AHPhotoswpg/iStock via Getty Images

In just hours after the stock market opened yesterday, Leafly Holdings (NASDAQ:LFLY) jumped over 100% on the day to nearly hit $11. Anyone holding onto the stock was just gambling because the financials and the trading of peer WM Technology (MAPS) suggest the rally wasn’t based on fundamentals. My investment thesis would’ve been Bearish with the stock back up at $10, but my view remains Neutral with Leafly giving up virtually all of the gains.

Irrational Rally In Leafly

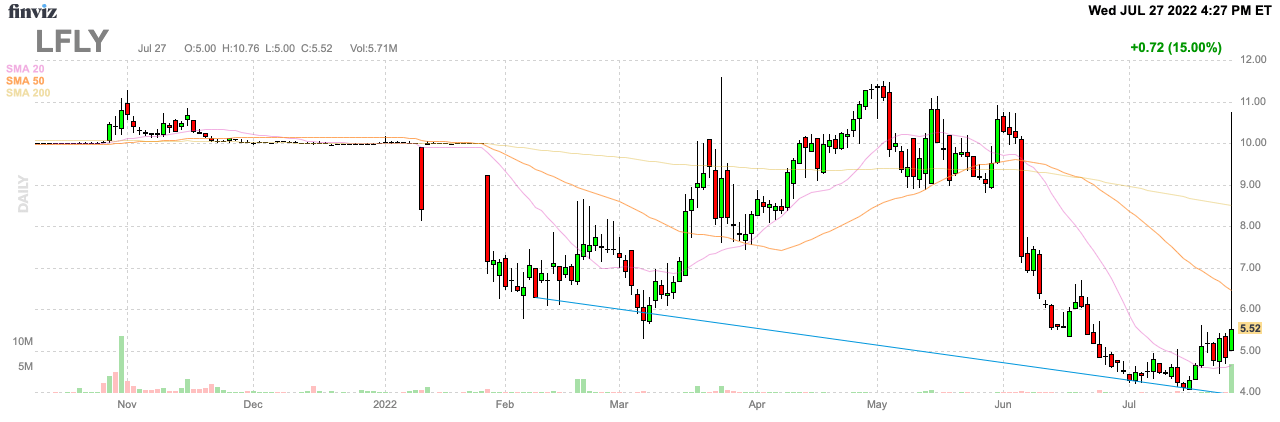

For no apparent reason, Leafly traded from a close yesterday below $5 to nearly $11 in just hours after the market opened. The stock has rarely had daily volume above 100K, yet the stock has now had nearly 6 million shares traded on July 27, or nearly 40x the average daily volume.

Source: Finviz

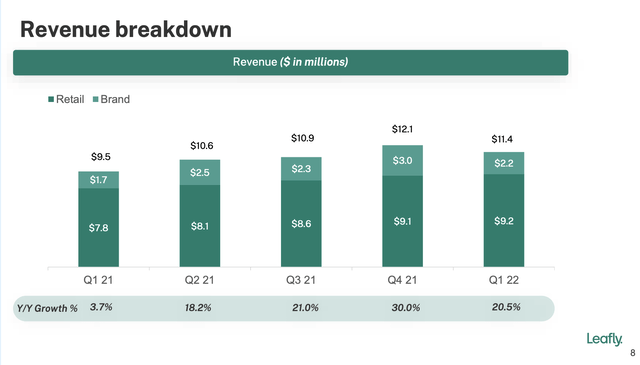

The online cannabis business reported Q1 results in May with revenues growing 21% YoY. Due to an infusion of capital, Leafly is now back to growing retail accounts with this amount up an impressive 37% to 5,422 accounts at the end of Q1’22.

Regardless, total quarterly revenues were still only a meager $11.4 million. With a booming domestic cannabis market, Leafly only producing revenues at a $46 million annual run rate is definitely disappointing. The company just doesn’t have the scale to warrant the sudden excitement in the business.

Leafly continues to pushing more in brand advertising, but this business is more seasonal than retail accounts with subscriptions. The Q1’22 brand revenues were up 21% over last Q1, but the amount was down substantially from the $3 million level of Q4’21.

Source: Leafly Q1’22 presentation

Leafly reported an EBITDA loss of $5.4 million and guided to escalating losses for the year. The 2022 prediction was for the company to report an EBITDA loss of at least $26 million and up to $31 million on revenues of $53 to $58 million.

The company doesn’t have the full suite of products offered by competitor WM Holdings that runs the Weedmaps platform and a suite of technology products to facilitate cannabis sales and regulatory compliance in the complicated sector where every jurisdiction has different laws.

WM Holdings has ~5x the revenue base and dominates the market usually making life difficult for a much smaller secondary player.

Don’t Chase LFLY Stock

The stock is definitely more appealing back at $5 due to the market opportunities in the cannabis segment as new states like New York and New Jersey move forward with recreational cannabis and look to expand license holders. Along with other state markets, the amount of dispensaries and cannabis brands should only grow in size and influence leading to a larger set of potential accounts.

Leafy could definitely be a buyout target, but a lot of such rallies where a small cap stock doubles in a day is just due to technical trading or someone playing a pump and dump scenario. No signs exist anyone is actually looking to buy the cannabis retail platform stock for a major premium to warrant holding the next big jump.

The company is definitely aggressively investing in the business to drive future growth. Leafly only has a cash balance of $35 million, so certainly a push to raise additional funds is part of the picture. A big rally could lead the company to rush out a capital raise beneficial to future shareholders, but the stock hasn’t held the rally for this to occur.

The stock valuation sits at about $200 million before any dilutive options and warrants. The rally naturally pushed the valuation up over $400 million at the peak, which clearly isn’t supported by a $46 million run rate business with large losses. Any firm interested in the sector would probably buy WM Holdings still trading at the lows while the acquirer would be unlikely to offer a price above the $10 peak today.

Takeaway

The key investor takeaway is that investors should use these irrational rallies to cash out of such stocks. Any investors in Leafly are highly unlikely to see a higher price in the next few years, though the stock collapsed so quickly that only alert shareholders were able to dump shares.

Investors shouldn’t chase the next rally and actually look to cash out any profits.

Be the first to comment