Jonathan Kitchen

It’s been a little over 2½ months since I took my Advanced Energy Industries, Inc. (NASDAQ:AEIS) chips off the table, and in that time, the shares have declined about 20.5% against a loss of 9.61% on the S&P. For those who don’t have their “Almanac of Doyle’s Trades” open on their desks, I went long the stock way back in 2018 and outperformed the market on the way up. I mention all of this for two reasons. First, and most importantly, it gives me yet another opportunity to brag, and I never pass those up. A distant second in terms of import is the fact that this stock obviously has the potential to fairly massively outperform the overall market, so I think we should revisit it today. After all, a stock trading at $75 is, by definition, less risky than the same stock when it’s trading at $94.

I’ll try to work out whether or not it makes sense to buy back at current levels. My view is that this is a growth company, as evidenced by the fact that their revenue has grown at a CAGR of about 19.2% since 2013, and their net income has exploded higher at a CAGR of about 17.3%. For that reason, I remain of the view that this is a decent investment if you can manage to pick up the shares at a reasonable valuation.

When reviewing this stock, one of the things I found intriguing was the disconnect between Wall Street sentiment and the subsequent performance of the stock. For instance, the mood on the company’s most recent earnings call was universally positive. For instance, the analysts for Loop Capital, Needham, and D.A. Davidson all congratulated the firm on a great quarter. All of those good vibrations did nothing to stop the stock from massively underperforming the market, though. I think there’s a lesson here that I think all investors would be wise to heed. It’s not about great results. It’s about the disconnect between expectations of results, and subsequent results. It seems that much of the good news was already “baked in” to the price, meaning that the shares had limited upside and a great deal of downside, even after posting such wonderful results. This is why I will buy back into this stock only if it’s sufficiently cheap. Stocks become cheap when the expectations about future performance become muted.

With that sermonizing done, it’s time for the “thesis statement” paragraph. This is a public service I offer to my readers who may want the “gist” of my thesis but may not have the stomach for a full helping of “Doyle Mojo” at the moment. I understand that some people find my immature jokes, repetitive nature, and constant bragging to be tiresome for some reason, so I package up my thoughts in this handy paragraph to allow you to get in and get out as quickly as possible. I think Advanced Energy is a very compelling business and would represent an excellent investment at the right price. The problem is that the shares aren’t yet near the right price. In my view, the best risk-adjusted returns to be had here come from short puts. Specifically, I like the January 2023 puts with a strike of $55 at the moment. While I’m going to monitor the company’s upcoming results, I think the stock remains too rich for my blood. Thus ends the “thesis statement” portion of this article.

Why I Like This Business

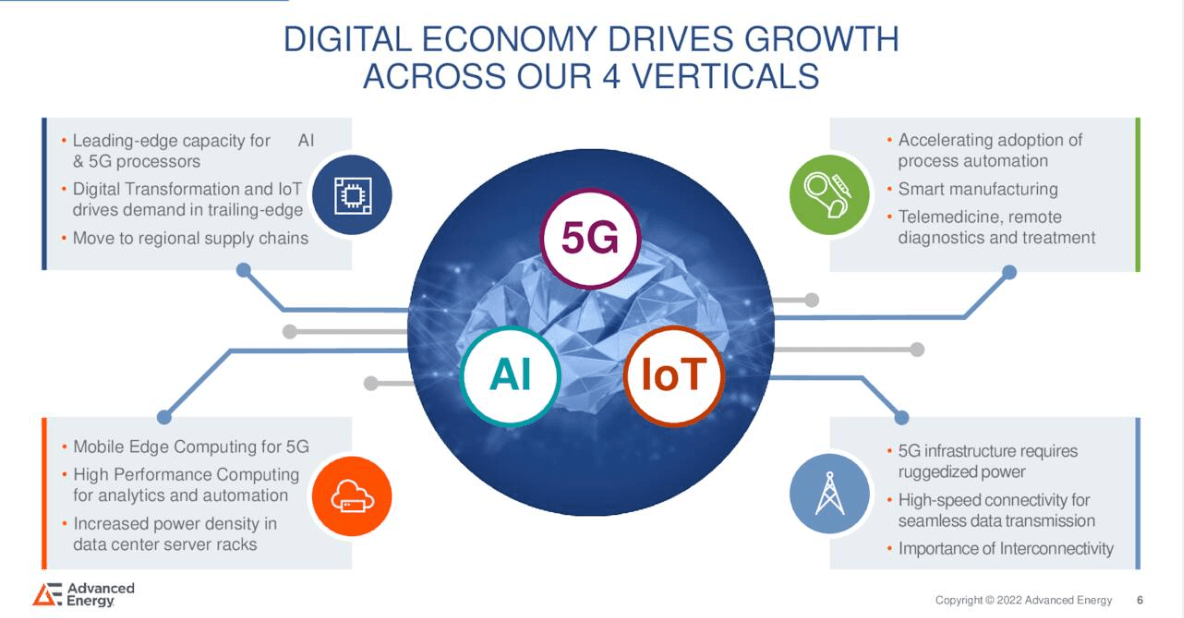

I’m a fan of this business because, as I stated earlier, it’s a growth company. More than that, it has a history of innovation, and it enjoys the #1 or #2 spots in those markets in which it competes. About a month after I published my article, the company produced a presentation, two slides from which are recreated below for your enjoyment and edification. The first of these speaks to why the company has enjoyed such robust growth.

