Michael Vi

The last time Okta (NASDAQ:OKTA) reported earnings the market reaction was egregious, with the stock plummeting over 33% in one day mainly due to a slowing revenue growth. Okta was once a market’s darling, up almost 900% from the IPO price in 2017 but now down from those highs over 80%. What got me interested in the stock is the combination of negative market sentiment and near-term headwinds, which usually creates potential long-term opportunities. After looking into Okta, however, I don’t believe that at today’s price the stock offers a very positive risk-reward scenario. Let’s dive deeper into why I believe this is the case.

Okta defines the identity solutions market

Okta is a technology company focused on identity and access management. Okta offers its customers an extensive package of authentication solutions such as single sign-on, adaptive multi-factor authentication, centralized users management and much more. Okta also offers integration with thousands of popular B2B and B2C services so that a customer’s workforce can seamlessly login pretty much everywhere.

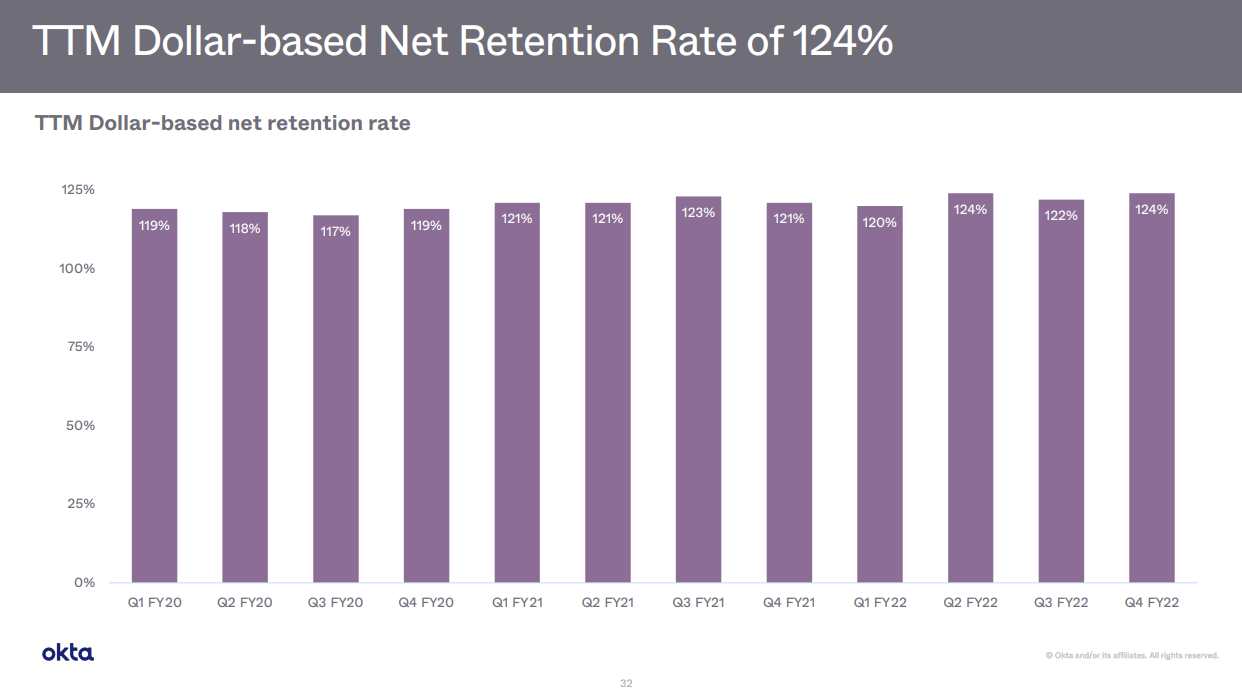

Okta uses a Software-as-a-Service (SaaS) model through the use of multi-year contracts as well as land-and-expand model, generating more revenue from the same customers year after year by increasing the number of users that each customer onboard and by upselling more services to the same customers. The success of this model is clearly visible in the company’s Dollar-based Net Retention Rate over the years, which was consistently around 120%.

