Ron and Patty Thomas

Investment thesis

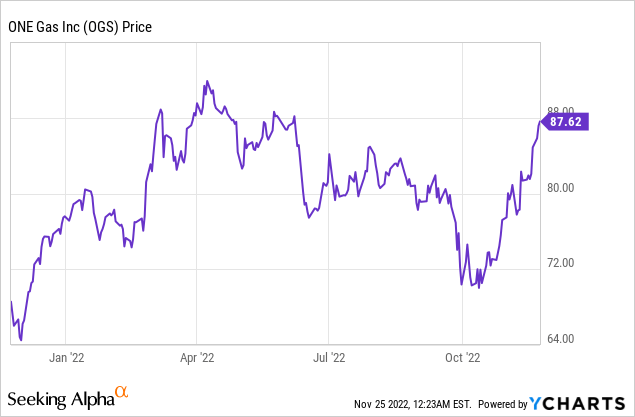

As a result of rising demand and surging prices, the gas business is thriving right now. Since a decrease in gas prices is not happening soon, companies in the industry may look forward to maintaining their abnormally high-profit margins. The conflict between Russia and Ukraine, which led to sanctions on Russia, caused a supply shortage in the market. The share price of ONE Gas, Inc. (NYSE:OGS) fell sharply in 2021, despite the company’s high revenues and increasing demand for gas. The share price decline is attributable to the winter storm Uri, which damaged the U.S. gas supply business.

However, things are looking up for the firm. Over the previous year, OGS has gained over 28% in share price and outperformed the market with a margin of more than 42%. I attribute this performance to the company’s adaptability after the Uri storm.

Amidst continuing storm-related challenges, the corporation has stuck to its dividend-growth track record. Therefore, I recommend it to investors seeking a dividend-increasing company in this rising sector. I am bullish on ONE Gas stock, given the growing demand for gas products and the high profits from soaring gas prices.

The Winter Storm Uri

In February 2021, Winter Storm Uri affected natural gas supply, market pricing, and demand in the U.S., especially in Oklahoma, Kansas, and Texas. Oklahoma, Kansas, and Texas each declared a state of emergency, and regulatory authorities issued emergency measures affecting the utility and natural gas businesses. Due to this winter’s historic nature, the corporation suffered unforeseen and unprecedented gas market pricing in Oklahoma, Kansas, and Texas, resulting in $2.1 billion in natural gas purchases for February 2021 to keep providing the product to their customers.

Weathering the storm

The storm affected the U.S. gas supply; thus, OGS had to adapt. The corporation needed funds to buy the product and sell it to clients. They used a few techniques that I’ll mention below. To ensure they had enough cash to meet their commitments (supply to their customers) in the wake of Winter Storm Uri, on February 22, 2021, OGS signed into the ONE Gas 2021 Term Loan Facility to finance their natural gas purchases.

In March 2021, OGS issued $1 billion in 0.85% senior notes due 2023, $700 million in 1.10% senior notes due 2024, and $800 million in floating-rate senior notes due 2023. The floating-rate senior notes pay a three-month LIBOR plus 61 basis points per year, reset quarterly (2.35 percent on June 30, 2022). The net proceeds were crucial in Winter Storm Uri-related gas purchases and general corporate reasons. The net proceeds of the March 2021 debt offering reduced the ONE Gas 2021 Term Loan Facility commitments dollar-for-dollar, resulting in no outstanding commitments and the facility’s termination. On September 21, 2021, the firm called $400 million of floating-rate senior notes maturing March 2023 at par. Before September 11, 2021, they couldn’t call senior notes. OGS gas expenses are recoverable by state tariffs.

Due to higher gas purchase costs during Winter Storm Uri, related financing expenses, and other operational response expenses, the company is working with authorities to prolong recovery timeframes to decrease immediate customer damage. As of June 30, 2022, OGS had put off paying almost $1.9 billion due to Winter Storm Uri.

Looking at the balance sheet as of June 20, 2022, the deferred payment improved the company’s liquidity because its cash and cash equivalent were $7.3B. Additionally, the company’s total liability and equity increased slightly from $8.40B in December 2021 to 8.41B in June 2022. In addition, the company has negotiated the repayment period of the one gas credit agreement to 2027. In my opinion, this longer repayment period gives the company humble time to recover from the effects of the wave by capitalizing on the growing demand and soaring prices. The improved liquidity will enable the company to fund its operating expenses.

Winter Storm Uri deferred costs

OGS has deferred $1.9 billion in unusual costs for natural gas purchases, finance, carrying costs, and other operating expenses due to this winter weather event. When the discrepancies are solved, the sum can be revised. Winter Storm Uri also caused penalties for over- or under-delivering natural gas during operational flow restrictions. Furthermore, Kansas Gas Service assessed fines on marketers and individually balanced transportation customers, or their agents, per the KCC-approved modified penalty sections of its tariff in March 2022.