Advanced Energy Well Positioned Among Growth Industries (Advanced Energy presentation, September 2022)

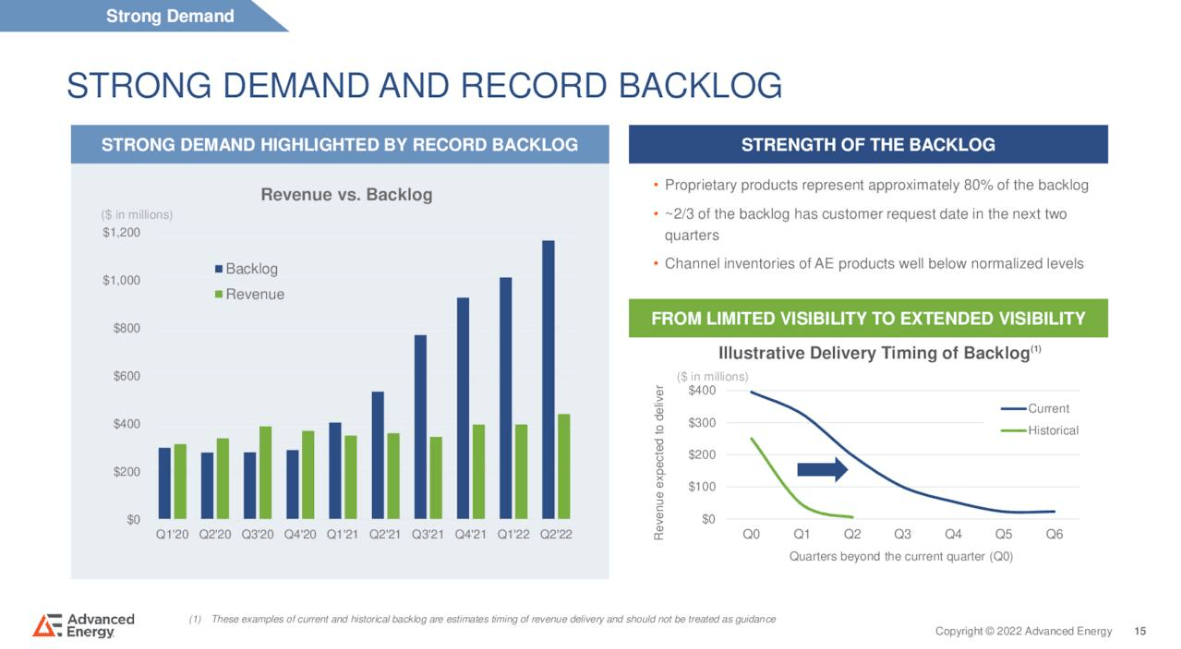

More intriguing to me is the fact that the company has a large, growing, and very visible order backlog. Anyone who’s read my stuff on railcar manufacturers recently knows how much I like the visibility that strong and growing backlogs give investors.

Advanced Energy Backlog (Advanced Energy Presentation)

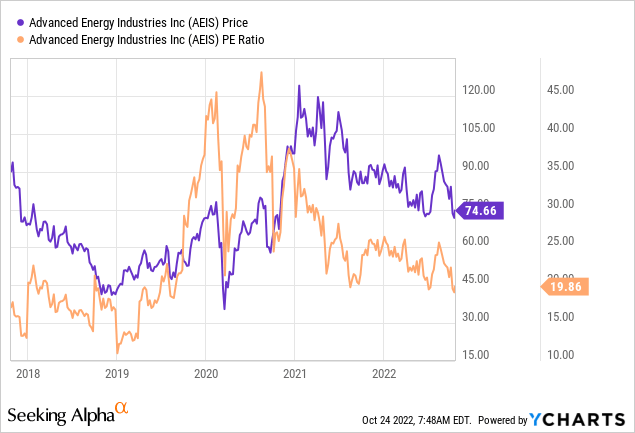

The Stock

I’ll admit that a growth business like this one deserves higher valuations than the typical company. For example, if a company is growing the “E’ part of the “PE” ratio at a CAGR of 17%, it may make sense to pay a premium. That written, I don’t like spikes in the valuation. So, when the PE here exploded higher just prior to earnings, I took notice, and I didn’t like what I saw. The PE had been in a slow decline, spiked prior to the earnings release, and that spooked me. Thankfully, we see that the PE multiple is back on trend, per the following:

