shaunl/iStock via Getty Images

Old Dominion Freight Line (NASDAQ:ODFL) is a trucking company of the highest quality in the United States, and its stock may come into buy range soon.

Old Dominion’s Business: Less-than-Load

Old Dominion started in 1934 and was run by the Congdon family into the 1990s. Today the company boasts 23,000 employees and more than 11,000 trucks.

The company operates in “less-than-load” shipping, or LTL. The basic concept is that one truck carries shipments for multiple clients originating in one city with a common destination of another city. Each customer shares only part of the cost of sending the truck to the destination. A less-than-load shipper offers “economies of scale so that freight costs of individual shipments are minimized.” Old Dominion is one of the largest LTL carriers in the country.

Coordinating shipments for more than one customer in a single truck requires significant logistics planning. Delivery can take longer than a direct shipment as well. The trade-off is lower cost for the delivery.

Old Dominion has been recognized by Mastio & Company to be one of the best LTL carriers in the United States in its 18th edition of the U.S. LTL Carrier Customer Value & Loyalty Report. Although the report gave the Overall Weight Quality Score Rank to Peninsula, Old Dominion came in 4th place out of 184 carriers. Old Dominion did come in 1st place for National Carriers, and it also achieved the Mastio Quality Award.

The company has a respectable ranking of 3.8 from employees at Glassdoor.

Old Dominion recently received Autocar’s first “emissions-free, all-electric terminal tractor.” The company will be testing the performance of the truck, according to its press release.

Recent Results

In the most recent quarter, Old Dominion announced new records for revenue and earnings. Their on-time service was 99%, and they had a claims ratio of 0.1%.

When asked about continued expansion in the face of a murky outlook for the economy, CEO Greg Gantt replied, “Sometimes our opportunities are a little better when it slows down. And sometimes you just have better opportunities when it’s like it is today…We want to grow that share and we know we’ve got to continue our efforts on a consistent basis to have that tight capacity when things get tight like they have been in the last 1.5 years [to] two years.”

When asked about fuel costs, CFO Adam Satterfield responded that “our surcharge has certainly been effective with offsetting the increased cost of diesel fuel.”

The company supports a healthy Current Ratio of 1.79 and an impressive Quick Ratio of 1.92.

The debt load is remarkably low, especially for a company that maintains a large fleet of trucks. Total Debt / EBITDA is 0.05x. Total liabilities to Total Assets is an impressive 25.8%

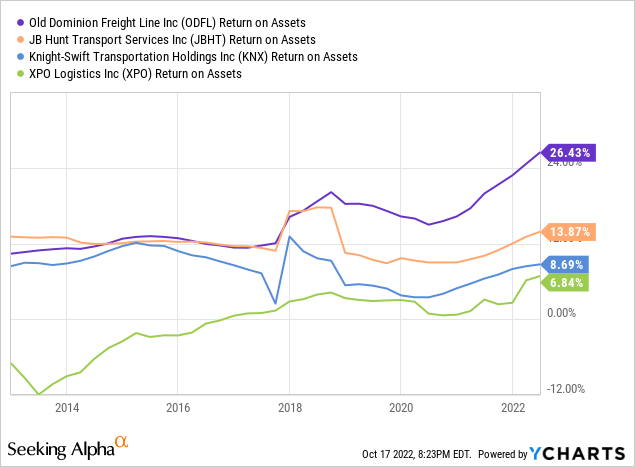

Return on Assets is 22.4% and Return on Equity is 35.7%. These metrics are nearly twice that of J.B. Hunt (JBHT), and nearly three times that of Knight-Swift (KNX).

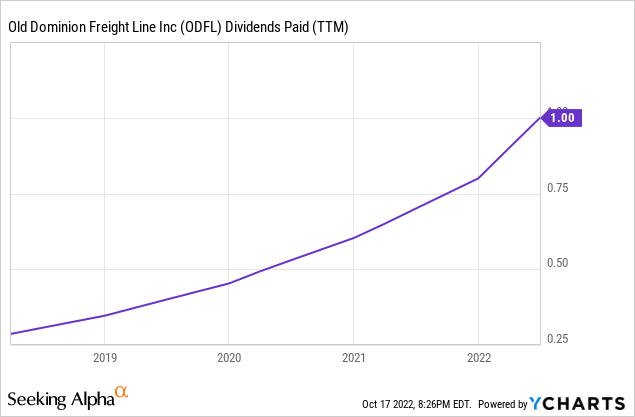

Dividend hunters will likely reject the stock, given its yield of 0.45%. But the company started paying out dividends in 2017, and continued to increase dividends through the pandemic.

The company has been buying back stock since 2013. It is opportunistic in its repurchases and does not issue debt for it.

Valuation

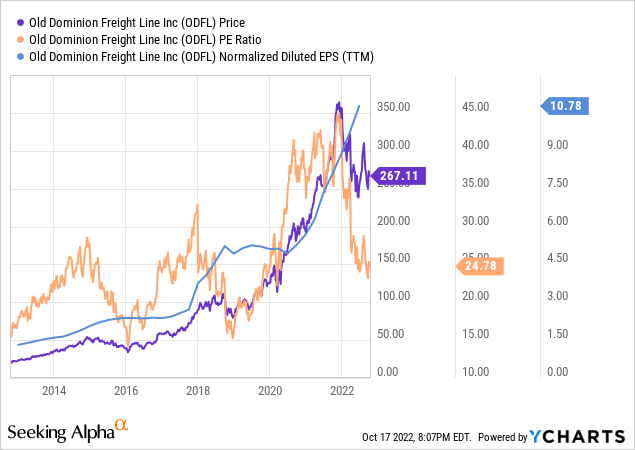

Old Dominion is of high quality, and investors pay for it. Its P/E has always been high, and the same is true today. However, the earnings per share has been rising for some time, and the price has been dropping since the beginning of the year.

I calculate the trailing 5-year PEG Ratio to be an impressive 0.75, indicating the stock is well within buy range. However, using analyst forward estimates from TIKR.com, I calculate the PEG Ratio to be at 1.75.

Risks

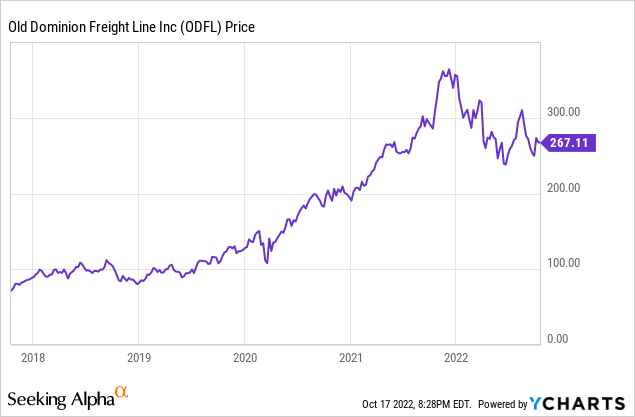

The stock price has come down substantially, but there is still room to drop some more.

A recession could cause less packages to be shipped, which would cause a decline in revenue for the company.

Conclusions

With solid fundamentals, good customer relations, and relatively good ratings by employees, Old Dominion is one of the best trucking companies in the country, and well worth investing in.

It is difficult to predict which way the stock price will go at present. Investors interested in the long term should do well by dollar averaging now. There is, however, a risk that the price will slide more yet. For that reason I consider the stock a hold.

A dip below $240 will likely be a good buy, and I will probably initiate a position at $250.

Be the first to comment