Antagain

This article is part of a series that provides an ongoing analysis of the changes made to Ole Andreas Halvorsen’s 13F stock portfolio on a quarterly basis. It is based on Viking Global’s regulatory 13F Form filed on 8/15/2022. Please visit our Tracking Ole Andreas Halvorsen’s Viking Global Portfolio series to get an idea of his investment philosophy and our previous update for the fund’s moves during Q1 2022.

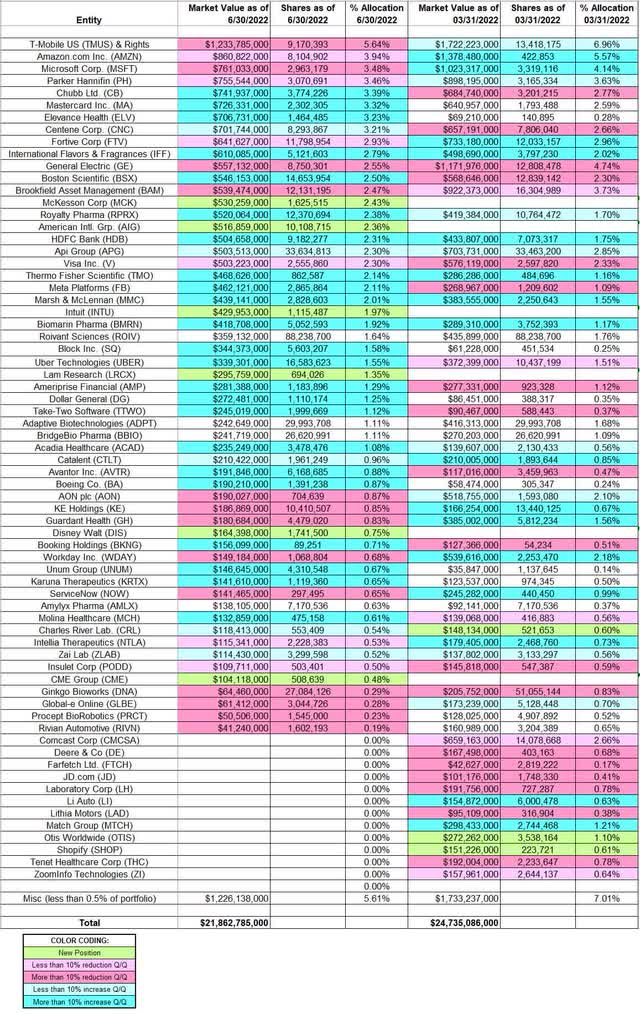

This quarter, Halvorsen’s 13F stock portfolio value decreased ~12% from $24.74B to $21.86B. The number of holdings increased from 56 to 82. Largest five individual stock positions are T-Mobile US, Amazon.com, Microsoft, Parker Hannifin, and Chubb Limited. They add up to ~20% of the portfolio.

Ole Andreas Halvorsen is one of the most successful “tiger cubs” (protégés of Julian Robertson & his legendary Tiger Fund). To know more about “tiger cubs”, check out the book Julian Robertson: A Tiger in the Land of Bulls and Bears.

New Stakes:

McKesson Corp. (MCK), American International Group (AIG), and Intuit (INTU): MCK is a 2.43% of the portfolio position purchased this quarter at prices between ~$300 and ~$336 and the stock currently trades above that range at ~$346. The 2.36% of the portfolio position in AIG was established at prices between ~$50 and ~$64 and it is now at $53.65. INTU is a ~2% of the portfolio stake purchased at prices between ~$353 and ~$506 and it now goes for ~$423.

Lam Research (LRCX), Walt Disney (DIS), and CME Group (CME): These are small (less than ~1.5% of the portfolio each) new positions established during the quarter.

Stake Disposals:

Otis Worldwide (OTIS) and Shopify (SHOP): The ~1% OTIS stake was established last quarter at prices between ~$72 and ~$87. The disposal this quarter was at prices between ~$68 and ~$78. The stock currently trades at $67.80. SHOP was a 0.57% of the portfolio position purchased at prices between ~$51 and ~$136. It was sold this quarter at prices between ~$30 and ~$73. The stock is now at $31.73.

Comcast Corp (CMCSA): CMCSA was a 2.49% of the portfolio stake built during H2 2021 at prices between ~$48 and ~$62. It was sold this quarter at prices between ~$38 and ~$48. The stock currently trades at $34.52.

Farfetch Ltd. (FTCH): The original FTCH stake was purchased in Q3 2021 at prices between ~$37 and ~$51. There was a ~50% reduction next quarter at prices between ~$30 and ~$47. That was followed with similar selling last quarter at prices between ~$11 and ~$34. The remainder stake was disposed this quarter. The stock currently trades at $10.38.