OKTA Annual Report

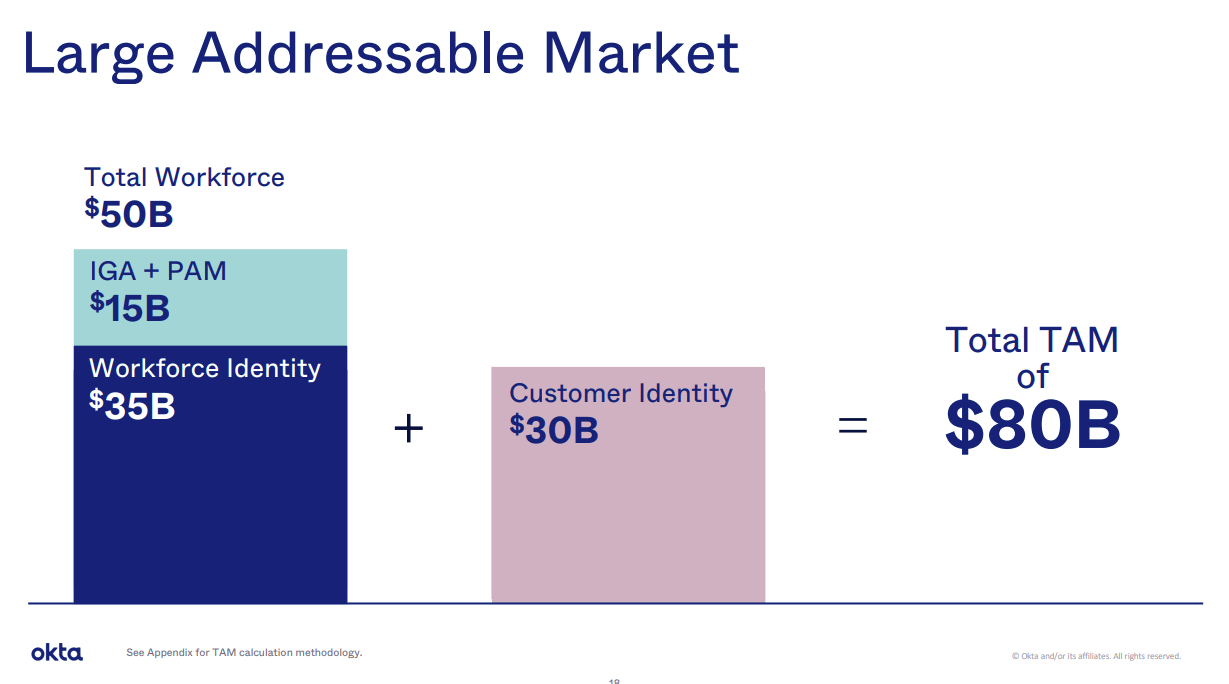

While Okta was always focused on Workforce Identity Cloud, the acquisition of Auth0 allows the company to expand into the Customer Identity Cloud. According to the 2022 Annual Report presentation, the acquisition of Auth0 should increase the Total Addressable Market for the combined entity from $50 billion to $80 billion.

OKTA Annual Report

Latest earnings report prompted a huge selloff

For the quarter, Revenue rose 43% overall to $451 million. Gross Margins slightly improved from 68.16% to 69.52%, while Net Income was negative $210 million, an improvement from a loss of $276 million posted a year ago in the same quarter. Free Cash Flow was also negative at a loss of $24 million, however that should be the lowest point of the year according to management commentary.

What scared the market in particular is the strong slowdown in Remaining Performance Obligations (RPO), which grew YoY only 25% while the last quarter they were up 43% YoY. RPO is an important metric for SaaS companies and is generally interpreted as a window into the future revenue for the company. Management has highlighted in the call straight up that the top line growth was disappointing and that there were challenges with the integration of Auth0 and Okta sales teams. CEO Todd McKinnon also has highlighted how many companies are tightening the belt in relation to IT expenses and as such Okta is experiencing longer sales cycles. On this regard, management offered some insights into different solutions that the company is putting in place to fix the issue:

In order to improve our performance going forward, we’ve implemented a number of action items. For starters, we’re committed to stemming attrition within our go-to-market team. This is a top priority for me and my staff, and we’re in lockstep on actions to take. […]

The second action we’ve taken is to improve our go-to-market effectiveness. Earlier this month, we unified the pricing, quoting and opportunity management system. […] And third, as of the beginning of this month, we’ve simplified our approach to our markets. […] As part of our plan to achieve that, we’re moving forward with a more clearly defined approach with the unveiling of the Customer Identity Cloud and Workforce Identity Cloud. Auth0 will power the Customer Identity Cloud.

Given the challenges the guidance was also lower than expected. For the next quarter (Q3 2023), Okta expects revenue growth of around 32%/33%, quite slower than last year’s result of 61% YoY growth.

