Michael Vi

As you may know, cybersecurity firm Okta (NASDAQ:OKTA) operates a SaaS-based platform that provides identity and access management solutions. OKTA has a demonstrated a remarkable revenue growth rate (46% CAGR from FY20-FY23E) and has a global TAM of an estimated $80 billion (or more than 40x FY23 estimated revenue). The downside is that the company has been drowning in red-ink for years and that may not change anytime soon. That’s likely why the recent bear market took the stock down 60% from its 52-week high. However, that is an opportunity for investors in my opinion. I say that because the revenue growth thesis is firmly intact, OKTA continues to scale up its platform by investing in that growth, and – at some point – the company is going to generate strong free-cash-flow similar to many other fast growth, SaaS-based cybersecurity companies, many of which are no longer growing nearly as fast as OKTA yet trade a premium valuation in comparison. The stock is a BUY.

Investment Thesis

OKTA operates its “Identity Cloud” platform around two self-explanatory partitions: Workplace Identity and Customer Identity. Customers can securely access applications over a public-cloud, or on-premise servers, or on 7,000+ integrations on the Okta Integration Network of IoT devices and mobile or web apps. In short, Okta knows the key to managing corporate or personal security is by assuring digital identity prior to accessing networks and digital data. And it’s good at it.

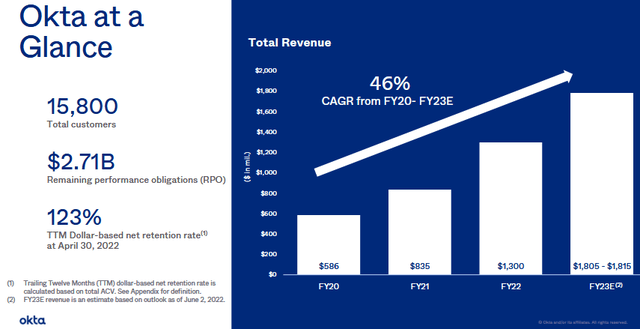

The company has leveraged its Identity Cloud platform into a wildly successful growth story as shown by the “at a glance” profile shown below:

Note the large number of customers (15,800), over 3,300 of which have annual contract value (“ACV”) of $100,000+. Gross margins are high (in the mid-to-high 70% range), but operating margin is still negative as the company continues to invest heavily in sales & marketing in order to add more clients (i.e., “get while the gettin’s good”). That being the case, the investment opportunity is to be a shareholder when OKTA begins to experience what will likely be strong margin expansion on its cloud-based subscription business as it continues to scale-up the SaaS-based platform.

Q1 FY23 Earnings

To learn about more about OKTA’s financials it is instructive to look back at the most recent quarterly EPS report that was released on June 2. The report was more of what investors have come to expect from OKTA: rapid top-line growth, strong gross margins, and red-ink on the bottom line. Q1 FY23 EPS report highlights included:

- Total Q1 revenue of $415 million grew 65% yoy.

- Subscription revenue of $398 million was up 66% yoy.

- Total gross margin in Q1 was 76.1% (versus 78.1% in Q1 last year).

- Total customers were up 48% yoy.

- Free-cash-flow was positive ($11 million).

Shares popped 16% on the report as it was generally considered to be a strong beat as compared to consensus estimates. In addition, OKTA raised guidance going forward.

On the Q1 conference call, Okta CEO & Co-founder Todd McKinnon reported:

New customer additions remain strong at 800, bringing our total customer base to 15,800, representing growth of 48%. We also continue to do well with large customers. In Q1, we added over 200 customers with $100,000 plus ACV. These new large customers continue to be balanced between new customers and upsells. Our total base of $100,000-plus ACV customers now stands at over 3,300 and grew nearly 60%.

McKinnon went on to report that Okta won a Fortune 500 Insurance company that was sourced through Amazon’s (AMZN) “AWS Marketplace” “which has been doing well for Okta since we became available there in late 2020.” I encourage existing and potential investors to read through the Q1 conference call to get more insight into the plethora of growth initiatives (like Auth0 and Identity Governance) Okta has going for it moving forward.

Going Forward

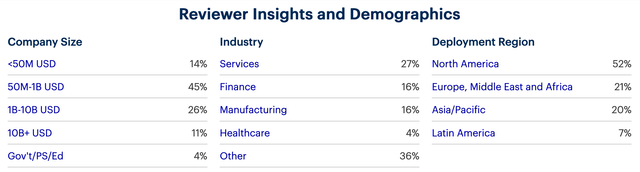

Okta continues to be ranked highly in terms of industry reviews. On Gartner.com, OKTA is ranked 4.5/5.0. Reading through the reviewer comments is interesting and enlightening, but more so is the demographic information of those responders:

As can be seen in the graphic, OKTA’s products are being used across the company size spectrum and also across many sectors and global regions. That bodes well for the future in my opinion. That’s because OKTA estimates it has a $50 billion Workplace Identity market, and a $30 billion Customer Identity market, for a total global TAM of $80 billion. To see OKTA executing well across a variety of government, business sizes, industries, and regions is a good sign the company is well-positioned for success at capturing large percentage of that TAM. And, as I mentioned earlier, that is why OKTA is still losing money: it is heavily investing in sales & marketing in order to grow the business and capture as many clients as it can as soon as it can. Meantime, OKTA’s TTM dollar-based retention rate in Q1 was a very strong 123%.

