DNY59

Investment thesis

Okta (NASDAQ:OKTA) has been on a roller-coaster since the completion of its acquisition of Auth0 at the beginning of this year. Management publicly acknowledged integration problems on the Q2 FY23 earnings call at the end of August leading shares to plummet more than 30%. Q3 FY23 earnings and management commentary showed that Okta could have run out of negative surprises, which could pave the way for a more predictable future.

Taking a step back the company still operates in of the most important segments of today’s IT environment, IT security, where it holds a leading position within access management. This has been further cemented with the Auth0 acquisition that significantly strengthened the customer identity management leg after an already well-established workforce identity offering.

In addition, the identity management market has seen substantial M&A activity in the preceding quarters (on the top of the Auth0 acquisition) leading to a more concentrated market, which is usually beneficial for the existing players from a pricing perspective.

Meanwhile, the valuation of shares has fallen to a 40-45% discount compared to recent acquisition prices of direct competitors even after the 26% post-earnings rally. These factors make me come to conclusion that Okta shares are a good risk/return investment at current levels even if executional risks still exist.

Q3 earnings: Better than feared

After scaring investors during the Q2 FY23 earnings call Okta released Q3 FY23 numbers recently that soothed investors’ nerves. The company beat its previously set revenue guidance by 3% close to its usual beat of 5-6%. More importantly in contrast to the Q2 quarter management raised the FY23 revenue outlook with the magnitude of the revenue beat (~$18 million) signaling confidence in the business for the closer future.

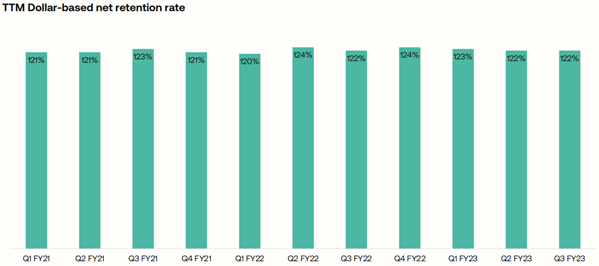

Another well-timed decision from management in my view was the preliminary communication of the FY24 revenue guidance as expectations had to be tempered sooner or later for that financial year. They guided for a seemingly conservative 16-17% YoY growth rate in contrast to the current run rate of ~30-35%. One reason I think it’s quite conservative is that the dollar-based net retention rate of Okta has been tracking above 120% for many quarters and shows no signs of a slowdown:

Okta Q3 FY23 earnings presentation

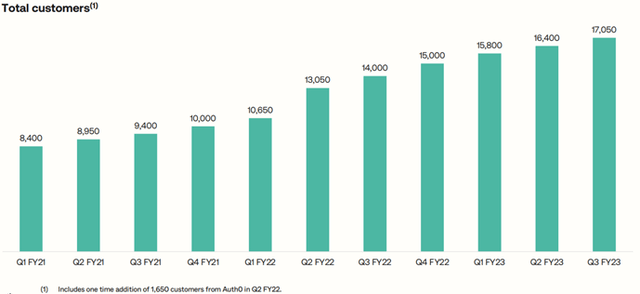

If this strong trend continues in the upcoming fiscal year as well revenue could grow by ~20% only from existing customers, which would already surpass the 16-17% guide of management. In addition, the number of new customers is steadily increasing as well, which will most probably add several percentage-points to topline growth in FY24 again:

Okta Q3 FY23 earnings presentation

To be honest, I’ve been surprised that even with such a soft guidance for FY24 shares rallied 26% after the earnings report. It seems that investors expected the negative news announced during the Q2 earnings call to get possibly worse. This didn’t happen eventually, so they breathed a sigh of relief.

With all this, I think significant risks of negative surprises have been eliminated for the upcoming earnings releases, which make the stock more investable. Before moving on to profitability, I want to take a quick look at current and expected revenue trends to get a clear picture of Okta’s top line growth in the aftermath of the Auth0 acquisition.

Q2 and Q3 quarters for FY2023 have been those ones where YoY comparisons haven’t been distorted by the Auth0 acquisition. In Q2 revenues grew 43.2% YoY followed by a 37.2% increase in Q3. Management guided for a conservative 27.7% YoY growth for Q4, but after considering the “usual” ~5% beat this would increase to 34.1%. Based on this current top line growth is tracking around 35%.

