Halfpoint/iStock via Getty Images

This week I have written several articles with updates on different real estate investment trusts (“REITs”). Two covered the industrial REIT sector on STAG Industrial (STAG) and Terreno Realty (TRNO). The other was on National Storage Affiliates (NSA), a storage REIT. Today’s article will be covering Omega Healthcare Investors, Inc. (NYSE:OHI), a senior housing REIT that I last covered in May.

Investment Thesis

Omega Healthcare Investors is a senior housing and skilled nursing facility REIT that attracts investors due to its large 8.7% dividend. However, there are several factors that investors should be aware of that could spell trouble for the bullish thesis. OHI has seen revenue declines in 2022 as well as issues with their tenants being able to pay contractual rents. The other thing that I am nervous about is the company’s debt-laden balance sheet, which has significant maturities coming due over the next few years. The valuation is cheap at a price/FFO of 9.8x, but I wouldn’t count on multiple expansion due to issues I mentioned above. They have bought back some shares this year, but the buybacks stopped in Q3, and I would be surprised to see any dividend hikes coming in the near future. While I love juicy dividends and cheap valuations, the potential problems with OHI outweigh the reasons to be bullish.

Q3 Update

OHI recently reported Q3 earnings, and I spent some time skimming the most recent 10-Q. There were a couple things that stood out to me, but the most obvious was the declining revenues. For the first nine months of the year, revenues declined approximately 10% compared to 2021. For Q3, revenues declined approximately 15% versus 2021, a sign that things have been heading in the wrong direction as the year has progressed.

Part of this decline in revenues is likely due to issues with tenants and their ability to pay contracted rent. Like other REITs in the healthcare space, OHI has experienced tenant issues. This could spell trouble for the long-term health of OHI, and it is something I will be keeping an eye on.

As previously disclosed, as of the end of 3Q22, operators representing approximately 12% of our 3Q22 annualized contractual rent and mortgage obligations did not pay all of their contractual obligations in 3Q22. In October 2022, Omega collected rent from operators representing approximately 91% of our 3Q22 annualized contractual rent and mortgage obligations.

Furthermore, with many operators continuing to struggle with the impact of COVID-19 on both occupancy and staffing, there remains an elevated risk that additional operators may be unable to pay in accordance with their contractual terms.

-OHI Q3 Investor Presentation.

I’m curious to see if things get better or worse for operators in the medical real estate space, but it is something worth keeping an eye on for investors. While the declining revenues and tenant troubles could be a problem for OHI, many investors are bullish on OHI due to its cheap valuation.

Valuation

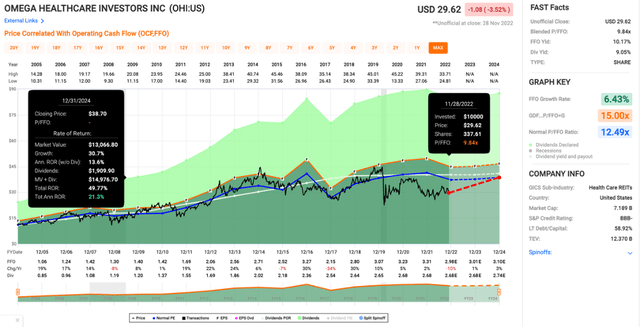

Shares of OHI are cheap today at a price/FFO of 9.8x. Since the panicked selloff in 2020, shares haven’t spent much time above a price/FFO of 10x, and I don’t think that is likely to change in the future. Going back further shows that shares have typically had a higher multiple (12.5x), so if I’m wrong on my assessment, investors could see some degree of multiple expansion, which would boost returns.

There are three primary reasons I think we won’t see multiple expansion. The first is a balance sheet that has a significant amount of debt. While they debt doesn’t all come due at the same time, OHI has significant borrowings maturing each year from 2023 until 2029. The amounts range from $350M to $700M, but on average, OHI will have over $500M maturing each year. If they issue new notes, they will likely be at a higher interest rate.

The second reason is declining revenues. If the top line continues to shrink, eventually that will cause problems in other areas of OHI, which already has a questionable balance sheet. The third reason is the tenant problems, which add another layer of complexity to the equation. We will see how all these factors play out, but these three things have kept me on the sidelines despite OHI’s juicy yield. Even bullish investors usually come to the conclusion that most of OHI’s forward returns will be driven by the juicy 8.7% dividend.

Dividends?

The dividend is the main thing bulls point to, and an 8.7% yield is nothing to sneeze at. However, the dividend hasn’t been raised since 2019, which is an automatic red flag in my book, especially for a REIT with a balance sheet like OHI’s. We will see if dividend hikes make a return in 2023, but I wouldn’t hold my breath. The other thing some people point to is the buyback program authorized earlier this year.

Buybacks

They didn’t buy back any shares in Q3, but they have repurchased a decent chunk of shares in the first nine months of 2022. So far, they have repurchased 5.2M shares at an average cost of 27.32 for a total of $142.3M. The authorization will last until March 2025, so they have plenty of time to use the whole $500M program. I am curious to see how aggressive they get in the coming quarters, especially if problems with tenants get worse. I usually like buybacks, because all else being equal, reducing share count means investors own a larger piece of the pie, but I’m indifferent on OHI’s current buyback. If they can take advantage of market fluctuations to buy back shares at lower prices, it will be a positive. If I were an investor, I wouldn’t be that thrilled with buybacks at the current price.

Conclusion

Many investors, including myself, love to look for high yield opportunities in the REIT sector. Picking up mispriced dividend stocks can create attractive income streams with a solid return potential. OHI, with its 8.7% dividend, certainly fits the bill for investors looking for current income. However, there are three main problems that poke holes in the bullish thesis for me.

The first is declining revenues. I try to avoid companies that have a shrinking top line as a general rule, and REITs are no exception. The second reason is the tenant issues that OHI has had to deal with. They might be able to resolve them, but I think tenant problems are just as likely to deteriorate as they are to improve. The third reason is the balance sheet which carries more debt than I am comfortable with. They also have a string of maturities approaching, so it will be interesting to see how the company handles those.

The bullish case rests on two things: a cheap valuation and a large dividend. At a price/FFO of 9.8x, shares are at a discount to OHI’s average multiple, but I wouldn’t count on multiple expansion. OHI does have a large dividend at 8.7%, but it hasn’t grown since 2019. I’m curious to see what happens over the next couple years with the quarterly payout. I’m not predicting a dividend cut in the next couple years, but I wouldn’t rule it out either.

If investors are interested in the medical REIT space, I would look at potential alternatives like Global Medical REIT Inc. (GMRE). It has a cheap valuation like OHI along with a juicy 8.5% dividend, which it has raised for the last couple years. Forward returns for OHI could still push towards the double-digit range due to the large dividend, but there are problems that could spell trouble for OHI’s future. For me, the potential issues outweigh the cheap valuation and large dividend, which is why I’m still on the sideline when it comes to Omega Healthcare Investors.

Be the first to comment