mikkelwilliam

By Rob Isbitts

Fidelity® Nasdaq Composite Index ETF (NASDAQ:ONEQ) is the subject of this article, more because of what it represents than because of any particular statistics or traditional analysis associated with it. This ETF is one of several Nasdaq-linked funds around. And this one really goes for it. As opposed to limiting itself to the 100 largest stocks in the Nasdaq Composite Index, it uses a “sampling” approach to own over 1,000 stocks. The sampling method essentially seeks to replicate the full Nasdaq Exchange, which contains over 3,500 companies.

Many investors know the Nasdaq today as a tech-heavy index, with a small number of giant, iconic companies acting as its headliners, sort of like at an entertainment event. And that is part of the reason I decided to break from our traditional ETF profile format to talk about ONEQ, the Nasdaq, and how they are the center of what I fear is throwing many investors off of their game this year.

And, for those who continue to be tempted by the fear of missing out on blast-off rallies like ONEQ and its peers had again last week, and who are in retirement or nearing it (say, within 10 years), let me remind you: this could be the 50-year flood for investors. It is not anything like what we have seen before. And to use another “liquidity” analogy, as Warren Buffett famously said, “when the tide goes out, you can see who was swimming naked.”

Why pick on the Nasdaq, the superhero of investors worldwide?

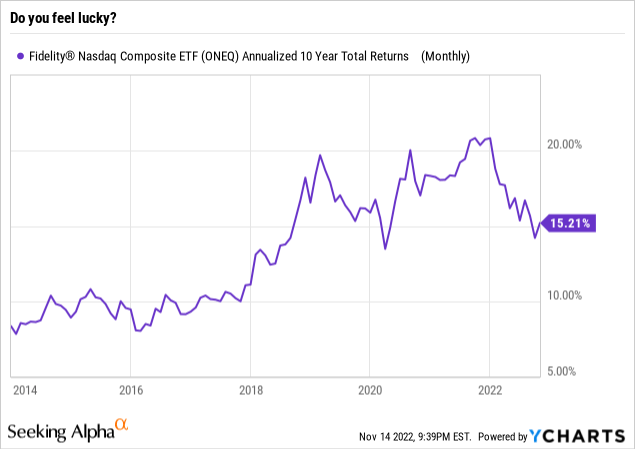

Because investing is not about blind belief in owning “great companies” regardless of how expensive they are. And that’s what has happened to the Nasdaq Composite. This graph gives you an idea why. When an investment, stock market-related or otherwise, produces 15-20% annualized returns the way ONEQ and its peers have, that will create some real love and admirers.

But this is the 50-year flood. And while anything can happen going forward, one of my simplest but most important observations from 36 years in professional investment management is this: any investment can go up in value at any time. The difference between investments is how much risk of major loss is attached to that reward potential. For the Nasdaq and ONEQ, after a decade of outsized returns, the intermediate-to-long-term technical picture, combined with that “love” factor, threatens investors in the worst way: it can make them believers, instead of investors.

I did some research and analysis this past weekend, in hopes of providing perspective to investors at a time when risk of making catastrophic decisions about their wealth is historically high. Not since the early 1970s, when the Nasdaq Stock Exchange was the new, baby cousin of the New York and American Stock Exchanges, have we had a market like this. Stocks are way down, credit bonds are way down, short-term bonds are way down, and only recently did anything “stable” yield much more than what they pay in advisory fees. Note that the 1-year U.S. Treasury Bill rate crossed 1% in early March, 2% in early May and 3% in early August, and sits at 4.75% now. That has changed the nature of taking risk in the stock market. Specifically, it has put a higher cost on those risks not working out. Because, as opposed to when the Nasdaq was ripping to those 20% annualized returns, short-term Treasury rates are now providing an oasis that has not existed in a long time. For many investors, this is the first time they have seen the number 4 at the head of a Treasury yield. They were more used to seeing it at the end, as in 0.04%.

Rising rates? Interest-sensitive stocks? What could possibly go wrong?

