da-kuk

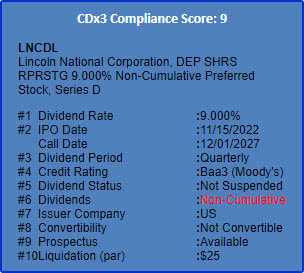

New offering summary:

CDX3Investor.com

State of the preferred stock market

Extreme conditions in the preferred stock market continued in November with US-traded preferred stocks overall trading at an average discount to par value of 16% and an average current yield of 8.16%. With previous issues trading at such discounts, we saw just one single new offering alert here at CDx3 during the month, for $500 million worth of new non-cumulative preferred shares issued by Lincoln National (LNC), rated Baa3 (Moody’s) / BBB- (S&P) / BBB- (Fitch) and offered at a whopping 9% dividend rate – just a year ago a similar-rated preferred might have only needed to offer half that rate.

SEC filing: LNCDL

Indeed, looking back at our November 2021 article, First Republic Bank (FRC) had priced an offering that month of $650 million worth of new non-cumulative preferred stock, offering a fixed dividend rate of 4.5% and rated Baa3 by Moody’s and BBB- by Standard and Poor’s. When new issues here in November 2022 are offering twice the dividend rate similar issues in November 2021 had offered, it is no wonder the previously-issued securities are now trading at such discounts; FRC-N today changes hands a hair above $18, or about 72% of the price investors paid a year ago.

Further illustrating the current state of the preferred stock market, past offerings of the highest quality preferreds with CDx3 Compliance Score rankings of 10 out of 10 currently trade at an 8.2% discount to par and offer a current yield of 6.26% — a month-over-month improvement however compared to last month’s 12.6% discount to par and 6.56% yield.

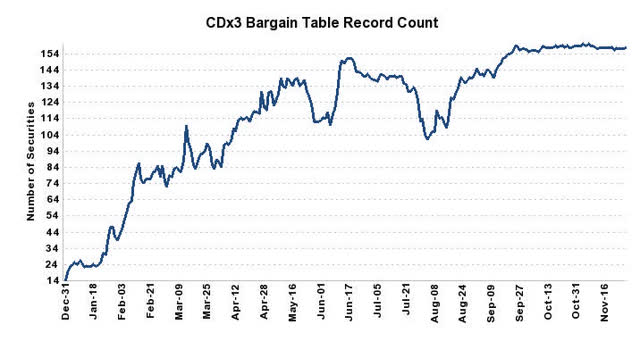

Our internal CDx3 “bargain table” count remains near all-time-high levels since we began tracking the metric in 2015, at a current 158. Here is a YTD chart of our bargain table count:

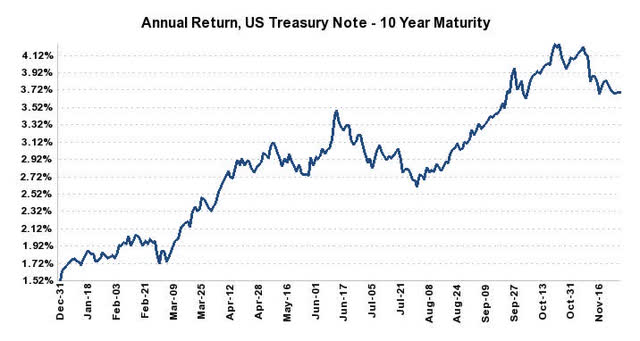

The main driver of these movements in preferred stocks continues to be the increasing “risk-free” rate of return offered by US treasuries, with longer duration government-backed bond yields moving considerably higher throughout the year; as we got towards the end of October and entered November, 30 year Treasury bonds could be purchased to yield 4.2-4.4% and 10 year Treasury bonds could be purchased to yield 4.1-4.25%. When long-duration government-backed bonds can be bought with yields in the 4’s, is it any wonder why a corporate-backed preferred stock issued in the 4’s a year ago now needs to trade at a discount? Below is a year-to-date chart of the 10-year US treasury yield:

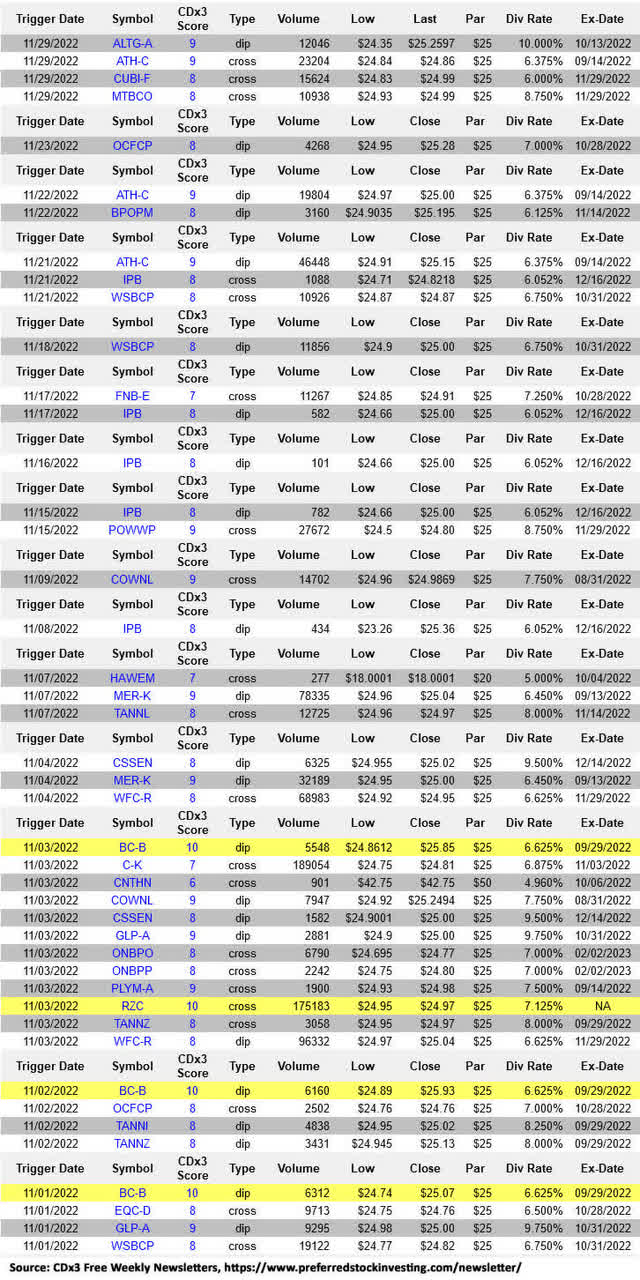

Past preferred stock IPOs below par

In addition to covering new preferred stock and ETD offerings, here at CDx3 Notification Service we also track past offerings, with alerts when securities fall below their par values. Here are some of the recent dips/crosses below par we observed:

Note: Any yellow highlighted entries indicate eligibility for the “CDx3 Bargain Table.”

Until Next Time…

Here at CDx3, our typical articles will provide month-end preferred stock (and ETD) IPO summaries, plus a look at selected past preferred stock IPOs that are now trading below par. Whether you are the kind of investor who sticks with preferred stocks with a CDx3 Compliance Score rated 10 out of 10, or whether your portfolio has room for 9-score-and-lower securities, stay tuned for future articles recapping new IPOs and interesting preferred stock activity that we notice. Thanks for reading!

Be the first to comment