SARINYAPINNGAM

Investment Thesis

Okta (NASDAQ:OKTA) is about to report its fiscal Q3 2023 results next week. I lay out precisely what investors should be thinking about.

Namely, investors should cast their eyes on Okta’s fiscal Q4 2023 guidance. More precisely, whether or not the company is seriously focused on improving its profitability profile on a GAAP basis.

Because if Okta’s Investor Day from earlier this month is anything to go by, the company hasn’t yet figured out how to stem some of its elevated stock-based compensation.

Even though the stock is down a lot in the past year, this doesn’t necessarily mean it’s cheap. Here’s why.

What’s Happening Right Now?

The reason why investors love to invest in high-growth companies is that they are growing so fast, that even if their profitability, once stock-based compensation (”SBC”) is factored in, doesn’t seem all that impressive today, that’s ok.

After all, companies are investing for future growth and thinking long-term. And investors are more than willing to back those winning growth companies.

Indeed, that’s how Amazon (AMZN) and Tesla (TSLA) got to be so big. What investors didn’t pay enough attention to is that the strategy of investing for growth works tremendously well in a benign economic environment. When the economy is conducive, and rates are close to 0%. With those ingredients in place investing for future growth makes sense.

In fact, I could go so far as to declare that companies that weren’t investing in future growth were doing a disservice to their shareholders.

And now? Now the tide has turned. And done so fiendishly quickly.

The strategy will have to change. Companies now need to be paranoid. Not only about keeping market share, but showing investors that they can turn a profit.

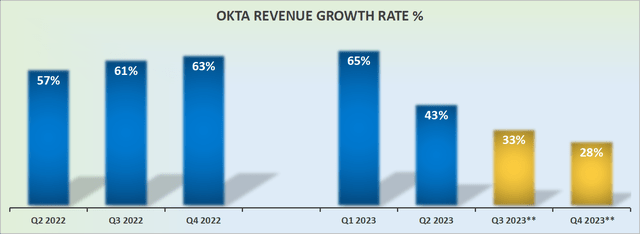

Revenue Growth Rates, Look Out For Q4 Guidance

We are just days away from Okta’s fiscal Q3 2023 results. And investors should zero in on what Okta’s guidance for Q4 will look like.

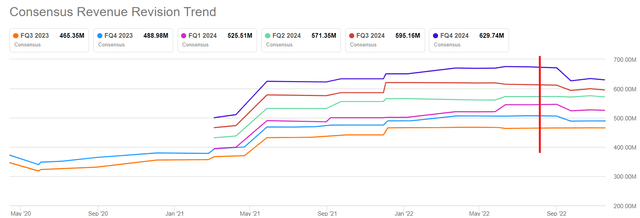

The problem that I’m describing here is this. Since Okta reported its fiscal Q2 results, analysts have refused to lower Okta’s revenue estimates.

As you can see below, the red line is when Okta reported its fiscal Q2 2023 results.

We now know, without a doubt, that the macro environment has become challenging. Commentaries from Fortinet (FTNT), Microsoft (MSFT), and Amazon’s AWS, all echo the same theme.

Even though enterprise customers are still interested in investing in their cloud migration, cloud security, and ancillary services, the enterprise sales cycle is elongating. And that makes sense if you think about it.

Consider this, if we are hearing day after day of tech companies laying off staff, as companies are forced to do more with less, surely, that’s going to impact all tech companies. After all, isn’t it the case that one company’s capex is another company’s revenue line?

Profitability Profile, Is GAAP Useful?

When stocks were going up, investors all too casually overlooked GAAP profitability. Management was being paid with stock. And the management was happy. And investors were also happy to turn a blind eye.

But now that the genie is out of the bottle, investors are zeroing in on underlying profitability and asking difficult questions. Such as when will their business become profitable?

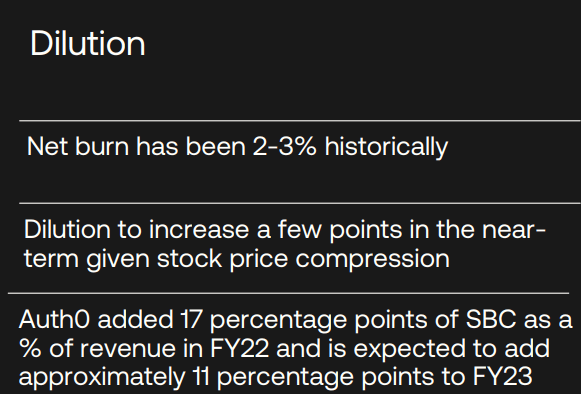

Okta investor day 2022

In the best case, Okta’s fiscal Q3 2023 non-GAAP operating margins will be negative 6%. That compares with negative 3% in the same period a year ago.

Again, this figure is before SBC expense.

OKTA Stock Valuation – Didn’t Matter Before, Now, It’s All The Focus

Investors are struggling to marry up two aspects.

On the one hand, Okta’s revenue growth rates are slowing down. Naturally, there are big questions being put forward about whether Auth0 was truly a worthwhile investment? Simply put, was Auth0 worthwhile paying $6.5 billion?

Secondly, how does one value an unprofitable company, with slowing growth rates? Should we still value companies on a P/Sales ratio? Personally, I’m not sure that still makes sense.

The Bottom Line

I want every CEO and every board of director in the world to think if someone asks them, what are their most important two or three technology platforms? I want them to say, amongst the AWS’s and the Salesforce and the SAP, whatever they would say, I want them to say identity in Okta. (CEO Todd McKinnon, conference call)

Okta is an ambitious company led by a highly ambitious CEO. And for a really long time, ambition, compelling narratives, and market share were all that were necessary to reward investors.

But now that the stock is down below its 2019 levels, investors are asking more serious questions. And the topic du jour is no longer does Okta have the best platform? Instead, the real question is when will Okta’s profitability improve?

Be the first to comment