jetcityimage

Underwhelming results and outlook

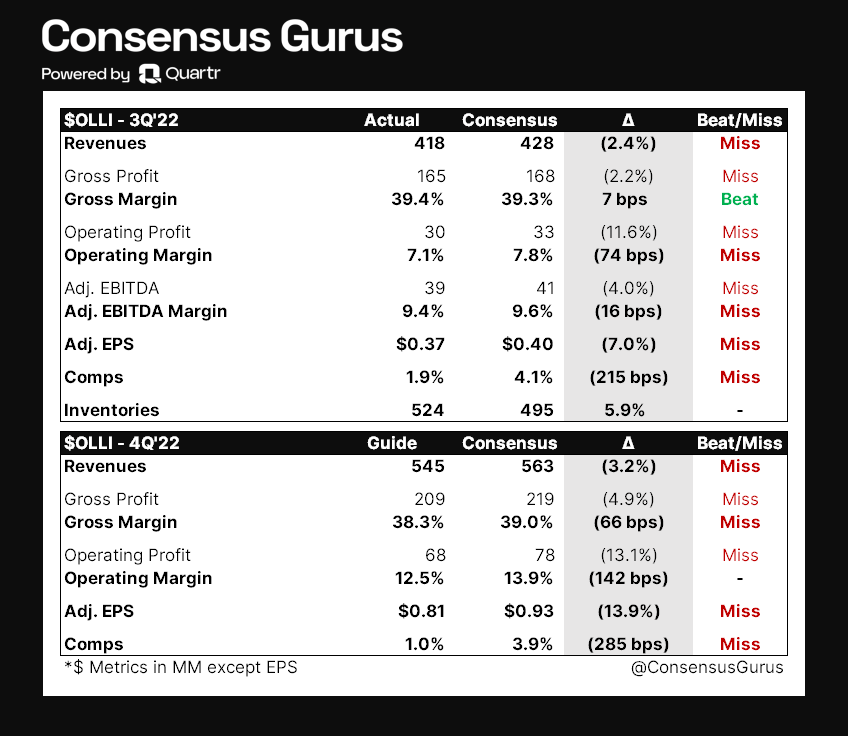

Shares of closeout retailer Ollie’s Bargain Outlet (NASDAQ:OLLI) were down 17% following disappointing 3Q22 results that missed most consensus estimates. Though Ollie’s may be understood as a beneficiary in a highly inflationary environment where consumers trade down to its extreme value offerings, the company delivered Q3 revenue growth of 9% vs. 11.6% consensus, while comps were 1.9% vs. 4.1% consensus.

For the current quarter, revenue guidance of $545 million at the midpoint indicates a YoY growth of 8.8% vs. 12.3% consensus, and comps of flat to 2% (vs. 3-5% prior) were materially below the Street’s 3.9%. Margin-wise, both gross margin and EBIT margin miss consensus, while adj. EPS of $0.81 also missed $0.93 consensus.

ConsensusGurus

For full year 2022, Ollie’s expects total sales of $1.82 billion at the midpoint and comps of negative 3.3-3.8%. Gross margin is expected to be 36.1-36.2%, lower than the usual 39-40% during pre-pandemic periods. Operating income is guided to $131.5 million at the midpoint, implying an EBIT margin of 7.2% vs. 12.2% in 2019.

Looking out to 2023, Ollie’s expects to open 45 new stores on top of the estimated 468 stores this year, bringing the total number of stores to 513. The long-term target of 1,050 was reiterated during the Q3 conference call. While management did not provide any sales outlook for 2023, the team sees gross margin gravitating towards 39% and SG&A to be roughly 26% of sales in an environment that’s not likely to be as promotional as 2022. As of writing, consensus estimates call for 2023 revenue of $2 billion (+10% YoY) and EPS of $2.59, where analysts are likely giving Ollie’s the benefit of the doubt by assuming a 39% gross margin. This comes down to a forward earnings multiple of 18.4x vs. 5-year average of 32x.

Not exactly benefiting under the current macro

As a closeout retailer that scoops up extreme-value deals in an environment characterized by slowing consumer spending and excess inventories, Ollie’s is theoretically to benefit from the current backdrop where consumers are extremely price sensitive. However, results and management’s comments on the outlook don’t quite reflect the advantage of Ollie’s business model.

Despite strength in several categories (hardware, lawn & garden, health & beauty aids, sporting goods and food) in Q3, Ollie’s saw business slowing in the last 2 weeks of October and noted it will continue to invest in price to compete in a “highly promotional” environment.

While management highlighted that the closeout market remains extremely strong where “deals are getting bigger” in categories such as flooring, automotive, lawn & garden and housewares, there is indeed some pressure on discretionary items (especially high ticket items) as noted in other retailers such as Costco (COST) that recently reported a low-single-digit sales decline in non-food sales in November. Margin-wise, Ollie’s sees consistent closeout margin vs. last year.

So what’s stopping Ollie’s from achieving above-expectation results and guidance when the closeout market remains healthy with growing deals and stable margins? Management believes the runway for closeout should extend well through 1H23, indicating a favorable environment for the business. Why isn’t Ollie’s outperforming?

My sense is that while major retailers from Target (TGT) to Walmart (WMT) can very well cut prices aggressively to remove excess inventories, Ollie’s isn’t the only closeout name in town. For example, Big Lots (BIG) has been quite active in pushing its bargain assortments where management targets 33% of sales in FY23 vs. 5-6% in FY22. This represents a $1.5 billion additional closeout revenue from Big Lots’ almost 1,440 stores vs. Ollie’s 463 stores today.

In other words, although Ollie’s is supposed to win in a highly promotional environment, aggressive price competition from retail peers has likely put a cap on any operational upside. While management noted some benefits of higher income consumers trading down, these were offset by lower income, fixed income consumers trading out.

What to do with the stock?

Ollie’s is an early-stage growth retailer with plenty of runway ahead, but the company isn’t exactly producing above-average growth despite operating under a favorable macro. While the weakness in top-line growth and margins may have been priced and the stock is now becoming a “show me” story, it’s uncertain whether (1) revenue growth can return to 15-20% during years before the pandemic and (2) gross margin can revisit 40%. Though shares trade at a forward earnings multiple of 18x, which could be viewed as cheap, I now have less confidence of the business outperforming peers in a highly price sensitive environment. As a result, I’d remain on the sidelines and wait for further valuation reset.

Be the first to comment