We Are

Omnicom Group (NYSE:OMC) just delivered Q3 2022 results that exceeded expectations, with organic growth of 7.5%, which was broad-based. Shares are responding positively in after hours, since there was a lot of pessimism given the recessionary winds the industry is facing. Earnings per share for the quarter were $1.77, up 7.3% versus 2021, despite a negative currency impact due to the strong US dollar. On a constant currency basis, earnings per share would have increased approximately 12.3%. The company also provided positive guidance, raising the organic revenue growth outlook to 8.0% – 8.5% for the full-year 2022.

The company believes that part of the reason why companies are not cutting marketing budgets more aggressively despite the recession talk, is that it believes they have learned the previous two recessions that companies that continue to market through recessions prospered and came out of them more quickly than the ones that just focused on cutting costs. In any case, the company also has a couple of positive catalysts, including the Olympics that are coming up and the FIFA World Cup.

Omnicom’s Q3 2022 Results

Reported total revenue in the third quarter was flat y/y at $3.4 billion. Organic growth was 7.5% for the quarter. Almost half of the company’s revenue is outside the US, therefore the strong dollar had a big impact and resulted in a 6.3% reduction of revenue. Reported operating profit for the third quarter increased around 1%. While on a constant currency basis, it increased 6%.

Net income rose 2.5% on a reported basis, which combined with a 4% reduction in shares meant that diluted earnings per share rose 7.3%, even after a negative 5% headwind from foreign currency translation.

Business Transformation

During the company’s conference call to discuss the results, there was an interesting discussion about the transformation of the business portfolio. Omnicom believes that the portfolio today isn’t comparable to that three or four years ago, especially given significant business dispositions. The company took advantage of the good times to offload some lower growth and less attractive businesses.

Omnicom also made investments in areas where it believed that growth would be consistent in good times and in bad, such as in precision marketing, and the expansion of services in the health area. It also cleaned up low-growth geographies.

This process served the company well now that it is facing more challenging times due to things like inflation and a weak macro-economic environment.

Financials

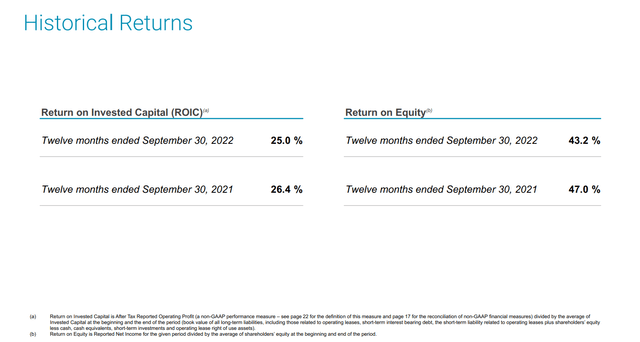

The company continues delivering above-average returns on both invested capital and equity. For the 12 months ended September 30, 2022, it generated a solid return on invested capital of 25% and a strong return on equity of 43%.

Balance Sheet

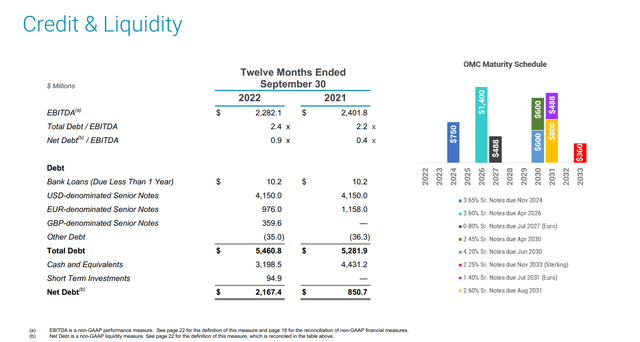

The balance sheet remains solid, but net debt/EBITDA is creeping up. Last year it was a 0.4x, and it now stands at 0.9x. Cash and equivalents were $3.3 billion at the end of the period, so we are not too concerned about the company’s liquidity. Its maturity schedule remains well laddered, and other than the increase in leverage from very low levels we do not see anything else worth pointing out.

