PeopleImages/iStock via Getty Images

Olaplex (NASDAQ:OLPX) has significantly cut guidance for FY 2022, citing macroeconomic pressures, increased competition, a moderation in new customer acquisition and inventory rebalancing across certain customers. I had previously written about the risk of Olaplex’s revenue growth stagnating and margins compressing as the company is forced to invest more in growth, but did not expect performance to deteriorate this significantly. The question for investors now is if the current situation is primarily the result of increased competition or the result of a normalization of demand and subsequent excess channel inventories. The latter could present an opportunity, but the former could result in further downside.

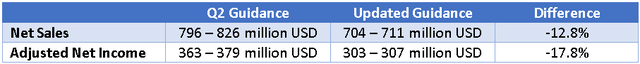

Table 1: Olaplex Full Year 2022 Guidance (source: Created by author using data from Olaplex)

Olaplex was a high flyer through the pandemic as consumers flocked to their best-in-class products. The company leveraged this success to go public in the midst of a red-hot IPO market in 2021 at an extraordinary valuation, but things are beginning to look decidedly grim. Revenue is now expected to be down significantly YoY by the end of 2022, and Olaplex is potentially facing pressure on margins.

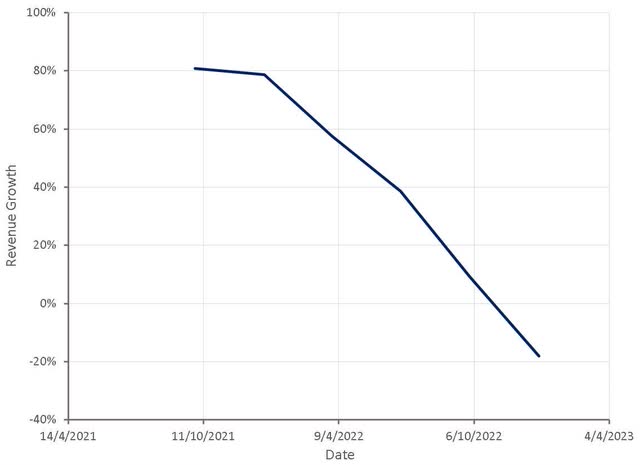

Figure 1: Olaplex Revenue Growth (source: Created by author using data from Olaplex)

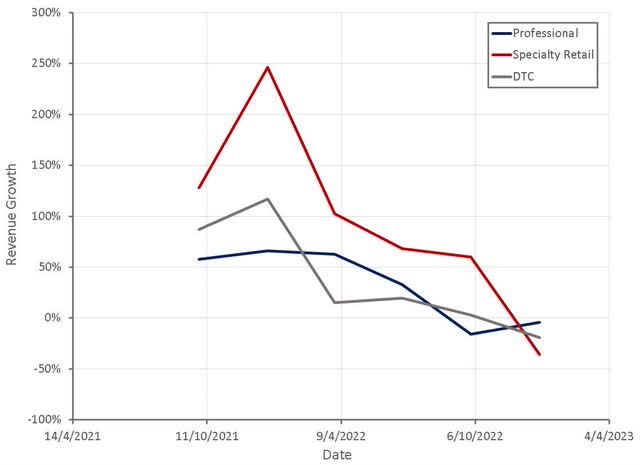

Olaplex relies heavily on the Professional channel for revenue, and this appears to have been one its biggest problems in the third quarter. Revenue growth through the Professional channel in the third quarter was approximately -16%. Macroeconomic weakness could be causing consumers to forgo expensive trips to hair dressers / hair stylists. Internet search data also appears to indicate that 2021 saw a boom in interest for hair dressers / hair stylists, as consumers ventured out after the pandemic. This may have created excess revenue for Olaplex in 2021 and difficult comparable periods in 2022.

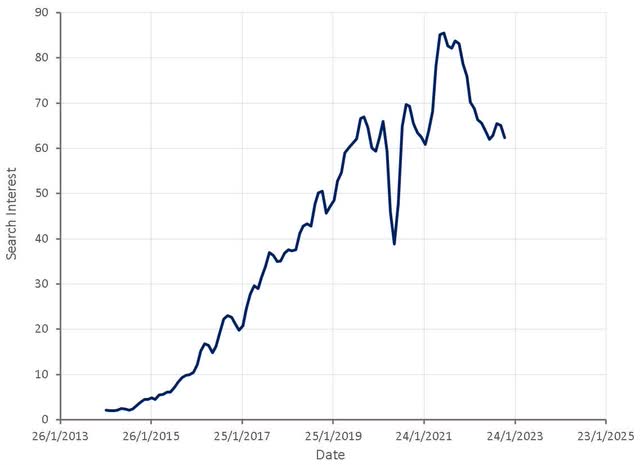

Figure 2: Search Interest Related to Hair Dressers / Stylists (source: Created by author using data from Google Trends)

More important for Olaplex are questions over potential market saturation and rising competition. Much of Olaplex’s revenue growth over the past few years has been driven by access to new distribution channels and expansion into new geographies. Olaplex’s revenue growth was always destined to decelerate significantly as these new channels matured. Research by Piper Sandler also indicates that Olaplex could be losing a mid-to-high single digit percentage of share in salons to other hair repair brands like K18.

