3DSculptor

Investment Thesis

With the global push for EVs, especially in the US and the EU, we expect massive growth for the relevant EV supply chain as well, including ON Semiconductor (NASDAQ:ON). This is due to its Silicon Carbide devices, which allow for lighter and longer-range electric vehicles while enabling faster-charging systems. Assuming an eventual partnership with Tesla (TSLA) and other EV automakers, we expect massive tailwinds to ON’s revenue and profitability growth for the next decade, as the number of EVs nearly quintuples by the end of this decade.

Nonetheless, given the considerable volatility in the past six months, we recommend caution for any interested investors since the stock market may soon experience another drastic correction. In addition, it would be meaningful to wait for ON’s upcoming earnings call on 01 August 2022, before making any decision.

ON Is Nearing The Inflection Point For Massive Growth Ahead

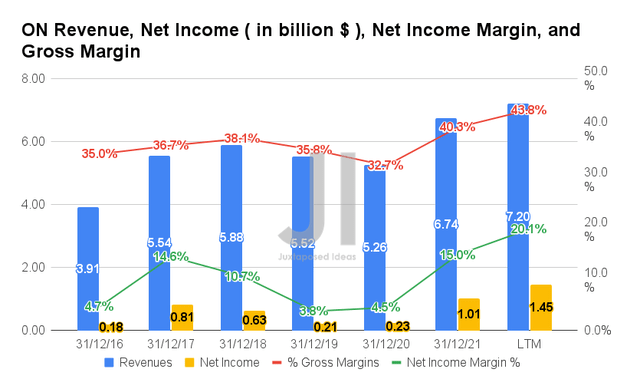

ON has shown remarkable recovery despite the brief dip during the COVID-19 pandemic. By the LTM, the company reported revenues of $7.2B and gross margins of 43.8%, representing an impressive increase of 22.4% and 5.7 percentage points from FY2018 levels ( ignoring FY2019 levels due to the multiple merger and legal costs ), respectively. As a result, ON also reported much-improved profitability, with net incomes of $1.45B and net income margins of 20.1%, indicating a tremendous increase of 230.1% and 9.4 percentage points from FY2018 levels, respectively.

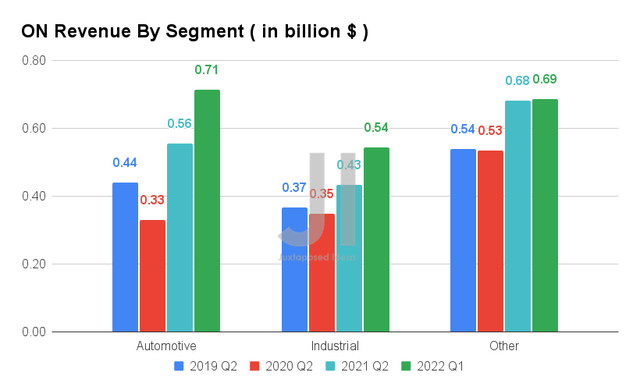

Based on the chart above, it is evident that ON’s automotive and industrial segments will be significant revenue drivers for the next decade. By FQ1’22, the company reported automotive revenues of $0.71B, industrial revenues of $0.54B, and other revenues of $0.69B, representing YoY growth of 38.3%, 48.1%, and 14.8%, respectively. Therefore, assuming similar performance, we may expect to see ON report automotive revenues of up to $0.73B and industrial revenues of up to $0.56B in FQ2’22, representing YoY growth of 30.3% and 30.2%, respectively.

Assuming that the partnership with Tesla (TSLA) is accurate, we expect massive tailwinds for growth in the automotive segment ahead, since the latter has nearly 2.65M in designed production capacity in its Gigafactories worldwide. Other legacy automakers, such as General Motors (GM), Stellantis NV (STLA), and Toyota Motor (TM), have already included Silicon carbide inverters in their new models as well. In the long run, we expect ON to do very well indeed.