Looking at the current portion of remaining performance obligations (RPO), which is a good leading indicator for revenues shows a somewhat similar tendency. 36.3% YoY growth for Q2 followed by 33.8% for Q3. Management guidance of 21% YoY growth for Q4 seems quite conservative again, so take it with a pinch of salt.

All in all, it seems that the growth dynamic of the company has showed some slowdown in Q3 but based on Q4 guidance this doesn’t seem to be that bad. According to management the majority of this can be attributed to sales integration problems on the one hand as this is the first year when both former Auth0 and current Okta sales reps began to sell both solutions. Mastering both the customer identity solution of Auth0 and the workforce identity solution of Okta takes time for the sales reps. In the top that the sales attrition rate has increased above 20% for Q2 in the wake of the Auth0 acquisition from ~15% in pre-pandemic times, which is another aggravating factor for revenue growth. Management laid out a framework for overcoming these problems earlier, whose success seemed to bear already some fruit in Q3.

If Okta would get over these frictions in the sales engine it could probably reaccelerate the still impressive YoY revenue growth rate of ~35%, which could be an important catalyst for shares in my opinion.

The first steps toward profitability

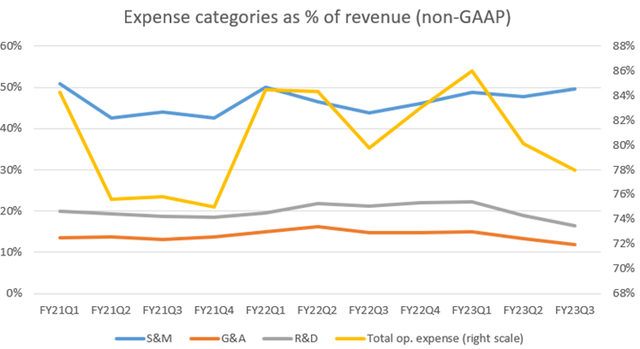

Besides the stabilization (or reacceleration) of topline growth the other thing Okta must prove to investors is that it can achieve this with simultaneously decreasing the growth in expenses, especially in sales and marketing (S&M) expenses. As shown in the following graph these are still quite high and don’t seem to be coming down:

Created by author based on company fundamentals

It’s welcoming news that operating expenses came down to 78% of revenues in the previous two quarters thanks to the proportional reduction in general and administrative (G&A) and research and development (R&D) expenses. However, S&M spending was still around 50% of revenues, which seems to be quite much for the first sight. Although looking at SaaS companies that have gone public in the past 5 years 50% seems to be the average.

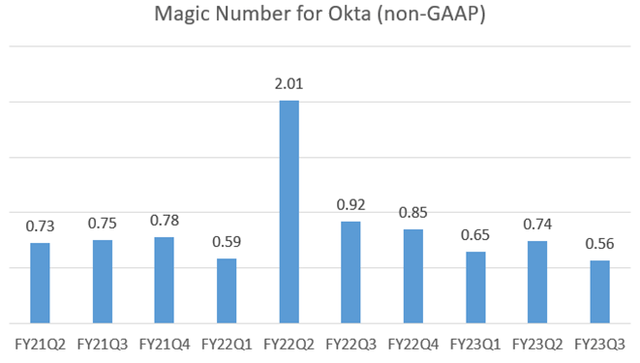

Another aspect to gauge whether S&M spending is appropriate is to look at the so-called Magic Number, which shows the ability of S&M spending to generate future revenues:

Created by author based on company fundamentals

The number of 0.56 for Q3 shows that S&M spending during Q2 has driven less increase in sales than the same amount of spending in the preceding quarters. This is in line with management comments on sales integration problems and increased attrition. If these problems show signs of progress indeed this should be reflected in the increase of the Magic Number in the upcoming quarters. Usually, a number above 0.5 is sufficient, but it should rather track above 0.75-1 to justify every single cent spent on S&M.