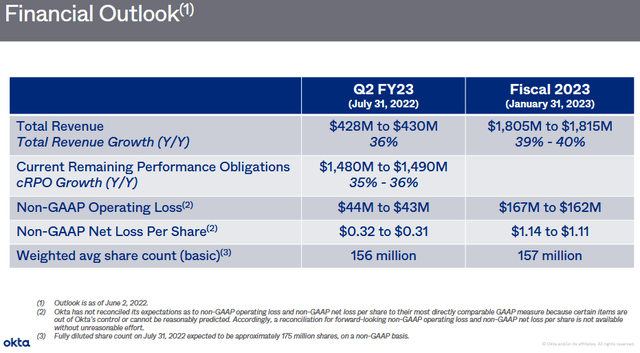

Looking ahead to Q2, OKTA issued the following guidance:

Note the midpoint of FY23 non-GAAP earnings guidance is for a net loss of $1.125/share. That is more than double the net loss of $0.46/share for FY22.

Okta is still taking the long view. Listen to what CFO Brett Tighe had to say on the previously referenced Q1 conference call:

Our long-term financial goals anchor on at least $4 billion of revenue in FY ’26 with organic growth of at least 35% each year and 20% free cash flow margin in FY ’26. To achieve these targets, we will continue to scale the company from a people and processes standpoint, including investing in talent across all areas of the company as well as in systems to prepare us for the next phase of growth.

From that comment, it appears OKTA has no intention of changing its priority from revenue growth and locking-up customer contracts to profitability any time soon.

Valuation

The following table compares Okta’s valuation metrics (as per Seeking Alpha) and latest quarterly revenue growth rate with that of its cybersecurity peers Palo Alto Networks (PANW), CrowdStrike (CRWD), and Zscaler (ZS):

|

EV/TTM Sales |

Price/TTM Sales |

Price/Book |

Quarterly Revenue Growth |

|

| OKTA C | 11.5 | 11.3 | 3.1 | 65% |

| PANW D | 10.2 | 10.0 | 155.7 | 30% |

| CRWD D- | 27.8 | 28.2 | 42.5 | 61% |

| ZS D- | 25.9 | 26.2 | 48.5 | 63% |

NOTE: The letter following each stock symbol in the left column is the Seeking Alpha composite Valuation Grade.

As can be seen in the comparison, OKTA has an overall “C” valuation grade and is not only significantly undervalued as compared to the peers shown, but also grew revenue faster than any of them last quarter.

Risks

Okta is not immune to the overall macro-environment of high inflation, rising interest rates, covid-19 related shut-down and supply-chain challenges, and the impact of Putin’s horrific war-of-choice on Ukraine that has effectively broken the global energy & food supply-chains and could result in slowing global growth and/or a global recession. That said, all those factors didn’t appear to negatively impact OKTA’s revenue growth in the latest quarter.

Other – and bigger – companies could decide to enter the Identity Security field and nibble away at OKTA’s market share and/or cause reduced margin. That said, Okta was founded in 2009 and has a good long head-start and is generally considered the global Identity Expert.

Due to what I consider to be rather exorbitant stock-based compensation, ordinary shareholder dilution is high: in Q1 of last year OKTA had 131.8 million average shares outstanding compared to 155.9 million at the end of Q1 this year (+18% in one year).

The biggest risk for OKTA is operational: when will it begin to translate revenue growth into greater operational margin, free-cash-flow, and positive earnings. From my standpoint, it would appear that the only question is when will management reduce investments in sales-n-marketing and accept a slower revenue growth rate. That said, I don’t expect OKTA to put a priority on profitability until they have contracted and locked-up a much larger share of the TAM than it currently has. And that might not be until 2026-2027.

As of the end of Q1 FY23, OKTA’s balance sheet was strong. The company had $2.5 billion cash & cash equivalents and $2.2 billion in long-term debt. And, as mentioned earlier, OKTA was actually FCF positive in Q1 (though not by much, only $11 million).

Summary & Conclusion

OKTA may not become profitable company on a GAAP basis prior as far out as 2026 or 2027. Until then, the company is targeting a 35% organic growth rate. Now, all things being equal, the stock of a company growing at 15% should double about five years. At a 35% CAGR, Okta stock should more than triple over the next 5-years. And, as its Identity Platform SaaS-based model scales up revenue, shareholders should be greatly rewarded by fast growing operational margin and, eventually, tons of free-cash-flow.

Looking at it another way, if Okta reaches its goal of $4 billion by 2026 (I think that is in the bag), the stock will have to more than double just to achieve a 10x EV/sales multiple.