Furthermore, we expect ON’s industry segment to do well as well, due to the rising oil and gas prices. The cloud and energy infrastructure market will be long-term revenue drivers, due to the continuous migration to cloud services and 5G networks post-reopening cadence. The global cloud computing market is expected to grow from $418B in FY2021 to $1.55T by 2030 at a CAGR of 15.7%, while the global 5G services market is expected to grow even faster at a CAGR of 44.63%, from $64.54B in 2021 to $1.87T by 2030. Thereby ensuring ON’s continued relevance, revenue and profitability growth, and stock price appreciation over the next decade.

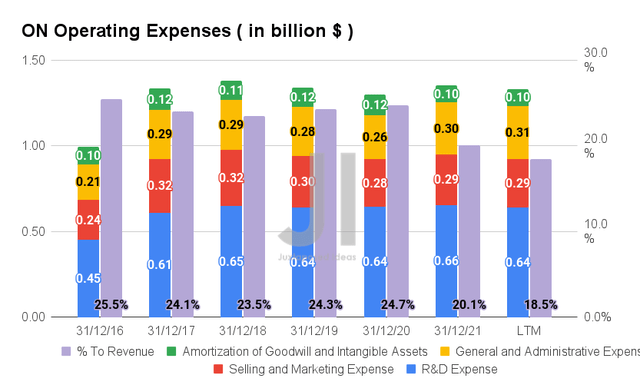

ON has also shown much restraint in its operational management, given the sustained operating expenses of $1.34B in the LTM, broadly in line with FY2019 levels of $1.34B. However, it is also apparent that the ratio to its growing revenues has been moderating thus far, to 18.5% in the LTM, compared to 24.3% in FY2019. Thereby, improving the company’s profitability in the current economic climate with rising inflationary issues. It is evident that ON’s “Intelligent Power Solution” slogan is also well applied to the company’s highly efficient operations thus far.

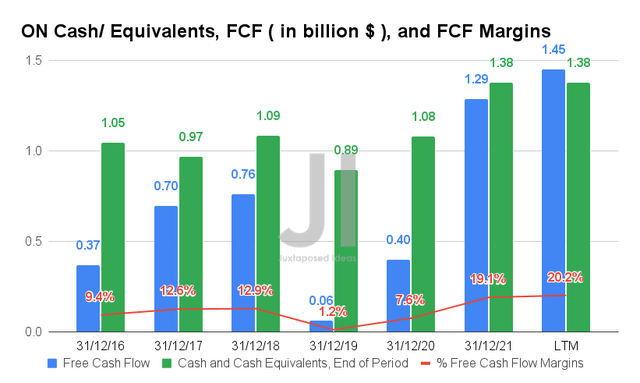

Therefore, it is not surprising that ON also reported a much improved Free Cash Flow (FCF) generation of $1.45B and an FCF margin of 20.2% in the LTM, representing an increase of 90.7% and 7.3 percentage points from FY2018 levels, respectively. Thereby, boosting the company’s cash and equivalents on its balance sheet to $1.38B by the LTM.

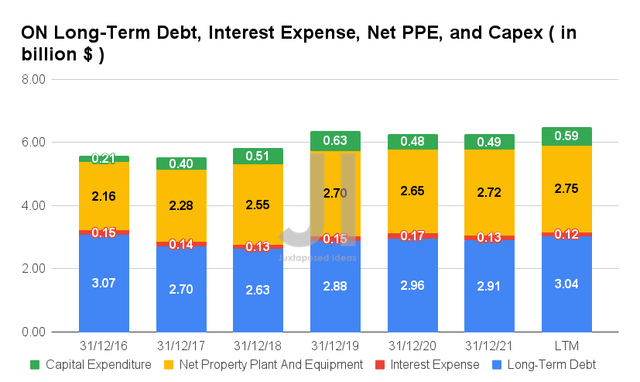

In the meantime, ON’s long-term debts have remained relatively stable at $3.04B with interest expenses of $0.12B in the LTM. However, it is also essential to note that its total debt to EBITDA ratio has continued declining from 2.98x in FY2019 to 1.36 in the LTM, due to its improved profitability.

On the other hand, ON continued to invest in its business with an estimated capital expenditure of up to $1.08B in FY2022, while also growing its net PPE assets to $2.75B in the LTM. We are highly encouraged to see the company heavily ramping up its silicon carbide manufacturing, since these investments may yield up to $2.6B in revenue through 2024, with up to 80% attributed to the massive demand from the EV market ahead. Thereby, eventually top and bottom lines accretive.