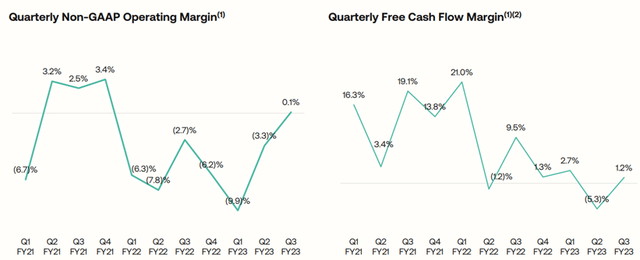

Based on Okta’s Investor Day presentation and management comments on Q2 and Q3 earnings calls there will be much more emphasis on profitability going forward, which already resulted in a slightly positive non-GAAP operating and free cash flow margin this past quarter:

Okta Q3 FY23 earnings presentation

For FY24, management announced a low-single-digit operating margin guidance and a not-specified significant increase in free cash flow margin, further strengthening their commitment to profitability.

This is welcoming news in my opinion, it seems that the current market environment has forced management to rethink their profitability vs growth strategy, which has been admitted by the CEO on the Q2 earnings call:

“I think overall, in the Okta sales team, I think one of the — if I had to do all again, one of the things I would do differently is we had a super, super aggressive hiring plan coming into this year. And we were really trying to cover all the market and make sure we had every nook and cranny in terms of growth opportunity covered. And that, in retrospect, was a mistake. We should have been more from the beginning had a more of a moderated growth plan to make sure that we could achieve that at the level we wanted to. So that’s one thing I would do differently.” – Todd McKinnon, CEO

This and several other comments suggest to me that management is taking a more transparent approach toward investors than in the preceding quarters. If this persists in the future, this is also welcoming news.

Still, the big question around S&M expenses is whether their reduction will lead to a significant slowdown in revenue growth or is it possible to counterbalance this with increasing sales efficiency? I think currently no one has the answer for this, but probably a bit of both. I believe possible negative or positive surprises in that regard could influence the share to a great extent.

Valuation based on recent acquisitions of competitors

The valuation of Okta (and many other high-growth, zero-profit tech stocks) is usually a fiercely debated topic and there are always voices saying no matter how low a sales-based valuation multiple (P/S, EV/S) goes it’s still expensive because the company is burning cash. Luckily, this time there have been two further acquisitions this year in the identity management space, where a leading private equity firm with 40 years of history, Thoma Bravo (16) acquired two leading companies, Ping Identity, and ForgeRock (FORG) (the deal is waiting on DOJ approval). I suppose that they made a very thorough valuation before paying billions of dollars, which provides a good basis for deciding whether Okta shares are under- or overvalued.

Based on the purchasing price paid for the two companies, their balance sheets immediately before the acquisition and their expected revenues for calendar year 2022 I have calculated that Ping Identity has been acquired for an enterprise value of ~8.5x CY22 expected sales, while ForgeRock for ~9.3x CY22 expected sales.

Looking at Okta’s current market cap of $9.84 billion subtracting cash and short-term investments of $2.47 billion and adding long-term debt of $2.19 billion results in an enterprise value of $9.56 billion. Management gave an outlook for FY23 sales of $ 1.837 billion, which results in an EV/Sales multiple of 5.2. Compared to the multiples of 8.5 and 9.3 discussed above this shows a 39-44% discount. Furthermore, Ping Identity has been a 20% topline grower based on ARR, while ForgeRock a 30% one, so the differences in future growth prospects favor Okta as well. Finally, both companies acquired by Thoma Bravo were deeply in the red on the bottom line, so this doesn’t support the huge difference in valuations as well.

This makes me conclude that shares of Okta are undervalued at current levels, even if GAAP profitability is still not close on the horizon. If a strategic buyer paid these prices for direct competitors in the space, I think long-term investors can use this as a good rule of thumb in the future.