Deere & Co. (DE), JD.com (JD), Lithia Motors (LAD), Laboratory Corp. (LH), Li Auto (LI), Match Group (MTCH), Tenet Healthcare (THC), and ZoomInfo Technologies (ZI): These very small (less than ~1.25% of the portfolio each) positions were disposed during the quarter.

Stake Increases:

Boston Scientific (BSX) and Chubb Ltd. (CB): The 2.15% BSX stake saw a ~175% stake increase in Q4 2021 at prices between ~$38 and ~$45. Last quarter saw a roughly one-third selling at prices between ~$41 and ~$45. The stock currently trades at $41.70. There was a ~14% stake increase this quarter. CB is a 3.39% position that saw a ~20% stake increase in Q4 2021 at prices between ~$174 and ~$196. It is now at ~$189. There was a ~13% trimming last quarter while this quarter saw a similar increase.

Mastercard (MA) and Elevance Health (ELV): These two positions saw substantial increases this quarter. The 3.32% MA stake saw a ~30% increase at prices between ~$309 and ~$379. The stock currently trades at ~$315. The 3.23% ELV stake was primarily built this quarter at prices between ~$444 and ~$530 and it is now at ~$480.

Centene Corp. (CNC): Most of the 3.21% of the portfolio stake in CNC was purchased in H1 2019 at prices between $47and $66. H2 2019 saw a ~22% selling while next quarter there was a ~50% stake increase at prices between $45.50 and $68. The two quarters through Q1 2021 had seen a one-third selling at prices between ~$58 and ~$71. That was followed with a ~20% reduction this quarter at prices between ~$75 and ~$88. The stock is now at ~$84. There was a minor ~6% stake increase this quarter.

International Flavors & Fragrances (IFF): The 1.88% IFF stake was built last quarter at prices between ~$116 and ~$150 and the stock currently trades at ~$102. This quarter saw a roughly one-third increase at prices between ~$108 and ~$135.

HDFC Bank (HDB) and Royalty Pharma (RPRX): HDB is a 2.31% of the portfolio position built over the last three quarters at prices between ~$51 and ~$78 and the stock is now at $64.92. The 2.38% RPRX stake was built in Q4 2021 at prices between ~$35 and ~$43. The stock currently trades at $41.95. This quarter saw a ~14% stake increase.

APi Group (APG): Viking Global was an early investor in J2 Acquisition, a SPAC which acquired APi Group in October 2019. APi Group started trading at $10.40 and now goes for $14.94. Last two quarters have seen marginal increases.

Note: Viking Global has a ~17% ownership stake in the business.

Meta Platforms (META), previously Facebook: META is a ~2% of the portfolio position established over the two quarters through Q1 2021 at prices between ~$246 and ~$295. The next two quarters had seen a ~27% selling at prices between ~$295 and ~$382. There was another one-third selling last quarter at prices between ~$187 and ~$339. This quarter saw a ~135% stake increase at prices between ~$156 and ~$234. The stock is now at ~$146.

ACADIA Healthcare (ACAD), Ameriprise Financial (AMP), Avantor, Inc. (AVTR), Block, Inc. (SQ), BioMarin Pharma (BMRN), The Boeing Company (BA), Booking Holdings (BKNG), Catalent (CTLT), Charles River (CRL), Dollar General (DG), Karuna Therapeutics (KRTX), Marsh & McLennan (MMC), Molina Healthcare (MOH), Take-Two Interactive Software (TTWO), Thermo Fisher Scientific (TMO), Uber Technologies (UBER), Unum (UNUM), and Zai Lab (ZLAB): These small (less than ~2.2% of the portfolio each) stakes were increased this quarter.

Stake Decreases:

T-Mobile US (TMUS): TMUS is currently the largest position at 5.64% of the portfolio. It was purchased over the six quarters through Q1 2021 at prices between ~$74 and ~$135. Next quarter saw a ~25% reduction at prices between ~$125 and ~$147 while in Q3 2021 there was a ~35% stake increase at around the same price range. That was followed with a ~30% stake increase in Q4 2021 at prices between ~$107 and ~$128. This quarter saw a similar reduction at prices between ~$122 and ~$139. The stock is now at ~$140.

Amazon.com, Inc. (AMZN): AMZN is now a large (top three) 3.94% of the portfolio position. It was established in Q2 2015 at prices between ~$19 and ~$22 and increased by roughly one-third the following quarter at prices between ~$22 and ~$27. The position has wavered. Recent activity follows: The four quarters through Q1 2021 had seen a ~80% selling at prices between ~$95 and ~$177. The stake was rebuilt next quarter at prices between ~$155 and ~$175 but was again sold down in Q3 2021 at prices between ~$159 and ~$187. The pattern continued over the last two quarters: stake more than doubled at prices between ~$136 and ~$185. The stock currently trades at ~$124. There was minor trimming this quarter.

