HJBC

Introduction

Thursday, December 1, ONE Gas (NYSE:OGS) stock dropped 18% in one day, from $86.95 per share to $71.27. This was a complete surprise to investors, especially those like me who have been bullish on the company. Shareholders need to know what happened, why, how the future of the company might be affected, and what do to now with our OGS investment dollars. As a follower of the company since its IPO in 2014, I will do my best to answer those questions.

ONE Gas Company overview

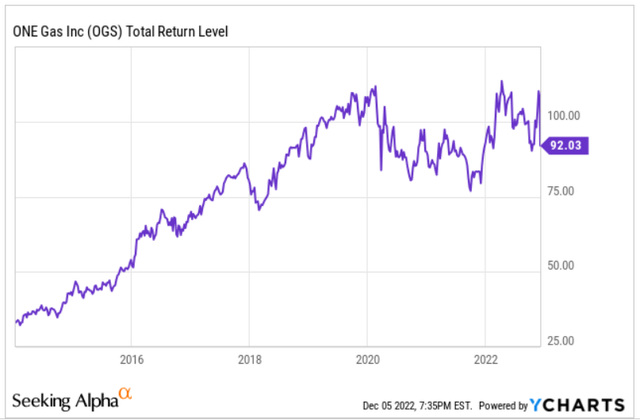

ONE Gas is a local gas distribution company [LDC]. LDCs market and distribute natural gas in a specific geographic area to commercial, industrial and individual customers. It is a highly regulated business with prices and profits established by government commissions in the states in which it operates. OGS operates in Texas, Kansas and Oklahoma, which are good regulatory environments for gas. With a guaranteed profit, LDCs are characterized by slow, steady growth, especially with dividends reinvested – the ultimate widows and orphans stock. The chart of OGS since its IPO clearly illustrates this.

The Precipitating event

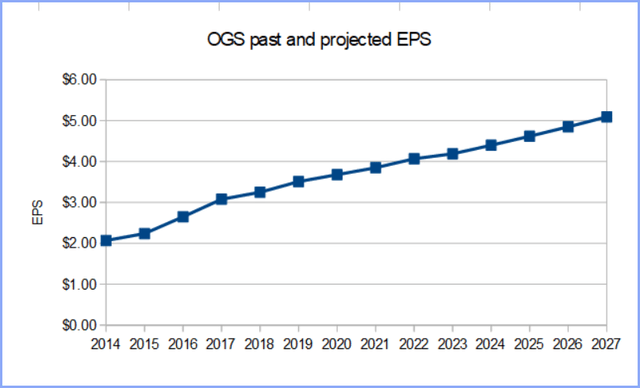

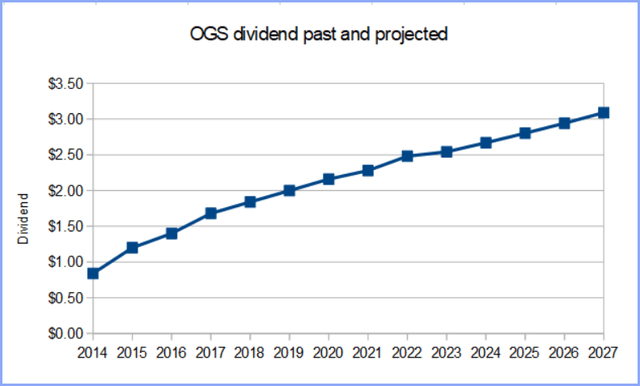

The event precipitating the big drop was an announcement by the company on November 30 that FY 2023 earnings would be lower than previously forecast. The forecast is now for earnings of $4.02 to $4.26 per share, compared to analyst estimates of $4.38. In its five year plan through 2027 the company now forecasts net income increasing 7-9% a year (down from 8-10%), EPS increases of 4-6% a year (down from 5-7%), and dividend increases of 4-6% a year (unchanged). Higher expenses, higher labor costs, and higher interest costs were cited for the lower guidance, offset by rate increases and customer growth. The next day Guggenheim Securities hit OGS with a downgrade from Hold to Sell. As one of only five analysts covering this small mid-cap stock with a daily trading volume of only about $21 million, this event likely amplified the effect of the lowered forecast.

The Technical picture

As I reported in October in Technicals And Fundamentals Align For Big Gains In ONE Gas, the ONE Gas price chart reveals an obvious technical picture.

