return is on the stock repurchase dependent on when the time is right to do that. – Austin Singleton, Q3 Earnings Call

OneWater Share Count (Author’s Chart using 10-K / 10-Q Data)

Management looking at returns before the allocate capital to an acquisitions vs. buyback should make investors more confident in ONEW’s leadership. Additionally, the buyback would hopefully help create a floor for ONEW’s stock, as if the market punishes the share price too much, then management can take advantage of the situation to pull in their share count, further boosting EPS and your ownership percentage.

Valuation

After OneWater’s Q3 report, they now have a TTM EPS of $9.20 and have guided to an EPS of $9.20 to $9.60 for FY22. Using the mid-point of the guidance of $9.40 and their current share price of $32.23, this is guiding to a P/E ratio of 3.42 for FY 2022. MarineMax, one of ONEW’s closest competitors, continues to also trade at a low Fwd. P/E ratio of 4.26. If this P/E is applied to OneWater, this would represent a share price of $40.04, or a 24% increase in share price.

The boating industry is certainly cyclical, but even if EPS drops back to Q1 2022 levels of $3.55, then ONEW still trades barely over a 9 P/E. Compared to that time, OneWater owns more retail locations and has continued to expand their parts and services. We also need to remember the buyback program that could scoop up shares should prices decline.

Conclusion

The market continues to punish discretionary stocks like OneWater Marine, and it is certainly understandable as the world has a long list of risks, including some that could drastically affect the economy. OneWater is a well-managed company that is preparing to take on the cyclical nature of its industry. They have drastically expanded their parts and services offering, which offers higher margin products that are more resilient to ships compared to new and used boat sales. I currently have a position in OneWater and will be adding more on continued dips in the share price.

And as always, use my article only as a starting point for your own research. I am not an investment advisor, and this article is not investment advice. Please do your own research before any investment decisions.

Be the first to comment