Market consolidation is welcoming news for Okta

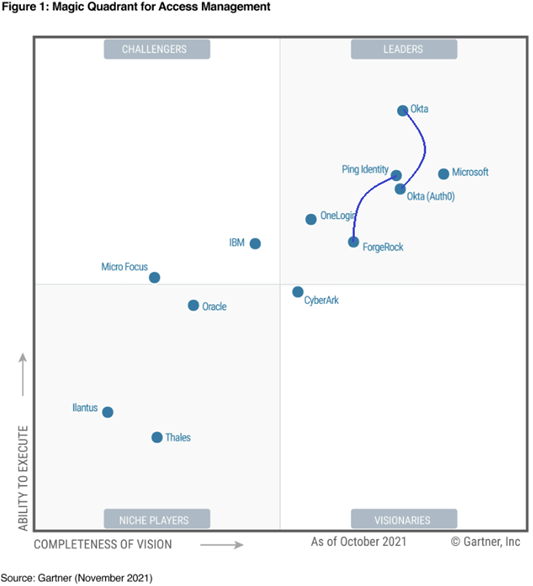

The recent acquisitions in the sector are not just good for valuation purposes, but I think they will be beneficial for the margins of Okta in the future as the level of competition in the sector decreases. If we look back at Gartner’s Magic Quadrant for Access Management in 2021, we could see five companies positioned as leaders. For now, there are only three left of them, as Okta acquired Auth0 (it was already announced back then) and Thoma Bravo acquired Ping Identity and ForgeRock:

Gartner (edited by author)

I think this is a significant level of consolidation, which led perhaps the Department of Justice to take a closer look at the recently announced ForgeRock deal. However, it seems that the deal will slip through, which will lead ultimately to further consolidation. Finally, it’s important to note that Microsoft (MSFT) is still there as the largest player in the access management market providing strong competition for Okta.

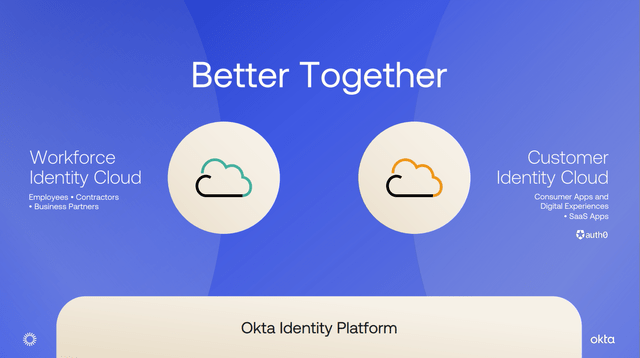

Okta is trying to make strong efforts to differentiate itself, and position itself as the independent, neutral leader in identity management for both workforce and customer identity use cases. I think their message is a simple and effective one, which can be conveyed effectively to customers:

Okta 2022 Investor Day presentation

I believe that after sales reps get acquainted with both use cases strong cross-sell opportunities will be unleashed enabling Okta to go more aggressively after the $80 billion market opportunity.

Risk factors

One obvious risk factor is the sales attrition and sales integration problem of Okta. Based on the Q3 earnings call there has been progress on both:

“So, if you think about attrition, you heard about it earlier in the call, significant improvement, but it’s one quarter. We’re not getting overly excited. So we’re remaining cautiously optimistic. We’re not going to say, hey, one quarter is a trend. We got to see a longer trend. So, we’re going to see that over time and make sure that continues to improve.

The second one is around the integration, the Customer Identity Cloud. You heard earlier today, there’s some progress there, early progress. Larger number of sales reps and field being involved with customer identity deals. Once again, one quarter trend. We’re pleased with where we are. It’s — but once again, cautiously optimistic.” Brett Tighe, CFO

As the CFO says investors shouldn’t get overly optimistic based on the results of one quarter, but it’s a good start. Let’s see how this evolves in the upcoming quarters.

Besides these executional problems macro headwinds have gotten worse during Q3:

“And then the third one we talked about last time was around the macro. And last time we talked about, like I just said, it wasn’t very apparent to us, right? It was small. You could start to see signs of it. This quarter has gotten significantly — it’s worsened since then, so. And we’re thinking it’s going to get worse from here.” Brett Tighe, CFO on Q3 earnings call

So, how the macro landscape evolves is also an important risk factor. Until now, weakness has been more pronounced at Okta in the SMB segment in the U.S., so it’s important to follow whether it will spread to the larger enterprise segment.

Conclusion

My previous article on Okta was titled: Okta Stock: Large Risk, Large Return. Since then the large risk has been decreased to some extent with management acknowledging execution problems on the Q2 earnings call. The large return part still holds as valuation got cheaper, while long-term growth prospects are still compelling. An alternative title and also the conclusion could be: Okta Stock: Decreasing Risks, Large Return.

Be the first to comment