Personally I believe that the headwinds experienced in relation to the sales teams integration are short-term in nature, as the company sooner or later will figure out a path going forward. More uncertain is the impact of macro headwinds on the company’s revenue growth, which seems to have taken management by surprise and could potentially last much longer if the economy is heading towards a recession. There are a lot of uncertainties in this regard which further add risks of another reset of Okta’s valuation should the slowdown persist or even get worse.

Stock-based compensation is a bit out of control

One of the issues pertaining to Okta is the extensive use of stock-based compensation. I don’t have anything against SBC ideologically: I’ve been employed in a major corporation that relied extensively on issuing new stock as part of the overall compensation package; it’s a tool that allows companies to retain cash while at the same time be competitive on the job market by attracting top talents. However, in certain situations an excessive use of SBC could be detrimental not only for shareholders but also for a company’s operation.

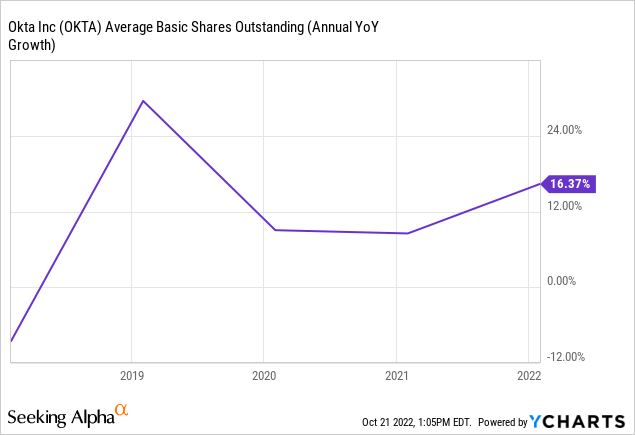

Okta’s SBC grew very fast in the past few years, reaching $565 million in FY2022. For comparison, in the same year the company realized a total of $1.3 billion in revenue and is currently valued at $8.4 billion, hence the SBC compensation alone is accounting to a large chunk of shares. Indeed total shares outstanding have grown on average 8% per year between 2019 and 2021. Moreover, in FY2022 shares outstanding grew more than 19% due to the acquisition of Auth0, which was financed entirely through stock. Issuing so many new shares is clearly impacting current shareholders by the effect of dilution.

YCharts, Seeking Alpha

Very high SBC can also impact a company operationally if the stock goes down a lot, as in the case of Okta (down 81% from all time highs): suddenly all the employees that were happy to receive shares as part of their compensation are not so happy anymore, since they have been seeing their bonuses shredded by the market. Okta might choose to increase the compensation packages to make up for the drop in share price, but it could indicate even higher dilution down the road. The result of this conundrum is that usually attrition rises because the company has fewer tools to retain the employees. There seems to be an early indication of that happening as Guggenheim analyst John Difucci published a note in September saying that attrition in Okta’s sales force is at historically high levels.

Valuation and conclusion

Okta has recently targeted $4 billion in Revenue and 20% FCF margin by FY2026, although management has expressed cautious concerns that in light of near term headwinds the target should be revisited. For comparison, in 2022 the company had 1.3% in FCF margin ($87 million) on a revenue of $1.3 billion. In order to achieve the target, Okta would need to grow Revenue consistently 35% YoY and FCF 55.8% YoY CAGR. If management will be able to reach this target, it means that the stock is currently trading at about 2026E P/FCF of 10, which is clearly quite cheap but one should take into consideration that it would need to wait several years to reach that level and only in a best-case scenario.

I built a quick Discounted Cash Flow (DCF) model to quickly run a more realistic scenario. Let’s say that Okta grows free cash flow not at 55% but 35% for the next 10 years, in line with revenue. With a 10% discount and terminal P/FCF valuation of 10 (the same that the market seems to imply now for management’s target) the intrinsic value today of Okta would be $8.1 billion, about 6% down from current price. The market at the moment does not seem to believe entirely in management’s growth story given the recent performance, and is probably taking into account still high levels of shares dilution due to excessive use of stock based compensation which further adds risks to the investment thesis. I tend to agree with the market that near-term headwinds will probably impact the 2026 target a lot and as such current shareholders will need to be more patient. Given the situation, I personally believe that there are better opportunities at the moment; nevertheless, should the stock drop more in price or should the company post much better results in the future, the thesis can be revisited.

Be the first to comment