Microsoft Corporation (MSFT): MSFT is now at 3.48% of the portfolio. It was established in Q2 2016 at prices between $48.50 and $56.50 and increased by ~140% in the following quarter at prices between $51 and $58.50. Recent activity follows. Last year saw the position sold down by ~75% at prices between ~$212 and ~$343. The stock is now at ~$245. Last quarter saw a ~13% stake increase while this quarter there was a similar reduction.

Parker-Hannifin (PH): The 3.46% PH stake was built during Q3 2021 at prices between ~$279 and ~$313. The stock currently trades at ~$260. Last three quarters have seen only minor adjustments.

Fortive Corp. (FTV): FTV is a 2.93% of the portfolio position established during the three quarters through Q1 2020 at prices between $42 and $83. There was a ~40% stake increase in Q1 2021 at prices between ~$66 and ~$73. Q4 2021 saw a ~20% selling at prices between ~$70 and ~$79 while last quarter there was a ~40% stake increase at prices between ~$56 and ~$74. The stock currently goes for $62.72. This quarter saw a minor ~2% trimming.

General Electric (GE): The 2.55% of the portfolio GE stake was purchased over the five quarters through Q4 2021 at prices between ~$44 and ~$115. There was a ~50% selling over the last two quarters at prices between ~$64 and ~$103. The stock is now at $66.39.

Brookfield Asset Management (BAM): BAM is a 2.47% of the portfolio position purchased over the two quarters through Q3 2021 at prices between ~$44 and ~$57 and it is now at ~$48. There was a ~25% reduction this quarter at prices between ~$43 and ~$59.

Visa Inc. (V): The 2.30% Visa position was primarily built in Q4 2020 at prices between ~$181 and ~$219. There was a ~45% reduction over the next two quarters at prices between ~$193 and ~$237. H2 2021 saw a stake doubling at prices between ~$190 and ~$251 while last quarter there was a one-third selling at prices between ~$191 and ~$235. The stock currently trades at ~$193. This quarter saw a minor ~2% trimming.

Ginkgo Bioworks (DNA): Shares of Ginkgo Bioworks started trading last September after the close of their De-SPAC transaction with Soaring Eagle Acquisition. Viking Global started investing in Gingko Bioworks in 2015 when the business raised ~$45M in a Series B funding round. The valuation at the time was ~$200M. The position was sold down by ~85% last quarter at prices between ~$2.80 and ~$8.70. This quarter saw further selling. The stock now trades at ~$3.

Aon plc (AON), Global-e Online (GLBE), Guardant Health (GH), Insulet Corp. (PODD), KE Holdings (BEKE), Intellia Therapeutics (NTLA), PROCEPT BioRobotics (PRCT), Rivian Automotive (RIVN), ServiceNow (NOW), and Workday (WDAY): These very small (less than ~1% of the portfolio each) stakes were reduced during the quarter.

Kept Steady:

Roivant Sciences (ROIV): ROIV came to market last September through a SPAC merger with Montes Archimedes. The stock currently goes for $3.25. Viking Global’s 1.64% of the portfolio stake goes back to a private investment made in July 2016.

Note: Viking Global controls ~13% of Roivant Sciences.

Adaptive Biotechnologies (ADPT): ADPT position is now at 1.11% of the portfolio. It came about as a result of Adaptive’s IPO in June 2019. Viking Global was a majority investor in Adaptive. Shares started trading at ~$48 and currently goes for $7.63. Q1 2020 saw a ~13% trimming at ~$25 per share. There was another ~10% trimming in Q4 2020 at ~$50 average price.

Note: Viking Global still controls ~21% of Adaptive Biotechnologies.

BridgeBio Pharma (BBIO): BBIO is a ~1% stake. It had an IPO in Q1 2019. Viking Global’s position goes back to earlier funding rounds prior to the IPO. The stock started trading at ~$27 per share and currently goes for $11.14.

Note: Viking Global controls ~21% of BridgeBio Pharma.

Amylyx Pharma (AMLX): The very small 0.63% of the portfolio stake in AMLX was kept steady this quarter.

Note: Regulatory filings from last week show them owning 5.77M shares (9.9% of the business) of Amylyx Pharma. This is compared to 7.17M shares in the 13F report. The reduction was at prices between $27 and $33.

Note: Viking Global has significant ownership stakes in the following businesses: 4D Molecular (FDMT), Celldex Therapeutics (CLDX), Edgewise Therapeutics (EWTX), PepGen (PEPG), Pharvaris NV (PHVS), Rallybio Corp (RLYB), Talaris Therapeutics (TALS), and Zentalis Pharma (ZNTL).

The spreadsheet below highlights changes to Halvorsen’s 13F stock holdings in Q2 2022:

Ole Andreas Halvorsen – Viking Global’s Q2 2022 13F Report Q/Q Comparison (John Vincent (author))

Be the first to comment