Sundry Photography

The best part about this 2000s-style crash in tech stocks, even though it has been painful for us who have overweighted tech in our portfolios, is that we finally now have the opportunity to buy some prior high-flying favorites at levels previously unthinkable. Though fear and caution remain the prevailing sentiments in today’s stock market, I would encourage investors to adopt a long-term mindset here and buy aggressively for a multi-year timeframe.

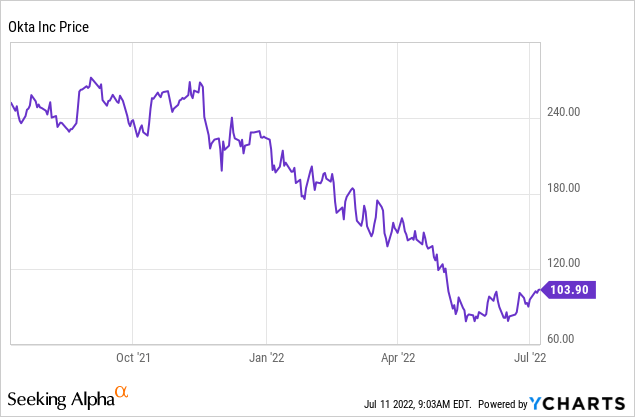

One opportunity I am eyeing is Okta (NASDAQ:OKTA), the security company that specializes in IAM, or identity access management. A gold standard among Silicon Valley peers for single-sign on applications as well as its products that help companies map out and provision access to employees and customers within internal networks, Okta has seen a massive correction since the start of the year: down more than 50% year to date, which is a steeper loss than most SaaS peers.

Throughout most of the past few years, I have either been bearish or neutral on Okta, owing primarily to valuation. I have never doubted that Okta is one of the highest-quality software stocks on the market, one of the few companies that can reach a >$1.5 billion revenue scale and yet still grow at an incredibly impressive pace.

Now consider this: Okta is now trading at levels not seen since 2019. The market is effectively ignoring the tremendous strides Okta has made in the three years since, and the fact that the business has more than doubled since then. I’m finally ready to be bullish on this name, and think that this is the perfect juncture to pick up this stock at the right price.

Here, in my view, are the key reasons to be bullish on Okta:

- Despite its massive scale, Okta is still able to grow at an incredible pace. Once most companies reach a $1.5-$2.0 billion revenue scale, their growth typically slows down to the high teens or 20% range. Okta, meanwhile, is still managing to grow ~40% y/y on an organic basis. This is a reflection of both the company’s strong execution plus the attractiveness of the IAM market.

- Huge $80 billion TAM. Okta estimates its total addressable market at $80 billion, which means its current revenue scale is only about ~2% penetrated. It’s also the clear market leader here, with competitors like OneLogin and Duo Security being smaller and lesser-known entities.

- Recurring revenue and high net retention rates. All of Okta’s business is in recurring subscriptions; in addition, the company’s seat-based pricing plus its multiple modules lends itself nicely to its >120% net revenue retention rates. In short, Okta has a very stable subscription revenue base that is a powerful growth engine from within the current install base.

- Closing the profitability gap. Okta is guiding to single-digit pro forma operating loss margins for the current year, which is impressive for a company growing at its pace.

We note that Okta is trading at its most favorable valuation ever. At current share prices near $104, Okta trades at a market cap of $16.39 billion. After we net off the $2.49 billion of cash and $2.19 billion of debt on Okta’s most recent balance sheet, the company’s resulting enterprise value is $16.10 billion.

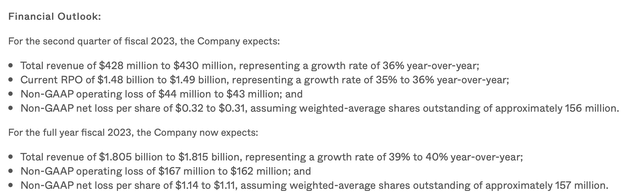

Okta recently just boosted its full-year guidance to $1.805-$1.815 billion, representing 39-40% y/y growth – up from a prior outlook of $1.78-$1.79 billion in revenue, or 37-38% y/y growth.