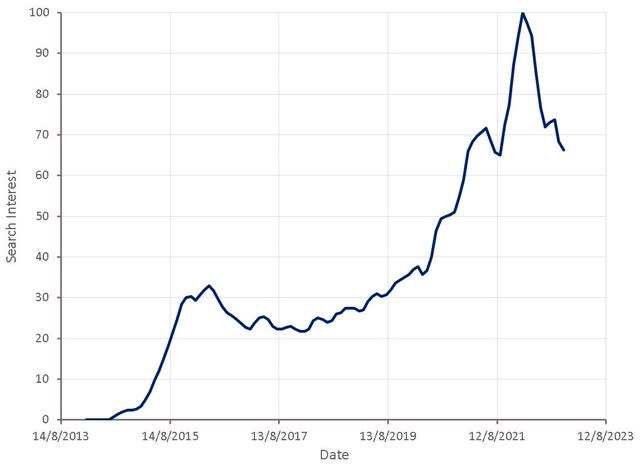

Figure 3: Search Interest for “Olaplex” (source: Created by author using data from Google Trends)

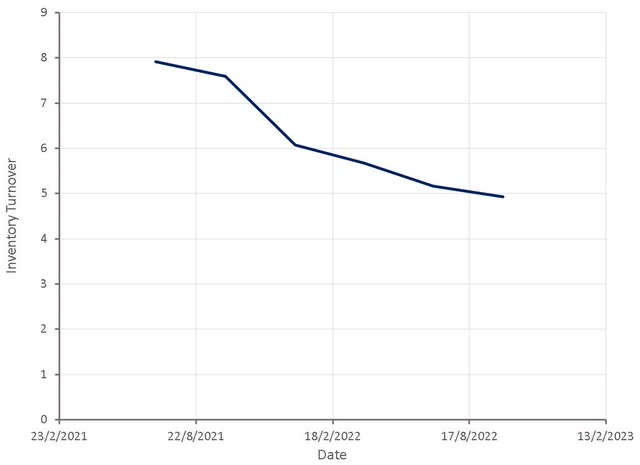

While Olaplex clearly faces a demand issue, high channel inventory levels may be exacerbating the problem. Management specifically called out inventory rebalancing across certain customers as part of the problem, although it is unknown how bad the problem is or what channels are affected. Olaplex’s own inventory levels do not currently appear to be a large problem, despite inventory turnover declining over the past 12 months.

Figure 4: Olaplex Inventory Turnover (source: Created by author using data from Olaplex)

The large, anticipated decline in Specialty Retail revenue growth in the fourth quarter suggests that retailers have excess Olaplex inventories that they need to work through. If this is the case, the current dip in revenue may not be as bad as it appears on the surface. Expected revenue declines across all three distribution channels in the fourth quarter do point to serious demand problems though.

Figure 5: Olaplex Revenue Growth by Channel (source: Created by author using data from Olaplex)

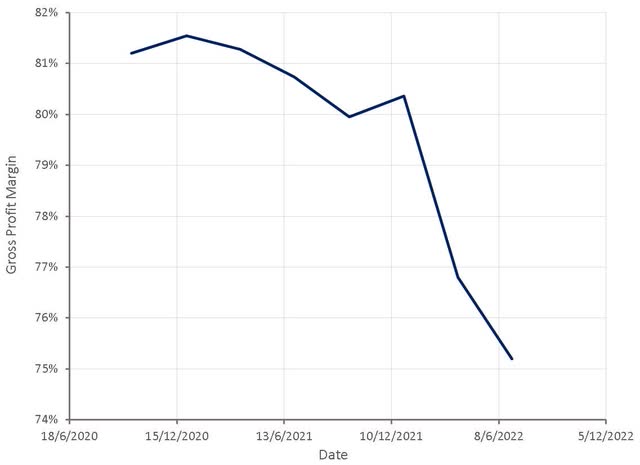

Olaplex’s gross profit margins have declined from the low-80s to the mid-70s over the past 12 months. The source of this deterioration is not clear, but is likely due more to inflationary pressures on COGS than price competition. With management specifically calling out increased competition, competitor discounting and consumer weakness in the guidance update, margins may still have further to fall.

