Michael Vi

Investment thesis

Following the acquisition of Auth0, Okta (NASDAQ:OKTA), the global leader in Identity and Access management (IAM), is experiencing difficulties in integrating the two sales teams. These difficulties, in conjunction with demand headwinds, are putting downwards pressure on the stock price, which might create an opportunity for long-term accumulation.

Financials

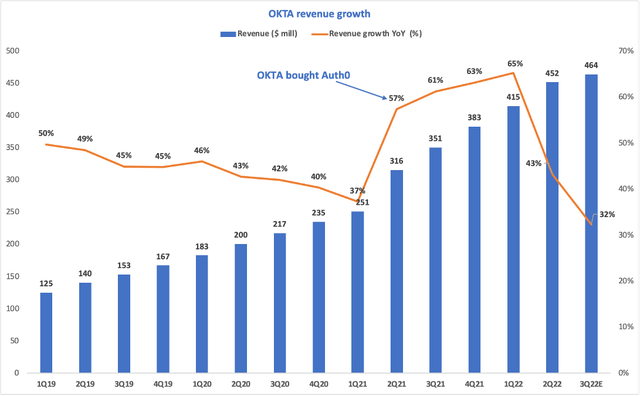

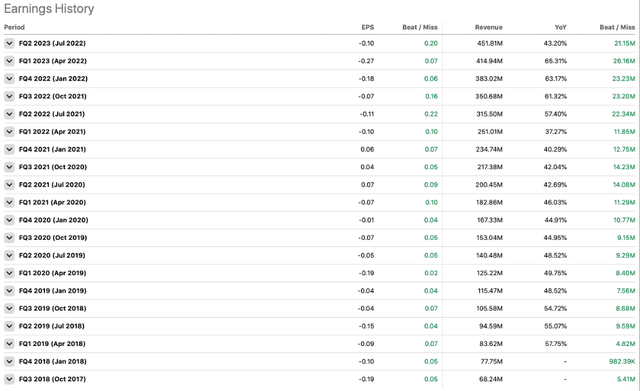

The most important aspect about a business’s future is its revenue growth. To understand revenue better, we need to remember that Okta made a transformative acquisition in 2021, which led to a bump in its revenue growth. It acquired Customer identity vendor Auth0 in what was the biggest ever deal in the space.

Okta’s revenue grew nicely, 43% in Q2 but the company only guided for a 32% revenue growth for 3Q22. This came as a result of difficulties that Okta has in merging the two sales teams. Auth0 has a bottom-up developers first go-to-market strategy, which is different than Okta’s top-down approach. The sales teams were integrated in 2022 and it looks like the synergies that Okta was hoping to get by combining these two teams will be delayed.

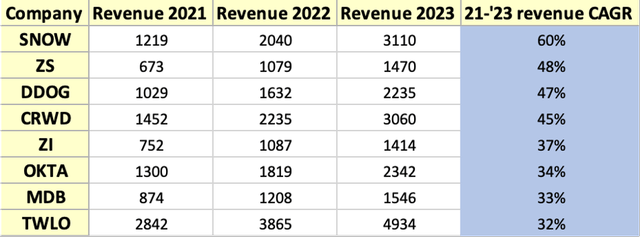

However, Okta raised its guidance for FY 2023 and now expects 40% YoY growth, which remains impressive for its scale. There are only 5 companies with >$1 billion in revenue that are growing faster than Okta:

Revenue is growing nicely considering Okta’s scale and while there might still be room for improvement, the successful sales integration is the key to unlocking a lot of potential. The sooner the company can successfully integrate Auth0, the better.

Gross Margin

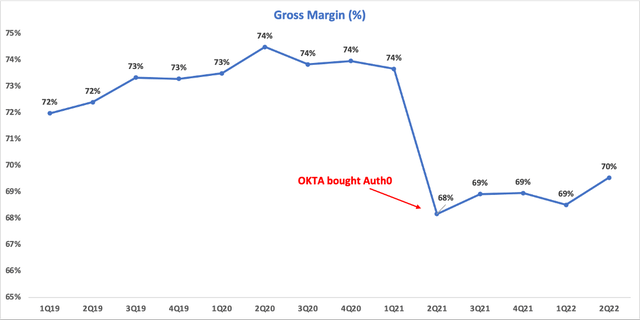

In terms of margins, gross margin is arguably the most important margin for a business. I generally try to avoid the low-margin, high turnover businesses because they carry a very high degree of risk.