Okta outlook (Okta Q1 earnings release)

Against the midpoint of this revenue guidance, Okta trades at an attractive 8.9x EV/FY23 revenue multiple – compare that to the height of its boom in 2021, when it traded at greater than a >20x forward revenue multiple. While there’s no question that Okta was heavily overvalued last year and needed a big correction to bring it back down to earth, the current sell-off has gone way too far in light of Okta’s huge fundamental merits.

The bottom line here: if you’ve been waiting to buy Okta, I think now is the best time to build a position for the long haul. This is a fantastic, rapidly-growing and high-margin cybersecurity stock that is racing past its peers, and today represents a historically rare opportunity to buy the stock at a reasonable price.

Q1 download

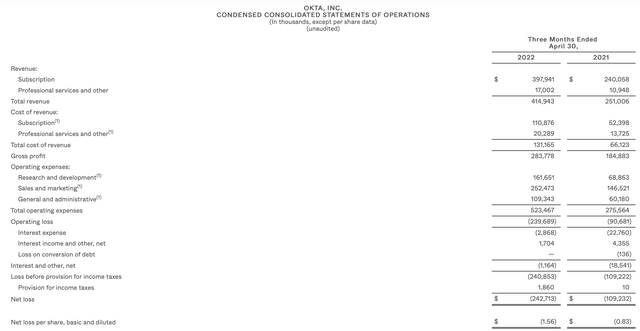

Let’s now discuss Okta’s latest quarterly results in greater detail, which were released in early June and prompted the stock to jump double-digits. The Q1 earnings summary is shown below:

Okta Q1 results (Okta Q1 earnings release)

Okta’s revenue in the first quarter grew 65% y/y to $414.9 million, besting Wall Street’s expectations of $388.7 million (+55% y/y) by a ten-point margin (though a beat of this magnitude is not exactly unusual for Okta). Revenue growth accelerated two points versus Q4’s growth pace of 63% y/y.

We note that Okta’s acquisition of Auth0 is still contributing to a large chunk of the company’s total growth rates. On an organic basis, Okta reported that revenue growth would have been 39% y/y. Note that the Auth0 acquisition will be comped by Q2.

The company also reported that billings growth was 55% y/y when excluding the impact of one-time billings process improvements that boosted billings in Q1 of last year. Again, this huge billings growth rate helps to highlight that Okta’s total growth may not fall so quickly below 40% y/y as the company may be suggesting. The company’s net revenue retention rate of 123%, indicating a 23% average upsell, also indexes well above most other SaaS peers and shows the success of Okta’s “land and expand” sales playbook.

Note that Okta recently experienced a brief security breach that temporarily had investors worried. Now, however, the company notes that the event had a minimal impact to its book of business. In response to an analyst question on the subject during the Q&A portion of the Q1 earnings call, CEO Todd McKinnon noted as follows:

We’ve looked and we can’t see any quantifiable impact. I actually spent a good amount of time myself looking through opportunity by opportunity in Salesforce because as you know, I just talked to over 400 customers after the security issue. And the management team talked to over 1,000 customers. So we really heard the concerns firsthand and responded to them with our detailed action plan. And so I was curious, as we did our analysis, like I wanted to see for myself on the ground what was happening. So I look through hundreds and hundreds of opportunities, myself looked at the comments, looked at things that were pushed, looked at the reasons why they were pushed in the normal course of business, of course, things get pushed, things get pulled in, but I wanted to see for myself.

And I was really surprised the lack of anything about lapses impacting the business. But I do think it was a significant issue for us.”

The one potential drawback in the quarter was that Okta’s pro forma operating margins did pull back to -10%, four points weaker than -6% in the year-ago quarter (though this was consistent with/slightly better than guidance).

Okta operating margins (Okta Q1 earnings release)

Okta is re-investing in growth, as well as the fact that last year presents a tougher comp due to the slowdown in sales travel and customer events. Looking ahead, the company still expects a -9% pro forma operating margin on the year. Recall as well that the company has a long-term target of growing revenue at a 35% y/y pace each year through FY26 and hitting $4 billion in revenue, while also generating a 20% FCF margin at that time.

Key takeaways

It’s difficult to ignore the fact that Okta remains a best-in-breed vendor in the software sector. Even though many companies around it are pegging lower growth rates on a weak macro picture and recession fears, Okta has kept its head down and continued its incredible execution trend. Don’t miss the opportunity to buy this stock at <9x forward revenue.

Be the first to comment