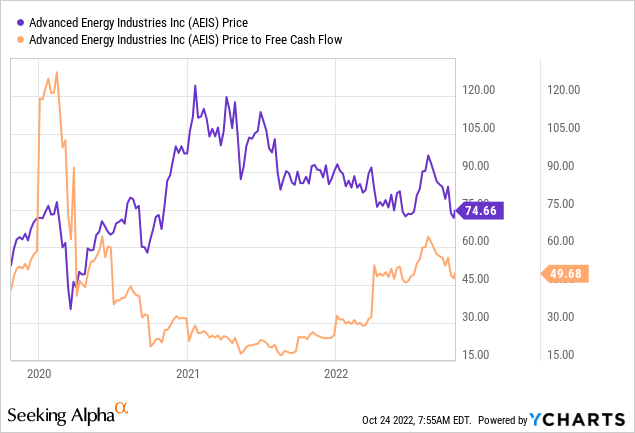

Although the ratio of price to free cash remains high, it’s come down about 23% since I last reviewed the name. So, it’s no longer as egregiously expensive. The ratio has been higher in the past, and the stock has subsequently gone on to enjoy great returns.

While I like comparing a stock to its own history, this company is so fast-moving that historical comparisons are less helpful. For example, the company just recently acquired SL Power, meaning that comparisons to last year, for instance, are less helpful. When history is less helpful a guide, I’m particularly interested in trying to work out what the market is “thinking” about a given investment. If you read my stuff regularly, you know that the way I do this is by turning to the work of Professor Stephen Penman and his book “Accounting for Value” for this. In this book, Penman walks investors through how they can apply some pretty basic math to a standard finance formula in order to work out what the market is “thinking” about a given company’s future growth. This involves isolating the “g” (growth) variable in this formula. In case you find Penman’s writing a bit dense, you might want to try “Expectations Investing” by Mauboussin and Rappaport. These two have also introduced the idea of using the stock price itself as a source of information, and then infer what the market is currently “expecting” about the future.

Anyway, applying this approach to Advanced Energy at the moment suggests the market is assuming that this company will grow earnings at a rate of ~5% in perpetuity. Although this is a “growth” company, perpetuity is a very long time, so I consider the stock to be fairly richly priced at current levels. Given the above, I’m still not willing to buy back in.

Short Puts As An Alternative

Just because I’m not interested in buying the stock at the moment doesn’t mean I don’t think there’s opportunity here. Those who’ve been following me a long while know that I absolutely love to write deep out-of-the money put options on great businesses, because I consider such trades to be “win-win.” Either the puts expire worthless, which is quite good, or I’m “forced” to buy a great business at a very decent price. So, I’ll be doing that with Advanced Energy.

At the moment, my preferred trade is the January 2023 puts with a strike of $55 which last changed hands at $1.15. If the shares trade above $55 over the next three months, the investor will simply pocket the premium. If the shares continue to fall in price, the investor may be obliged to buy, but they’ll do so at a price about 27% below the current price. I would consider that to be a great entry price for this stock.

Now that I’ve presented you with my preferred trade here, it’s time, once again, to write about risk. It’s all well and good for a stranger on the internet to write about “win-win” trades, but if you’re going to trade these, you need to be made aware of the fact that this investment, like all investments, comes with risk. I consider the risks associated with these instruments to fall into two broad categories: the economic and the emotional.

Starting with the economic risks, I’d say that the short puts I advocate are a small subset of the total number of put options out there. I’m only ever willing to sell puts on companies I’d be willing to buy and at prices I’d be willing to pay. So, I would never advocate that people simply sell puts either “willy” or “nilly” with the highest premia. In my view, that strategy would lead to disastrous results. So my first bit of advice is to only ever sell puts on companies you want to own at (strike) prices you’d be willing to pay. Take my word on this one, as it’s informed by painful history.

The two other risks associated with my short puts strategy are both emotional in nature. The first involves the emotional pain some people feel from missing out on an upside. To use this trade as an example, let’s assume that Advanced Energy stock price goes parabolic and hits $150 per share between now and the third Friday of January 2023. Obviously, my puts will expire worthless, which is a great outcome in some ways. I will not catch any of the upside in the stock price, though. So, short put returns are capped by the premium received. This may be emotionally painful, but my attitude is that if the shares are too expensive at $75, they’d likely be destined for a fall at $150, so no harm, no foul.

Secondly, it can be emotionally painful when the shares crash below your strike price. So far, whenever this has happened to me, things have worked out well over the long term, because I insist on only ever writing puts at “screaming buy” strike prices. That said, it has been emotionally stressful in the short term on occasion. If you’re going to sell puts, please be aware of this phenomenon.

If you understand these risks and can tolerate them, I would recommend that you sell puts rather than buy stock. In my view, these represent the best risk-adjusted returns you can make on this name over the next few months. I’ll revisit the name then, but for now, short puts are the way to go in my view.

Be the first to comment