Bottom Line: the bear market has taken OKTA stock down 60% from its 52-week high. The company is now selling at a valuation level that is a discount to its cybersecurity peers, yet OKTA is growing faster than any of them. OKTA is a BUY and could easily reach $150/share over the next twelve months (up ~40% from Tuesday close of $106.02) based on a price-to-sales multiple of ~13x on FY23 revenue of an estimated $1.81 billion (the midpoint of guidance). I believe this slight expansion in multiple (over the current 11.3x) is needed to close the valuation gap between peers and will materialize as OKTA continues to grow revenue and expand gross margin. That said, investors must be patient: as I said earlier, OKTA may not become profitable on a GAAP basis for another 4-5 years.

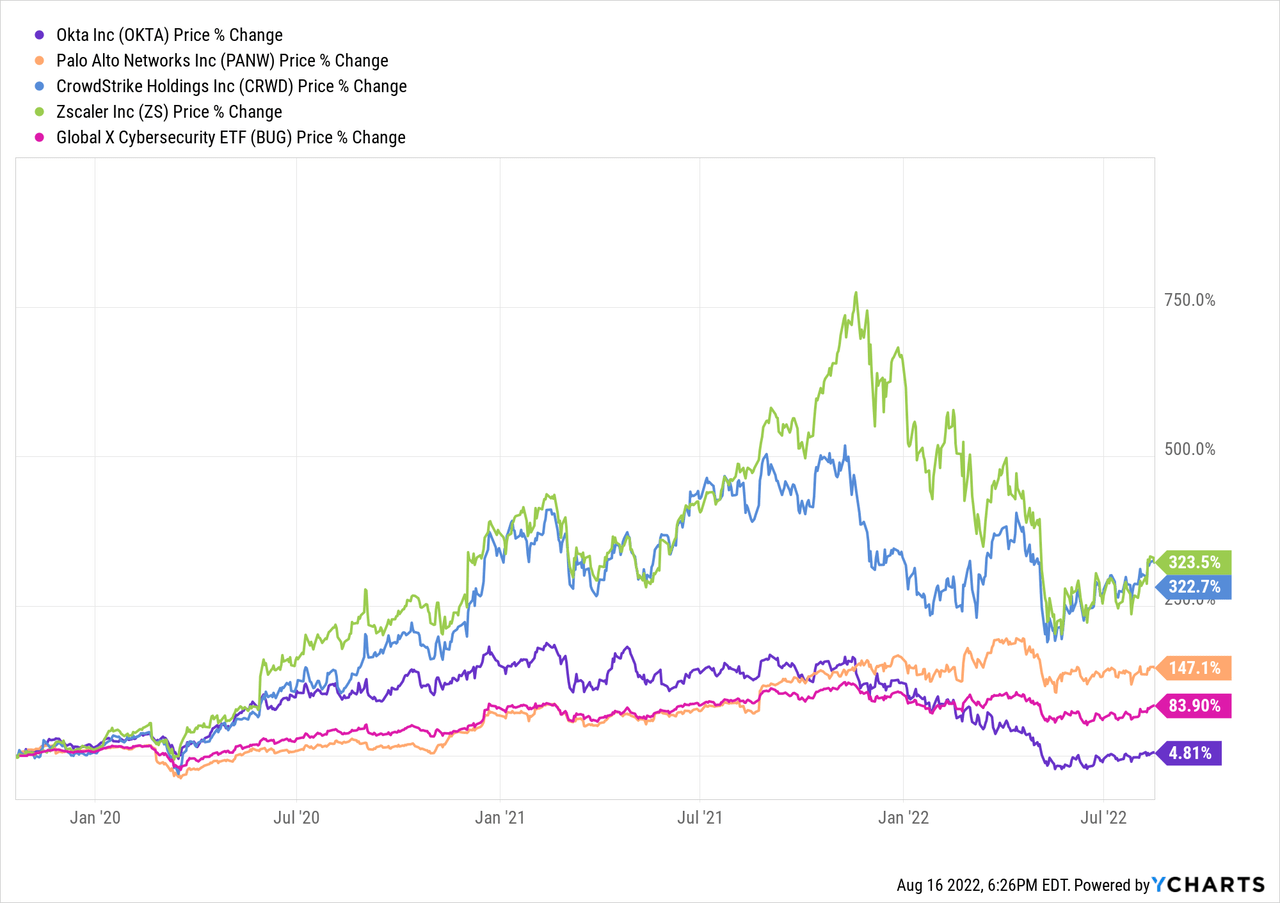

I’ll end with a three-year price chart comparing OKTA with the peer-group mentioned earlier, and also with the Global X Cybersecurity ETF (BUG):

As can be seen, OKTA’s stock price (and its shareholders) have paid a price for the company’s focus on revenue growth over profitability. However, in my opinion, you want to own this stock when the tide turns. Meantime, with a market cap of only $16.9 billion, OKTA could be potential takeover target by the bigger cybersecurity firms (like PANW, market-cap $52.6 billion) or even companies like IBM (IBM) or Salesforce (CRM) who would likely find Identity Assurance to be nice additions to their portfolios.

Be the first to comment