An Upwards Re-rating For ON’s Revenues Is Highly Likely

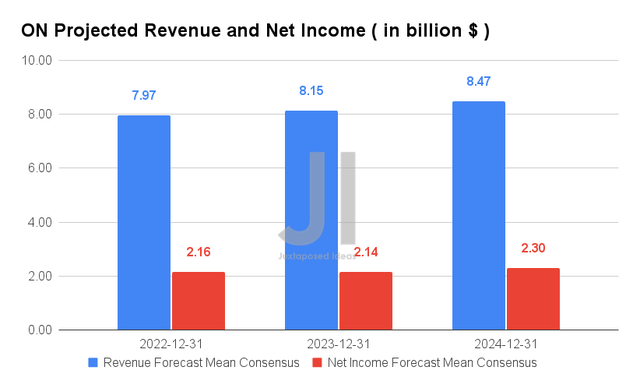

For the next three years, ON is expected to report revenue and net income growth at a CAGR of 7.97% and 32%, respectively. In addition, its net income margins are expected to improve tremendously from 3.8% in FY2019, to 15% in FY2021, and 27.1% in FY2024. For FY2022, consensus estimates that ON will report revenues of $7.97B and net incomes of $2.16B, representing impressive YoY growth of 18.4% and 216%, respectively.

Nonetheless, we expect a speculative upwards re-rating of ON’s revenue and net income growth, assuming a widespread adoption of silicon carbide in the EV and energy market moving forward. The global silicon carbide market is projected to grow from $2.95B in 2021 to $7.79B by 2030, at a CAGR of 11.4%, while the global electric vehicle market is expected to grow faster at a CAGR of 18.2%, from $163.01B to $823.75B by 2030.

Therefore, based on ON management’s previous guidance of quadrupled silicon carbide output by the end of FY2022 and a $1B revenue run rate from late 2023 onwards, we may expect ON to report revenue CAGR growth of over 9% from FY2024 onwards, which will bring its revenues to a more optimistic estimate of $9.3B then, indicating a 9.7% upside from current estimates.

In the meantime, analysts will be closely looking at ON’s FQ2’22 performance, with consensus revenue estimates of $2.01B and EPS of $1.26, representing an increase of 20.62% and 100.07% YoY, respectively. We expect another stellar FQ2’22 earnings call ahead similarly to its consecutive past seven quarters, triggering a potential stock recovery. However, we do not expect it to hold for long, due to the Fed’s continuous hike in interest rates and potential recession.

So, Is ON Stock A Buy, Sell, or Hold?

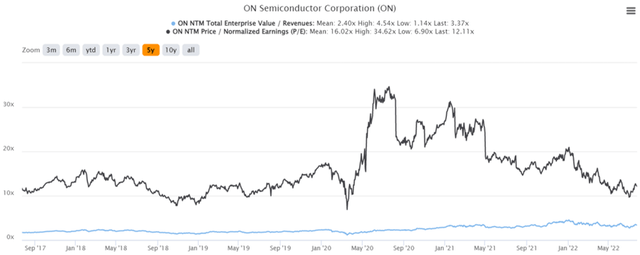

ON 5Y EV/Revenue and P/E Valuations

ON is currently trading at an EV/NTM Revenue of 3.37x and NTM P/E of 12.11x, higher than its 5Y EV/Revenue mean of 2.4x though lower than its 5Y EV/Revenue mean of 16.02x, respectively. The stock is also trading at $58.25, down 18.2% from its 52 weeks high of $71.26, though at a premium of 67.3% from its 52 weeks low of $34.81.

ON 5Y Stock Price

Though ON is a solid stock for a long-term hold, it is evident that the stock is trading at a slight premium, given consensus estimates price target of $67.76 with only a 16.33% upside. The stock has also shown massive volatility in the past six months, with up to 51.4% price swings thus far. As a result, investors looking to add ON should definitely wait a little and consider only below $50s, since the market seems ready for some serious shake-up in the short term. Investors, take note.

Therefore, we rate ON stock as a Hold for now.

Be the first to comment