Okta has a high gross margin, that deteriorated following the integration of Auth0. Since it was growing faster, Auth0 has a much lower gross margin that Okta’s core business. Still, the trend is improving, with the Gross margin touching 70% for the first time after the sale was completed.

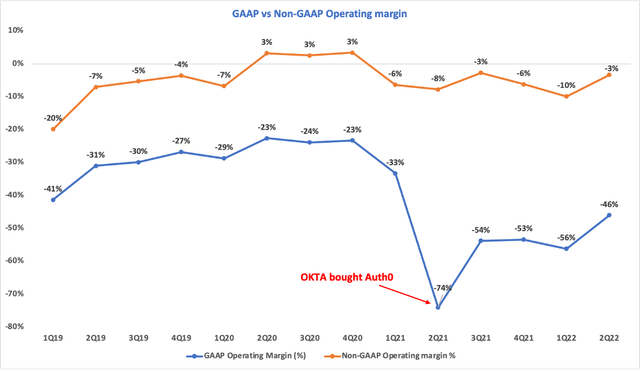

Operating margin

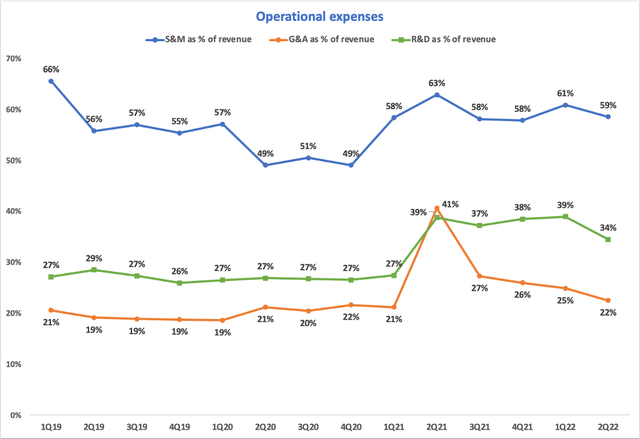

Okta isn’t profitable even when considering the adjusted Operating margin, which ignores all the stock-based compensation (SBC) expenses. In order to understand why the operating margin is so bad, let’s analyze the operating expenses individually:

All the operating expenses are higher than before the merger, with the sales & marketing being the most significant one. This proves that Okta’s strategy is optimized for massive growth. The company spends really big amounts on S&M and R&D in order to bring more products to market and cross-sell to its existing customers.

How can we tell if OKTA’s (GTM) strategy is successful?

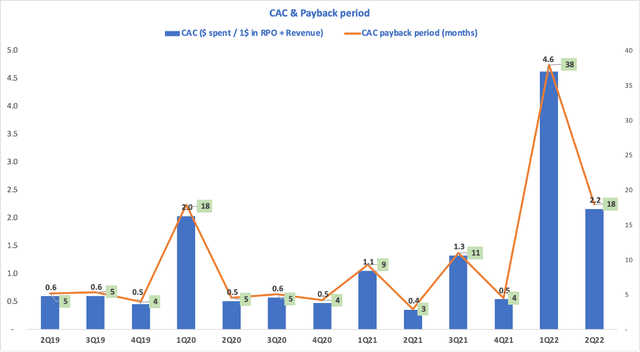

In order to find out, let’s look at a crucial operational metric, the customer acquisition costs (CAC). This shows how much Okta spends in order to acquire $1 of contractual value:

(CAC) = S&M Expenses period n-1 / Net new RPO + Net new revenue

Even with its great GTM strategy of Land-and-expand, Okta’s sales efficiency crumbled in the first half of 2022. The company spent around $4.6 for every $1 of contracted revenue that it attracted. Moreover, the payback period has seen an all-time high of 38 months before going down to 18 months in the last quarter.

The trend remains still very elevated and it is clear that Okta needs to rethink its sales efforts since the company is forced to deal with the “growth-first” strategy after acquiring Auth0.

Rule of 40

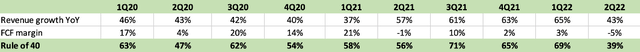

As a way to keep expenses in check, management follows closely a great operating KPIs, called the Rule of 40.Rule of 40 tells us how fast Okta can grow without burning too much money. So, it’s about growing fast while also keeping an eye for profitability. As long as the total is bigger than 40%, the company is executing well.

