Solskin

Omega Healthcare Investors, Inc. (NYSE:OHI) is benefiting from the healthcare industry’s fundamental recovery following the Covid-19 pandemic. The health care real estate investment trust’s operating performance continues to improve, and Omega Healthcare Investors covered its dividend with funds from operations in the third quarter.

Omega Healthcare Investors, with a pay-out ratio of 88% in 3Q-22, is in a good position to continue paying its dividend, and the trust’s stock has a compelling valuation based on FFO.

Portfolio Composition And Recovery Of Fundamentals

Omega Healthcare Investors, like many healthcare-focused real estate investment trusts, struggled during the Covid-19 pandemic. However, core fundamentals in Omega Healthcare Investors’ business are improving, suggesting that the trust could not only maintain its dividend payout, but also grow into a richer FFO multiple over the medium term.

Omega Healthcare Investors is a leading skilled-nursing healthcare trust that owns and leases skilled-nursing and senior-housing facilities to a group of operating companies.

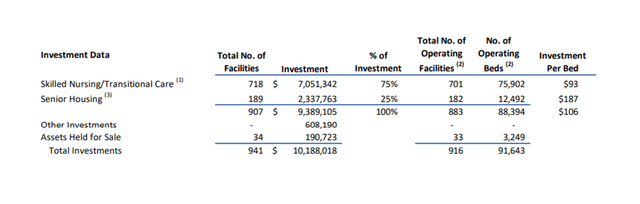

The trust’s portfolio contained 907 facilities as of September 30, 2022 (excluding those that are classified as assets held for sale). The core of OHI’s portfolio is made up of skilled-nursing facilities, which account for 75% of the trust’s investments, while senior-housing facilities account for 25%.

Portfolio Composition (Omega Healthcare Investors Inc)

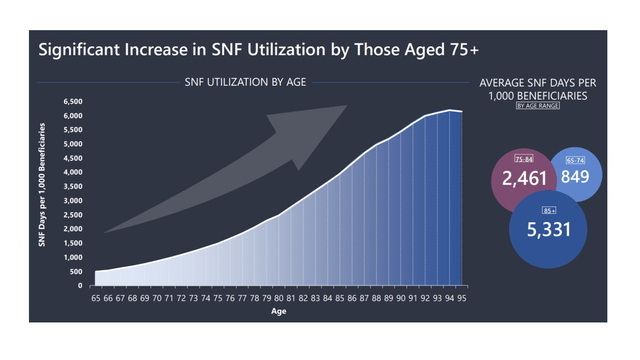

Omega Healthcare Investors profits from long-term ageing trends that point to a steadily increasing share of elderly people in the United States and growing demand for services provided by Omega Healthcare Investors’ operators.

Because SNF utilisation rises with age, an increase in life expectancy is expected to be a major driver of increased demand for skilled-nursing facility space.

Increase In SNF Utilization (Omega Healthcare Investors Inc)

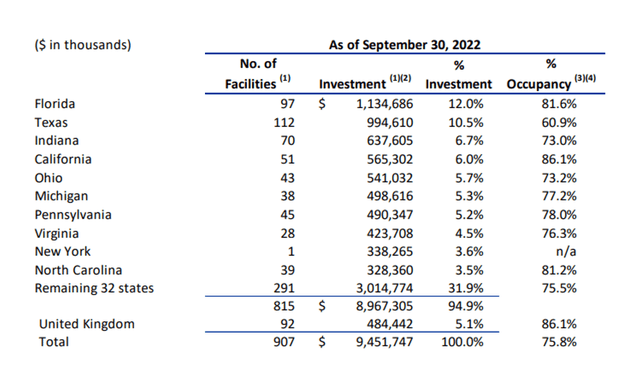

Approximately 12% of the trust’s contractual rent and mortgage obligations (on an annualised basis) were not paid in 3Q-22, indicating that OHI still has some issues to work out with its operators, though the situation has improved since the pandemic’s peak. The occupancy rate has also levelled off and slightly increased.

Omega Healthcare Investors’ occupancy has increased by 6 percentage points since the low in January 2021. The occupancy rate, including UK properties, was 75.8% as of September 30, 2022.

Occupancy Rates (Omega Healthcare Investors Inc)

Despite Operator Problems, The Trust’s Dividend Remained Consistently Covered By AFFO

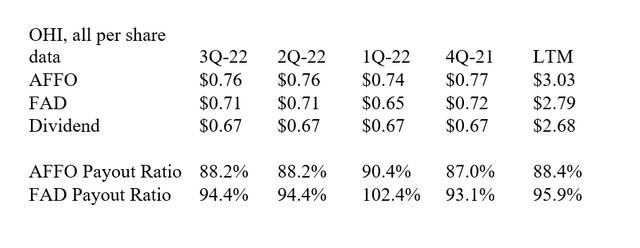

In the third quarter, Omega Healthcare Trust covered its dividend with adjusted funds from operations. The importance of a dividend pay-out ratio cannot be overstated for passive income investors, especially since investors were concerned about Omega Healthcare Investors’ ability to fund its dividend during the pandemic because a few operators failed to make rent payments.

Despite defending its $0.67 per share quarterly dividend, Omega Healthcare Investors transitioned properties to other operators and placed some of its operators on a cash basis as a result of the Covid-19 pandemic.

In 3Q-22, Omega Healthcare Investors earned $0.76 per share in adjusted funds from operations, easily covering the $0.67 per share per quarter dividend pay-out.

The pay-out ratio was 88.2% based on adjusted funds from operations, which was the same as the dividend pay-out ratio in the previous twelve months.

AFFO Pay-Out Ratio (Author Created Table Using Company Supplements)

AFFO Potential In 2022

Based on the $2.26 per share in adjusted funds from operations that Omega Healthcare Investors earned in the first three quarters of 2022, I believe the trust has a good chance of earning at least $3.00 per share in AFFO this year.

The real estate investment trust has not provided AFFO guidance for this year due to uncertainty regarding the financial health of some of Omega Healthcare Investors’ operators.

The trust’s stock has a P/AFFO-ratio of 10x based on $3.00 per share in adjusted funds from operations. In my opinion, the P/AFFO-ratio implies a reasonable margin of safety, and the trust’s stock price could rise in the future if portfolio recovery trends continue in 2023.

Why Omega Healthcare Investors Could See A Lower Valuation

OHI’s future prospects are heavily reliant on the health of its operator base. During the pandemic, some operators failed to make rental payments, which impacted Omega Healthcare Investors’ operational performance and resulted in lease restructurings.

With that said, I believe the company’s recovery trends are positive and in the right direction, and investors can reasonably expect such trends to continue in 2023. If, on the other hand, more operators went bankrupt, straining OHI’s cash flow, the trust’s stock may face ongoing valuation issues in the future.

My Conclusion

Omega Healthcare Investors, in my opinion, continues to be a good investment option for passive income investors seeking stable and predictable dividend income from a recovering healthcare real estate investment trust.

Portfolio recovery trends are encouraging, and the pay-out ratio suggests that investors should not be concerned about dividends.

Furthermore, Omega Healthcare Investors trades at a compelling valuation multiple of 10x AFFO, implying that there is still room for growth if recovery trends continue.

Be the first to comment