Figure 6: Olaplex Gross Profit Margins (source: Created by author using data from Olaplex)

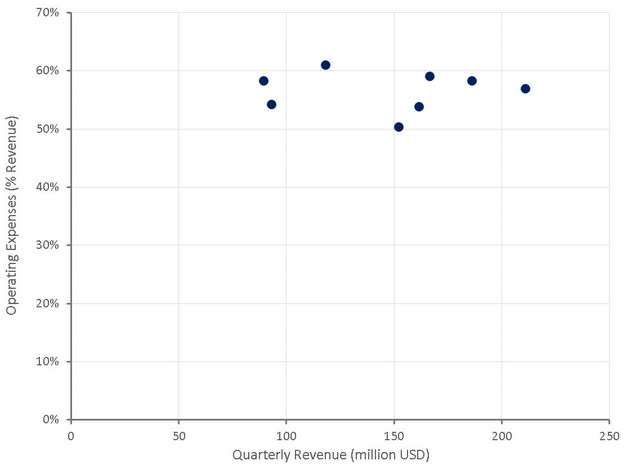

Olaplex’s bottomline may not suffer too much though, despite the expected decrease in revenues, as the company has outsourced most activities and hence has a fairly low fixed cost base. Marketing has also so far been largely driven by Olaplex’s passionate consumers, meaning that operating expenses have been fairly insensitive to the amount of revenue generated.

Given the increase in competition it would not be surprising to see Olaplex significantly step up their investments in sales and marketing. The company still has a highly differentiated product, but the company’s value proposition may not be reaching new consumers. Olaplex has also suggested they plan on extending their proprietary technology into adjacent markets, like skincare. This could add substantially to the company’s investments in product development.

Figure 7: Olaplex Operating Expenses (source: Created by author using data from Olaplex)

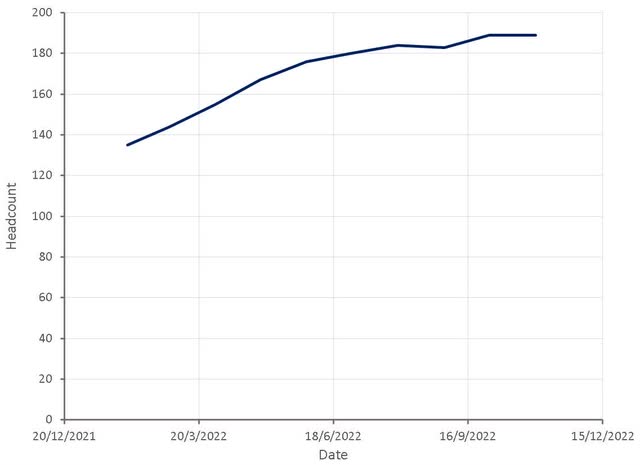

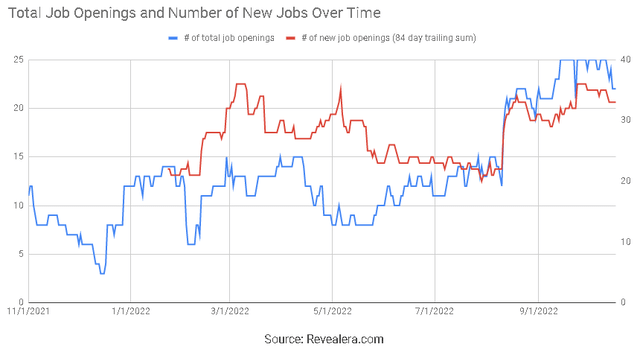

Olaplex has increased their costs substantially over the past 12 months, as the company has been forced to work harder to try and sustain growth. Headcount is up significantly and hiring plans still appear to be robust.

Figure 8: Olaplex Employees on LinkedIn (source: Created by author using data from LinkedIn) Figure 9: Olaplex Job Openings (source: Revealera.com)

Conclusion

Olaplex’s management has so far given investors little insight into their current issues. If the expected drop in revenue is mainly the result of overstuffed channels, the drop in share price could present investors with a buying opportunity, although Olaplex’s PE ratio is still far from bargain territory. If the decline in revenue is more due to market saturation and rising competition, Olaplex will likely face weak growth and declining margins going forward, presenting further downside risk for the stock.

Be the first to comment