Rule of 40 = YoY revenue growth + Operating margin / FCF margin

Unfortunately for Okta, the Rule of 40 saw a major decrease in Q2, with the metric coming in slightly below the management’s expectations:

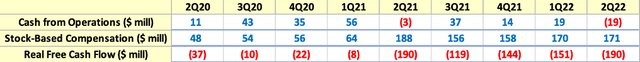

Free Cash Flow (or FCF)

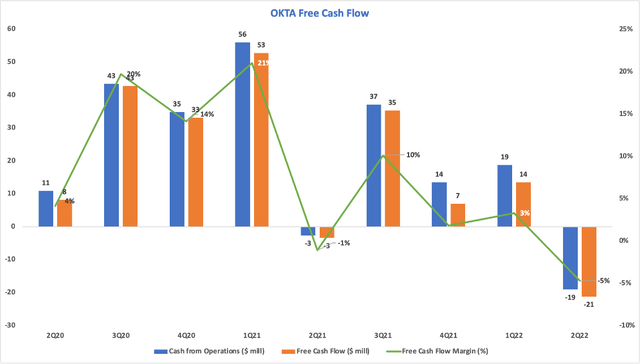

One of the most important aspects about a company’s execution is its ability to generate free cash flow. Let’s see how much free cash flow the company is generating:

The cash flow trend for 2Q22 is a letdown since the company didn’t manage to attain operating cash flow, as it set a new minimum of -5% FCF margin. And while you might think that’s not so bad since Okta generated consistently cash flows during the last quarters, this is not true. Since the Free cash flow statement adds back all the stock-based compensation that the company pays to its employees, this makes it look like the company actually has FCF. However, if we take a look at the SBC amounts, there are much more significant than the FCF generated, so if we take these into account, Okta has yet to generate Free cash flow.

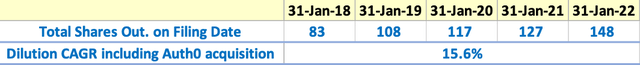

Dilution

Besides the fact that Okta doesn’t generate FCF, there’s another silent killer for shareholders, which is dilution. Okta diluted its shareholders on average 15.6% every year since it got listed, which means you would lose 15% of your ownership every year without doing anything.

Key Performance Indicators (KPIs)

Now let’s get into the operating KPIs and see why I believe that Okta still has plenty of potential in spite of its not-so-great financials:

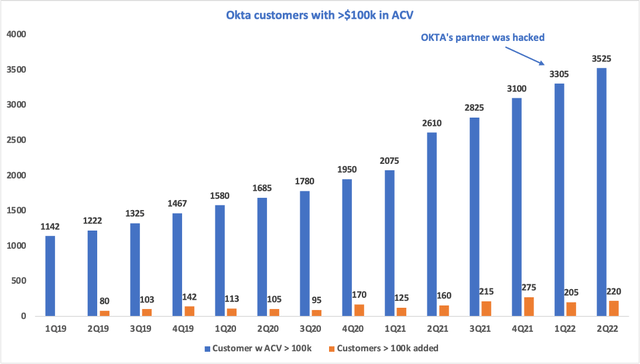

Customers

Even after one of its partners was hacked, Okta’s brand remains strong as the company added around 220 customers with more than $100k in ARR in the last quarter.

Net retention rate (NRR)

The most important metric regarding customers is the Net retention rate. This shows how much do customers they like your platform and it’s calculated as the net expansion of annual contract value (ACV) from existing customers over the preceding 12 months:

Net Retention Rate = Annual Recurring Revenue (or ARR) / Annual Recurring Revenue (or ARR) from 12 months ago

Okta maintained its NRR consistently above 120%. Generally, anything above 120% is a great value, especially considering Okta’s scale so NRR is definitely a plus:

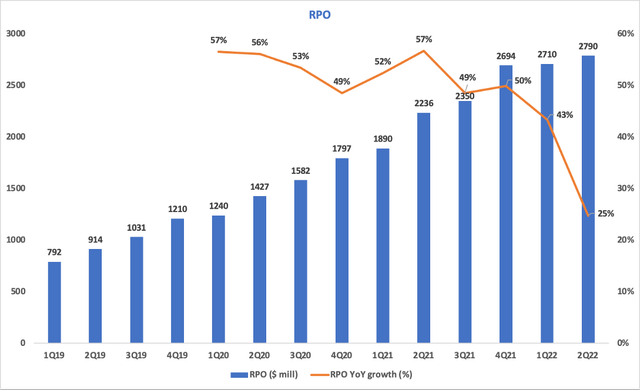

Remaining Performance Obligations (RPO)

Another crucial metric for software companies is the RPO. It consists of amounts that have not been recognized as revenue and offers a good image about the future revenue prospects (tells us how strong future demand is for Okta’s services):

RPO = Deferred revenue (billed, unearned revenue) + backlog (future performance obligation that hasn’t been invoiced)

Unfortunately for OKTA, RPO was relatively flat on a Q/Q basis, which confirms that demand for Okta’s services is slowing down and we might see this trend persist in the next quarters. RPO is one of the metrics that I’m going to be following closely to see if Okta can get its momentum back.