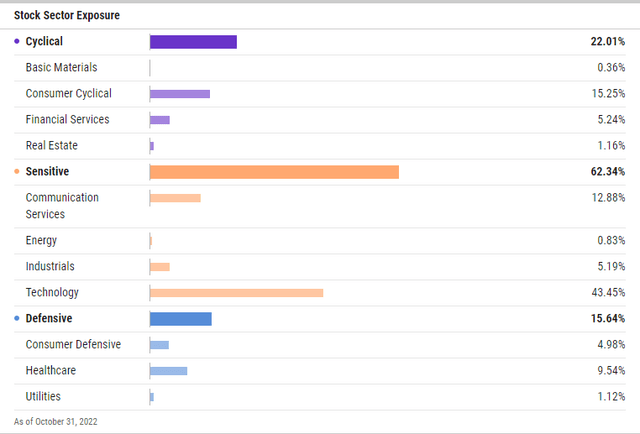

ONEQ Sector Exposure (YCharts)

A glance at the super-sector exposure of ONEQ shows that the four major economic sectors which are most sensitive to interest rates (Technology, Communication Services, Industrials, and Energy) make up over 60% of this ETF, and thus of the Nasdaq Composite. Add in another 15% for Consumer Cyclical on the verge of a likely recession, and you have a toxic brew for those who blindly assume that the past will be prologue for the “Naz.”

Again, I do not aim to speak in certainties here. All any of us can do is size up the odds, allocate sensibly, and not fall in love with what we own, no matter how long we’ve seen it perform magic with our investment portfolio. I would have thought that after seeing ETFs like ONEQ drop one-third of its value as casually as a motorist throws their junk food lunch out of their car window on a highway (please don’t!), this would be a call to action for Nasdaq lovers. My hope was at least that they would self-downgrade to Nasdaq likers, and recognize that there are a bunch of other places in the U.S. and global equity markets where strong potential returns are possible. Furthermore, in the years ahead, I see potential for 2000-2003 redux, whereby the “stock market” continues to flood slowly, like a boat taking on water drop by drop. That period was characterized by three years of Nasdaq misery, but some sectors spend the first half of that period generating some nice returns.

Bottom line: I see the potential for the Nasdaq to continue to dramatically underperform other parts of the stock market. In particular, sectors like Basic Materials, Energy, and some Industrial stocks, among others, look less like the “leaning tower of uh-oh” than ONEQ and its Nasdaq-driven brethren.

Bottom-Fishers: Know your history before you dive back in

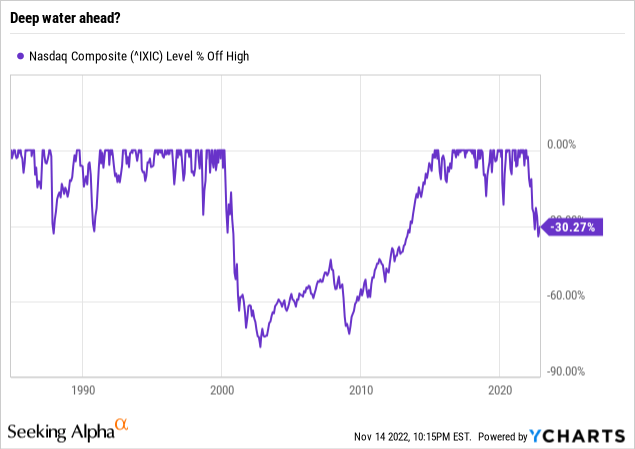

Above, you see the Nasdaq Composite going back to the 1980s. This chart essentially covers my own investing career, having debuted in the industry in 1986. So, you might say I haven’t seen it all, but I’ve seen a lot. And if there’s any useful role that tenured Wall Street can play in today’s manic stock market environment, it is this: making investors aware of what is possible, not just guesstimating what will happen next.

So, look at that picture. The Nasdaq Composite has had several 30% declines from its all-time high. Sometimes, that’s where it ends. Other times, as in the last two significant bear markets before this one, the ultimate decline was more than double that. Bull markets become bear markets, but bear markets don’t typically end when there is a chorus of “buy the dip” and “this is the bottom” as is the case in many parts of the investment business currently.

ONEQ: Sell-rated

Bear markets end when no one wants to even hear about the stock market anymore. That was 2003 and 2009. So far, I don’t think 2022 fits that description. So, ONEQ is a Sell from me, over the intermediate term. How long is that? When the love ends, the “pain” (Jerome Powell’s word) has been experienced, and the flood of market circumstances not seen in 50 years resolves itself.

Be the first to comment