Valuation

We’ve been pounding the table that Omnicom shares are cheap, and already discounting at least a mild recession. We believe the results the company just delivered show that to be the case, and that it is proving resilient despite the tough environment. The company appears to agree, as continues repurchasing shares, expecting buybacks to amount to around $500 million to $600 million for the year.

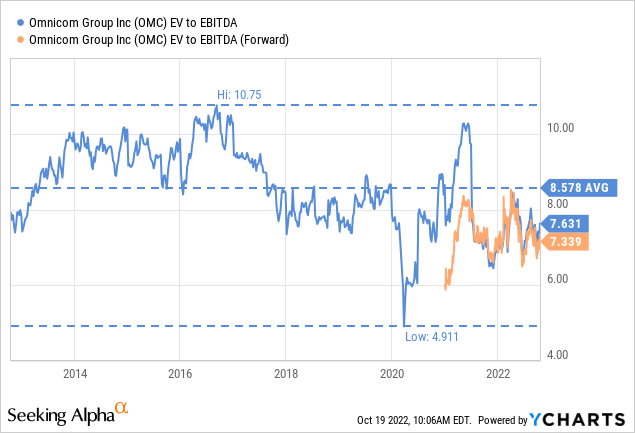

Shares are trading below their historical EV/EBITDA valuation, at a 7.6x multiple. This is also cheaper than the sector median of ~9x, despite Omnicom being one of the leaders in its industry. Once the recession fears pass, we expect shares to re-rate higher.

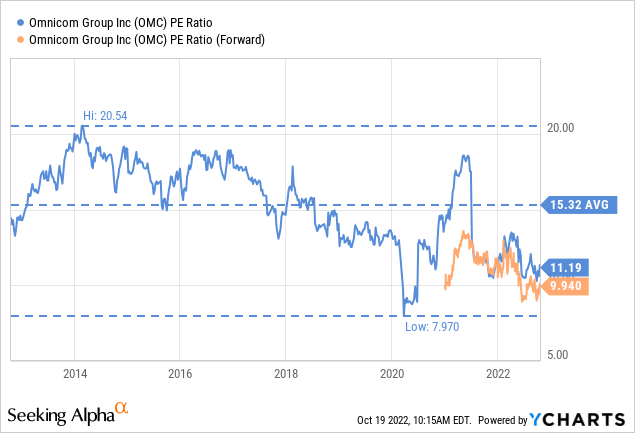

Based on the price/earnings ratio shares look even cheaper, with the forward p/e below 10x, this is approaching a bargain valuation.

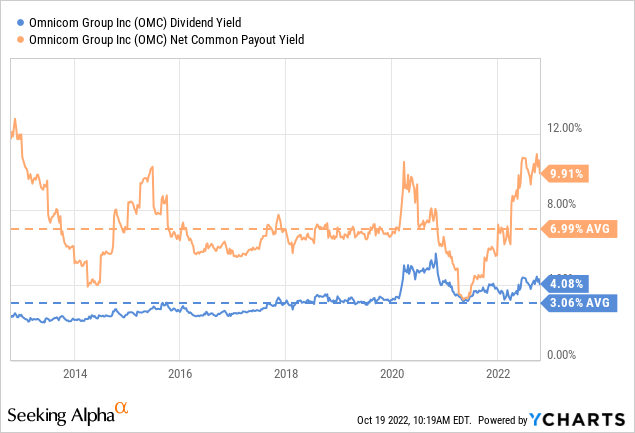

What’s more, most of these earnings are being returned to investors in the form of dividends and share repurchases. The net common payout yield, which combines both, is approaching an impressive 10%.

Risks

We understand that investors remain cautious, as advertising agencies tend to be hit disproportionately hard during recessions, and there is the additional challenge of transforming to better adapt to the digital era. Despite these challenges, what Omnicom proved with its results is that it is adapting and proving resilient.

Conclusion

We continue to rate shares as a ‘Buy’, and while we acknowledge there are risks to the thesis, so far, the company has proven it can successfully navigate the challenging waters. The valuation is extremely attractive, with a forward p/e below 10x, and a well-covered dividend that exceeds 4%. What we are seeing is also that the business transformation the company has undergone in the last few years has created a better business, and one that investors should pay more attention to.

Be the first to comment