Management

One crucial aspect about every business is its management. Okta is led by its CEO and co-founder, who is also the president of the board and owns around 5% of Okta, which proves that he has skin in the game.

Another key to evaluate the team is how well does management deliver on its promises. Okta has an outstanding record as the company delivered on all 13 quarters since it got listed for both revenue and earnings:

As a result, I believe that Okta’s management is a plus and for now it looks like they are serving shareholders well (besides the HUGE SBC of course).

Industry & expansion opportunities

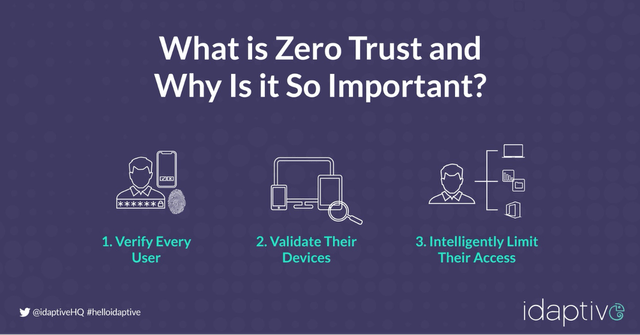

The cyber security industry is growing at a phenomenal pace because of the transition to a Zero Trust paradigm, as well as the migration towards a cloud-based network that will slowly replace the hardware networks:

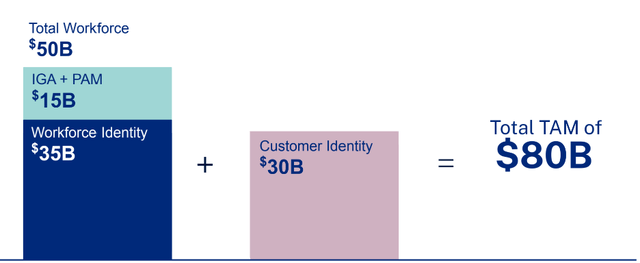

The IMA space is a critical piece of the bigger Zero Trust movement (Step 1, verify every user). As a result, the total addressable market is huge:

Right now, Okta is the market leader in the IMA space as confirmed by Gartner and Forrester and it seems like Okta is really well positioned to benefit from the significant market expansion.

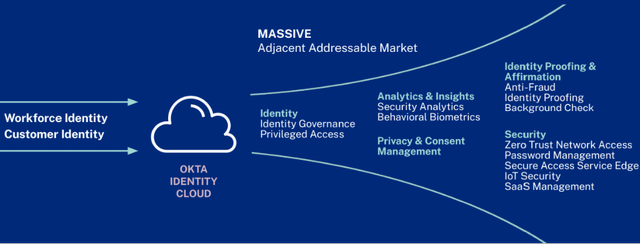

Moreover, because of the nature of the sector and its market position, Okta has plenty of opportunities to expand into adjacent markets:

The first two, Identity Governance and Administration (IGA) and Privileged Access Management (or PAM) Okta will be rolled out in 2022 but they won’t have any materially impact on the financial results. Still, these represent great opportunities for up-selling its existing customers and increase the potential for growth.

As a summary, I love Okta’s position in the market and the fact that it has many opportunities to expand. However, this comes at a price. And that’s intense competition. Giving the large market opportunity, it’s only logical that competition is intense. It is split between dedicated companies like CyberArk or OneLogin but also between deep-pocketed companies like Oracle, IBM or Microsoft.

Risks

Although Okta is a market leader and has achieved scale, there are still many risks involved with the company, starting with the most important one: the fact that the company doesn’t have any real Free cash flow and it might take it a couple of years before it attains any level of real profitability / FCF while also growing fast.

Secondly, Okta overpaid for Auth0 in a period where valuation multiples were very high and now carries around $5.4 billion on its balance sheet as Goodwill. This will probably be impaired soon and it seems like the synergies expected from this acquisition will be delayed.

Moreover, one of Okta’s partners got recently hacked. Although these are isolated events, they have a strong impact on Okta’s brand from a potential customer / investor’s perspective.

