LilliDay

Thesis

ONEOK, Inc. (NYSE:OKE) is a leading natural gas midstream operator in three critical segments. Its most profitable segment is its pipeline segment, while its NGL segment is the primary driver of its adjusted EBITDA. It also has a gathering and processing (G&P) segment that has underpinned its recovery.

OKE has also leveraged the recovery in the natural gas market, even though it’s less susceptible to underlying prices. As a result, its long-term contracts provide robust visibility into its profitability, helping the company to maintain a high dividend payout ratio.

Notwithstanding, OKE is not immune to the coming recession or underlying volatility in the energy markets. Therefore, it’s still important for investors to assess whether ONEOK can sustain its operating leverage through the cycle.

Our assessment suggests that the market has de-rated OKE since its April highs, anticipating a slowdown in utilization and commodity price decline. Therefore, we deduce that OKE’s valuation seems pretty well-balanced now. It’s also likely at a near-term bottom, so investors could see a short-term rally moving ahead.

However, we would like to see further digestion in its valuation, given the coming recession. Furthermore, while its dividend yield is attractive, its high payout ratio suggests that the company could find it more challenging to raise them much further through the cycle.

We rate OKE as a Hold for now, even though we expect a short-term rally to ensue.

OKE Has Been De-rated

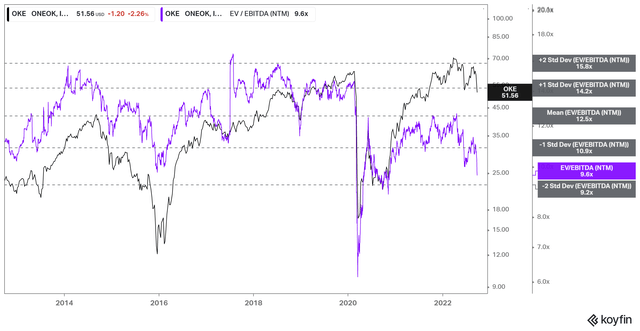

OKE NTM EBITDA multiples valuation trend (koyfin)

OKE has struggled to regain its upward momentum since its highs in 2022, as its NTM EBITDA multiples were rejected at its 10Y mean. Therefore, we parsed that the market has likely de-rated OKE in anticipation of a slower profitability growth cadence moving ahead.

Furthermore, the recent pullback from its August highs sent OKE spiraling down from the one standard deviation zone under its 10Y mean. Therefore, we believe the market is attempting to model the appropriate earnings multiples for OKE against the coming recession.

We believe the market’s adjustment could result in further downside volatility, sending OKE below the two standard deviation zones under its 10Y mean.

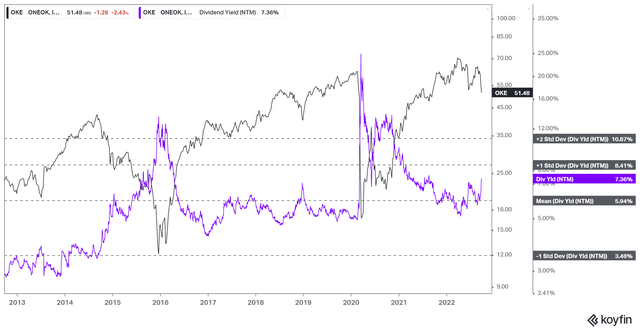

OKE NTM Dividend yield % valuation trend (koyfin)

Furthermore, OKE’s NTM dividend yields remain well below the levels observed in its significant market bottoms in 2016 and 2020. Hence, we postulate that OKE’s dividend yields may not offer adequate valuation support to mitigate the worsening macro headwinds.

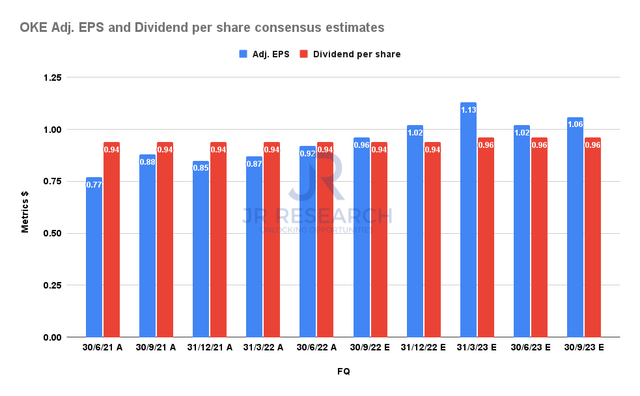

ONEOK Adjusted EPS and Dividend per share consensus estimates (S&P Cap IQ)

Moreover, ONEOK’s high payout ratio could impede the company’s ability to improve its dividends markedly through the cycle to underpin its valuation. Accordingly, we aren’t convinced that the market has de-risked OKE’s valuations sufficiently, even though it has already lost all its YTD gains (including dividends).