Since OGS first achieved a share price equal to today’s $73, 5 ½ years ago, it has hit a low of $64-70 six times. EVERY time, it then rose to a high of between $80 and $96. This history is summarized in the table below.

| Date of Low | Low Price | Time to High | High Price | Gain % |

| 02/26/18 | 63.59 | 19 months | 95.91 | 51% |

| 03/19/20 | 67.62 | 1 month | 90.24 | 33% |

| 09/17/20 | 66.80 | 3 months | 81.98 | 23% |

| 02/26/21 | 68.78 | 2 months | 81.16 | 18% |

| 09/22/21 | 63.84 | 6 months | 90.90 | 42% |

| 10/10/22 | 70.03 | 1 month | 88.55 | 26% |

| 12/01/22 | 71.27 | ?? | ?? | ?? |

As of this week we now have a seventh event, in which the price dropped to $71.27.

Has ONE Gas once again presented investors with a base for substantial price appreciation, possibly in a very short time, or is the latest price drop a sign of seriously impaired prospects for investors? To answer this question we need to look more closely at the revisions.

ONE Gas outlook before and after revisions

Prior to the company’s revised outlook, the analyst consensus of 2023 EPS was $4.38. This was higher than the company’s own projections of $4.20-4.36 per share, which raises the question once again of whether investors should rely on analysts. Since the revision by OGS the chastened analysts are projecting $4.07, near the low end of OGS’s range of $4.02-4.26. How does the new company projection through 2027 change the near and long-term outlook?

The message from the new numbers is that OGS expects lower growth in 2023, followed by a return to higher growth rates out to 2027. We will look at net income as an example, using simple growth rates rather than compound rates for simplicity. The new midpoint for annual net income growth through 2027is 7%. Total 5 year growth would be 7+7+7+7+7=35%. The previous outlook was for growth of 9% at the midpoint through 2027. Total 5 year growth 9+9+9+9+9=45%. Incorporating the new projection of 2% growth in 2023 and leave the old, higher rates in for the other 4 years, the 5 year calculation is 2+9+9+9+9=38%. 38% is close to the new projection of 35%, indicating that OGS expects to return to the higher growth rates after one year of lower growth. The same arithmetic applies to the growth revisions to EPS and dividends. When we look at the past and projected growth, the 2023 slowdown is barely noticeable.

Seeking Alpha and company data Seeking Alpha and Company data

It’s important to note that OGS is not projecting a reduction in net income, EPS, and dividends for 2023, only a near term reduction in the rate of growth. OGS has increased these three important items every year since the IPO, and is confident it can continue to do so. While such a projection for many companies might be viewed with skepticism, there is a higher degree of confidence when applying it to an LDC. As mentioned above, the regulatory guarantee of a specific profit level along with a growing customer base is a formula for slow and steady growth.

OGS investment implications

The 18% share price drop last week after the revised outlook and downgrade by Guggenheim was unwarranted. The new outlook is a reduction in 2023 earnings growth from 5% to 3% and anticipated growth in 2024-2027 remains intact. But this market environment severely punishes all signs of weakness, so here we are.

In 2016, 2021, and October 2022, as OGS dropped close to $70, I wrote that it was ready for a strong gain. Each time the price rose to between $81 and $98. After the 18% drop to $71.27 last week another substantial gain is very likely. Technical setups this strong are rare. The fundamentals, in terms of net income, EPS, and dividends, support this view.

The factors causing the revised outlook are the same ones affecting many industries – higher interest rates, higher costs for labor and materials, and a slowdown in the economy. If these things continue beyond 2023 it’s OGS’s business will be affected longer than anticipated. Growth will be slower for longer, and it will take longer for investors to see the expected return. In addition, a bear market will have a negative effect, although the stability of its business will insulate OGS to some degree.

Any price in the low 70’s is a gift. Using the past as a guide, the price will rise to between $80 and $95 within 12 months. At the midpoint this is a gain of about 20% to $87. Including dividends the return is 24%. Since the low of $71.27 last week, the share price has already risen 6.6% to $76, making the expected return a still respectable 14% plus 3.4% in dividends. Some investors may want to wait see if random price fluctuations or market conditions drive the price closer to $70 before buying, others may buy now on the assumption that the price is already on the way back up.

I have found that while gas companies are a reliable source of slow long-term gains, there are more gains to be had by trading around the fluctuating valuations that are commonly seen in their chart patterns. Consequently, early last week I sold my long-held shares with a $65 cost basis at $87.30, and bought them back this week at $72.49. With growing income and dividends the risk is minimal, and less for longer time frames.

In a time of great market uncertainty, OGS can provide investors with safety, profits and growth. With the recent drop the share price is back to where it was in 2017, but since then the EPS has grown 33% and the dividend is up 48%. Growth is expected to continue. This is a golden opportunity to get shares at a price that may not be seen again.

Be the first to comment