Lastly, the stock is volatile and the market is now very fond of profitable companies. This is not the case for Okta so I expect that pain will continue for Okta’s stock, which might create a good risk/reward for the future.

Valuation & Technical

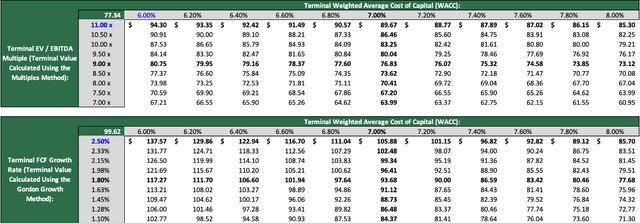

Although Okta is the cheapest that is has ever been, let’s look at what I believe to be the maximum price that you would pay for Okta:

DCF valuation

I believe that right now Okta is worth somewhere between $77 and $100 dollars, with an average price of $88 for the Base case. For the DCF analysis here are the assumptions that I’ve used:

Revenue CAGR of 20% between 2021 and 2031, higher than the 13.5% expected for the cyber security sector because of Okta’s leading position in the IAM and CIAM fields.

In terms of margins, the Base case implies that Okta’s EBIT margin will become positive in FY2026. Since management estimated in the Q1 earnings report that Okta will achieve $4 billion in revenue in FY2026, I’ve used this estimate since management hasn’t lowered it in the last earnings report.

Lastly, since the company doesn’t have historically high investments, the D&A and NWC are very low, while the CAPEX are around 4%, significantly higher than the historical trend.

Discount rate – I’ve calculated a 7% terminal discount rate using the assumptions from below.

Still, for the first year I started with a 12% (WACC) that I gradually lowered towards the terminal WACC.

Since the Terminal value represents the biggest part of the Equity value, I’ve used 3 methods to calculate it:

– Revenue exit method – I took the Average Software P/S for January 2015 – January 2020 from Damodaran (this should eliminate the effect of the exacerbated multiples from 2020-2021) and I’ve applied it to the FY2026 Revenue. The price target for this scenario is around $92 or around 56% discount from the market price.

– Multiples method – applying a 9X EV/ EBITDA multiples for the terminal year EBITDA. Price target of $77, a 31% discount from the market price.

– Lastly, probably the best method to value a company is the perpetual growth method since it doesn’t use any peer comparison and focuses solely on the company’s free cash flows. I’ve applied a 2% perpetual growth for the terminal year FCF, which is lower than the 3.3% Risk-free rate, which is a good proxy for the long-term US GDP growth. This leads to $100 price target, a 69% discount from the market’s price.

Taking all these 3 methods into account, the average price for Okta is $90 or 52% discount from the market price. But since DCF can’t predict exactly the price for a company, I believe that the true intrinsic value for OKTA is somewhere between these prices:

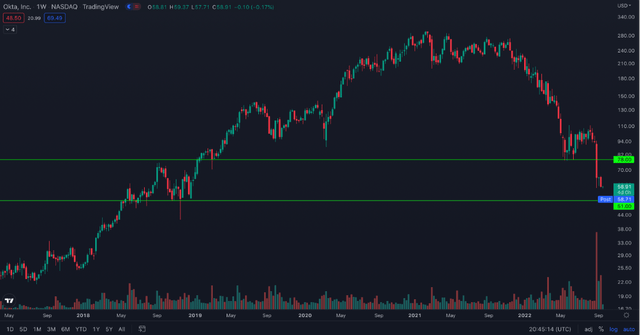

Where to buy

Technical analysis is a good filter that can tell where to open a position. Following the lower guidance for Q3, OKTA’s stock crumbled 30%. I expect the overall market to be volatile in September so OKTA might have a lower-low and it might come as low as $50 (2018 support). I believe that the stock is really attractive if it hits that level, but considering macroeconomic headwinds, no one can predict how low the price can go so probably the best thing to do right now is to wait for a clearer macroeconomic environment.

Final thoughts

To sum up, I believe that OKTA has a ton of potential. Even if the market is now punishing stocks that are unprofitable and not growing fast enough, this might be the opportunity to open a long-term position in a market-leader. The company is really solid, has a good management and I believe they will realize the long-term growth objectives.

However, the market is telling us that this is the worst time to have difficulties integrating an acquisition as well as to be unprofitable and without FCF, which is the reason why I won’t open a position until the price hits $50 since the risk-reward is really attractive at that level.

Be the first to comment