Amounts reflected management’s best estimate of what they may pay or receive and may change in future quarters upon assessing the collectability of disputed bills and penalties. While the company seems to be successfully hedging the effects of this storm, investors should be wary of the impact the review on the deferred payments would have on the company. As these are deferred gas purchase costs from Winter Storm Uri, future adjustments won’t affect profitability adversely.

The Gas industry: Soaring prices and growing demand justify a bullish case

Increased demand for fuel, Russia’s invasion of Ukraine, and disruptions in supply chains brought on by the pandemic have all contributed to the current predicament. Four months after Russia’s attack, the conflict in Ukraine is still disrupting global oil and gas markets, contributing to the price increase. The oil supply was affected when the U.S. and EU prohibited imports of Russian oil to coerce Russia into retreat through a series of punitive measures. However, as Russian oil is crucial to the global economy, this action increased market instability and oil and gas prices. The same supply disruption led to a market shortage and higher consumer demand. Further, the winter season contributed significantly to the growing demand for natural gas.

High and growing demand

Natural gas demand is under severe stress due to the high price and tight supply scenario, which began developing in the second half of 2021 and worsened since Russia invaded Ukraine in February 2022. Approximately 60% of the overall increase in gas demand between 2021 and 2025 will come from industrial consumption, as reported by the International Energy Agency [IEA].

In the future, the demand for gas in North America is predicted to increase by 0.7% each year. Constraints on U.S. coal supply and stockpiles, which promote gas-fired power generation, and temperature-sensitive demand in the first months of 2022 add up to a 2.3% increase despite high prices.

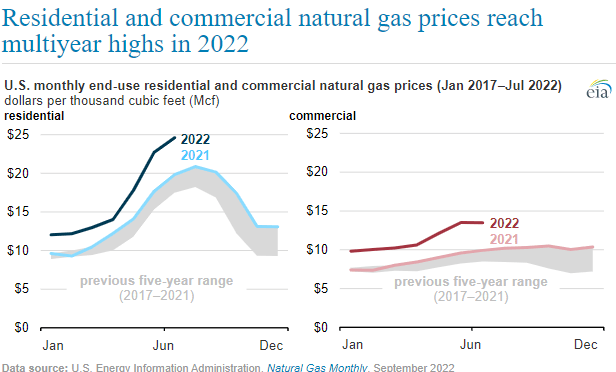

Skyrocketing gas prices in the U.S.

Natural gas costs for homes and businesses in the United States were relatively high throughout 2021, exceeding the range shown over the last five years (2017-2021). The residential and commercial yearly prices in 2021 were at their highest point since 2014 and 2015, respectively, in real terms. The nominal residential fee for January through July of 2022 was an average of $13.25 per thousand cubic feet [Mcf], up 25% from the corresponding period in 2021. With an average of $10.50/Mcf, the retail price is 33% higher.

EIA

The biggest problem for U.S. natural gas is that inventory levels are below historical averages. This leaves the market with less buff, which drives up prices. Because, although demand for gas has been high, supply has been inadequate, further escalating price hikes.

I anticipate that the OGS will maintain its long-term and short-term revenue and profit growth and thus continue the company’s trend of increasing dividends due to the rising demand for gas and the high price of gas.

Dividends

ONE Gas, Inc. has a 7-year dividend growth history. Its dividend payout frequency is quarterly, and the latest announced amount is $0.62 per share. In 2022, the average dividend yield is 2.88%. This low percentage means that the company’s ability to pay dividends is sustainable and will undoubtedly improve its amount per share in the future. I am confident that given the company’s potential to enhance revenues due to the high gas prices, it will continue its dividend growth history.

Conclusion

Share prices and ONE Gas, Inc.’s bottom line were seriously hit by winter storm Uri in 2021. The business nearly overcame the obstacle after mounting a solid response to it. Both year-to-date and year-ago, they have outperformed the market and are currently experiencing a solid bounce. Investors should keep an eye on deferred payments related to the hurricane, but it’s not something I’m too worried about. Investors and the company must prioritize capitalizing on the gas industry’s opportunity due to rising demand and high prices.

Since these openings are crucial to the company’s long-term financial health, they must take advantage of them as soon as possible. Investors will be pleased to hear that the company’s enhanced profitability will lead to increased liquidity and sustainable dividend growth. My optimism for the stock is due to fundamental drivers such as rising demand and high gas prices. My decision to give ONE Gas, Inc. a buy rating is because of its dividend track record of growth, the strong demand, and prices for natural gas.

Be the first to comment