But, We Don’t See A Collapse Back To COVID Lows

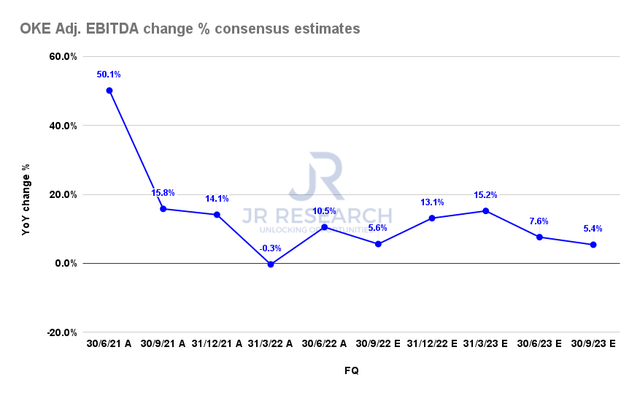

ONEOK Adjusted EBITDA change % consensus estimates (S&P Cap IQ)

The consensus estimates (bullish) suggest that ONEOK’s adjusted EBTIDA profitability should remain stable through the cycle. Therefore, it should assure investors that ONEOK’s operating metrics should perform better than its less-hedged peers more exposed to the underlying energy prices volatility.

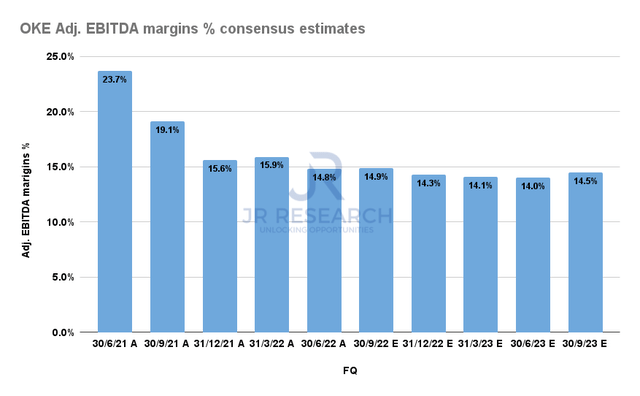

ONEOK Adjusted EBITDA margins % consensus estimates (S&P Cap IQ)

Accordingly, its adjusted EBITDA margins are expected to remain robust through FY23, providing tremendous visibility to its dividend payouts. Therefore, we assessed that the market would unlikely send OKE back to its March 2020 lows.

Is OKE Stock A Buy, Sell, Or Hold?

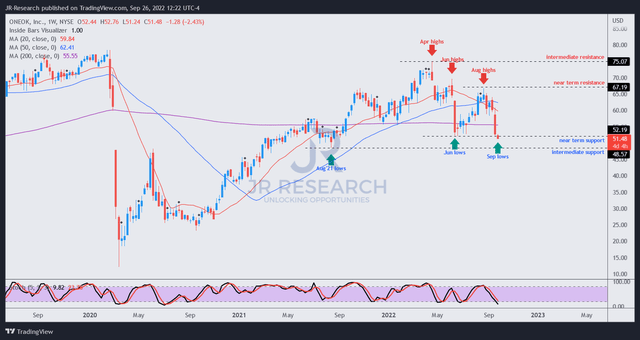

OKE price chart (weekly) (TradingView)

OKE has likely lost its medium-term bullish bias as the market rejected further buying upside from its August highs. Therefore, it’s critical for OKE to stage a bullish reversal at the current levels.

We gleaned that OKE is re-testing its June bottom. Coupled with oversold momentum indicators, OKE could stage a short-term rally from here. However, we don’t expect OKE to retake its near-term resistance with the coming recession and a relatively well-balanced valuation.

Therefore, we deduce that OKE’s valuation needs to be further de-risked. Accordingly, a subsequent re-test of its intermediate support cannot be ruled out, which should proffer clues on its medium-term directional bias.

Hence, we encourage investors to stay on the sidelines for now and rate OKE as a Hold.

Be the first to comment